[ad_1]

‘Buy the rumor, sell the fact’ is not just trader lingo but is rooted in human psychology and presents itself repeatedly in financial markets. Understanding why traders and investors pile into a particular market in anticipation of the news and then sell right after that very same news is confirmed, can help traders avoid poor entries.

What Does ‘Buy the Rumor, Sell the Fact’ Mean?

It seems illogical for markets to rise before confirming some economic news or data. Why wouldn’t investors or traders wish to wait for confirmation and then enter the market? Well, what tends to happen is a narrative is revealed via price action, anticipating the positive news/data which then gains traction as investors pile in. The good news is then confirmed, and the market sells off as a result of profit taking with many people left wondering why the market reacted contrary to the news.

Why Markets Sometimes Rise Before the News and Sell-off Straight After?

There are a number of driving forces behind the ‘buy the rumor, sell the fact’ phenomenon. They largely consist of the following:

- Speculation

- Crowd psychology or herd behavior

- Fear of missing out (FOMO)

- Mass selling

1. Speculation

Speculation is the process of buying into an asset with the hopes of eventually selling that asset at a higher price, at a later date. When fund managers, investors or traders conduct analysis that reveals an opportunity for price appreciation, they are likely to enter a speculative position.

When market moving information makes its way to the market it causes market participants to re-evaluate the current bias/trend. Such news/data can be in the form of an interest rate decision of a major central bank, inflation report, murmurs of a merger etc. However, we often observe that prices do not immediately adjust, instead, we tend to see price action gaining momentum as more and more investors pile into the trade. This is where crowd psychology takes center stage.

Foundational Trading Knowledge

Trading Discipline

Learn to improve your trading discipline and psychology

2. Crowd Psychology or Herd Behavior

Herd behavior is the process where a group of individuals collectively act in the same manner and is characterized by a lack of individual decision making or introspection. In a financial context this could be observed when driving up the price of an asset, for example bitcoin, or piling into shares of GameStop.

Herd behavior assumes that because everyone else is doing it, it must be the right thing to do. Once a narrative takes hold, it can be difficult to fight, much like a narrative that the Federal Reserve Bank will raise interest rates by a certain percentage or rumors that company A intends to acquire company B.

3. Fear of Missing Out (FOMO)

Crowd psychology is a powerful thing. Once it gets going it has the potential to accelerate as those that were previously on the sidelines are convinced to join the party – often at already elevated levels. It is the fear of missing out (FOMO), rather than strategy and detailed analysis that propels people towards the popular narrative or trade once the majority of the crowd is already on board. FOMO leads to impulsivity and a lack of long-term perspective, often to the detriment of the individual and adds to price appreciation.

4. Mass Selling

As soon as the anticipated news or data is confirmed, traders and investors often look to realize their gains and sell to close their winning positions. Markets can plummet in a short amount of time as selling orders are executed right after the news/data is released. In today’s modern age of trading this has the potential to trigger momentum-based algorithms which continue the selling. To make things worse, those FOMO traders that entered the market right at the peak may be inclined to cut their losses after the sudden and sharp decline, sending the market even lower.

Introduction to Technical Analysis

Market Sentiment

Don’t succumb to market sentiment, instead learn to use it

Example 1: The Fed to Hike by 75 Basis Points in June 2022

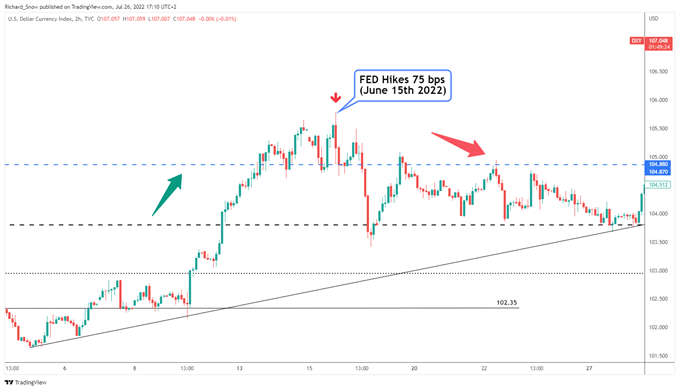

The June Federal Open Market Committee (FOMC) meeting provided an example where markets priced in a rate hike (via the US dollar Index, ‘DXY’) before it was confirmed, only to drop immediately after the confirmation of the hike.

Markets actually started to anticipate the 75-basis point hike based on rising inflation data which was released two days before the FOMC announcement. DXY advanced ahead of the meeting as each of the prior three inflation prints surprised to the upside, revealing a trend of higher-than-expected inflation readings. High inflation forces the Fed to act and raise interest rates. Then to almost confirm without a doubt that the Fed would hike by 75 bps the Wall Street Journal published a supposed leak from the 2-day FOMC meeting ‘confirming’ that the committee was united on the 75-bps hike. Immediately after the 75-basis point hike was confirmed, DXY dropped.

US Dollar Index (DXY) 2-Hour Chart

Example 2: Elon Musk’s ‘Dogefather’ Appearance on SNL

Alternative assets like cryptocurrencies are known to sway heavily with prevailing market sentiment, which has led to exponential rises and devastating declines over the years. In the first half of 2021, massive hype and media coverage spurred Dogecoin towards a value of 1:1 with the dollar ahead of Dogecoin cult figure, Elon Musk’s appearance on the popular TV show Saturday Night Live.

Dogecoin rose right up until the very day of his appearance and plummeted right after. This is another example whereby the market bid up the price of the coin and then sold off after the event.

Dogecoin Daily Chart

Other examples that witness a ramp up ahead of the news can include company socks before reporting earnings, as well as rumors of a takeover or mergers.

[ad_2]

Source link