[ad_1]

Canadian Greenback Speaking Factors:

Advisable by James Stanley

Get Your Free Prime Buying and selling Alternatives Forecast

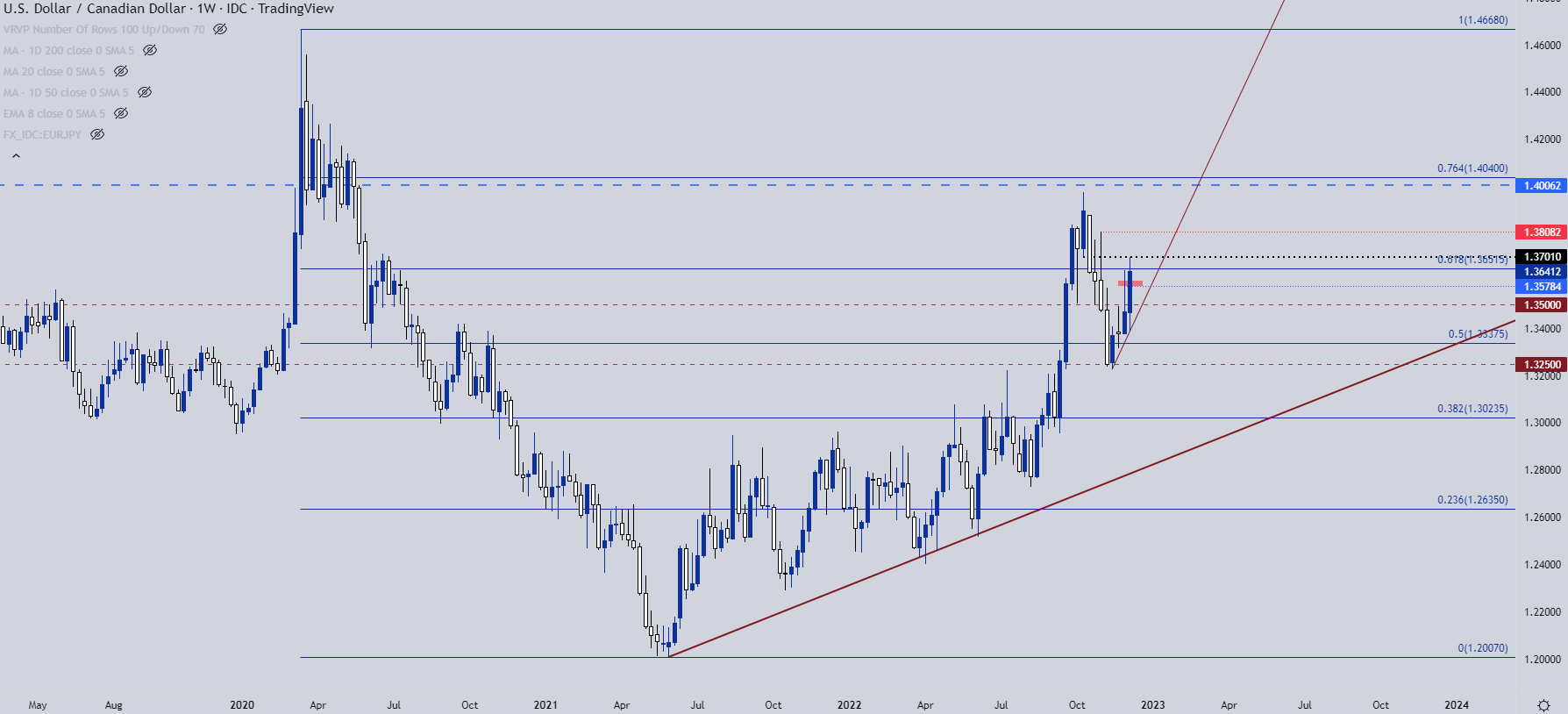

Canadian Greenback weak spot has been a constructing theme over the previous month. The US Greenback completed November as its worst month in additional than a decade, however since USD/CAD discovered help on the 1.3250 psychological degree in the midst of final month, the Canadian Greenback has truly been weaker than its US counterpart. The pair has now gained as a lot as 450 pips from that help check as much as this morning’s excessive, simply inside the 1.3700 deal with.

This units up USD/CAD as maybe one of many extra enticing pairs for working with themes of USD-strength, if that theme does come again into the top of the yr. Or, as I checked out final month, there’s additionally the choice of focusing that expectation of CAD-weakness elsewhere, equivalent to CAD/JPY or even perhaps EUR/CAD.

From the each day chart of USD/CAD, we will see this morning’s excessive coming in across the 1.3700 degree. Close to-term help exhibits round yesterday’s low, plotted at a space of prior resistance at 1.3578. If bulls stay very aggressive, which might seemingly have some overlay with USD-strength themes if it occurs, that degree might change into workable. Beneath that the 1.3500 psychological degree stays as help potential; and there hasn’t been a help check there since value broke out from this degree on a extremely sturdy Monday displaying.

As for resistance – value is correct now discovering sellers at a key Fibonacci degree, because the 61.8% retracement of the 2020-2021 main transfer rests at 1.3652.

USD/CAD Each day Value Chart

Chart ready by James Stanley; USDCAD on Tradingview

Taking a step again to the weekly chart and we will see the re-emergence of CAD weak spot in a really seen means since that 1.3250 help check. This week is already engaged on a big transfer and simply above the 1.3700 resistance is a swing excessive at 1.3800 that is still of curiosity.

And longer-term, it’s the 1.4000 psychological degree that looms massive. The topside run into October got here 20 pips away from the large determine earlier than turning round.

USD/CAD Weekly Chart

Chart ready by James Stanley; USDCAD on Tradingview

CAD/JPY

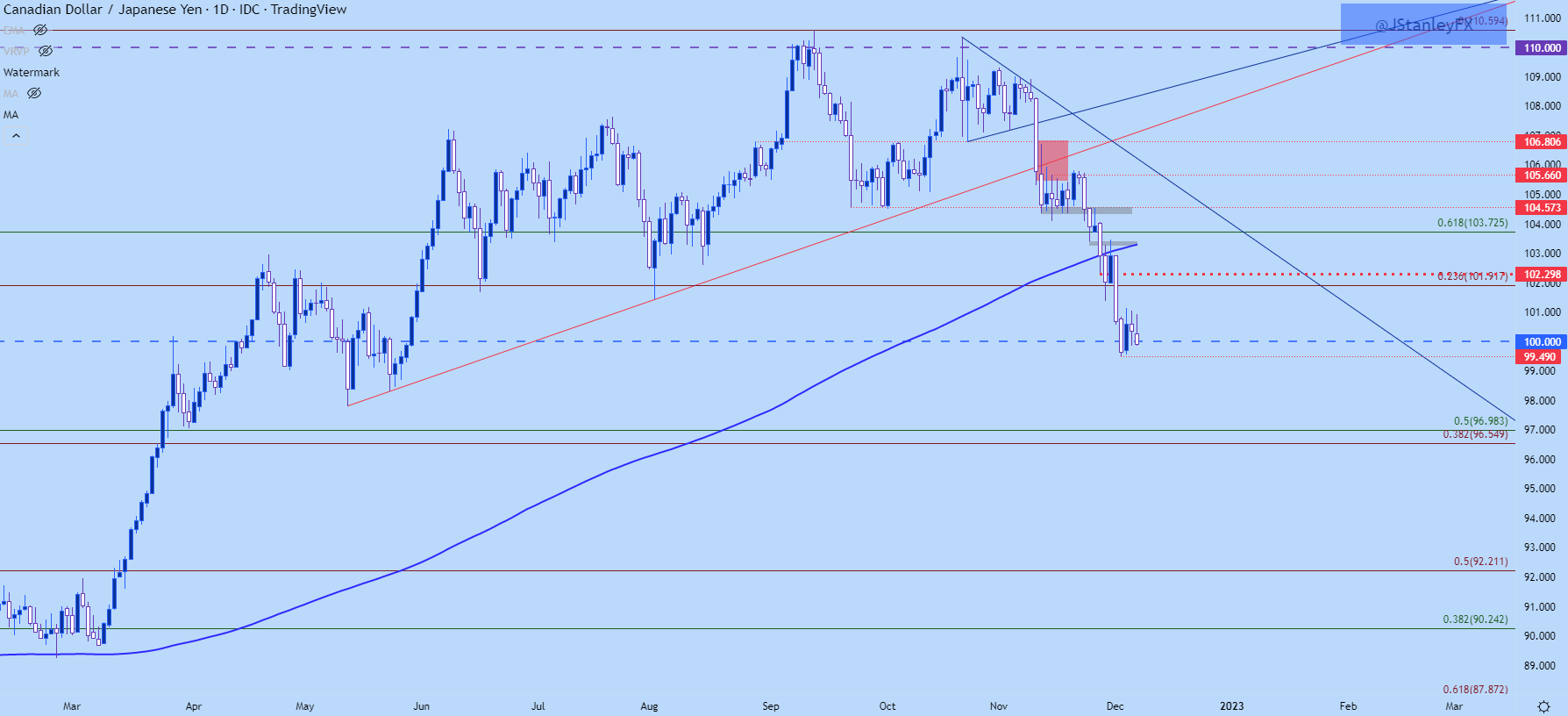

Once I had seemed into the Canadian Greenback a month in the past, I highlighted the potential to focus CAD-weakness eventualities away from the US Greenback, particularly as a result of uncertainty across the USD as costs in DXY had been persevering with to pullback.

Ideally, forex weak spot in CAD may very well be higher meshed with forex power elsewhere, and the Japanese Yen has been significantly stronger since that article was revealed.

CAD/JPY has developed an aggressive bearish transfer, breaking under a symmetrical triangle after which breaching a bullish trendline. At this level, psychological help is enjoying in off of the 100-handle. This may very well be a troublesome spot to chase the transfer given how prolonged the sell-off has been. There was a previous spot of help across the 102.30 degree and this now turns into resistance potential if a bounce can develop. For these trying to transfer ahead with breakout logic, the forex five-month-low is at 99.49.

CAD/JPY Each day Chart

Chart ready by James Stanley; CADJPY on Tradingview

EUR/CAD

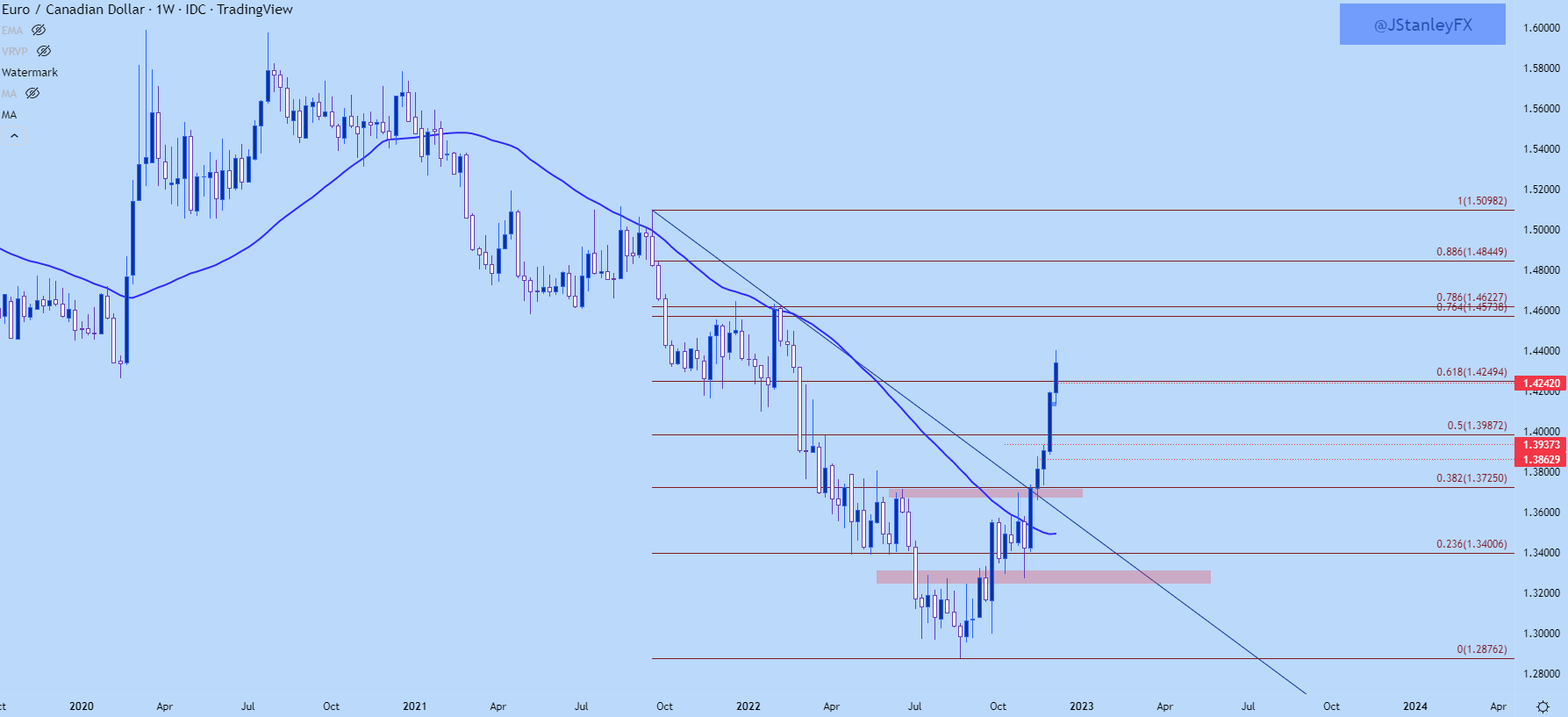

EUR/CAD has equally proven a really one-sided transfer over the previous month. Once I seemed on the pair in early-November it was working with resistance on the 200 day shifting common; and after a help check at prior resistance, the door was opening for bullish breakout potential.

Every week later, value pushed above the bearish trendline and it’s been off to the races ever since.

EUR/CAD Weekly Chart

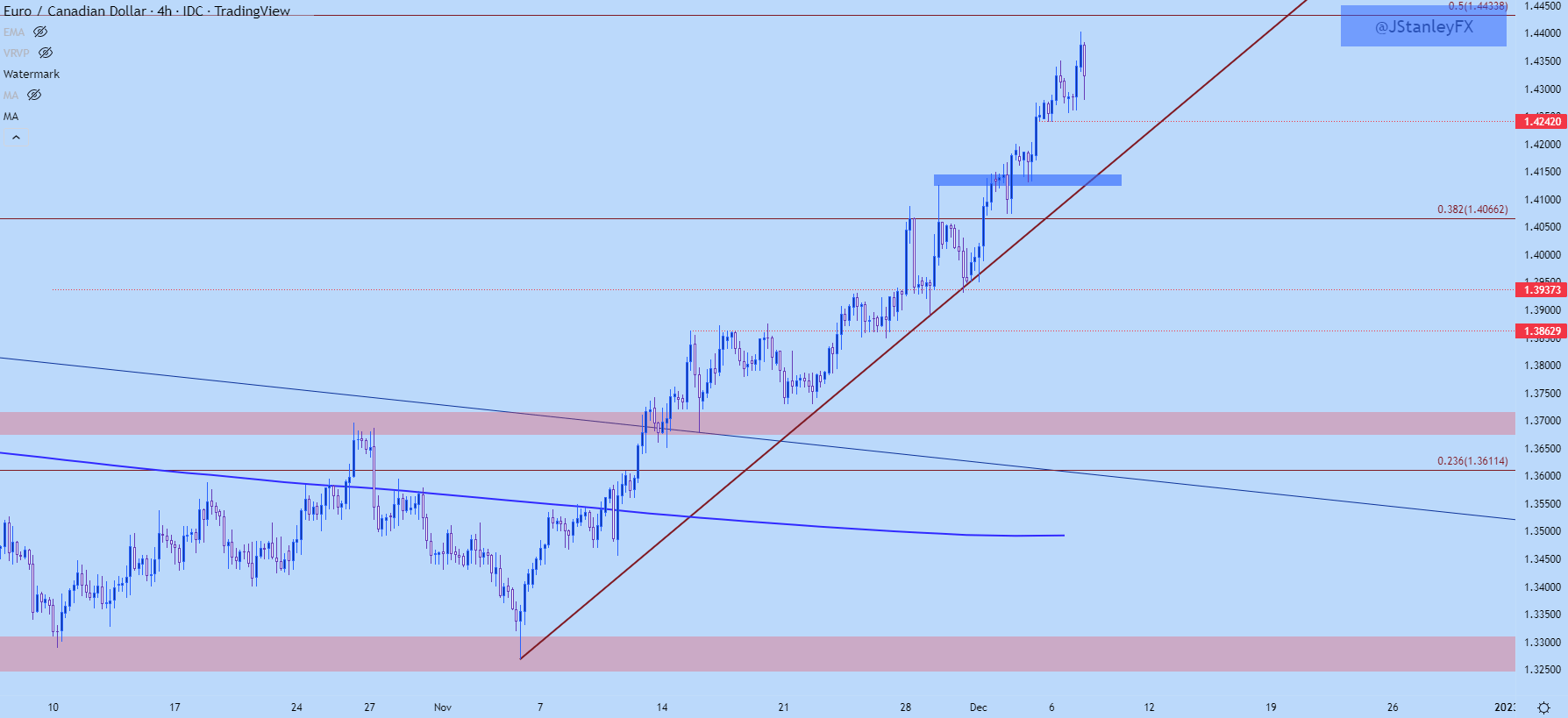

The pattern has actually grown in power, as nicely, as famous by the divergence from the current bullish trendline. This highlights that bulls could wish to attempt to train a little bit of persistence right here, with help potential across the 1.4250 psychological degree, which is confluent with each a Fibonacci degree and a previous swing excessive and if that may’t maintain, there’s one other spot of resistance-turned-support plotted across the 1.4125 space.

EUR/CAD 4-Hour Chart

Chart ready by James Stanley; EURCAD on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Schooling

Contact and comply with James on Twitter: @JStanleyFX

[ad_2]

Source link