[ad_1]

Bitcoin Technical Outlook: Candlestick Patterns Counsel Bullish Continuation is Doable in Q2

Within the first quarter of 2023, Bitcoin (BTC/USD) benefited from a discount in fee expectations and different basic catalysts that resulted in a leap in value motion, gaining over 70%. Query is, will bulls maintain onto management and drive costs to pre-war ranges?

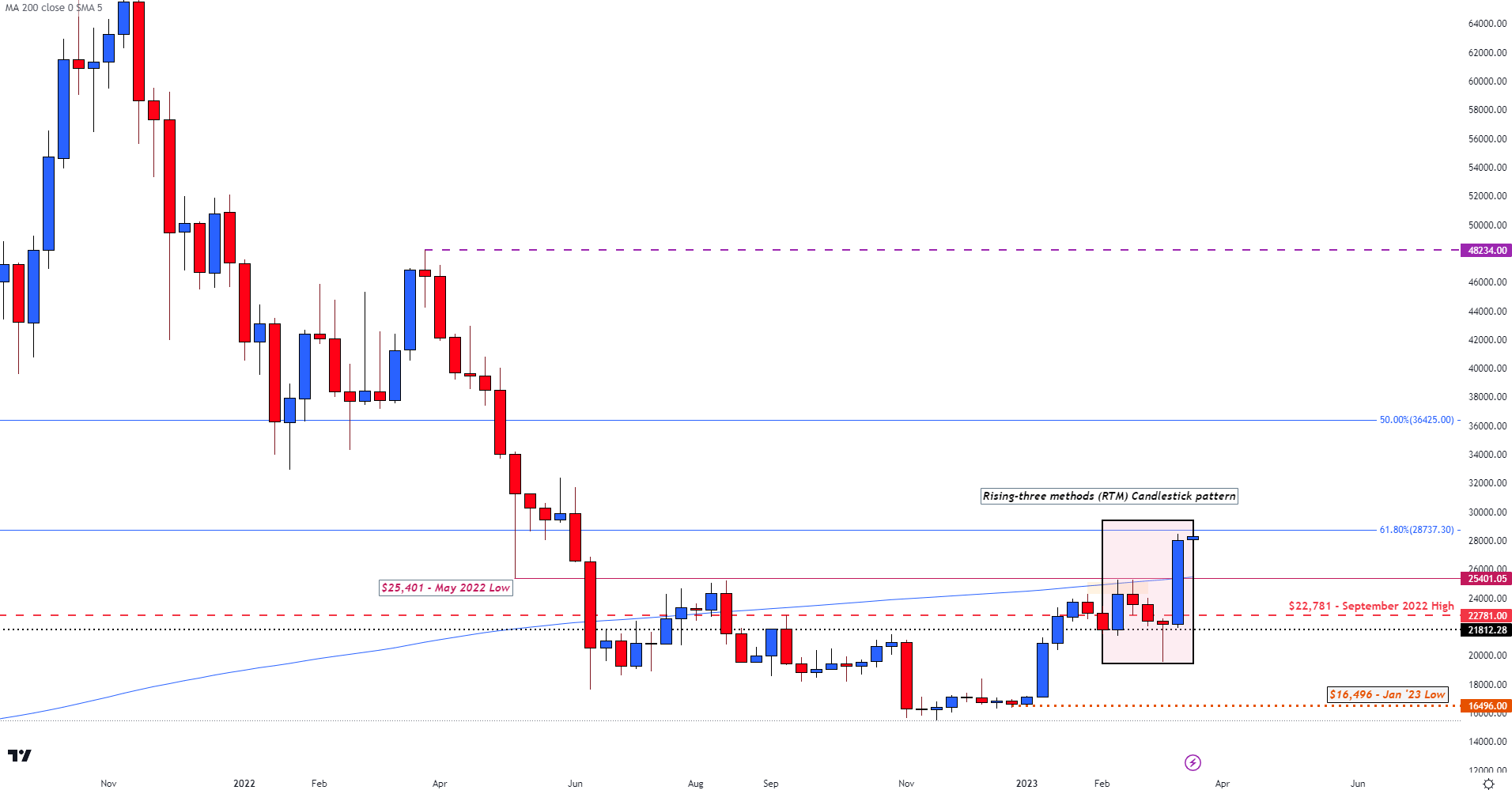

From a technical standpoint, the final three candlesticks on the month-to-month chart symbolize the primary quarter’s value motion.

Though this text focuses on the technical drivers of value motion, our recent Q2 information offers an in-depth overview of basic elements that might contribute to figuring out the underlying pattern.

Really helpful by Tammy Da Costa

How will Bitcoin react to the basic backdrop in Q2?

Abstract of Q1 Value Motion:

- January (lengthy, full-bodied candle) – Bitcoin costs surge, rising by almost 40% earlier than working right into a barrier of resistance across the September 2022 excessive of $22,781.

- February (costs open and shut across the similar degree, simply above the September 2022 excessive) – In technical evaluation, the doji is a single-candlestick sample that develops when a narrow-body kinds in the course of the month-to-month vary (Feb excessive and low). As bulls and bears fail to realize traction, costs settle across the month-to-month open, suggestive of indecision.

- March (full-body candle with lengthy lower-wick) – With the failure of the above-mentioned banks boosting the demand for Bitcoin, costs pushed by one other large degree of prior resistance now holding as assist on the 50-month MA (shifting common).

Bitcoin (BTC/USD) Month-to-month Chart

Supply: TradingView

By homing in on the medium-term fluctuations in costs, the weekly chart can help in highlighting extra ranges of assist and resistance. After a quick retest of the 200-day MA (simply above the psychological degree of $25,000) costs suffered a light pullback, forcing BTC decrease. Nevertheless, with the failure of SVB triggering one other rally, Bitcoin ripped greater earlier than setting a brand new 2023 excessive of $28,936.

Really helpful by Tammy Da Costa

Get Your Free Introduction To Cryptocurrency Buying and selling

This resulted in what is named the rising three strategies sample (a five-candlestick sample that signifies a continuation of the present uptrend).

Bitcoin (BTC/USD) Weekly Chart

Supply: TradingView

Bitcoin (BTC/USD) – Wanting Forward: Technical Ranges to Watch in Q2, 2023

Over the subsequent 12 weeks, modifications in sentiment might drive Bitcoin costs in both path. With costs at present buying and selling across the 61.8% retracement of the 2020 – 2021 transfer ($28,737), bulls might want to maintain above this degree to stay answerable for the quick and longer-term pattern. Above that lies one other key degree of historic resistance on the psychological degree of $32,000 after which the mid-point of the above-mentioned transfer at $36,425.

Nevertheless, if basic elements weigh on value motion, BTC might fall again to $27,000 earlier than plunging to the subsequent degree of assist on the 200-week MA (at present at $25,460). Beneath that’s the September 2022 excessive, a break of which might drive costs again to the December 2017 excessive at $19,666.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707

[ad_2]

Source link