[ad_1]

Invoice Oxford

Funding Thesis

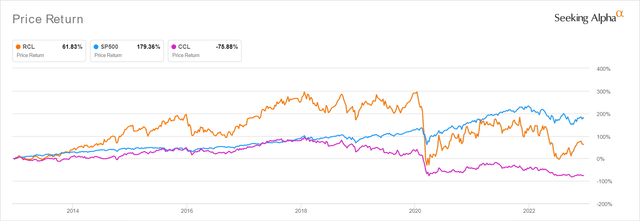

CCL & RCL 10Y Inventory Worth

Looking for Alpha

Contemplating the truth that cruise shares have generated minimal returns to this point, we don’t perceive why anybody would put money into them, since each Carnival Company & plc (NYSE:CCL) and Royal Caribbean Cruises (NYSE:RCL) will not be paying dividends as effectively. CCL presents a 5Y complete value return of -85.3% and 10Y of -70.7%, whereas RCL fares barely higher at 5Y of -53% and 10Y of 89%. Even after the -16.17% correction from December 2021’s peak ranges, the S&P 500 Index has supplied a lot improved 5Y returns of 49.31% and 10Y of 179.36% compared.

Mixed with the unsure macroeconomics and the Fed’s raised rates of interest by 2023, there can be minimal catalysts for restoration within the brief time period, particularly resulting from their slower return to pre-pandemic profitability over the subsequent few years.

CCL & RCL’s Efficiency Could Stay Disappointing

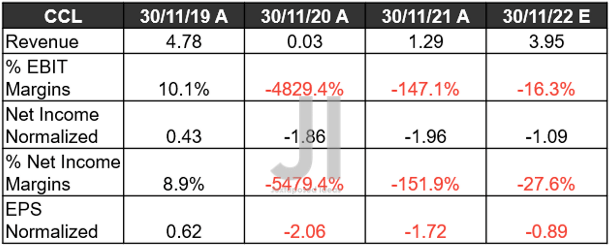

CCL Income, Internet Earnings ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

Over the subsequent few days, market analysts have projected that CCL could report a powerful FQ4’22 income of $3.95B, regardless of the supposedly weaker touring season. Nonetheless, it’s obvious that the price of revenues and working bills stay elevated, pointing to its lack of worthwhile margins and detrimental EPS for the upcoming quarter.

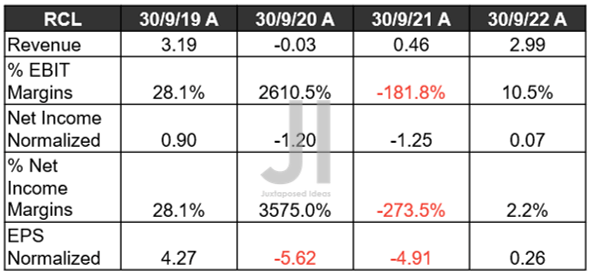

RCL Income, Internet Earnings ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

In the meantime, RCL has carried out comparatively effectively throughout its latest FQ3’22 name, notably impressing market analysts with its first constructive working revenue of $308.61M and EBIT margins of 10.5% because the begin of the pandemic in 2020. Thereby, additionally sparking its first constructive EPS of $0.26 towards consensus estimates of $0.17. Nonetheless, regardless of the document reserving volumes, it’s obvious that the corporate continues to undergo from elevated prices, given its lackluster FQ4’22 steering of as much as EPS -$1.5.

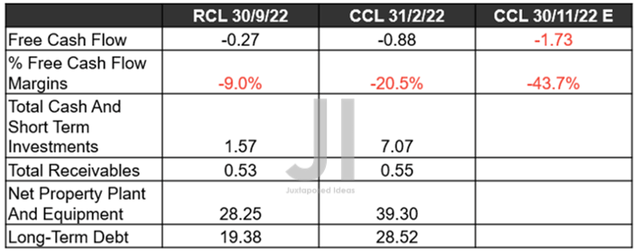

RCL & CCL FCF ( in billion $ ) % and Steadiness Sheet

S&P Capital IQ

Nonetheless, we stay cautiously optimistic, resulting from CCL & RCL’s strong complete receivables of $0.55B and $0.53B from the 2023 bookings, respectively. The latter’s money/ equivalents of $7.07B are greater than adequate to climate the short-term uncertainties as effectively. Nonetheless, its super long-term money owed of $28.52B have additionally posed a profitability risk, because the firm is taking a look at huge curiosity bills of $1.51B during the last twelve months [LTM], rising tremendously by 732.52% from FY2019 ranges of $206M.

However, RCL has comparatively decrease curiosity bills of $1.21B over the LTM, growing moderately by 296.56% since FY2019. Nonetheless, with RCL and CCL taking a look at $8.71B of debt maturity due 2024 and $7.44B (primarily based on its earlier annual report), respectively, it is rather possible each firms could must depend on additional debt refinancing or leveraging within the intermediate time period. We’ll see.

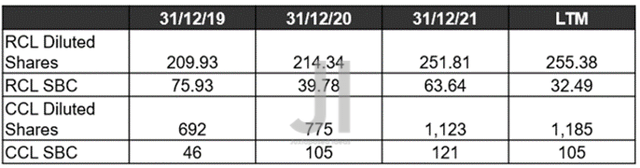

RCL & CCL SBC Bills ( in million $ )/ Share Dilution ( in million )

S&P Capital IQ

In the meantime, RCL has proved expedient in lowering its SBC bills to $32.49M by the LTM, indicating a decline of -57.21% from FY2019 ranges, contributing to the managed enhance in its share rely and the well being of its GAAP profitability.

However, CCL has closely relied on SBC bills over the previous three years, increasing at an eye-watering 228.26% to $105M by the LTM. Mixed with its a number of fairness choices in 2020 and 2021, it’s evident that long-term buyers have been diluted by 71.24% because the begin of the pandemic. Given how the corporate can be reporting minimal profitability in FY2023, we could possible see a continued reliance on share dilution and SBC bills within the brief time period.

When Are CCL & RCL Projected To Return To Pre-Pandemic Profitability?

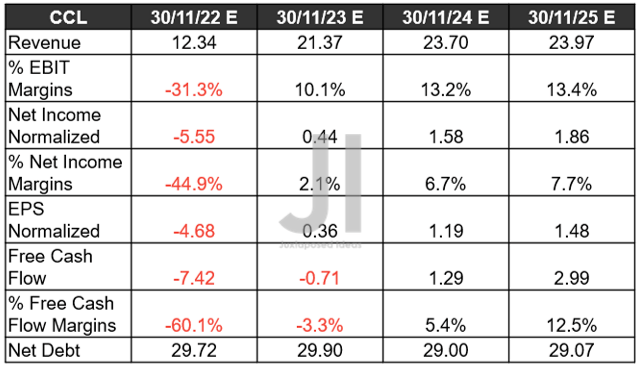

CCL Projected Income, Internet Earnings ( in billion $ ) %, EBIT %, EPS, FCF %, and Debt

S&P Capital IQ

Over the subsequent few years, CCL could proceed its underperformance, regardless of the return of its pre-pandemic topline by FY2023. Its EBIT margins of 13.4% and web revenue margins of seven.7% might doubtlessly stay urgent points by FY2025 as effectively, in comparison with FY2019 ranges of 15.7% and 14.6%, respectively. That is possible attributed to the rising inflationary pressures, which have decimated its gross margins by -27.8 share factors to 25.5% by the LTM, in comparison with FY2019 ranges of 53.3%, additional worsened by its elevated curiosity bills by 2030.

Although the CCL administration has additionally valiantly managed its working bills much like pre-pandemic ranges, it’s obvious that the macro headwinds are working towards the strong shopper demand. Regardless of the superb projected FCF technology of $2.99B by FY2025, the inventory’s near-term prospects stay unsure, as a result of minimal EPS growth and the minimal deleveraging to $29.07B of web money owed on the identical time.

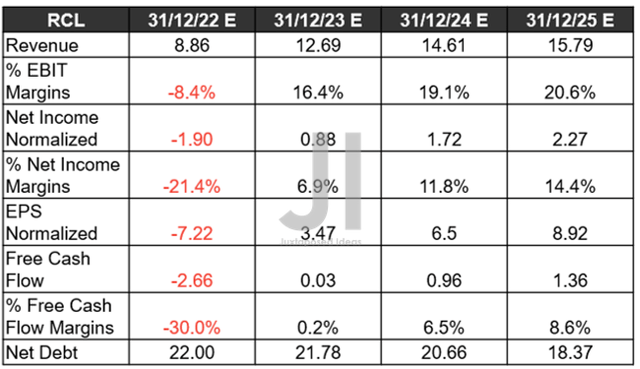

RCL Projected Income, Internet Earnings ( in billion $ ) %, EBIT %, EPS, FCF %, and Debt

S&P Capital IQ

Within the meantime, RCL is anticipated to carry out barely higher, with its high line and margins considerably returning to pre-pandemic ranges by FY2024 and the EPS by FY2025. Thereby, additionally explaining the continued deleveraging efforts to $18.37B of web money owed on the identical time, although nonetheless naturally elevated from FY2019 ranges of $11.55B. Nonetheless, we reckon that the corporate could carry out effectively transferring ahead, as soon as there are lowered curiosity obligations over the subsequent few years.

Solely time will inform how 2023 will end up, although early reserving developments from Cyber Monday look comparatively promising, considerably aided by the speculative value hikes forward. Thereby, doubtlessly resulting in the upward revisions of their long-term prospects by FY2025. In the meantime, we encourage you to learn our earlier article, which might assist you to higher perceive its place and market alternatives.

- Carnival: The Hurricane Is Not Over, Combined Indicators Forward

- Royal Caribbean: Recession Could Sink Demand And Profitability

So, Are CCL & CCL Shares Purchase, Promote, or Maintain?

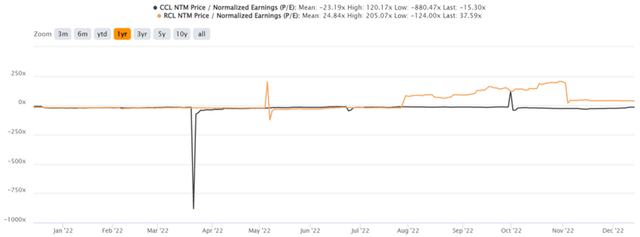

CCL & RCL YTD P/E Valuations

S&P Capital IQ

Each CCL and RCL are buying and selling at elevated NTM P/E valuations of -15.30x and 37.59x, greater than their 3Y pre-pandemic imply of 13.74x and 13.05x, respectively. If we’re to gauge sure value targets primarily based on their FY2025 EPS of $1.48 and $8.92, CCL could outperform with a 227.65% upside to $20.33, whereas RCL additionally seems engaging with a 210.57% upside to $116.40. Nonetheless, these numbers additionally appear to be overly bold compared to consensus estimates, resulting from their CCL’s goal at $13.43 with a 50.39% upside and RCL at $78.33 with a 41.70% upside. Thereby, pointing to Mr. Market’s sustained pessimism ranges, regardless of the Fed’s latest dovish stance.

Because of this, we select to stay skeptical about CCL and RCL’s long-term prospects and retain our maintain rankings on each shares. Conservative buyers trying to offload could achieve this on the subsequent pop, relying on their greenback price common.

[ad_2]

Source link