[ad_1]

HANG SENG, SHANGHAI COMPOSITE – Outlook:

- China GDP and retail gross sales beat expectations, however mounted asset funding slowed.

- The Shanghai Composite Index has risen above key resistance, whereas the upward momentum within the Hold Seng Index seems is enhancing.

- What’s the outlook and what are the important thing ranges to look at?

Really helpful by Manish Jaradi

Get Your Free Prime Buying and selling Alternatives Forecast

China/Hong Kong equities might be gearing up for one more leg increased because the restoration on the earth’s second-largest economic system picks up steam.

Information launched on Tuesday Asia morning confirmed the Chinese language economic system grew 4.5% on-year within the January-March quarter, nicely above 4% anticipated, and a couple of.9% within the earlier quarter. Industrial manufacturing rose 3.9% in March Vs 4% forecast, up from 2.4% in February, retail gross sales 10.6% final month Vs 7.4% anticipated, and above 3.5% in February, whereas mounted asset funding grew 5.1% in March Vs 5.7% anticipated, and 5.5% in February.

China Financial Shock Index

Supply knowledge: Bloomberg; Chart ready in Excel

This follows a string of upbeat China knowledge in current weeks – Financial Shock Index for China this month hit the best stage no less than since 2014 – reflecting the optimistic spillovers from the financial reopening. Moreover, hopes of a turnaround within the property cycle (new properties costs rose in March on the quickest tempo in 21 months) and hopes that regulatory crackdown on corporates might be ending recommend the expansion spurt might change into greater than short-term.

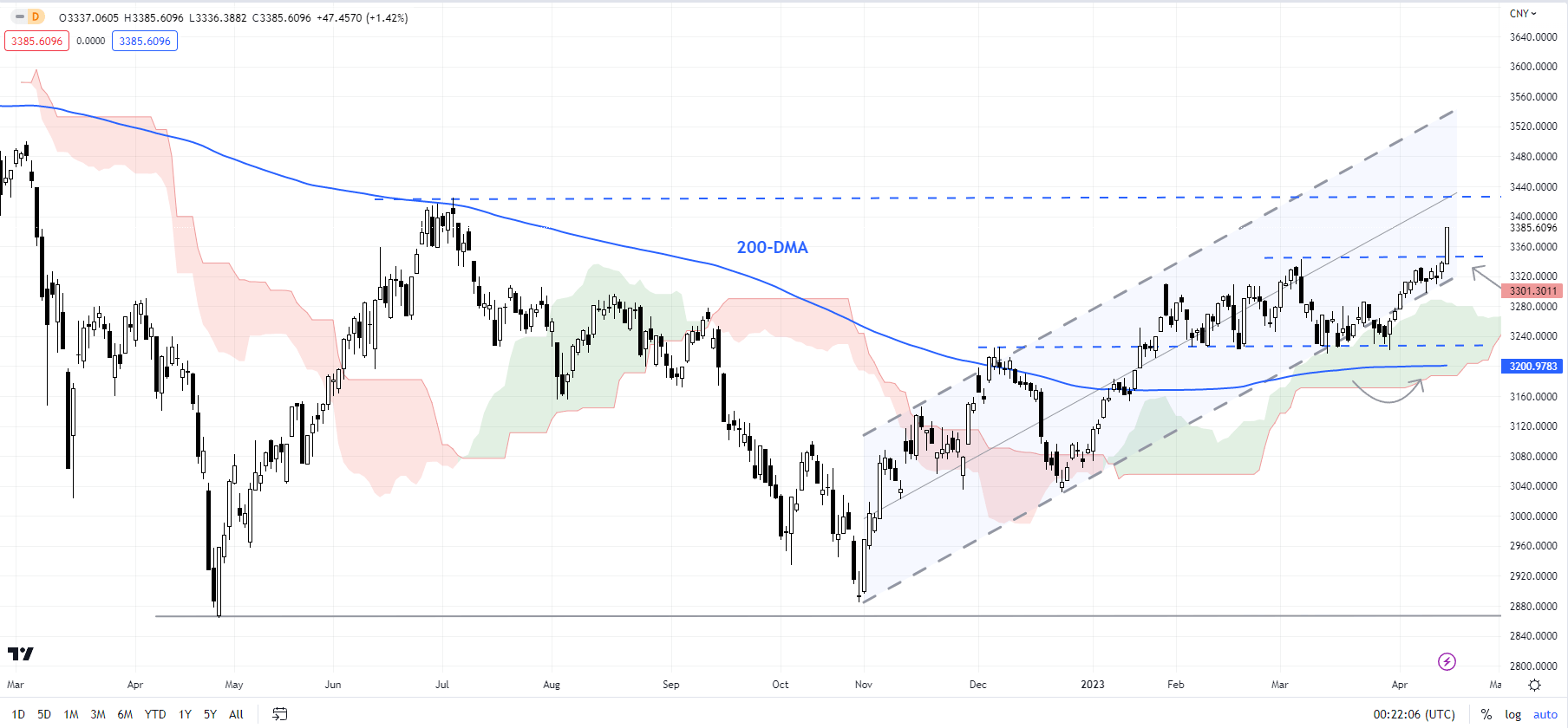

Shanghai Composite Index Every day Chart

Chart Created by Manish Jaradi Utilizing TradingView

Consensus expects about 5.3% on-year development for China for the yr 2023, up sharply from round 4.3% in January. The upgrading within the development outlook bodes nicely for China/Hong Kong equities – regardless of the rebound since late 2022, from a valuation perspective, Chinese language equities are buying and selling beneath the previous 20 years’ common.

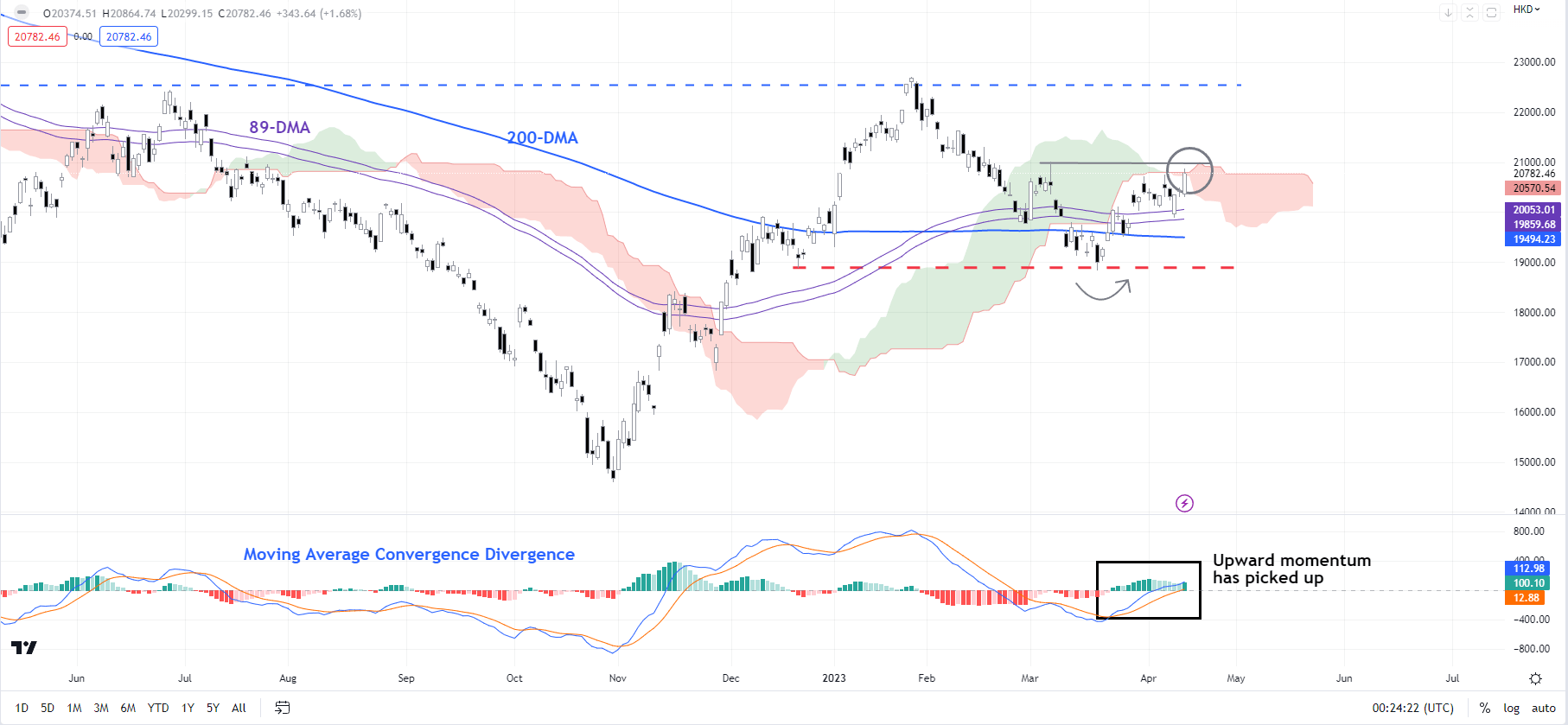

Hold Seng Index Every day Chart

Chart Created by Manish Jaradi Utilizing TradingView

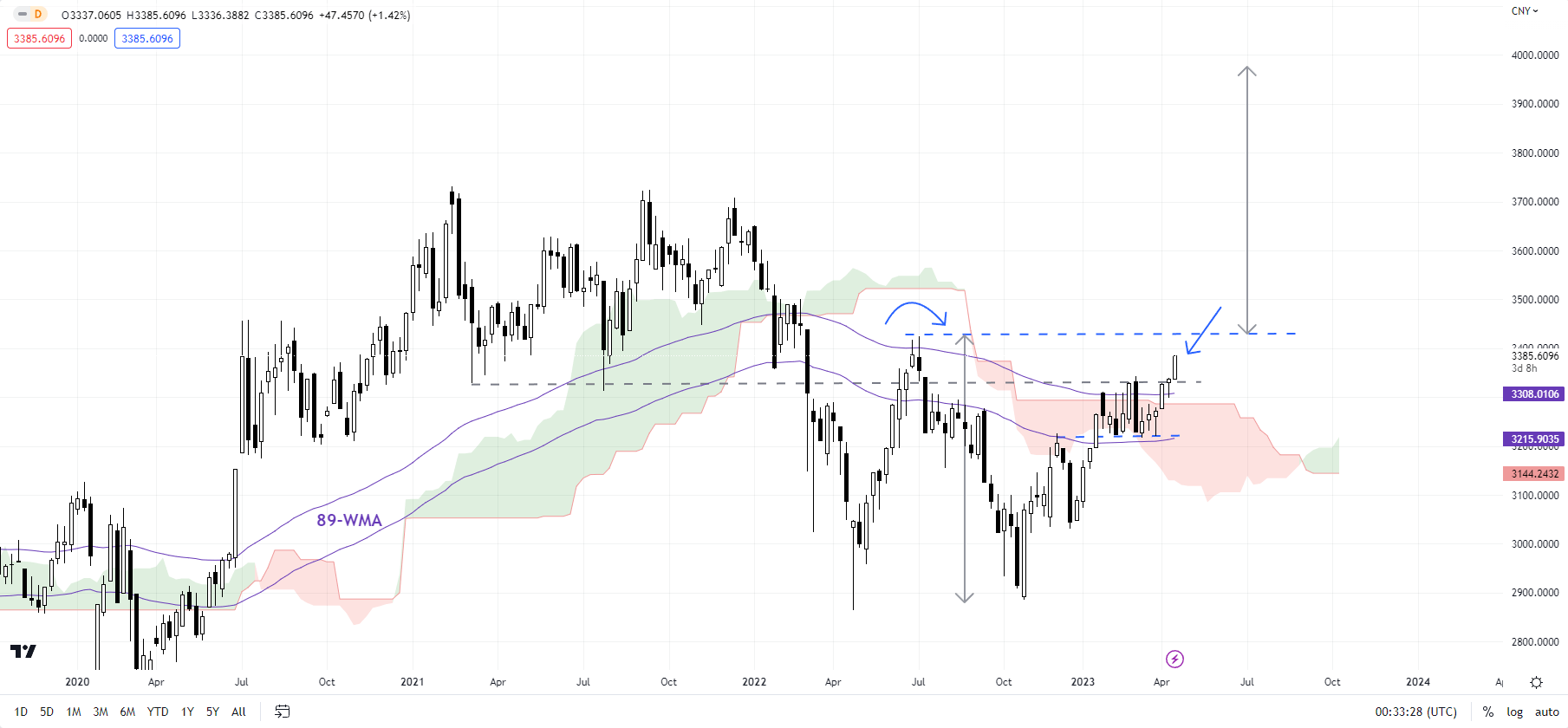

Shanghai Com: Rises above a key barrier

The Shanghai Composite Index’s break above a key hurdle on the early-March excessive of 3343, roughly coinciding with the 89-week transferring common (the rebound in 2022 ran out of steam on the Fibonacci transferring common). The index seems set to retest the mid-2022 excessive of 3425. Any break above 3425 would set off a serious double backside (the 2022 lows), doubtlessly opening the way in which for round 15% — above the 2021 excessive of 3730.

Shanghai Composite Index Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

Hold Seng: Starting to flex muscle groups

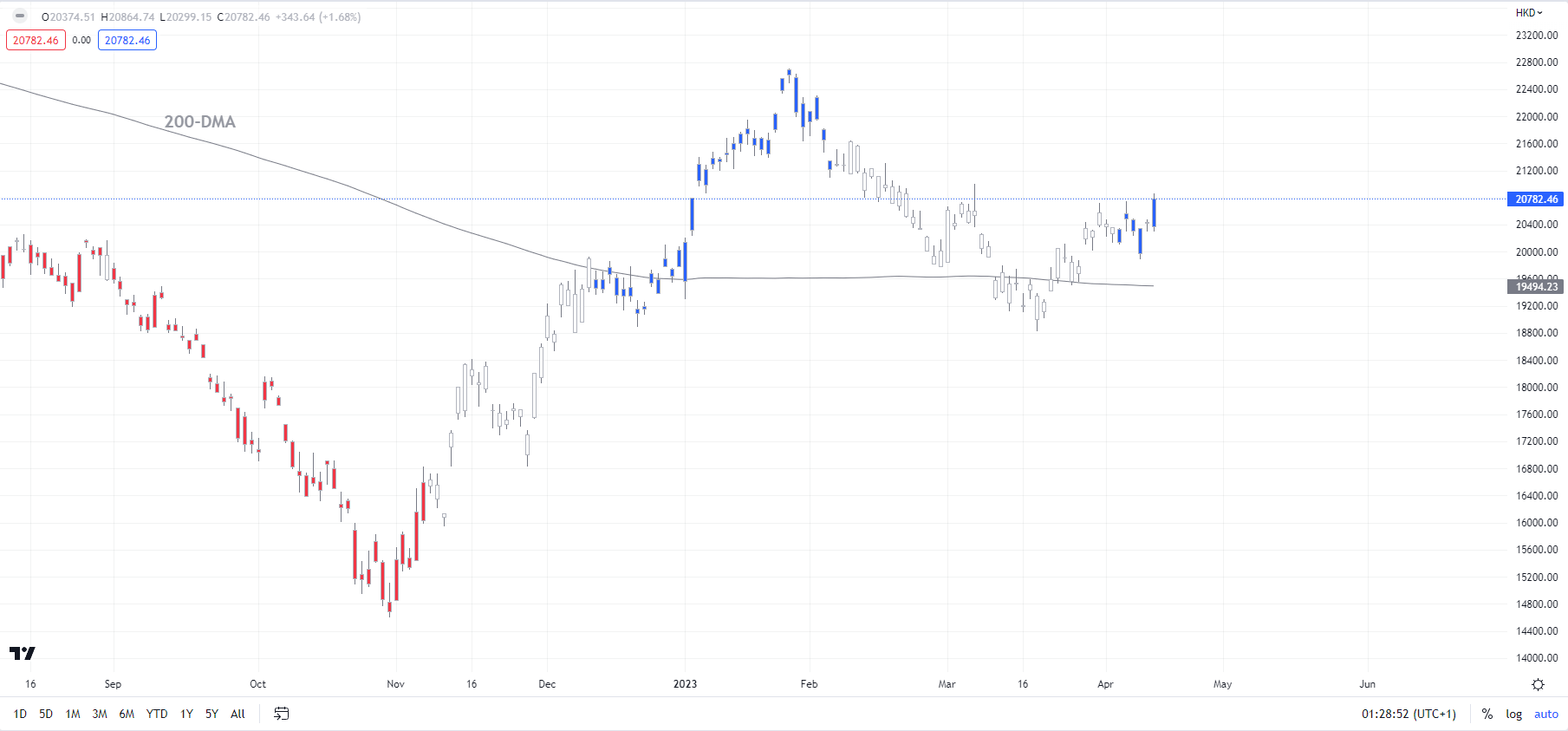

The Hold Seng Index’s maintain above important assist on the December low of 18885 confirms that the higher-top-higher-bottom sequence (that’s, an uptrend) from the tip of 2022 stays in place. The color-coded charts recommend the bullish section within the index has resumed (see chart).

The Hold Seng Index is now testing essential resistance on a horizontal trendline from early March at about 21000, roughly coinciding with the higher fringe of the Ichimoku channel on the every day chart. A decisive break above the resistance might open the door towards the January excessive of 22700.

Hold Seng Index Every day Chart

Chart Created by Manish Jaradi Utilizing TradingView

Be aware: Within the above colour-coded chart, Blue candles signify a Bullish section. Purple candles signify a Bearish section. Gray candles function Consolidation phases (inside a Bullish or a Bearish section), however typically they have a tendency to type on the finish of a development. Be aware: Candle colours are usually not predictive – they merely state what the present development is. Certainly, the candle coloration can change within the subsequent bar. False patterns can happen across the 200-period transferring common, or round a assist/resistance and/or in sideways/uneven market. The creator doesn’t assure the accuracy of the knowledge. Previous efficiency is just not indicative of future efficiency. Customers of the knowledge accomplish that at their very own danger.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and comply with Jaradi on Twitter: @JaradiManish

[ad_2]

Source link