[ad_1]

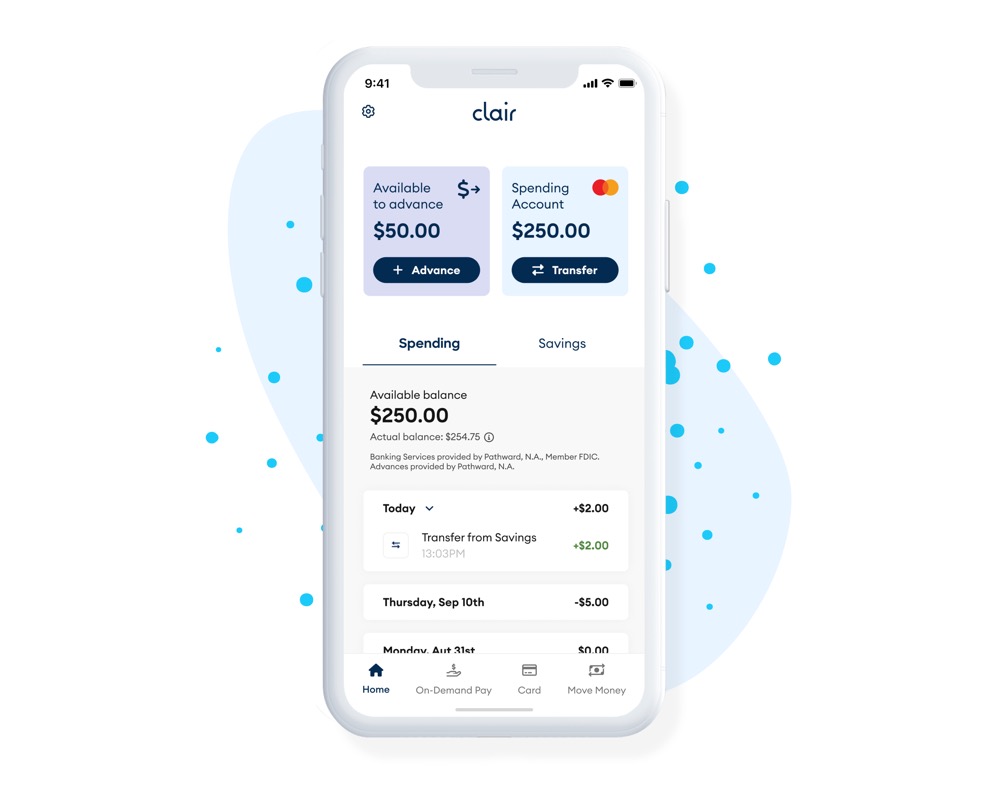

Almost two-thirds of Individuals reside paycheck-to-paycheck based on CNBC’s Your Cash Monetary Confidence Survey. Almost half will be unable to deal with an surprising $400 expense. With employees and their households working on such tight margins, enhancing the timing of money flows could be the distinction between retaining an worker or having them stop. Clair is a free, on-demand pay platform that permits front-line employees to take wage advances with out the onerous charges charged by standard payday lenders. The recently-launched startup works with Pathward, a nationwide FDIC-insured again, to supply the lending program along with a collection of different digital banking companies together with a Spending and high-yield Financial savings accounts in addition to a branded, rewards-earning Debit Mastercard. Clair is built-in with well-liked workforce platforms like Gusto, TCP, 7shifts, and After I Work to supply seamless entry for employees to obtain cost instantly on the finish of their shifts versus ready weeks for a verify that can take one other few days to money. The corporate has additionally launched Clair for Employers to permit employers that aren’t utilizing one of many built-in platforms to supply on-demand pay as a profit with out investing vital time and sources to rise up and operating. The banking-as-a-service supplier is already trusted by organizations like Viking, Everview, and SanStone Well being & Rehabilitation in addition to franchisees of Sheraton, DoubleTree by Hilton, and GNC.

AlleyWatch caught up with Clair CEO and Cofounder Nico Simko to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, way more…

Who have been your buyers and the way a lot did you elevate?

We raised $175M, together with $25M in VC fairness funding and a shopper lending program with a $150M most participation quantity from our nationwide banking accomplice Pathward®, N.A. (“Pathward, N.A.”). Thrive Capital was the lead investor, with Upfront Ventures, and Kairos collaborating. This Sequence A extension spherical brings our whole fairness funding to $45M.

Inform us in regards to the services or products that Clair affords.

In case you can ship your pals cash in seconds, why does it nonetheless take two weeks to get your paycheck? At Clair, we’ve created the primary and solely digital banking app with free on-demand pay. Which means they not solely get a high-yield Financial savings Account*, no excessive or hidden charges, and 40,000 fee-free in-network ATMs**, however they will additionally get free entry to cash they’ve already labored for however hasn’t been paid out but.

By integrations with platforms like TCP Software program’s Humanity Scheduling, After I Work, Gusto Embedded, and 7shifts, we’ve helped greater than 50,000 front-line employees receives a commission as quickly as they end their shifts, as an alternative of ready weeks for a paycheck – with zero charges for advances.

As a part of this information, we additionally introduced Clair for Employers, a set of free, holistic monetary wellness advantages for workers of companies that don’t use our accomplice HR platforms. Providing an on-demand pay profit normally means human sources groups should commit vital time and sources to implement and handle it, however Clair for Employers integrates seamlessly with corporations’ payroll suppliers at no cost and with no ongoing upkeep. Furthermore, staff of corporations utilizing Clair for Employers get extra options like 3% money again*** on gasoline and groceries bought on their Clair Debit Mastercard®.

What impressed the beginning of Clair?

After I was in faculty, I labored an hourly job and it will take me weeks to get my paycheck within the mail. And typically, there have been errors that made it take even longer to get the cash I earned. After faculty, I labored at J.P. Morgan and received deep into the fintech area. That’s the place I discovered that it’s potential to supply free advances to customers in the event you present them with a banking app to monetize from.

How is Clair completely different?

All corporations in our area make most of their cash on charges that they cost to customers for taking advances. We’re the one firm that truly loses cash on offering advances, and earns most of our income from the banking companies that Pathward, N.A. supplies. In consequence, we spend most of our time constructing a banking app that our clients love and wish to maintain utilizing as their predominant banking app, even after they go away their jobs. Moreover, we’re the one firm that has a nationwide financial institution offering the advances, by means of our partnership with Pathward N.A. That’s higher for customers as a result of it signifies that the establishment advancing their cash is correctly regulated.

What market does Clair goal and the way large is it?

Our goal is front-line employees and the businesses that make use of them. There’s a large market alternative with 76 million hourly employees within the U.S. representing 56% of the workforce. Clair is well-liked throughout industries from healthcare, to eating and hospitality, to retail and extra. Because the labor scarcity continues with 4 million extra job openings than folks to fill them, I count on that we’ll see slower financial development, elevated inflation, and provide chain disruptions. Fixing for this scarcity would have an immeasurable market affect.

We’ve discovered that employees are beginning to demand monetary wellness advantages, so corporations that present these advantages are higher capable of entice and retain staff. Entry to on-demand pay is a prime precedence profit, because it permits front-line employees to rapidly and simply entry their funds to maintain up with surprising bills, particularly after they don’t have a lot in financial savings. Our employer companions have seen improved morale and elevated retention, productiveness, and crammed shifts amongst their workforces – our inside analysis reveals staff who use Clair choose up 15% extra shifts and keep employed for 25% longer. That may have a huge impact on an organization’s backside line.

What’s your corporation mannequin?

We offer clients with a banking app and make wage advances free by default, for each employers to supply and employees to entry. As an alternative of charging charges for advances to staff who’re already struggling to make ends meet, Clair earns income from service provider charges each time a buyer makes use of their Clair Debit Mastercard.

Firms like payday lenders or earned wage entry corporations that cost charges for advances are incentivized by the improper issues – they earn cash when their clients aren’t doing properly financially. With our distinctive mannequin, our objectives are aligned with our clients’ objectives. We earn cash after they have cash to spend.

What was the funding course of like?

The toughest a part of the funding course of was discovering a nationwide financial institution with experience in shopper lending that was prepared to work with us on constructing a first-of-its-kind method to earned wage entry. Fortunately, Pathward, N.A. was excited to accomplice with Clair to supply a brand new on-demand pay answer to assist front-line employees entry their wages between pay cycles.

With the fairness funding, we have been fortunate that our lead buyers from our Sequence A have been prepared to guide once more, so it was principally about deciding on different buyers so as to add to the spherical. Fortunately, we met Kairos Ventures, which had developed one other fintech app known as Bilt, and the Kairos staff has been nice companions for us on this journey.

What are the most important challenges that you simply confronted whereas elevating capital?

The toughest half was deciding on the correct buyers to accomplice with. At the same time as we noticed 10x income development final 12 months, we didn’t wish to over-raise, as that may very well be difficult on this market.

What elements about your corporation led your buyers to jot down the verify?

Our buyers consider in our mission of giving front-line employees entry to monetary companies that assist them construct wealth and help their households. We’re grateful to work with buyers who’re excited by the progress that we’ve made up to now. They comprehend it takes time to construct a category-defining enterprise and so they wished to proceed including capital to permit us to proceed constructing on our success and offering this service to much more corporations and employees.

Our buyers consider in our mission of giving front-line employees entry to monetary companies that assist them construct wealth and help their households. We’re grateful to work with buyers who’re excited by the progress that we’ve made up to now. They comprehend it takes time to construct a category-defining enterprise and so they wished to proceed including capital to permit us to proceed constructing on our success and offering this service to much more corporations and employees.

What are the milestones you propose to realize within the subsequent six months?

We’re actually targeted on rising our enterprise over the following few months and increasing the shopper base that we’ve labored so arduous to construct and retain. We wish staff to proceed selecting Clair not just for the advances but additionally for the superior options that our accomplice financial institution affords. We additionally need employers to belief Clair to be the most effective monetary wellness possibility out there for his or her staff.

What recommendation are you able to supply corporations in New York that wouldn’t have a recent injection of capital within the financial institution?

Give attention to the basics of the enterprise and on hiring a high-performing staff. The capital will comply with.

The place do you see the corporate going now over the close to time period?

We’re utilizing our funding to develop our staff to help extra development. We’re additionally specializing in onboarding corporations to Clair for Employers, which we’re actually enthusiastic about. Now that corporations can accomplice with Clair instantly versus going by means of considered one of our accomplice HR platforms, we will help many extra companies and their staff.

What’s your favourite summer time vacation spot in and across the metropolis?

My favourite restaurant is Café Paulette in Brooklyn, which is a quaint, neighborhood spot with nice negronis. I additionally spend a number of time operating round Prospect Park.

You might be seconds away from signing up for the most popular checklist in Tech!

Join at present

[ad_2]

Source link