British Pound (GBP) Newest – Will the Financial institution of England Reduce Charges This Week?

- Expectations are rising that the BoE will begin reducing charges this week.

- GBP/USD might have already put in its medium-term excessive.

Really helpful by Nick Cawley

Get Your Free GBP Forecast

The Financial institution of England will launch its newest financial coverage report this week with monetary markets now seeing a 60%+ likelihood that the BoE will begin reducing rates of interest on Thursday at midday UK. On the June assembly the choice to maintain charges unchanged was seen as ‘finely balanced’ whereas annual inflation fell to 2% in Might, hitting the central financial institution’s goal. UK companies inflation remained elevated at 5.7% – down from 6% in March – however this power ‘partly mirrored costs which can be index-linked or regulated, that are sometimes modified solely yearly, and unstable parts’, in response to the MPC. If the UK Financial institution Price isn’t minimize this week, the market has totally priced in a minimize on the September 19 assembly.

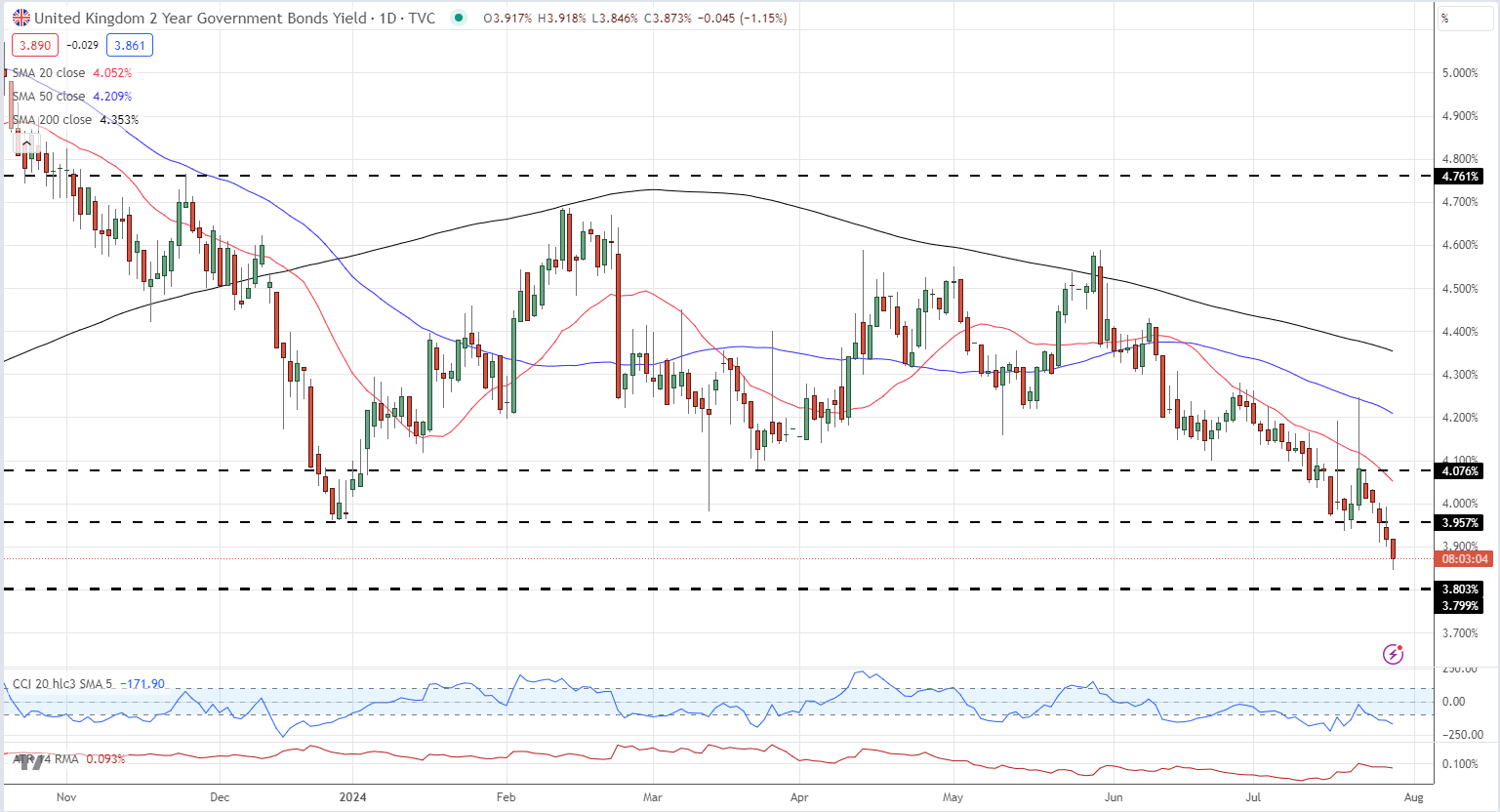

The hardening of price minimize expectations might be seen in short-dated UK borrowing prices, with the yield on the 2-year Gilt falling steadily since early June to its lowest stage in 14 months.

UK 2-Yr Gilt Every day Gilt Yield

Chart utilizing TradingView

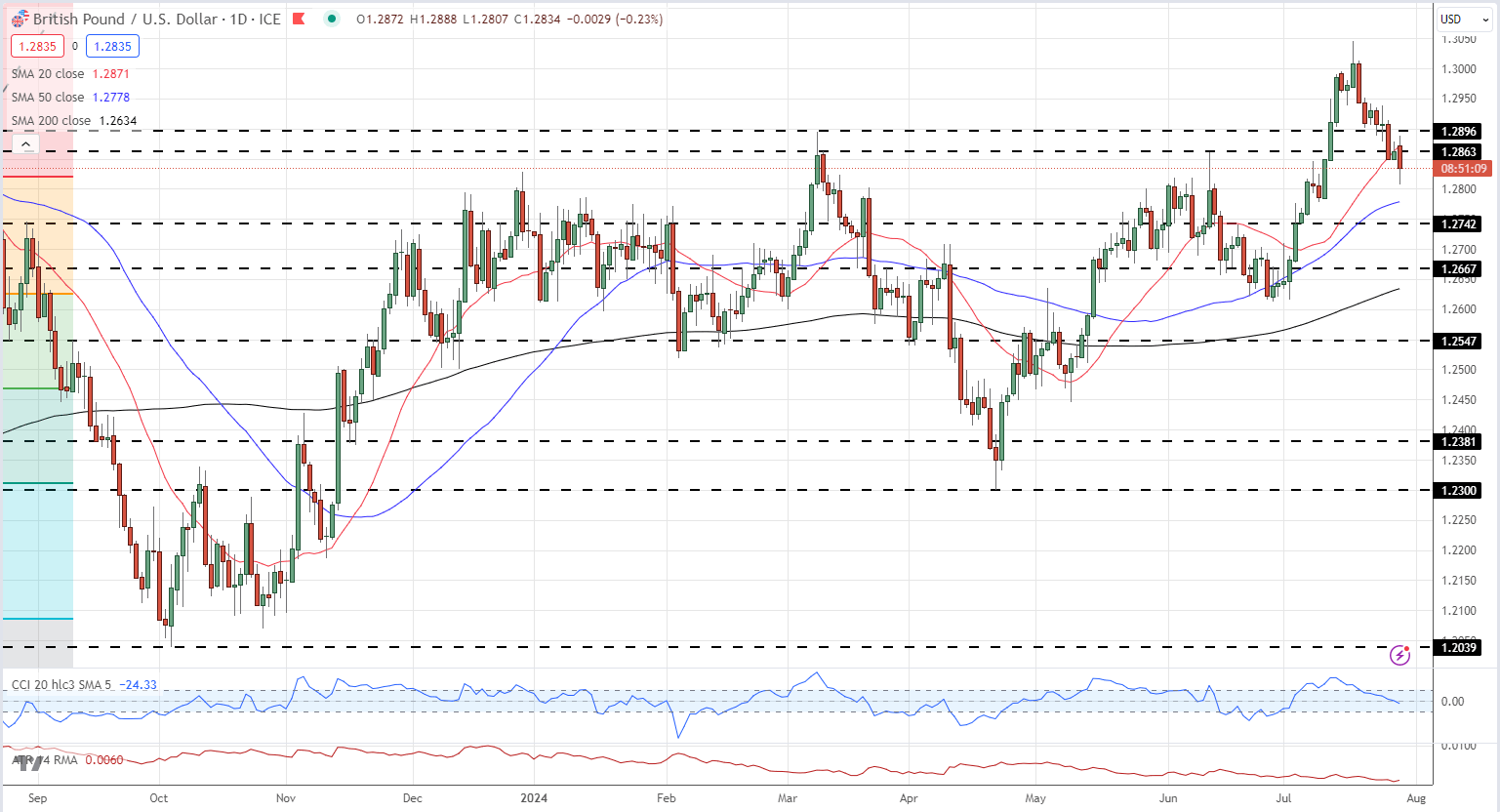

GBP/USD touched a one-year excessive of 1.3045 in mid-July, pushed by a renewed bout of US greenback weak spot. Since then, GBP/USD has given again round two cents on decrease bond yields and rising price minimize expectations. The US Federal Reserve will announce its newest financial coverage settings this week, sooner or later earlier than the BoE, with markets solely assigning a 4% likelihood that the Fed will minimize charges. If this performs out, GBP/USD is unlikely to see 1.3000 within the coming weeks. A UK price minimize and a US maintain will see the 1.2750 space come below short-term stress, adopted by 1.2667 and the 38.2% Fibonacci retracement space at 1.2626.

GBP/USD Every day Value Chart

Chart utilizing TradingView

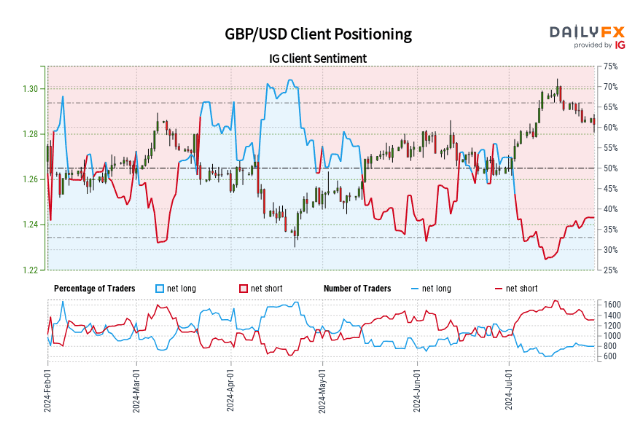

GBP/USD Sentiment Evaluation

Retail dealer knowledge exhibits 42.09% of merchants are net-long with the ratio of merchants quick to lengthy at 1.38 to 1.The variety of merchants net-long is 10.30% increased than yesterday and 1.57% decrease than final week, whereas the variety of merchants net-short is 7.86% decrease than yesterday and 19.09% decrease than final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests GBP/USD costs might proceed to rise. But merchants are much less net-short than yesterday and in contrast with final week. Current modifications in sentiment warn that the present GBP/USD worth pattern might quickly reverse decrease regardless of the very fact merchants stay internet quick.

| Change in | Longs | Shorts | OI |

| Every day | 3% | -3% | -1% |

| Weekly | -8% | -15% | -12% |

What’s your view on the British Pound – bullish or bearish?? You may tell us through the shape on the finish of this piece or contact the writer through Twitter @nickcawley1.