British Pound Vs US Greenback, Euro, Japanese Yen – Value Setups:

- Nonetheless-hot UK wage progress hasn’t translated into larger GBP/USD but.

- EUR/GBP is holding above important assist, irritating bears.

- GBP/JPY continues to be effectively guided by a rising channel.

- What’s the outlook and key ranges to observe in choose GBP crosses?

Really helpful by Manish Jaradi

Enhance your buying and selling with IG Shopper Sentiment Information

The British pound is testing essential assist in opposition to the US greenback forward of UK GDP information due later Wednesday.

The pound has been underperforming in opposition to a few of its friends in latest weeks and up to now, there is no such thing as a signal of reversal. For extra dialogue on the underperformance, see “See “Pound’s Resilience Masks Broader Fatigue: GBP/USD, EUR/GBP, GBP/JPY Setups,” printed August 23. The blended UK jobs information on Tuesday did little to change the mushy bias. The blistering wage progress seals the case for a 25-basis factors price hike by the Financial institution of England (BoE) when it meets on September 22.

BoE Governor Andrew Bailey final week mentioned rates of interest may nonetheless rise additional because of stick worth pressures, however the central financial institution is “a lot nearer” to ending its tightening cycle. The important thing focus now shifts to UK GDP for July – anticipated 0.4% on-year, down from 0.9% in June. The three-month common, nonetheless, ticked as much as 0.3% in July from 0.2% beforehand.

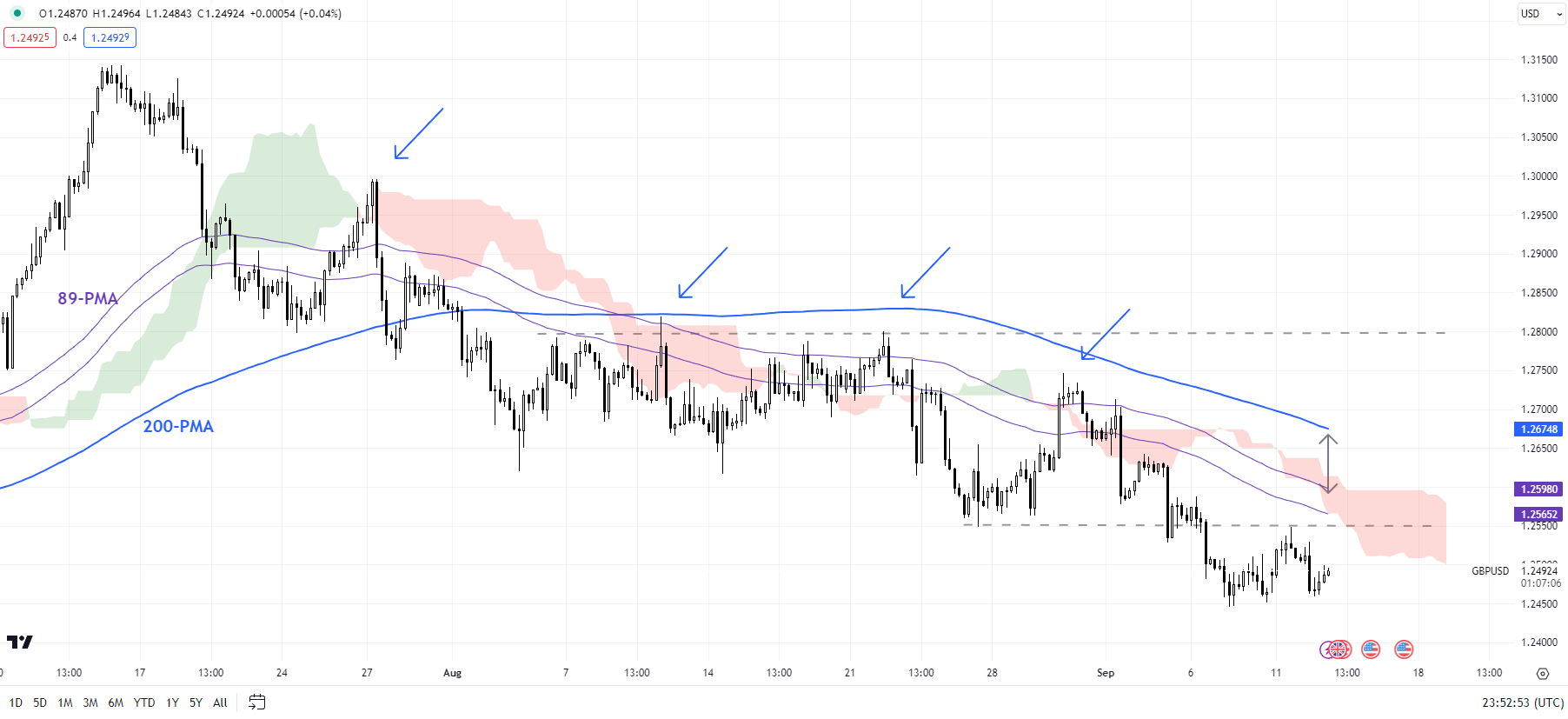

GBP/USD Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

GBP/USD: Testing important assist

On technical charts, the failure up to now this month to rise previous speedy resistance on the early-August excessive of 1.2820 has saved the downward bias intact for GBP/USD – a danger highlighted in theprevious replace. Moreover, in an indication of weak spot, GBP/USD has failed to carry above important converged assist on the 89-day transferring common, the decrease fringe of the Ichimoku cloud on the each day charts, and the end-June low of 1.2600. On the earlier two events because the finish of 2022, the pair has rebounded from comparable assist (see the each day chart).

GBP/USD 240-Minute Chart

Chart Created by Manish Jaradi Utilizing TradingView

The pair is now testing an important cushion on the 200-day transferring common – the final time it was decisively under this common was in 2022. So, a maintain above is vital for the broader bias to remain constructive. From a medium-term perspective, the rise in July to a multi-month excessive has confirmed the higher-tops-higher-bottom sequence since late 2022, leaving open the door for some medium-term positive aspects. (See “British Pound Buoyant Forward of BOE: How A lot Extra Upside?”, printed Could 8).

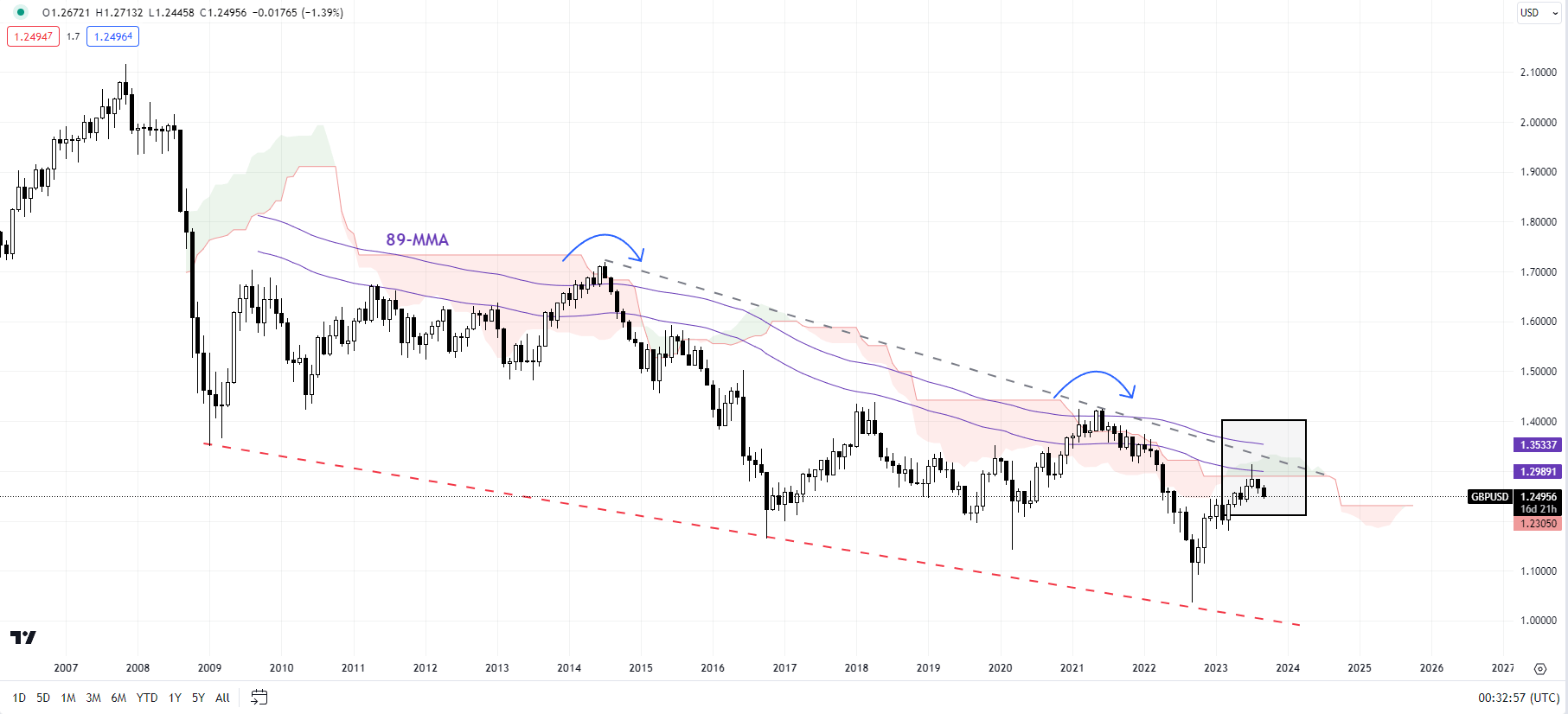

GBP/USD Month-to-month Chart

Chart Created by Manish Jaradi Utilizing TradingView

Importantly, as identified late final 12 months, a better excessive this 12 months (relative to 2022) might be unfolding into one thing greater than only a corrective rebound, that’s, it opens the door for a reversal of GBP/USD’s medium-term downtrend (first highlighted in October – see “GBP/USD Technical Outlook: Forming an Interim Base?” printed October 3.

Really helpful by Manish Jaradi

Constructing Confidence in Buying and selling

Whether or not the medium-term rebound is the beginning of a long-term uptrend? To be truthful, such proof is missing. GBP/USD stays under main resistance on the 89-month transferring common and the Ichimoku cloud on the month-to-month charts, coinciding with a downtrend line from 2014, suggesting the long-term downtrend is but to reverse.

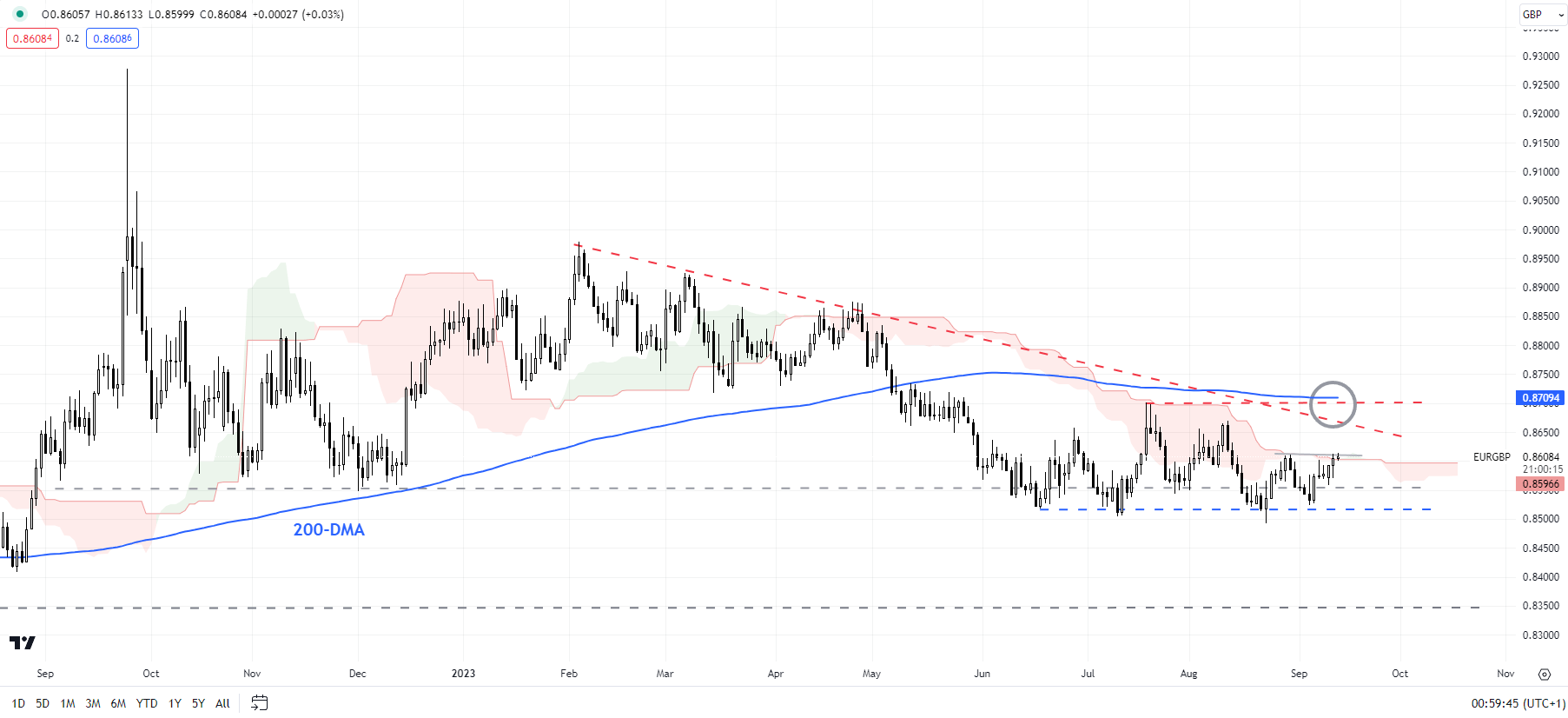

EUR/GBP Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

EUR/GBP: Nonetheless holding above Q2-2023 assist line

EUR/GBP continues to carry above the converged flooring on a horizontal trendline from June and one other horizontal trendline since late 2022 (at about 0.8550-0.8600). Nonetheless, until the cross clears resistance on the mid-July excessive of 0.8700, the trail of least resistance is sideways to down.

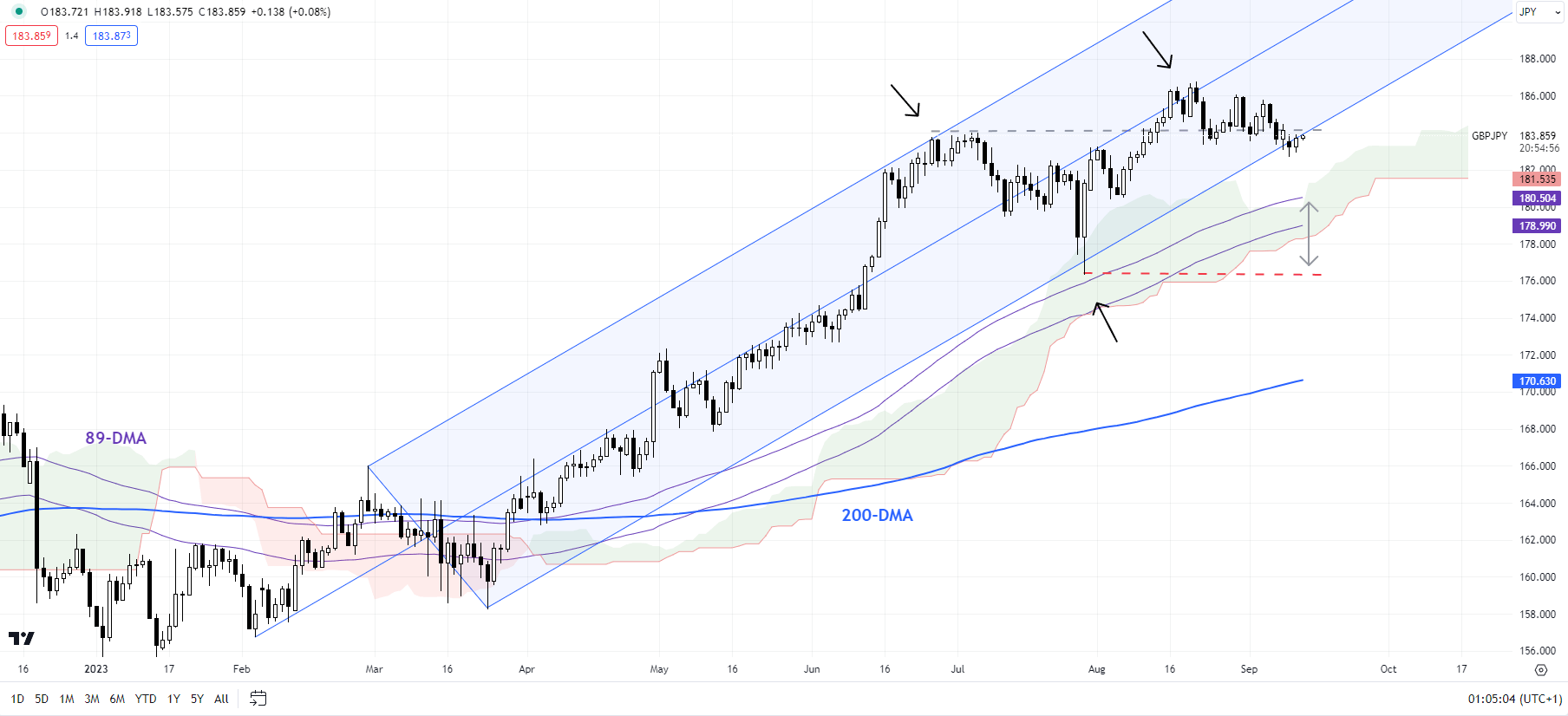

GBP/JPY Day by day Chart

Chart Created by Manish Jaradi Utilizing TradingView

GBP/JPY: Consolidation throughout the uptrend

GBP/JPY has continued to be well-guided by the rising Pitchfork channel since early 2023. Nevertheless, most just lately the cross has been struggling to carry above the resistance-turned-support on the July excessive of 184.00. A decisive break under would point out that the speedy upward strain had pale however gained’t essentially indicate a reversal of the broader uptrend. Solely a break under the July low of 176.25 would puncture the broader uptrend.

Really helpful by Manish Jaradi

Elliott Wave for Freshmen

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish