- Bitcoin has been buying and selling sideways across the $26,000 mark

- For the crypto to interrupt its present pattern, a sequence of occasions will need to have favorable outcomes

- In the meantime, Ethereum must reclaim $1660 to provoke an uptrend

has maintained its sideways motion across the $26,000 degree following a pointy decline within the first half of August.

Even with the carefully watched the place Fed President spoke final week, Bitcoin remained unmoved, and the most important cryptocurrency continued to expertise worth compression.

Powell’s messages in his speech echoed his earlier statements, leading to no important worth fluctuations within the unstable crypto sector, as they have been already priced in. Consequently, Bitcoin has entered the ultimate days of August with a comparatively calm outlook.

Nevertheless, as a result of persistent promoting stress, there may be all the time a threat Bitcoin may head decrease.

The upcoming month of September is poised to result in essential occasions with implications for the cryptocurrency sector. Firstly, all eyes can be on the US Securities and Change Fee (SEC) for its resolution on functions for spot Bitcoin ETFs.

Moreover, forward of this resolution section, an end result is anticipated quickly within the case filed by Grayscale, which seeks to remodel its present Bitcoin fund right into a spot ETF. A unfavourable ruling on this case might need unfavourable repercussions for the crypto market.

Amongst different important financial knowledge within the week, the , , and charge can be launched.

These figures, crucially watched by the Fed following the inflation knowledge of their rate of interest selections, may be pivotal in steering the market’s new path. If the info suggests the US financial system stays sturdy, it would suggest that inflation is staying resilient.

This might subsequently heighten expectations for a 25-basis level rate of interest hike by the Fed in September. Whereas the present anticipation for a charge enhance in September stands at 20%, it notably elevated from 10% prior to now week.

In gentle of this knowledge, we are able to see that the bearish pattern may proceed if Bitcoin sees a day by day shut beneath $26,000 on worth motion because it slips beneath the help zone.

Technically, the following help zone appears to be within the vary of $23,900 – $24,000, based on the 2023 pattern. Beneath this help, a retreat to the $ 22,000 restrict is probably going.

Whereas a unfavourable sentiment is presently prevalent within the Bitcoin market, it might shift relying on developments within the close to time period. The closest upside resistance lies at $26,250, equivalent to the situation of the 8-day EMA worth.

A bounce above this degree may result in encountering a secondary resistance level at $27,200. Trying forward, the potential for a broader Bitcoin market uptrend would possibly hinge on establishing a help base above $28,250. Any makes an attempt at upward motion main as much as this degree would possibly yield a restricted influence.

Concurrently, because the Bitcoin worth experiences sideways motion, the Stochastic RSI’s upward movement from the decrease finish on the day by day chart may point out a possible restoration. To attain this, Bitcoin would want to start out a bullish motion in direction of the $27,000 mark.

Whereas the typical buying and selling quantity in cryptocurrency markets has dwindled to a meager $20 billion, there is a important discount in threat urge for food, reducing total volatility.

Any unfavorable selections within the aforementioned developments may grow to be catalysts for heightened volatility.

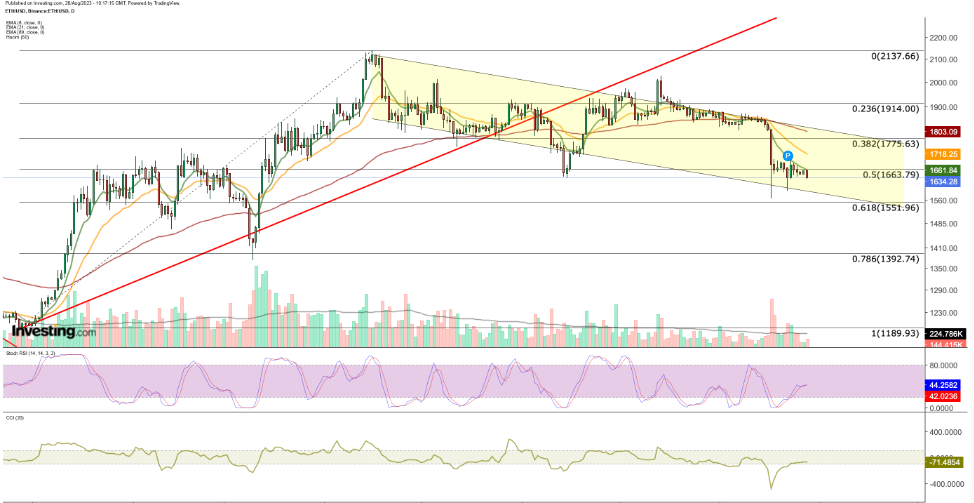

Ethereum: Essential Ranges to Watch

Following the numerous decline on August 17, has been buying and selling beneath the $1,660 help in a sideways sample. The prevailing momentum will increase the possibilities of ETH retracing towards the following help degree at $1,550.

If this help is breached, a pullback in direction of the $1,400 mark may come into consideration, given the formation of a spot.

To keep away from additional losses, it is essential for the worth to reclaim the $1,660 threshold. If a possible upward motion ensues, a decisive weekly shut above $1,775 turns into important to counter the prevailing unfavourable outlook.

This transfer would entail breaking the descending channel that has emerged because the peak in April, marking a chance to attempt to construct some optimistic momentum.

Consequently, it is doable that an upward trajectory may provoke for ETH, initially focusing on round $1,550, adopted by the potential to maintain this degree with day by day closes.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation.