The information of the week is NOT the Fed chopping 50 bps – sure positive, that’s vital however there’s something far more related occurring.

The Chinese language economic system retains imploding from inside.

And we must always listen.

The Property Worth Index for Chinese language tier-1 cities retains making new lows, and it’s now approaching ranges final seen 8 years in the past!

At this level you would possibly ask your self: properly, is it so dangerous if home costs drop a bit?

In normal circumstances I’d let you know this isn’t a catastrophe.

However for Chinese language individuals, issues are totally different:

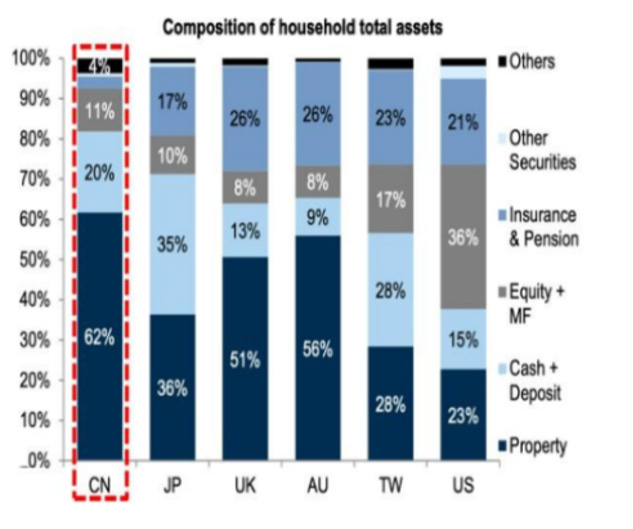

Chinese language households maintain 60%+ of their wealth in Chinese language properties.

That is manner increased than within the US, the place households solely maintain 23% of their wealth in properties whereas the bulk sits within the inventory market or retirement plans.

Now think about in case your inventory portfolio dropped again to 2016 ranges.

How would you’re feeling about it?

That’s how Chinese language households are feeling!

However why is China imploding this quick?

It’s as a result of Xi Jinping desires to engineer a brand new ‘‘widespread prosperity’’ financial mannequin which depends much less on leverage, tech bubbles, bridges in the midst of nowhere and frothy home costs and extra on inner consumption.

The issue is that whenever you deleverage a 50 trillion (!) value actual property market inflated with absurd ranges of leverage…properly, that’s not a straightforward activity to realize.

China is chopping rates of interest aggressively to attempt to restrict the slowdown: Chinese language 10-year rates of interest simply dropped under 2% for the primary time..ever?

But chopping rates of interest whereas the actual property market is deleveraging received’t assist a lot.

Ask Japanese individuals within the Nineteen Nineties for reference:

China retains imploding from inside and this issues for the remainder of the world.

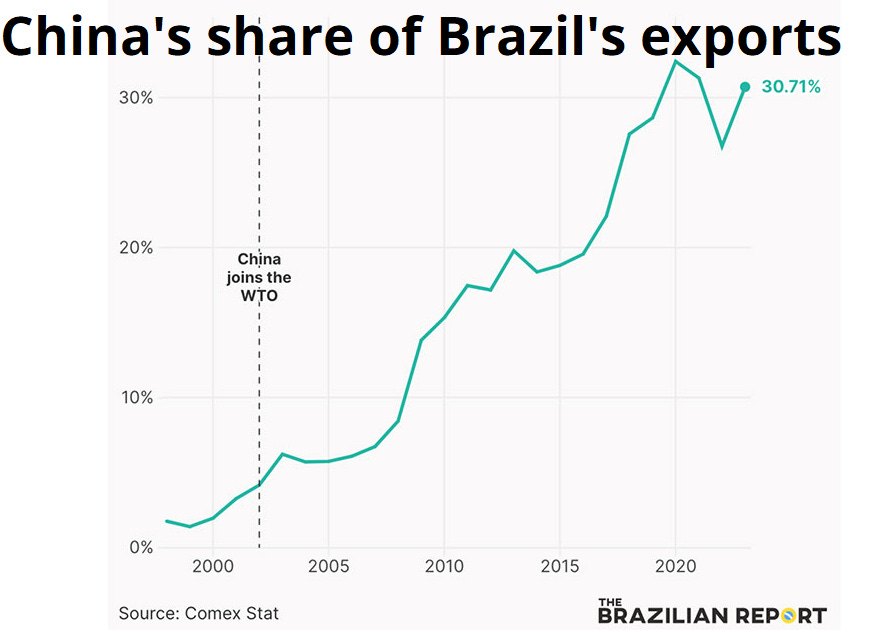

For instance, China is the number one commerce accomplice for a lot of international locations and for particular jurisdictions it represents a really massive importer for the commodities they produce.

See Brazil as an example:

Everyone is speaking in regards to the Fed.

However the actual macro mover to observe right here is China.

Preserve it in your radar!

And naturally – who am I to not spend just a few phrases on the Fed as properly.

This week’s 50 bps reduce was initially celebrated by markets: in any case, if the Fed proceeds with such a large reduce what’s to not have fun?

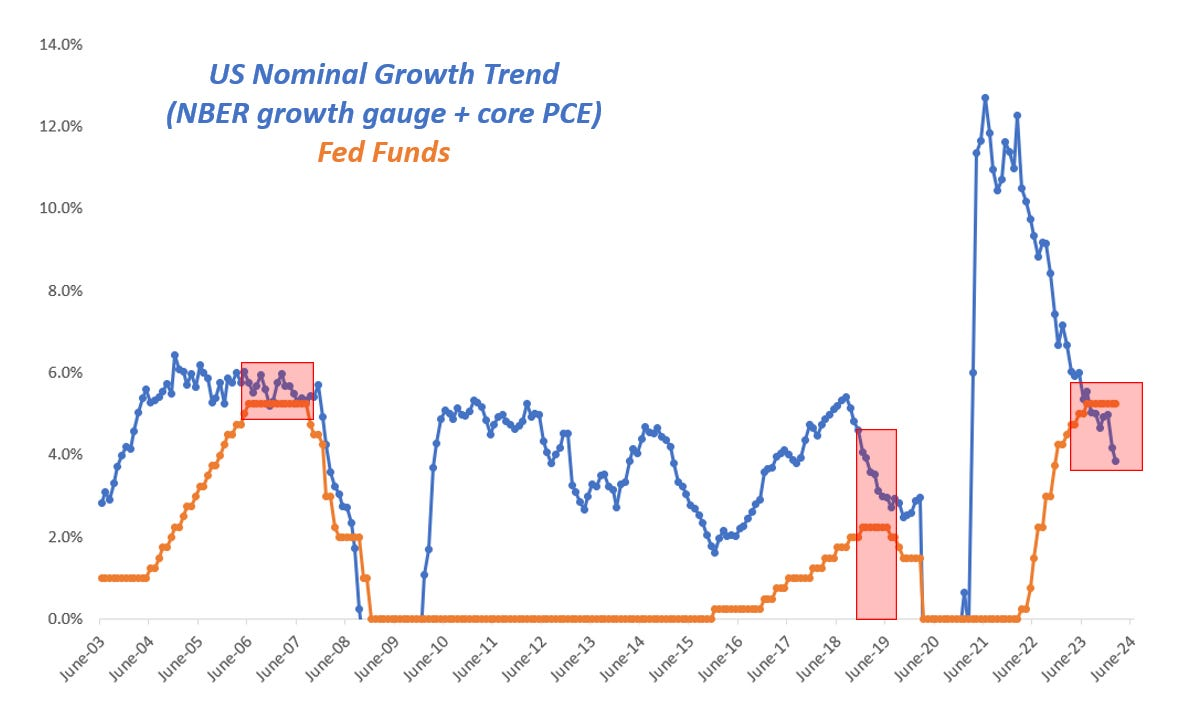

The issue with such a easy narrative is that the Fed’s financial coverage must be measured in opposition to the underlying development circumstances.

Fed Funds at 4.75% might be:

– Nonetheless free: if the US economic system is working ultra-hot

– Nonetheless tight: if the US economic system is quickly weakening

In different phrases: the financial coverage looseness/tightness must be measured taking into account the continued financial circumstances.

The chart above does simply that, and it compares Fed Funds (orange) with the underlying development of US nominal development (blue).

The US nominal development proxy is constructed utilizing core PCE – the Fed’s official goal for inflation – and the NBER gauge for US actual financial development.

Why the NBER gauge and never actual GDP?

As a result of the NBER is the physique that finally determines whether or not the US is in a recession, and so they accomplish that utilizing a broad basket of seven indicators monitoring each sector of the US economic system (from shoppers to industrial manufacturing to the labor market).

The result of this evaluation is simple.

There may be nothing to have fun.

The Fed’s coverage continues to be dangerously tight.

As you may see, it solely hardly ever occurs that Fed Funds (orange) sit shut and even above US nominal development (blue) for a protracted time period.

And when that occurs, it is by no means excellent news for the economic system.

The Fed must do extra.

Or it dangers falling additional behind the curve.

Disclaimer: This text was initially revealed on The Macro Compass. Come be a part of this vibrant neighborhood of macro buyers, asset allocators and hedge funds – try which subscription tier fits you probably the most utilizing this hyperlink.