[ad_1]

- Coca-Cola inventory has declined since late July, however it has proven indicators of restoration in current weeks

- Analysts anticipate Coca-Cola to report earnings per share of $0.69 and income of $11.4 billion for the third quarter of 2023

- Given the corporate’s sturdy fundamentals and market presence, might the decline be a possibility to purchase?

Coca-Cola (NYSE:), the world’s most recognizable beverage model, is poised to launch its Third-quarter 2023 earnings on October twenty fourth, simply earlier than the market open. Because the monetary outcomes draw close to, buyers are desirous to see if the numbers will become the catalyst wanted for KO inventory to get well from its +15% decline because the final week of July.

Current indicators of hope emerged because the inventory skilled a 3% uptick in worth final week. Buyers seem to have discovered worth at ranges akin to these seen on the identical time final 12 months, hovering across the $52 vary simply earlier than the earnings announcement. This means that with the discharge of the final quarter’s outcomes, shares could expertise elevated volatility.

Now, let’s delve into what buyers can anticipate on this upcoming report and whether or not the inventory presents an attractive shopping for alternative at present ranges.

Coca-Cola Revenues Face Headwinds

The inventory’s earlier steep and swift decline started shortly after the disclosure of Q2 . Throughout that quarter, Coca-Cola earnings per share (EPS) of $0.78, surpassing InvestingPro’s expectations by a formidable 8%. Moreover, the corporate’s income for that interval stood at $11.96 billion, exceeding expectations by 1.8%.

Regardless of the continued progress in income and profitability, the beverage titan has confronted challenges, with most analysts attributing the decline to the rising recognition of weight reduction medicine in the USA. The expectation that these medicine, outfitted with appetite-suppressing properties, might cut back demand for meals and drinks has forged a shadow over KO inventory.

Supply: InvestingPro

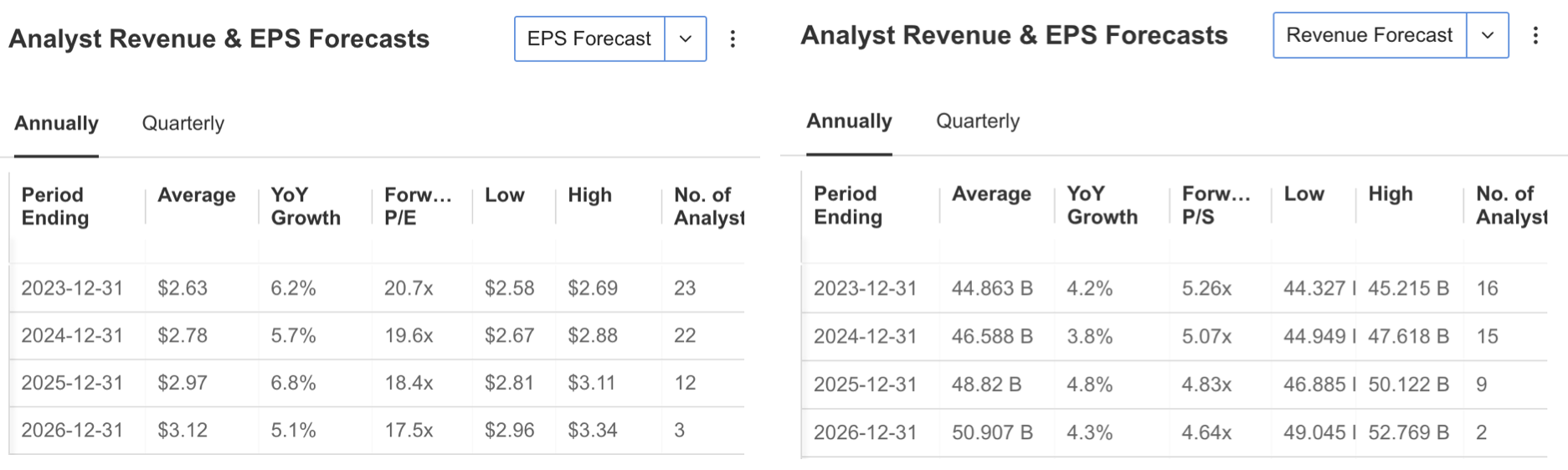

If we take a look at the Third quarter estimates; Whereas 12 analysts revised their estimates downwards, there’s a consensus estimate of $0.69 for EPS and $11.4 billion for the corporate’s quarterly income within the final quarter.

Supply: InvestingPro

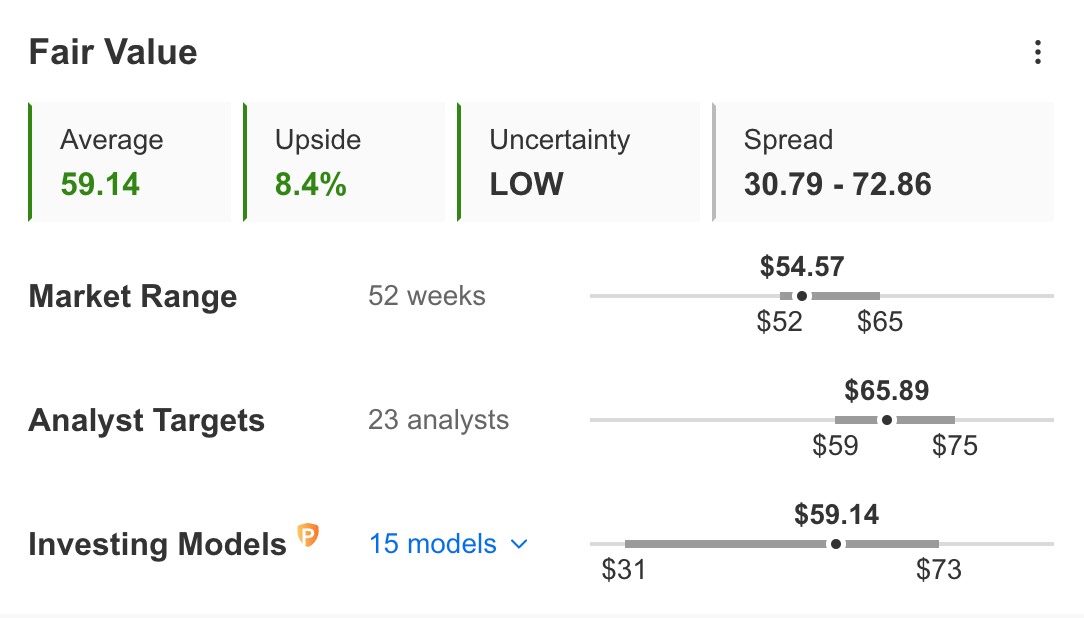

In accordance with the newest monetary outcomes, the share worth within the truthful worth evaluation is calculated as $59 based on 15 ratios. Whereas 23 analysts’ estimates stay extra optimistic, the typical estimate of analysts is that KO shares might attain $ 65 inside a 12 months. Which means that the share, which is presently within the $54 band, is estimated to maneuver at a reduction of 8% based on the truthful worth evaluation and shut to twenty% based on the opinion of analysts.

Firm’s Fundamentals Stay Robust

Wanting on the firm’s fundamentals, Coca-Cola boasts one of many strongest manufacturers within the beverage trade. Its strong financial construction supplies a aggressive edge, instilling confidence in its buyers. Notably, Coca-Cola generates a wholesome money movement, enabling constant dividend will increase and share buybacks over time.

Moreover, Coca-Cola’s well-managed strategy is clear in its current acquisitions diversifying its non-alcoholic beverage portfolio, together with forays into espresso and alcoholic drinks. This strategic growth solidifies Coca-Cola’s place, setting it other than its trade counterparts.

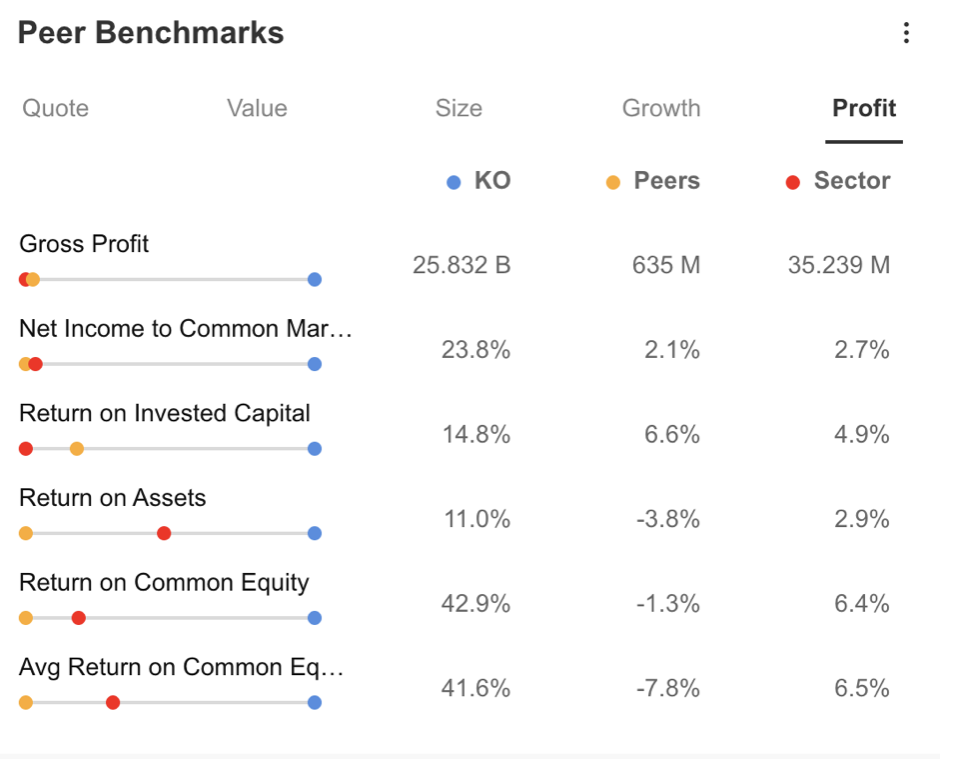

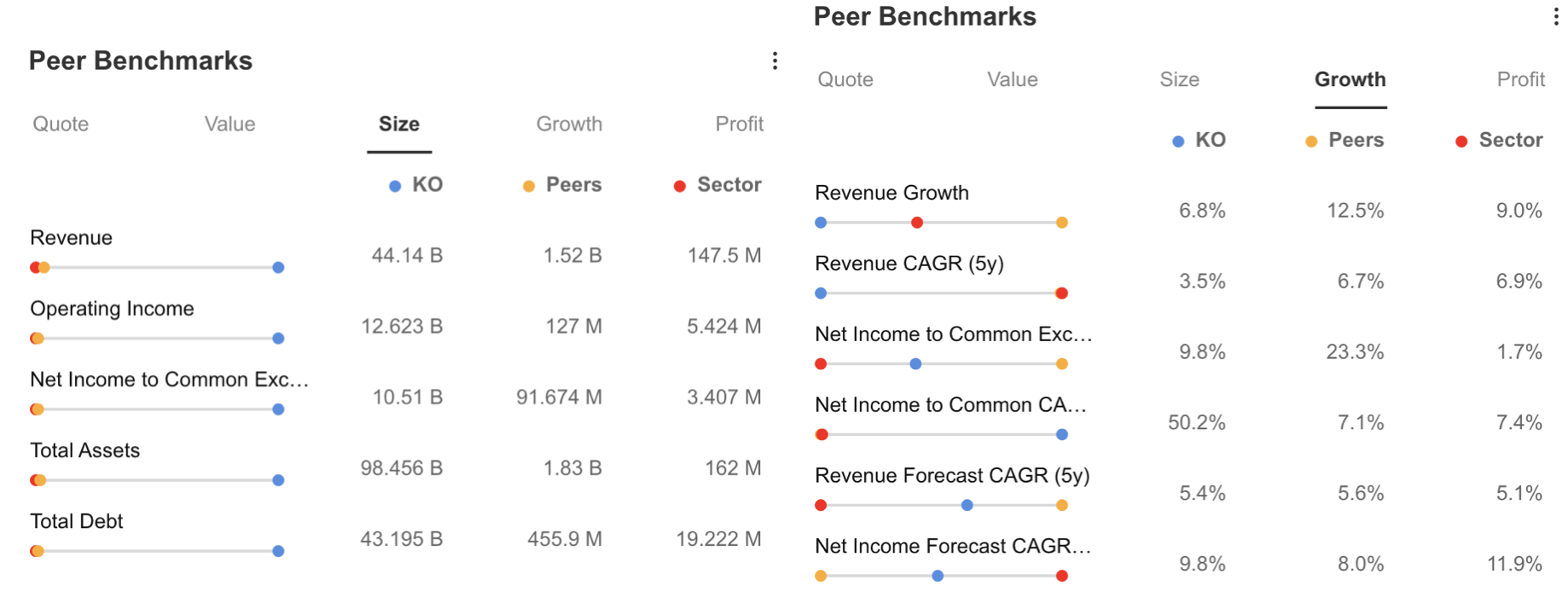

When it comes to profitability margins, Coca-Cola maintains a definite benefit over its friends and the sector. Nonetheless, contemplating its measurement relative to friends, there could also be limitations by way of progress. Whereas the previous 12 months’s income progress barely lags behind friends, the 5-year income forecast aligns carefully with peer corporations, with solely a marginal variance.

The constantly sturdy profitability signifies that long-term buyers could discover advantage in retaining Coca-Cola inventory of their portfolios, regardless of some progress constraints.

Supply: InvestingPro

Supply: InvestingPro

Once we look at the end-2023 and longer forecasts for Coca-Cola on the InvestingPro platform, an annual enhance of 6.2% in EPS and a median enhance of 6% within the subsequent 3 years are predicted. Revenues are projected to extend by 4.2% y-o-y to 44.8 billion by year-end and proceed at an identical tempo over the subsequent 3 years.

Supply: InvestingPro

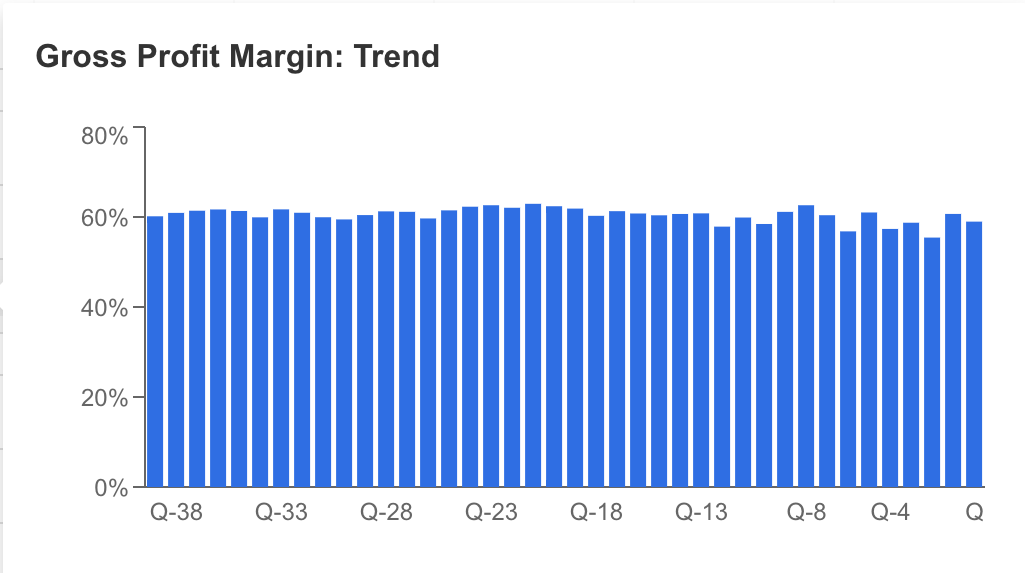

One of the crucial vital options that retains Coca-Cola forward of its rivals is its capability to chop prices considerably. The corporate’s enormous measurement and money energy allow it to barter arduous with its suppliers, giving it a value benefit over its rivals. Coca-Cola continues to keep up model consciousness through the use of price financial savings in advertising and marketing actions.

This additionally strengthens the corporate’s hand in pricing its merchandise and producing income from its operations, whereas contributing to a steady gross revenue margin at a excessive price.

Supply: InvestingPro

One other constructive issue that ought to be evaluated for Coca-Cola is that the corporate’s gross sales have continued steadily, particularly within the macro-level inflationary stress setting for the final 2 years.

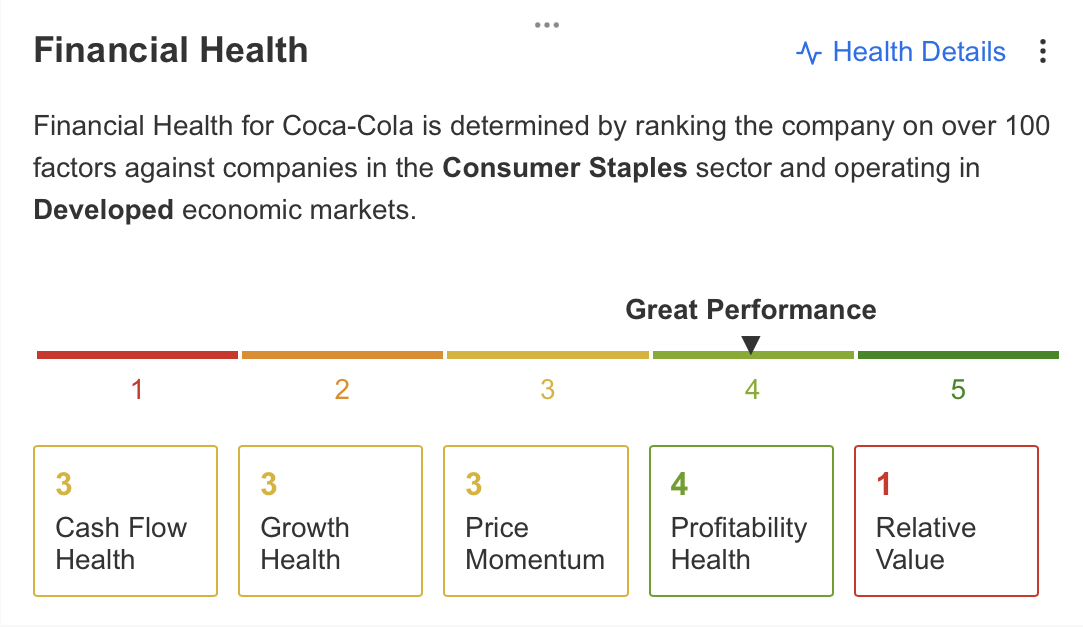

If we summarize the constructive and detrimental facets of the corporate by means of the theInvestingPro platform;

- Elevated dividend fee for 53 years in a row

- Spectacular gross revenue margin

- Providing excessive returns to buyers

- The inventory continues to be low risky with a beta of 0.6

are seen as positives.

Unfavourable elements for Coca-Cola are;

- 6 analysts revised their earnings expectations for the Third quarter downwards

- The inventory has a excessive F/S ratio regardless of short-term profitability progress

As well as, InvestingPro’s firm abstract cites Coca-Cola’s current slowdown in income progress and common debt ranges as a warning.

Conclusion

Coca-Cola stands as an organization that provides confidence to its buyers with its good administration in addition to many elements that it could possibly outperform its rivals. The corporate additionally has an vital benefit by way of sustaining its market share and remaining resilient towards financial difficulties with its wholesome monetary place and excessive profitability that stands out within the steadiness sheet.

Supply: InvestingPro

Then again, the truth that Coca-Cola has a low beta signifies that it’s much less risky than its peer firm shares, and since it’s a dividend inventory, it could proceed to be most well-liked as a defensive asset within the portfolio of long-term buyers.

***

Amazon Earnings on the Horizon: What to Anticipate?

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of as funding recommendation.

[ad_2]

Source link