[ad_1]

Most Learn: US Greenback Eyes US PCE for Cues on Fed Path; EUR/USD, USD/CAD, USD/JPY Setups

Gold costs misplaced floor on Monday following a powerful efficiency final Friday, pressured by rising U.S. Treasury yields – a scenario that usually diminishes the attraction of the non-interest-bearing asset relative to fixed-income securities. On this context, XAU/USD completed the session round $2,030, barely under a confluence resistance zone close to $2,035.

Many buyers appeared to undertake a wait-and-see strategy on the valuable steel at the beginning of the brand new week, refraining from making giant directional bets for concern of being caught on the mistaken aspect of the commerce. This cautious sentiment was possible attributed to an essential occasion on the U.S. financial calendar on Thursday: the discharge of the core PCE deflator, the Fed’s favourite inflation gauge.

Forecasts recommend January’s core PCE elevated 0.4% month-over-month, leading to a slight deceleration of the annual studying from 2.9% to 2.8%. Nonetheless, merchants ought to brace for the opportunity of an upside shock within the knowledge, echoing the traits noticed within the CPI and PPI surveys disclosed earlier this month. This might inject volatility into monetary markets.

For an in depth evaluation of gold’s basic and technical outlook, obtain our complimentary quarterly buying and selling forecast now!

Advisable by Diego Colman

Get Your Free Gold Forecast

UPCOMING US ECONOMIC DATA

Supply: DailyFX Financial Calendar

A red-hot PCE report exhibiting stagnating progress in disinflation might push rate of interest expectations in a hawkish path on bets that the central financial institution can be compelled to delay the beginning of its easing cycle in response to setbacks in efforts to realize value stability. This situation needs to be bullish for yields and the US greenback, however would pose challenges for the valuable metals advanced.

Questioning how retail positioning can form gold costs? Our sentiment information gives the solutions you’re in search of—do not miss out, get the information now!

Advisable by Diego Colman

Get Your Free Gold Forecast

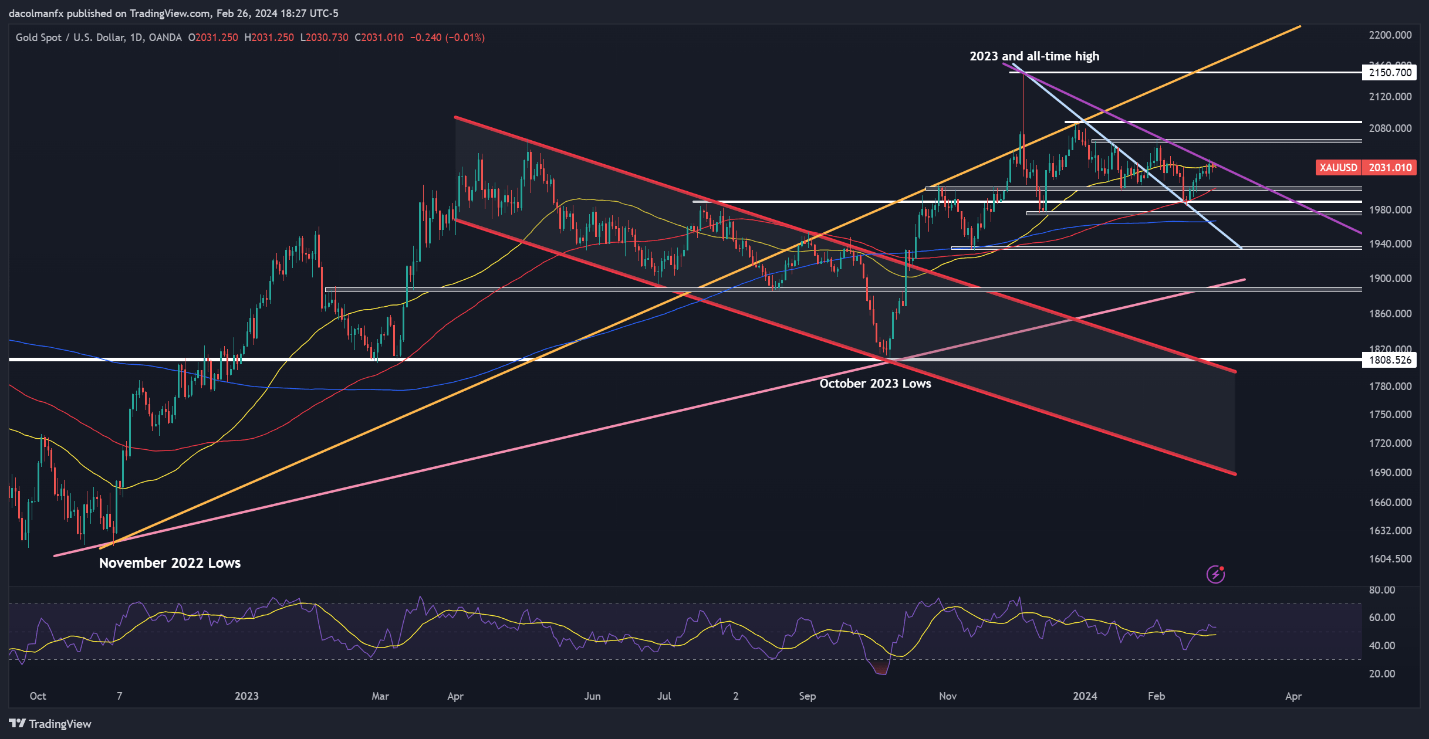

GOLD PRICE TECHNICAL ANALYSIS

Gold costs pivoted decrease on Monday after failing to clear the $2,035 zone – an space of confluence resistance the place a downtrend line converges with the 50-day easy shifting common. If this bearish rejection is confirmed within the days forward, a pullback in direction of $2,005 might be on the horizon. On additional weak point, consideration will probably be on $1,990, adopted by $1,995.

On the flip aspect, if consumers regain decisive command of the market and set off a breakout past $2,035, bullish impetus might collect tempo, reinforcing the upward thrust and laying the groundwork for a rally in direction of $2,065. Extra good points previous this juncture would possibly deliver focus to $2,090 and subsequently $2,150—the all-time excessive.

GOLD PRICE (XAU/USD) CHART

Gold Value Chart Created Utilizing TradingView

[ad_2]

Source link