Guido Mieth/DigitalVision through Getty Photographs

By Thijs Geijer

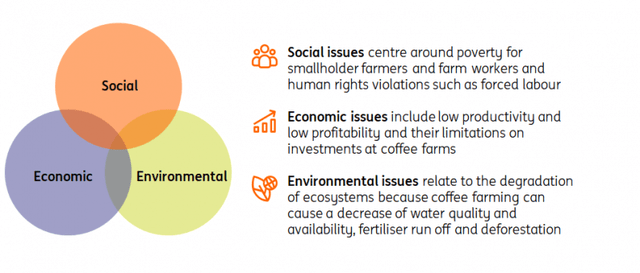

Espresso provide chains face three main sustainability points

Among the many many industries affected by the warfare in Ukraine is the espresso sector, with espresso corporations having to droop their exports to and operations in Russia. This has come at a time when the sector is striving to develop into extra sustainable, as a result of espresso farmers face persistent social, financial and environmental points. Social points are most urgent in coffee-producing international locations in Africa, whereas sure environmental points, reminiscent of extreme use of agrochemicals, are extra prevalent in Brazil and Vietnam. On this article, we argue why it’s within the curiosity of espresso merchants and roasters to seek out options, whereas we additionally check out present commitments within the trade and describe the basis causes that stop corporations from doing extra. We wrap up the article with a view on what circumstances are wanted to hurry up structural change.

Three forms of points come collectively within the espresso trade

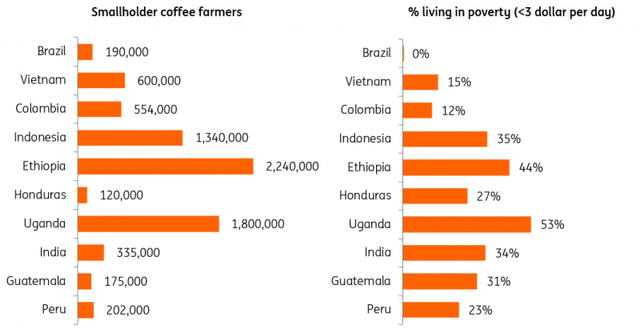

Poverty amongst small espresso farmers is a typical downside in lots of international locations

Estimated variety of smallholder espresso farmers* and proportion of farmers residing in poverty, nation rating based mostly on the share of complete world espresso manufacturing.

Enveritas, International Espresso Platform, ING Analysis, *farmers with lower than 5 hectares of land, for Brazil lower than 10 hectares

Future espresso provide and selection rely upon help from merchants and roasters

It’s within the curiosity of espresso merchants and roasters to counter the problems of their provide chains as they rely closely on the 12.5 million smallholder farmers who produce between 60-75% of the world’s espresso. Though espresso manufacturing has elevated by 75% for the reason that Nineties because of improved yields, each ageing farmer populations and local weather change pose dangers for future espresso provide.

- The common espresso farmer is estimated to be round 50 years previous. Ageing farmer populations can negatively impression espresso yields as older farmers have a tendency to take a position much less. It will possibly additionally result in a decline within the complete espresso space when farmers haven’t any successor.

- Local weather change poses a number of dangers for the trade, on condition that espresso bushes are very delicate to temperature rises. Within the brief time period, the elevated probability of utmost climate occasions like droughts or frosts negatively impacts yields. In the long term, some areas are anticipated to develop into much less fitted to espresso manufacturing, which poses a menace to common provide and a selected menace for espresso varieties in probably the most affected areas. Offering the know-how and know-how to adapt to the results of local weather change is a method of reducing these dangers.

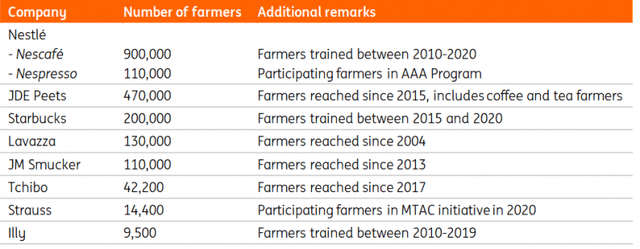

There are many sustainability initiatives amongst main espresso corporations…

Sustainability methods within the espresso sector are likely to have at the least one pillar aimed toward farmers. During the last decade, many main merchants and roasters developed a variety of programmes and initiatives to help farmers and elevated their reporting on this matter. Their methods usually deal with rising productiveness and reducing prices. For such initiatives, corporations often be part of forces with state-led improvement programmes and non-profit organisations to offer issues like coaching and better high quality espresso bushes. In lots of circumstances, these actions fill a spot in espresso areas the place governments aren’t capable of present the identical stage of safety and help as in main producing international locations like Brazil and Vietnam.

Tens of millions of farmers are reached by programmes wherein the most important roasters take part, however total, we estimate that eight out of ten smallholder farmers have not been reached.

Many espresso roasters point out the variety of farmers concerned of their programmes and initiatives

Firm data

…nevertheless it’s unclear whether or not the cash they make investments is enough

There’s an ongoing debate inside the espresso trade concerning the extra effort wanted to resolve the foremost points within the provide chain. Earlier analysis instructed that an annual US$10bn world fund can be wanted to make important progress in fixing sustainability points within the sector. However such an overarching fund hasn’t develop into a actuality but. In the meantime, bottom-up knowledge from a number of inventory listed espresso corporations exhibits that they make investments between 0.5% and a pair of.5% of their annual income in sustainability. If that vary would apply to all the ten main world roasters, then their mixed funding quantities to between $250m and $1.35bn a yr. On high of that, there are investments by smaller espresso roasters, merchants and (improvement) funds from governments, however when all taken collectively it appears unlikely that these add as much as $10bn.

Extra sustainable manufacturing is sensible, however economics don’t all the time play out

So what’s holding espresso corporations again from exhibiting a deeper dedication? We now have discovered a number of the explanation why there’s a hole between what’s presently invested and what’s wanted:

1. Firms will all the time make trade-offs because of competitors inside the espresso sector.

Given the aggressive setting wherein they’re working, espresso merchants and roasters will make trade-offs as investments in sustainability compete with different funding alternatives. Analysis additionally exhibits that having sustainability measures in place shouldn’t be a common apply, with one in three corporations within the espresso provide chain not having any.

2. Fragmentation within the variety of farmers and the variety of producing international locations.

As a result of fragmented nature of provide chains and the range of sustainability points, creating impression usually requires a tailored and structural strategy throughout a number of international locations, which is labour-intensive and expensive. On high of that, the farmers who want it probably the most are additionally the least related to (digital) infrastructure and thus the toughest to achieve.

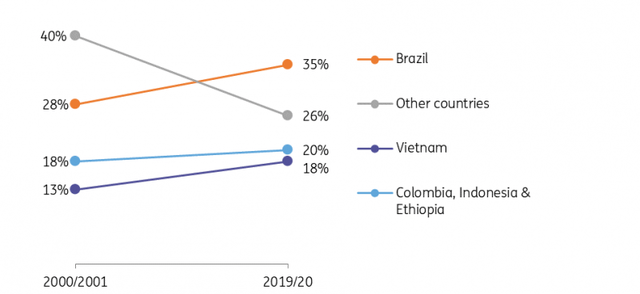

3. An absence of economies of scale complicates the enterprise case for a lot of smallholders.

Espresso manufacturing has develop into extra concentrated in a couple of international locations and for a lot of farmers, it’s exhausting to compete on worth with the highly-productive espresso sectors in Brazil and Vietnam. For instance, the common espresso plot in Brazil is 120 occasions bigger than in Uganda, 30-60 occasions bigger than in Ethiopia and 5 occasions bigger than in Colombia. For some farmers, a deal with premium speciality coffees does present another and a greater enterprise case however for a lot of others, it’s troublesome to be worthwhile all through the worth cycle.

4. Farmers may be reluctant to vary the way in which they work for quite a lot of causes.

Complying with larger sustainability requirements and extra regulation often requires funding or results in larger operational prices, whereas the beneficial properties when it comes to higher productiveness and/or a better worth are unsure or missing.

Espresso manufacturing is getting extra concentrated in a couple of international locations

Share in world espresso manufacturing

ICO, ING Analysis

And not using a coordinated strategy, it’s harder to achieve structural change

Espresso merchants and roasters play a pivotal function, however they can’t clear up the problems at espresso farms by themselves. Firms alongside the espresso provide chain, governments and shoppers share accountability and their mixed actions can result in structural change. Developments out there for licensed espresso present an instance of how this works out in apply.

The case for licensed espresso

Many main espresso corporations have commitments to elevating the share of sustainably produced and sourced espresso. Joint efforts to extend licensed espresso manufacturing have led to a scenario the place there may be extra licensed espresso than the market can soak up. At this level, it’s as much as the manufacturers that promote espresso to make the extra sustainable cup of espresso the default choice, and to get shoppers to pay a sure premium. In that sense, the premiumisation of espresso in developed markets is a beneficial development, however getting that premium shall be a harder nut to crack in rising espresso markets the place affordability is of main significance.

Lastly, governments in each espresso exporting and importing international locations can stimulate the adoption of sustainable practices by translating them into legal guidelines and laws. However lawmakers face a fragile steadiness as a result of well-intended measures in a single coffee-producing nation may end up in an obstacle to different exporting international locations. This will solely be averted by aligning pursuits and collectively elevating the bar. Interventions can even come from importing international locations – one instance is the EU’s deforestation regulation which requires everybody promoting espresso and several other different merchandise within the EU to show they’re residing as much as sure requirements.

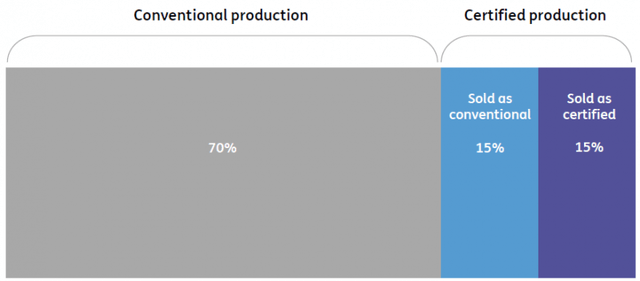

Solely half of all licensed espresso manufacturing is definitely offered as licensed espresso

Espresso manufacturing and low offered per certification/verification scheme* in 2019

Espresso Barometer, ING Analysis *we’ve adjusted this determine for double counting assuming that 35% of all licensed espresso is licensed by a number of certification our bodies

Environment friendly infrastructure is essential for extra impression at farm stage

When commitments are in place and funding is secured, it comes all the way down to execution and partnerships with others like farmer organisations, retailers, governments, NGOs and monetary service suppliers. As a result of complexity of their provide chains, espresso corporations require an environment friendly bodily and digital infrastructure to scale up their impression. Such an infrastructure consists of a number of components with a view to:

- Asses farmer wants: Merchants and roasters have to have the ability to attain out and acquire enter from an enormous variety of farmers in an environment friendly solution to make their strategy as tailored as potential.

- Distribute the precise help: It requires a whole lot of effort to arrange the bodily infrastructure to distribute tangible items like fertiliser and younger espresso bushes, and the partnerships to convey intangible information to farmers in distant locations throughout the globe.

- Show the impression: The evolution of reporting requirements creates extra urgency for espresso corporations to show their impression for traders and different stakeholders. So methods that allow or observe funds to farmers may be an essential a part of the digital infrastructure as they supply a assure that farmers acquired a residing wage or a premium for decreasing environmental impression. Novel schemes in different provide chains reminiscent of Nestle’s Cocoa Revenue Accelerator Program shall be watched carefully inside the espresso sector.

Content material disclaimer

This publication has been ready by ING solely for data functions no matter a selected person’s means, monetary scenario or funding goals. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Publish