On the peak of the 2020 to 2021 bull run, ADA, the native token of Cardano, rose to $3 in August. Apparently, builders activated good contracts across the prime of this cycle after finishing the Alonzo onerous fork, ushering within the Goguen part.

Did Alonzo And Sensible Contracts Kill ADA?

Nevertheless, as Atomic Pockets analysts notice, ADA has been on a downtrend since then, crumbling by over 90% through the years on the time of writing. ADA is altering fingers at $0.32 when writing, discovering fast help at round $0.30, a psychological quantity.

Associated Studying

Although merchants are optimistic about what lies forward, the flip of occasions during the last three years may recommend that the activation of good contracts on Cardano did “kill” the coin’s valuation. The plummeting costs, made worse by the 2022 crypto winter, imply those that purchased in August 2021 are holding mud.

Whether or not ADA will get well within the coming weeks and rewind losses of 2022 stays to be seen. What’s clear is that the activation of the Alonzo onerous fork and the beginning of the Goguen period was a key milestone for Cardano. The transition was essential contemplating that earlier than September 2021, builders couldn’t deploy dApps and tackle Ethereum and competing properties supporting good contracts.

For years, because the genesis block, Cardano builders have been accused of delaying the method whereas utilizing billions for improvement. After Alonzo, customers can, even now, create complicated good contracts utilizing Plutus scripts and run dApps. Like different blockchains, all charges are payable in ADA, the native token.

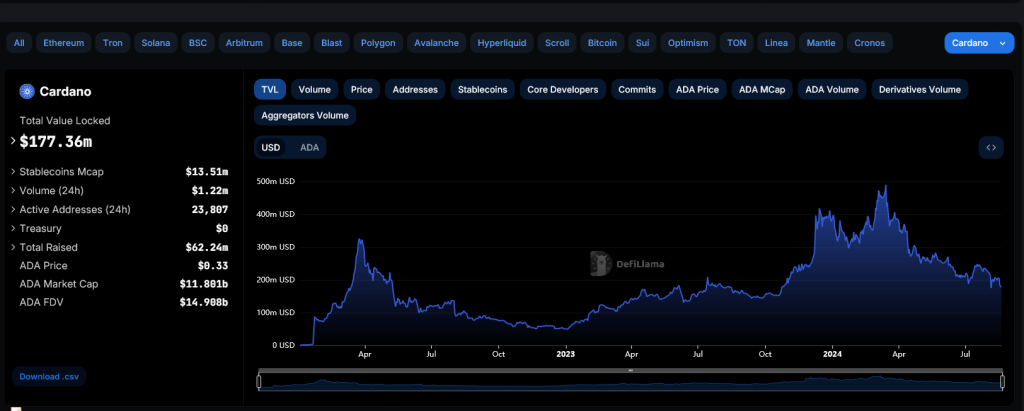

Through the years, Cardano has grown its ecosystem, wanting on the whole worth locked (TVL). In response to DeFiLlama, DeFi protocols on Cardano, lively after Alonzo, now handle over $177 million in property.

Although comparatively low in comparison with these in Ethereum and the BNB Chain, builders took benefit of good contracts and constructed options on the community.

Cardano Transitioning To Voltaire: Will Issues Change?

The present disconnect between ADA valuation and the expectation of coin holders post-Goguen is a priority. It’s so particularly as Cardano completes the Basho stage, shifting to Voltaire, the ultimate part of the platform’s improvement.

Associated Studying

Voltaire focuses on making Cardano governance decentralized. Right here, ADA can have extra utility, permitting holders to vote on proposals and instantly serving to enhance the community. Moreover, there shall be a treasury for funding initiatives deploying on Cardano. To this point, the Chang onerous fork is in progress, with roughly 33% of all stake pool operators (SPOs) prepared.

In the meantime, ADA stays underneath immense promoting strain and will plunge to 2023 lows of round $0.22 if consumers don’t step in. If costs rise above $0.50, bulls will probably push ADA towards March 2024 highs.

Characteristic picture from Shutterstock, chart from TradingView