[ad_1]

South Africa is grappling with financial challenges, marked by persistent energy outages, social unrest, and structural constraints hindering progress. The most recent knowledge from Statistics South Africa exhibits a 1.2% quarter-on-quarter GDP progress in Q2 2023, pushed by mining, finance, and commerce, whereas agriculture, manufacturing, and development contracted. Yr-on-year, GDP contracted by 17.2% in Q2.

Inflation, measured by the patron worth index (CPI), rose to five.4% year-on-year in September, reaching a three-month excessive. Meals, non-alcoholic drinks, housing, utilities, and transport prices have been major contributors. Whereas nonetheless throughout the South African Reserve Financial institution’s (SARB) goal vary of three% to six%, it moved farther from the 4.5% midpoint that the SARB goals to anchor.

Inflation, measured by the patron worth index (CPI), rose to five.4% year-on-year in September, reaching a three-month excessive. Meals, non-alcoholic drinks, housing, utilities, and transport prices have been major contributors. Whereas nonetheless throughout the South African Reserve Financial institution’s (SARB) goal vary of three% to six%, it moved farther from the 4.5% midpoint that the SARB goals to anchor.

The upcoming SARB rate of interest choice on November 23 is essential. Having maintained the repo fee at 8.25% in September, the SARB is using a cautious, data-dependent strategy, balancing financial assist and inflation containment. The SARB’s Quarterly Projection Mannequin suggests a possible 25 foundation factors fee hike in 2023, adopted by two extra hikes in 2024, contingent on inflation outlook and threat evaluation.

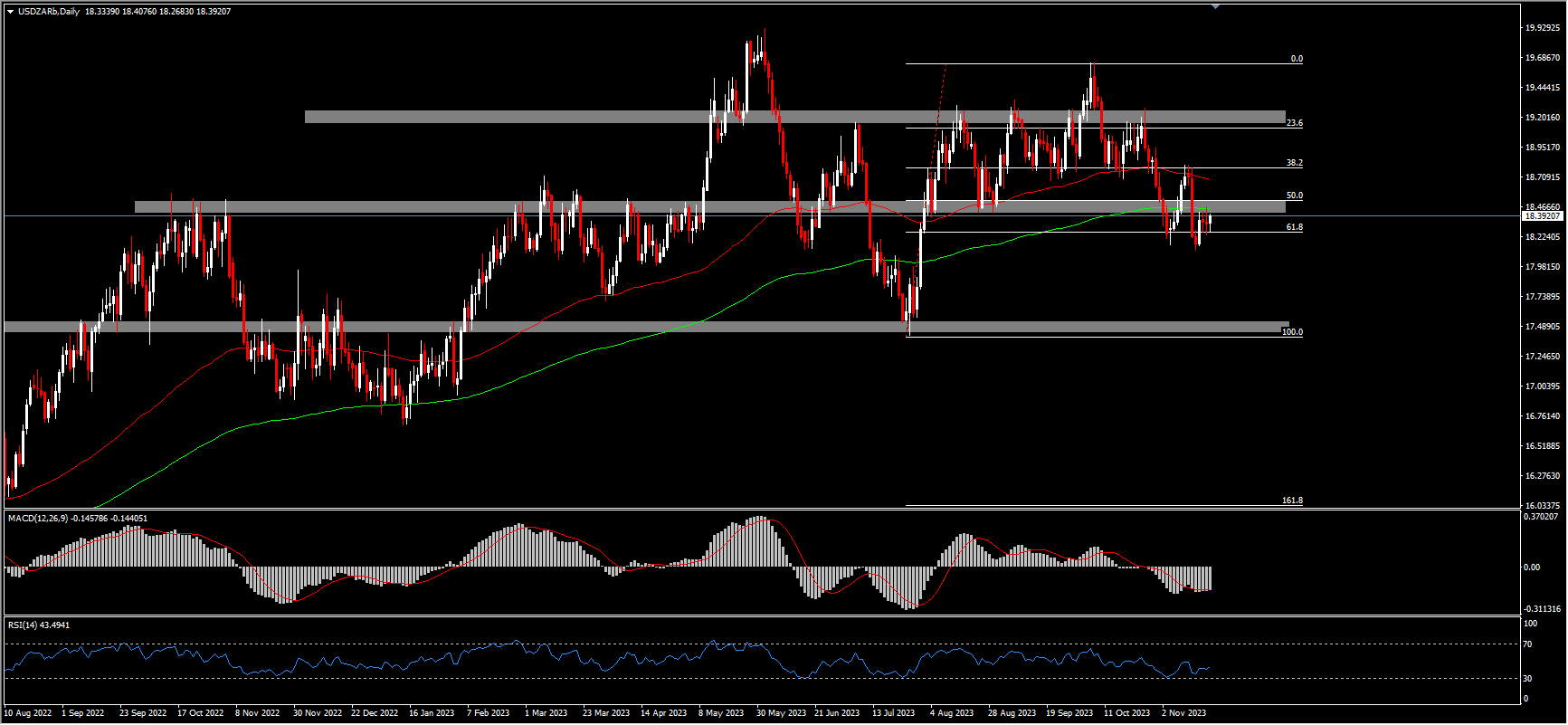

Inspecting the USDZAR technical evaluation on the day by day chart, the pair broke down the assist at 18.40 and the 200-day transferring common, buying and selling simply above the 61.8% Fibonacci degree at 18.39. A break under 18.25 may result in additional declines in the direction of 18.00 and probably 17.50. Conversely, a bounce would possibly encounter resistance at 18.52 and 18.78. The momentum indicators RSI and MACD are offering combined alerts, with RSI close to the impartial 50 degree, indicating a impartial bias, whereas MACD above the sign line suggests a bullish bias.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link