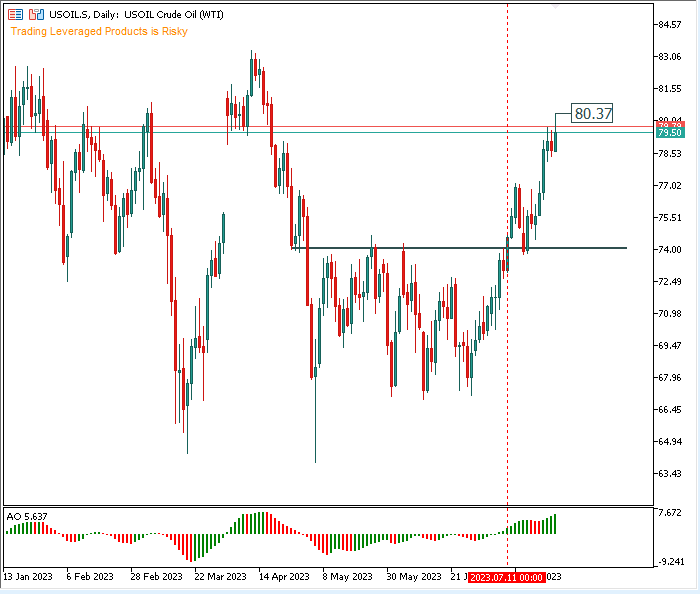

Chevron Corp. is predicted to report earnings on Friday (28/07) earlier than market open, amid rising crude oil costs. The report is for the fiscal quarter ending June 2023. USOil costs broke $80/barrel for the primary time since mid-April on Thursday (27/07). Analysts anticipate a drop in revenue as a result of decrease power costs in 2023.

Oil costs rallied amid the prospect of tighter international provide, a downgrade of US recession forecasts and stronger demand in China. Chinese language authorities not too long ago pledged to extend stimulus help, strengthening the oil demand outlook for the world’s high crude importer. Earlier, the Vitality Data Administration (EIA) reported a drawdown in crude and gasoline inventories in america, apparently including to issues about commodity provide. In the meantime, Shell recorded a big drop in earnings through the second quarter as a result of decrease manufacturing volumes and decrease margins in its oil refining enterprise.

Oil costs rallied amid the prospect of tighter international provide, a downgrade of US recession forecasts and stronger demand in China. Chinese language authorities not too long ago pledged to extend stimulus help, strengthening the oil demand outlook for the world’s high crude importer. Earlier, the Vitality Data Administration (EIA) reported a drawdown in crude and gasoline inventories in america, apparently including to issues about commodity provide. In the meantime, Shell recorded a big drop in earnings through the second quarter as a result of decrease manufacturing volumes and decrease margins in its oil refining enterprise.

Vitality big Chevron famous that manufacturing within the West Texas Permian Basin hit a quarterly file in its efficiency highlights for the second quarter. In keeping with Chevron, Permian output is on observe to succeed in its full-year forecast and complete manufacturing reached 772,000 barrels of oil equal per day. Regardless of the efficiency, Chevron has produced 2.9 million barrels of oil equal per day to date in 2023, sustaining a continuing manufacturing fee in comparison with 2022.

In the meantime, Chevron paid $7.2 billion in dividends and inventory purchases to shareholders within the second quarter, totalling $2.8 billion. As well as, the $6.3 billion acquisition of PDC Vitality (PDCE) is predicted to be accomplished in August.

Though income declined from a 12 months earlier, Chevron beat market expectations within the first quarter. First-quarter earnings elevated 6% to $3.55 per share. Gross sales fell 6% to $50.79 billion. Greater margins on refined product gross sales drove the earnings hit, partially offset by decrease oil costs and rising manufacturing prices.

In keeping with Zacks Funding Analysis, primarily based on 7 analysts’ estimates, the consensus EPS estimate for the quarter is $2.95. The reported EPS for a similar quarter final 12 months was $5.82. Rating the inventory at #3 (maintain), primarily based on short-term value targets provided by 18 analysts, Chevron’s common value goal stands at $188.33. Estimates vary from a low of $163.00 to a excessive of $212.00. The common value goal represents a 15.85% enhance from the final closing value of $162.56.

Technical Evaluation

#Chevron fell greater than -1% on Thursday’s buying and selling (27/7), and traded beneath the 160.00 spherical determine. The consolidation that occurred within the final 2 months between 149.68-160.76 was efficiently damaged to the upside by registering a excessive of 164.03 final Monday. And since then, the value has retreated greater than -2.5% to the draw back. For now, #Chevron is transferring amidst a flat 200-day EMA, as a result of gathered transferring common of value consolidation in Might-July. Main resistance continues to be seen at 167.07 because the neckline of the every day double high sample and the structural help of 149-66/149.90 will maintain the bears’ management. A break above this significant help would verify a continuation of the decline of the 189.66 peak recorded in November final 12 months and the bear market may transfer additional to 140.46 and 132.52. On the optimistic aspect, a transfer above 167.07 may equalize April’s peak of 172.83, if earnings expectations are exceeded.

The RSI repeatedly failed to succeed in overbought ranges through the consolidation and the MACD briefly portrays the bulls’ disappointment, after leaping out into the purchase zone amid decrease earnings expectations.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.