[ad_1]

USD/CAD ANLAYSIS

- Canada’s inflation report aided the loonie in opposition to the USD.

- Chinese language GDP endorsed the crude oil rally, leaving the CAD bid for a lot of the European session.

- Key technical zone being examined with breakout potential.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

USD/CAD FUNDAMENTAL BACKDROP

The Canadian greenback rallied on the again of an general optimistic Chinese language GDP print earlier this morning that stoked bulls to get behind world commodities together with crude oil. Each WTI and Brent crude oil are buying and selling increased immediately as demand-side components enhance. That being mentioned, world recessionary fears might decrease the affect of the Chinese language information with world demand faltering, the stays, can the Chinese language economic system preserve its post-COVID progress statistics?

Canadian inflation (confer with financial calendar beneath) information confirmed indicators of continued decline regardless of the marginal beat on MoM core inflation. I don’t consider this is sufficient to deter the present financial coverage stance from the Financial institution of Canada (BoC) in pausing their rate of interest cycle at 15-year highs (4.5%). From a US perspective, constructing allow information suggests an additional stoop within the US housing market, including strain to the USD selloff immediately forward of the US buying and selling session. Whereas the Fed remains to be prone to hike by 25bps in Could, there accumulating information factors in favor of a slowing economic system presumably indicative of the Fed nearing its peak.

Advisable by Warren Venketas

Get Your Free USD Forecast

USD/CAD ECONOMIC CALENDAR

Supply: DailyFX Financial Calendar

Later immediately, the Fed’s Bowman will come into focus (presumably including to the Fed’s Bullard’s current hawkish feedback) whereas the weekly API crude oil report that has been displaying indicators of accelerating stock might mute CAD positive factors ought to this week’s determine comply with swimsuit.

TECHNICAL ANALYSIS

USD/CAD DAILY CHART

Chart ready by Warren Venketas, IG

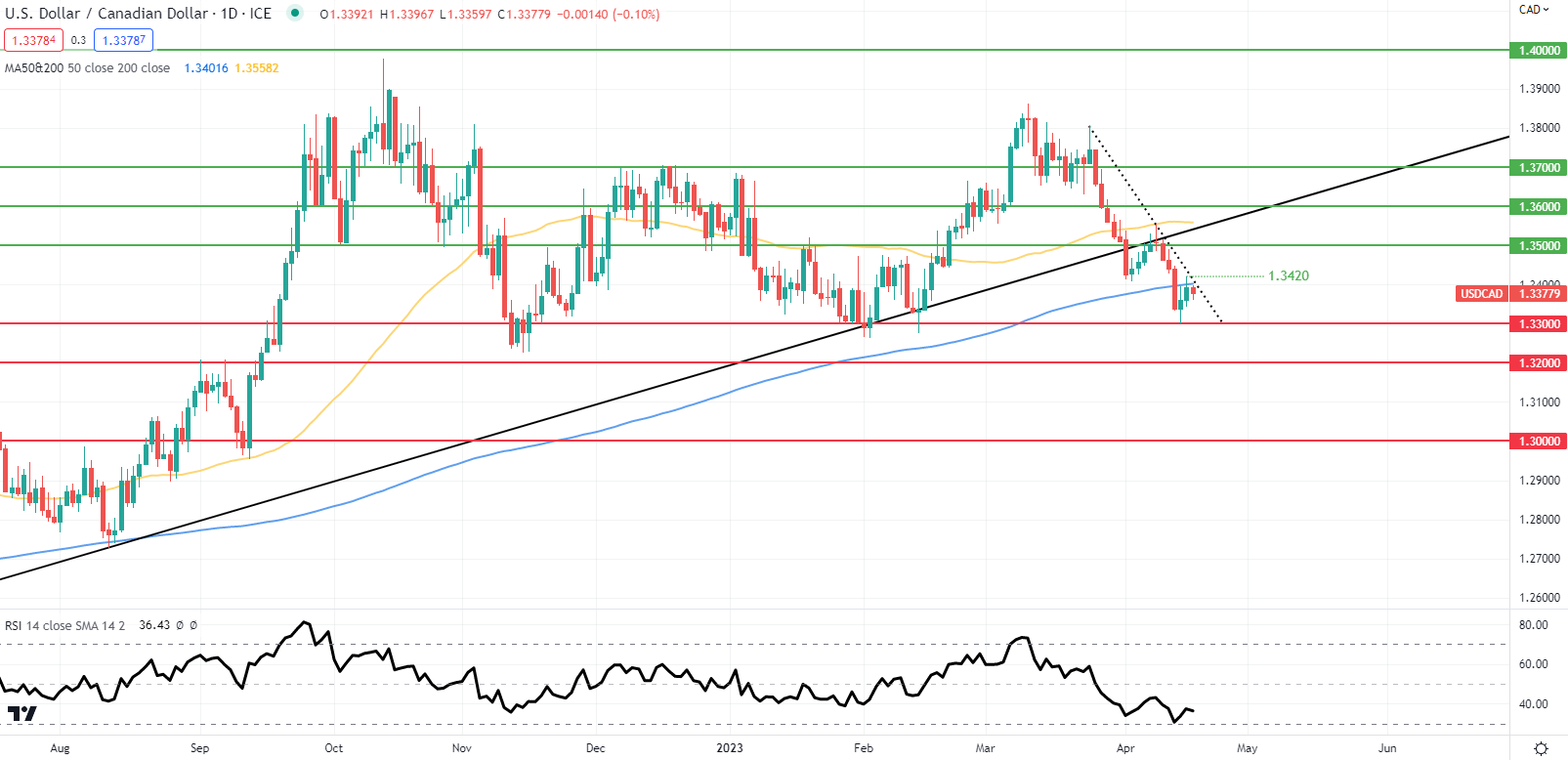

Day by day USD/CAD value motion has confirmed bulls willpower to defend the 1.3300 psychological assist deal with however now comes a key resistance check at a serious space of confluence together with the 200-day transferring common (blue) and the medium-term trendline assist (dotted black line). A profitable every day shut above the most important zones might USD/CAD claw its manner out of oversold territory as measured by the Relative Energy Index (RSI) up in direction of subsequent resistance zones.

Key resistance ranges:

- 1.3420

- 200-da MA/Trendline resistance

Key assist ranges:

IG CLIENT SENTIMENT DATA: MIXED

IGCS exhibits retail merchants are presently LONG on USD/CAD , with 62% of merchants presently holding lengthy positions (as of this writing). At DailyFX we usually take a contrarian view to crowd sentiment however as a consequence of current adjustments in lengthy and brief positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Source link