vitranc

Broadmark Realty Capital (NYSE:BRMK) is a nationwide hard-money lender REIT, with a $900 million mortgage e-book.

The corporate focuses on high-risk, high-interest loans which might be backed extra by collateral than by the borrower’s credit score historical past or credit score rating. I wrote a purchase rated article on the corporate in June. The corporate’s inventory has fell 40% since.

The explanations behind the current fall are a number of. BRMK was just lately hit by greater provisions for mortgage losses, property administration bills, and curiosity expenses. The corporate’s CEO and CFO resigned, with the corporate’s Chairman and founder now on the helm. Its dividend was reduce in half (one thing that was anticipated).

Nonetheless, I imagine BRMK is a chance. The largest dangers I see forward are twofold: excessive default ranges, sufficiently big to attract NAV down 50%; and better property administration bills, that put a drag on recurring earnings.

These dangers are counteracted by 90% fairness financing and a 40% low cost on tangible e-book worth per share. This offers the corporate with three protections: defaults need to be catastrophic to place NAV under the present share value; the corporate can promote property at steep reductions to keep away from managing it with out placing NAV under the present share value; and the corporate can improve charges as a result of greater leveraged opponents have to depart the market.

Be aware: Until in any other case acknowledged, all info has been obtained from BRMK’s filings with the SEC.

Enterprise description

Nationwide hard-money lenders: Arduous-money lenders consider short-term loans (one to a few years) that carry a excessive curiosity and are collateralized by carved-out property, typically with recourse covenants or private ensures. These loans are largely used as bridges till longer-term cheaper financing might be organized.

Excessive curiosity equals excessive default danger: Credit score is a commodity, and the credit score market may be very aggressive. Meaning an knowledgeable borrower will have a tendency to search out the bottom curiosity doable for its statistical danger bracket. The truth that BRMK was capable of cost 10% charges throughout 2021, a time when the Federal price hit 0%, talks in regards to the danger of its loan-book.

Credit score rating versus asset primarily based lending: HMLs make their residing by concentrating on a specific kind of borrower that doesn’t qualify for less expensive financial institution loans. With decrease capital provide, the credit score unfold on these loans is excessive. The profitability of an HML is predicated on the concept the upper credit score unfold greater than compensates for the upper danger. To additional scale back dangers, HMLs consider asset collateral and recourse covenants.

Focus within the center-west: 75% of the corporate’s mortgage e-book is concentrated in Washington, Colorado, Utah and Texas.

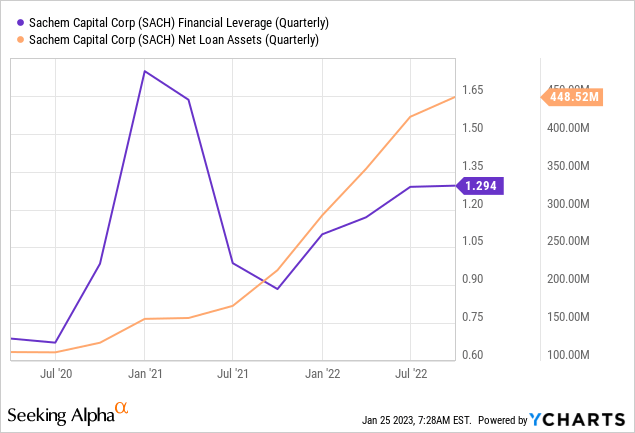

Extremely low leverage: BRMK is 90% fairness financed, registering solely a $100 million notice paying 5%, issued in November 2021. This significantly reduces danger, given {that a} credit score loss will not be multiplied by leverage throughout the e-book, and that curiosity earnings loss will not be operationally multiplied by curiosity prices down the earnings assertion.

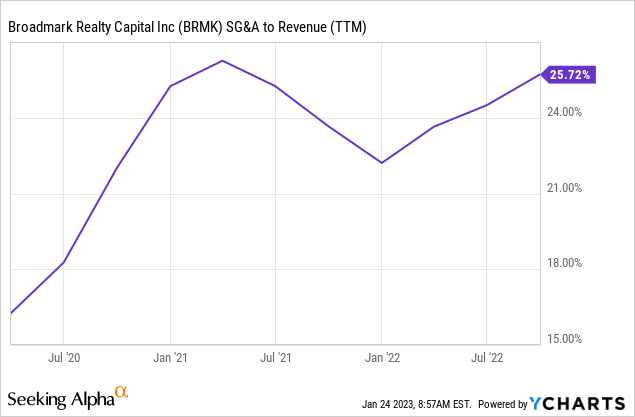

Lean operation: The corporate’s operational bills made a small proportion of curiosity earnings. Sadly, BRMK is including property administration bills on its foreclosed properties. Property administration bills not run at half the extent of G&A bills on the quarterly degree, from being virtually negligible one 12 months in the past.

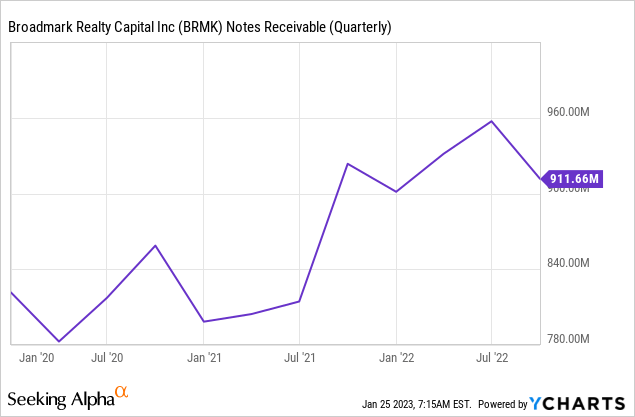

Conservativeness: The corporate didn’t improve its e-book considerably through the 2021 increase. This conservativeness is partially generated by REIT taxation, which makes the corporate distribute 90% of earnings, which makes it troublesome to build up capital and increase e-book.

Nonetheless, different REITs took low-cost leverage to be able to increase their books, and BRMK didn’t. An instance of that is Sachem Capital Corp (SACH), one other HML, however way more leveraged (1.3 in opposition to 0.09 for BRMK) and with an exploding e-book.

Low insider possession, no robust shareholder: The corporate’s managers and administrators maintain solely 3% of the corporate’s inventory. The biggest shareholders are ETF teams like Vanguard and BlackRock, with lower than 9% participation every (in keeping with the corporate’s proxy statements for FY22). I typically want an organization the place managers have pores and skin within the recreation and the place there may be not less than one robust shareholder.

Latest developments

The scenario has not been good typically for BRMK, a number of destructive developments have pushed the inventory’s value down 50%, solely to get well some 10% again.

Dividend reduce: Once I wrote my newest article on BRMK in June 2022, the corporate was not protecting its dividend with money. A reduce was imminent, however the yield appeared attention-grabbing even after the reduce. The corporate then determined to chop the dividend in half, from $0.84 to $0.42 yearly (paid month-to-month).

Resignation of CEO and CFO: The corporate’s CFO resigned in October, adopted by the CEO in November. The resignation of the CEO was communicated on the identical date because the 3Q22 outcomes (extra on this under). The Interim CEO place is now occupied by the corporate’s founder and Chairman, who occupied that place for the reason that firm went public in 2019 till 2021.

The corporate granted RSUs to the newly elected CFO and Interim CEO for $750 thousand that may hit SG&A bills in 4Q22.

Larger delinquencies: The corporate’s delinquent loans elevated 15% since 2021, representing $115 million as of 3Q22 in opposition to $100 million in December 2021. The corporate studies $286 million in non accruals however that features dedicated however not launched funds as nicely.

Larger mortgage loss provisions: Extra defaults, however significantly the foreclosures of a resort property that has grow to be troublesome to sale, prompted the corporate to acknowledge $13 million in mortgage loss provision allowances in 3Q22 alone. This represents an enormous drag on quarterly earnings.

Property administration bills: BRMK seized property e-book now stands at $93 million, from $68 million in December 2021. The e-book would have jumped to $121 million hadn’t been for a financed sale for $28 million of residential condos. The largest contributor was a senior housing growth, carried at $50 million. As a reader precisely pointed, managing properties is way more costly than managing loans. Quarterly property administration bills, near non existent one 12 months in the past, now run at $1.5 million.

Valuation and dangers

With all of those destructive developments, plus rates of interest that proceed rising, plus the corporate’s dangerous mortgage e-book, how am I bullish on the inventory? The reply comes from Howard Marks’ remark that ‘a low-quality asset can represent a very good purchase’.

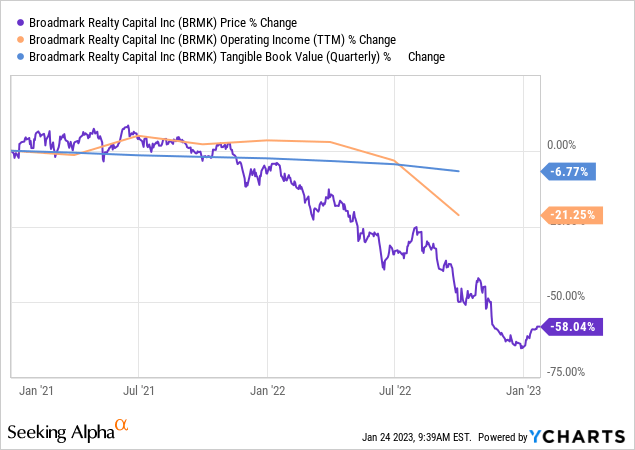

For my part, BRMK’s dangers are greater than discounted on its present value. Whereas tangible e-book worth has fell 7%, and working earnings one other 21% (that is earlier than mortgage loss provisions), the inventory’s value is right this moment 58% decrease than two years in the past.

Larger delinquencies: The principle danger for BRMK is the hazard of posting extra delinquencies. This has cascading results as a result of it will increase allowances for mortgage losses and materialized losses (by promoting properties under their recorded worth). It additionally will increase managerial bills, decreasing working earnings and placing the dividend in danger.

Stability sheet safety: The corporate presently has $7.27 per share of tangible e-book worth, in opposition to a inventory value of $4.2. That represents a 43% low cost. As a result of the steadiness sheet is usually fairness financed, for that low cost to materialize, the corporate must put up mortgage losses for an equal 43%. That implies that virtually one in each two loans is totally misplaced, or that each mortgage was overpriced by 100%.

The dividend reduce is a capitalization technique: The largest drag on earnings has been greater mortgage loss allowances. These are non money bills that acknowledge that an asset’s worth (a notice receivable) will not be as excessive because it was regarded as. Nonetheless, as a result of accrual earnings is diminished via greater allowances, the corporate has to distribute much less dividends. The money distinction is getting used to capitalize the corporate, one thing that’s normally troublesome for a REIT.

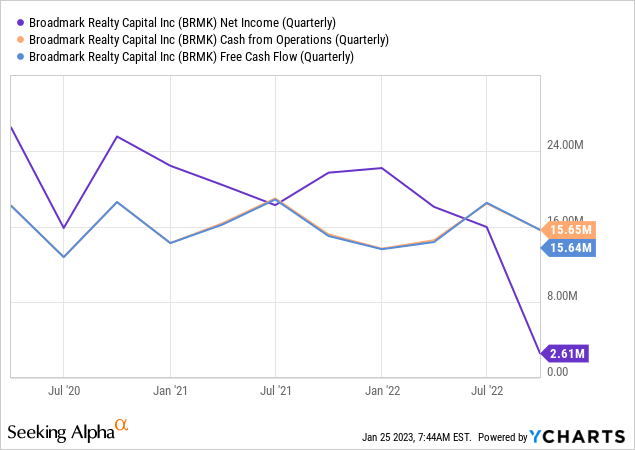

Recurring money earnings safety: When the corporate posts a mortgage loss allowance, it’s recognizing a previous occasion. This talks extra in regards to the firm’s earlier selections (and its monetary sustainability as thought-about within the steadiness sheet) quite than present profitability.

Then again, if extra loans go into non accrual, the corporate seizes on property or doesn’t get well the total worth of its loans, this impacts future earnings technology. This occurs for 2 causes: the e-book is diminished, and subsequently its capability to generate earnings decreases; and bills (significantly property administration) improve.

Smaller mortgage e-book: I imagine the primary danger (smaller e-book) is counteracted by greater charges. BRMK’s obtained $90 million in curiosity income on a $849 common mortgage e-book in FY21. This represents a ten.6% common price, in opposition to a reported common price of 10.2% for 3Q22. Meaning the current price improve has not been translated to new originations. My perception is that as greater leveraged opponents depart the scene, BRMK will be capable of improve its charges with out decreasing its mortgage e-book or rising credit score danger.

Larger property administration bills: On the expense facet, the best danger comes from managing foreclosed properties. However this danger might be eradicated if the corporate sells these properties rapidly. Once more, the fairness financed steadiness sheet and the deep share value low cost on NAV per share present a margin on security on property gross sales under recorded worth.

Larger curiosity bills: The corporate didn’t need to pay monetary bills on the $100 million in notes (5%) one 12 months in the past. These suggest $5 million extra per 12 months in bills.

Revenue concerns: If the present price is maintained, at 10%, on the identical mortgage e-book of $900 million, we’re considering of $90 million in yearly curiosity earnings, plus one other $20 million in origination charges. In opposition to these BRMK will put up SG&A bills of $30 million, and one other $6.5 million in curiosity bills ($5 million from the notes, $1.5 million from upkeep of a credit score facility). This leaves $73.5 million earlier than property administration charges, and mortgage loss allowances.

With a yearly dividend of $55 million and a market cap of $566 million, property administration charges ought to climb to $18 million (from the present $6 million annualized) to have an effect on the money used to pay the dividend, or to cut back the FCF a number of under 10x. Keep in mind that mortgage loss allowances have an effect on our calculation of e-book primarily based valuation, not earnings primarily based.

Conclusion

BRMK has seen some tough quarters, and extra ache may wait forward. Nonetheless, I imagine present valuations suggest a catastrophic occasion when it comes to mortgage losses. Approaching the corporate’s valuation from an earnings perspective in addition to from a e-book perspective renders an necessary margin of security.

From feedback in earlier posts, my understanding is that the bear case is predicated on these catastrophic situations, the place the e-book is value little or no and there are large defaults.