[ad_1]

Market Recap

Really helpful by Jun Rong Yeap

Get Your Free Equities Forecast

Preliminary beneficial properties in Wall Road took a flip in a single day, as a soar in Treasury yields stored the strain on danger sentiments. Notably, the 10-year Treasury yields noticed a soar of 13 basis-point (bp) to reclaim its key 4% stage, whereas the US two-year yields have been up by 8 bp, pushed by a confluence of stronger-than-expected US financial knowledge and chatters of a coverage adjustment from the Financial institution of Japan (BoJ).

The advance estimate for US 2Q GDP has smashed expectations by a large margin (2.4% versus 1.8% consensus), notably with shock power in client spending and enterprise funding, anchoring down on delicate touchdown hopes. However whereas market price expectations stay firmly priced for the Fed to maintain charges on maintain over coming months, the timeline for price cuts is extra unsettled with financial resilience supporting a high-for-longer price outlook.

Maybe the larger shock in a single day comes from a information launch from Nikkei, which reported that the Financial institution of Japan (BoJ) will talk about tweaking its yield curve management (YCC) coverage on the upcoming coverage board assembly. A tweak of its YCC coverage again in December 2022 has triggered a soar in international bond yields in its aftermath and stored danger sentiments in test. If confirmed later at this time, an analogous state of affairs could play out.

Regardless of greater Treasury yields, the USD/JPY has plunged by 1.3% in a single day on a stronger yen and put the pair in sight of the 137.60 stage, the place a key confluence assist stands (Ichimoku cloud assist, 100-day shifting common, decrease channel trendline). Its relative power index (RSI) has turned decrease from the important thing 50 stage, which places sellers in management within the close to time period. Any breakdown of the 137.60 stage could probably pave the way in which to retest the 134.50 stage subsequent.

Supply: IG charts

Asia Open

Asian shares look set for a detrimental open, with Nikkei -1.44%, ASX -0.86% and KOSPI -0.35% on the time of writing, monitoring the downbeat session in Wall Road. Little question the BoJ assembly will probably be on the radar at this time, with chatters that the central financial institution could contemplate letting long-term rates of interest rise above its 0.5% cap by “a sure diploma” overturning earlier expectations of extra wait-and-see from the central financial institution.

Whereas it’s probably that the BoJ’s accommodative stance may largely stay, market sentiments have been extremely delicate to any tweaks in coverage settings as a sign of a faster coverage normalisation because the shock YCC tweak again in December 2022. Any affirmation on the upcoming assembly will being about upside dangers to international bond yields, as Japanese bond returns might be extra engaging to its home buyers.

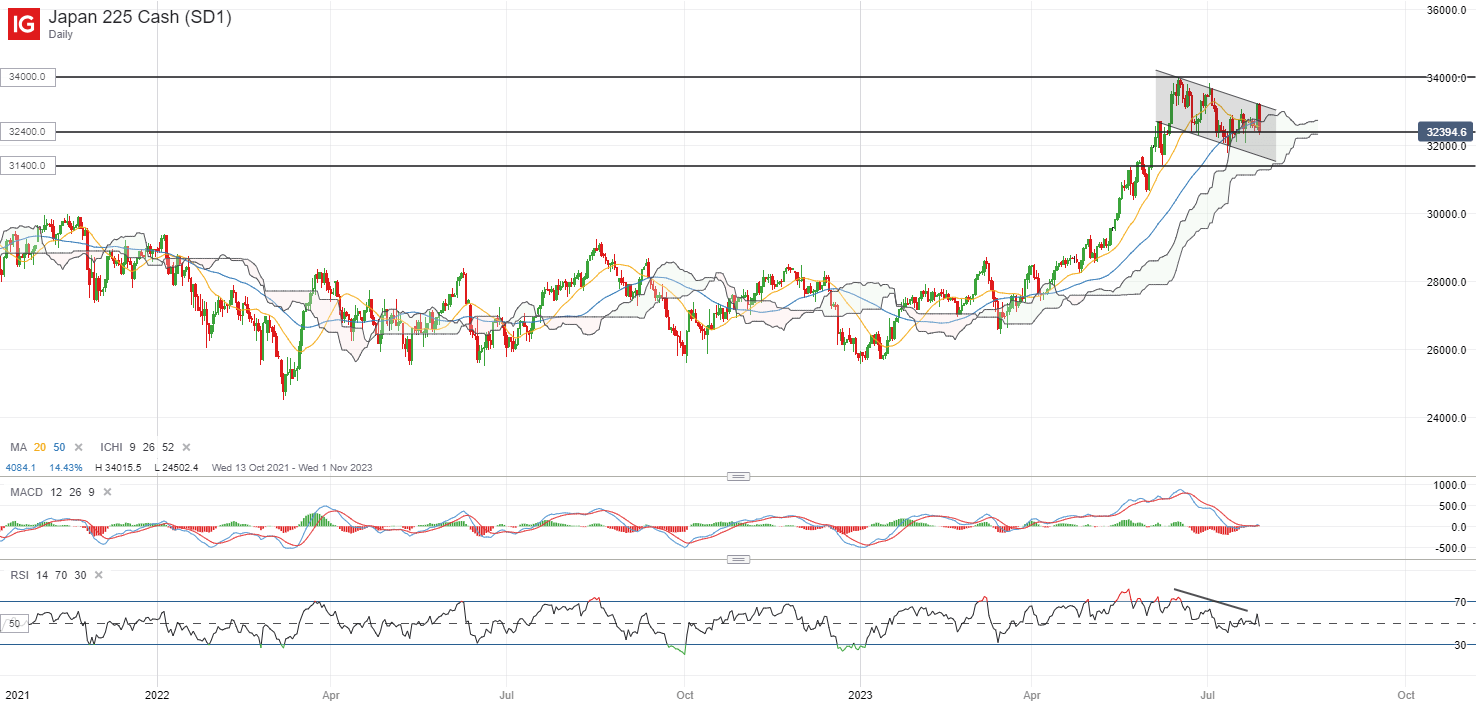

The Nikkei 225 index is placed on the radar as effectively. Earlier adjustment to its 10-year bond yield cap in December 2022 has triggered a 3% sell-off within the index in a single day, contemplating the lowered traction in holding equities on the next risk-free price. The index is presently again to retest its 32,400 stage of assist, discovering resistance at a near-term downward-sloping trendline. Any failure to defend the extent could probably pave the way in which in the direction of the 31,400 stage subsequent.

Really helpful by Jun Rong Yeap

Get Your Free High Buying and selling Alternatives Forecast

Supply: IG charts

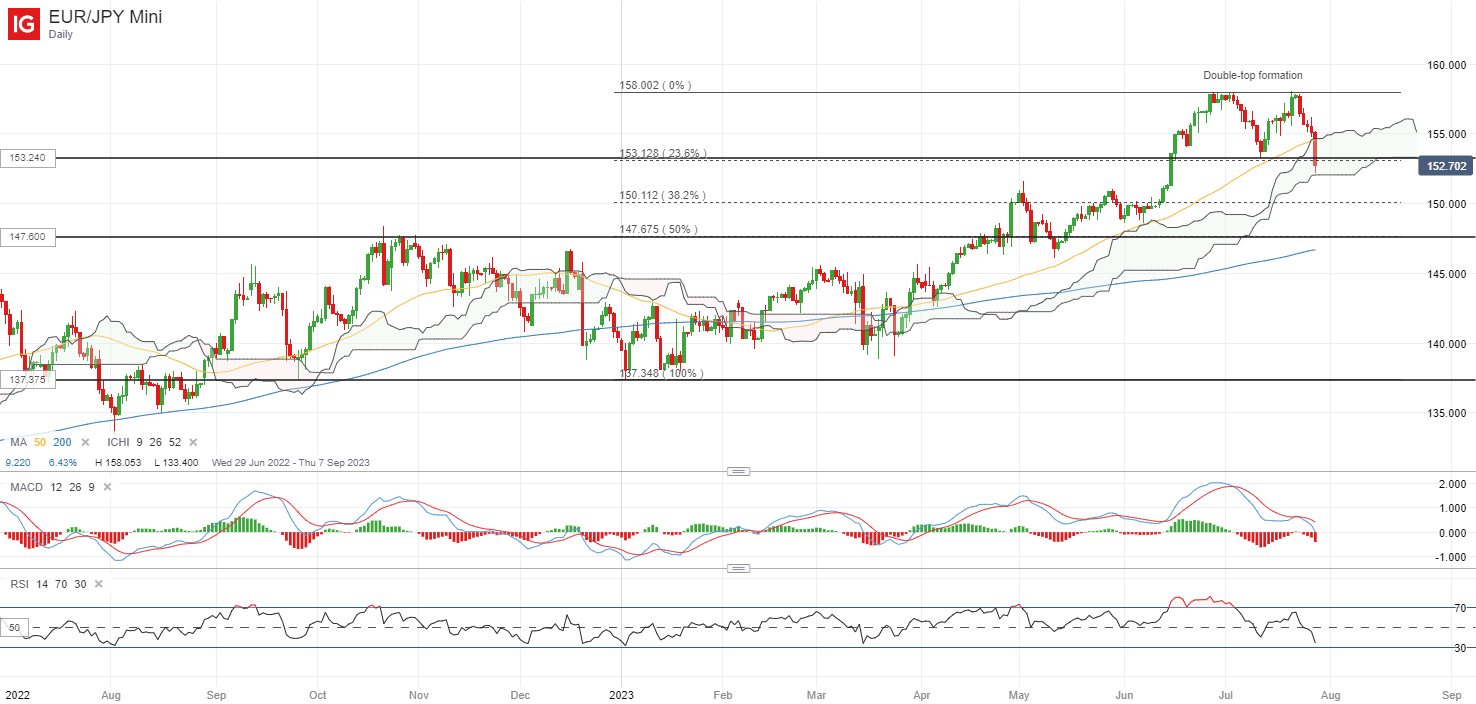

On the watchlist: Breakdown of double-top formation in EUR/JPY

The confluence of a extra data-dependent stance from the European Central Financial institution (ECB) and speculations of a coverage adjustment from the Financial institution of Japan (BoJ) have prompted the EUR/JPY to interrupt beneath the neckline of a double-top formation in a single day.

Regardless of an preliminary hawkish coverage assertion from the ECB, the tone from the press convention appears to hold some reservations. The ECB President Christine Lagarde floated the potential of a price pause through the press convention, saying that the central financial institution is “intentionally knowledge dependent” and “have an open thoughts” for subsequent price choices.

For the EUR/JPY, the 153.24 stage has been breached, with the projection of the double-top sample probably inserting the 147.60 stage on watch subsequent. A lot will revolve across the upcoming BoJ assembly, with any affirmation of a YCC tweak more likely to drive additional power within the Japanese yen and stored the lid on the EUR/JPY.

Really helpful by Jun Rong Yeap

Get Your Free JPY Forecast

Supply: IG charts

Thursday: DJIA -0.67%; S&P 500 -0.64%; Nasdaq -0.55%, DAX +1.70%, FTSE +0.21%

[ad_2]

Source link