[ad_1]

Lots is using on tomorrow’s US shopper for December for markets, that are pricing in comparatively upbeat information.

Numerous the inventory market’s upbeat profile not too long ago is carefully linked to forecasts that the worst has handed for inflation, which leaves room for the Federal Reserve to start out reducing rates of interest.

In that case, the market has a inexperienced mild to reprice fairness costs up, which it’s been doing to no trivial diploma in current months.

In the meantime, US Treasury yields have fallen not too long ago, largely for a similar purpose. Tomorrow’s CPI report will present a actuality examine on the rosy assumptions of late.

Economists anticipate a little bit of a blended bag. For the year-over-year headline knowledge, shopper inflation is projected to tick as much as 3.2% from 3.1% in November.

That’s nonetheless effectively under the current development, however the Fed’s 2% inflation goal seems set to stay elusive for the quick horizon.

The sticky headline knowledge can be offset by expectations for softer studying, which strips out meals and vitality in a bid to estimate a extra dependable measure of the development.

This estimate of pricing stress is on monitor to ease to three.8% year-over-year in December. If appropriate, this significant measure of inflation will dip under 4% for the primary time in practically three years.

Nonetheless, Vanguard’s senior worldwide economist says that “Costs proceed to fall at a speedy clip” vs. the beginning of 2023, however Andrew Patterson doesn’t anticipate that the Fed’s 2% goal will arrive till late this yr on the earliest.

Patterson’s outlook aligns with CapitalSpectator.com’s econometric forecast for core CPI, primarily based on a proprietary ensemble mannequin. By the top of 2024, this estimate of year-over-year inflation is projected to slip to only over 2%, primarily based on the purpose forecast.

Core CPI vs Avg. Mixed Forecast

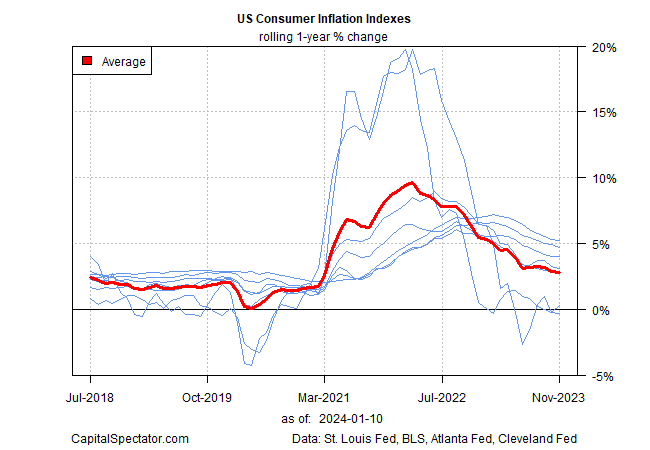

The case for anticipating ongoing disinflation additionally seems persuasive through a set of other measures of pricing stress (for an inventory, see p. 3 of this pattern subject of The US Inflation Pattern Chartbook, a companion e-newsletter for subscribers to The US Enterprise Cycle Threat Report).

Within the chart under, the sliding development stays intact and appears set to persist for the close to time period.

Inflation Developments

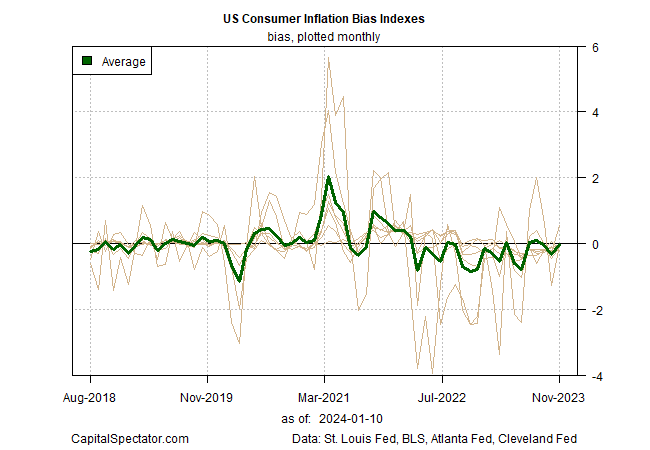

For one more perspective, think about how the bias compares within the chart above. Within the subsequent chart under, there’s a transparent draw back bias for the month-to-month adjustments within the year-over-year knowledge factors.

US Shopper Inflation Bias Indexes

Though the numbers recommend extra progress lies forward within the battle to tame inflation, the potential for upside surprises can by no means be dominated out, notably within the brief time period.

However wanting via the noise that would muddy the waters for any given month, the disinflation development stays on monitor, even when that’s not all the time apparent for anybody CPI replace.

Sam Bullard, managing director and chief economist for Wells Fargo’s company and funding banking group:

“On steadiness, we search for this week’s CPI report to indicate that inflation continues to sluggish on development in a method that positions the FOMC to start out reducing charges in June,”

[ad_2]

Source link