[ad_1]

Across the time of yesterday’s US market shut, rumours unfold that the Biden administration is contemplating new restrictions on exports of AI chips to China, as considerations rise over the facility of the know-how within the palms of US rivals. The information was reported by the WSJ, citing sources. This morning there was new affirmation from the DJ who declare that the US commerce division might transfer as early as subsequent month to cease shipments of chips made by Nvidia (NVDA).

The very fact is that semiconductors, chips, the beating coronary heart of our computerised and ultra-technological world, are as necessary as oil at this time and geo-political friction arises over them. You all know concerning the US-China confrontation over Taiwan however you might not know concerning the treasure hidden within the Asian island, the Taiwan Semiconductor Manufacturing Firm (TSMC), an organization that holds over 56% World Market Share of the Semiconductor Business. Semiconductor ICs manufactured by TSMC are utilized by virtually all Prime Semiconductor Corporations within the World together with – AMD, Apple, ARM, Broadcom, Marvell, MediaTek, and Nvidia itself.

NVDA is an organization based in 1993 and initially targeted on laptop graphics and the manufacturing of GPUs: driving high-resolution graphics for PC video games requires specific mathematical calculations, that are extra effectively run utilizing a “parallel” system; in such a system, a number of processors concurrently run smaller calculations. Nvidia focuses on these high-performance processors and was in the correct place on the proper time. Lately, the necessity for complicated calculations has unfold to each space of our lives and to probably the most cutting-edge sectors: autonomous driving, robotics, crypto currencies mining and – extra recently – machine studying and Synthetic intelligence, together with YouTube algorithms and ChatGPT.

NVDA is in a privileged and main place in all these segments. Not surprisingly, it’s the actual chief of this yr’s market rally with a efficiency of 186.55% YTD. However with yesterday’s closing worth of $418.71, questions come up: What are its multiples? Aren’t the valuations a little bit of a stretch? Or do the longer term prospects justify them?

Web margins are completely according to the sector (16.19% vs 16.52%), ROE considerably decrease than common (17.93% vs 19.52%), debt reasonably larger (debt/fairness 49.56% vs 29.50%).

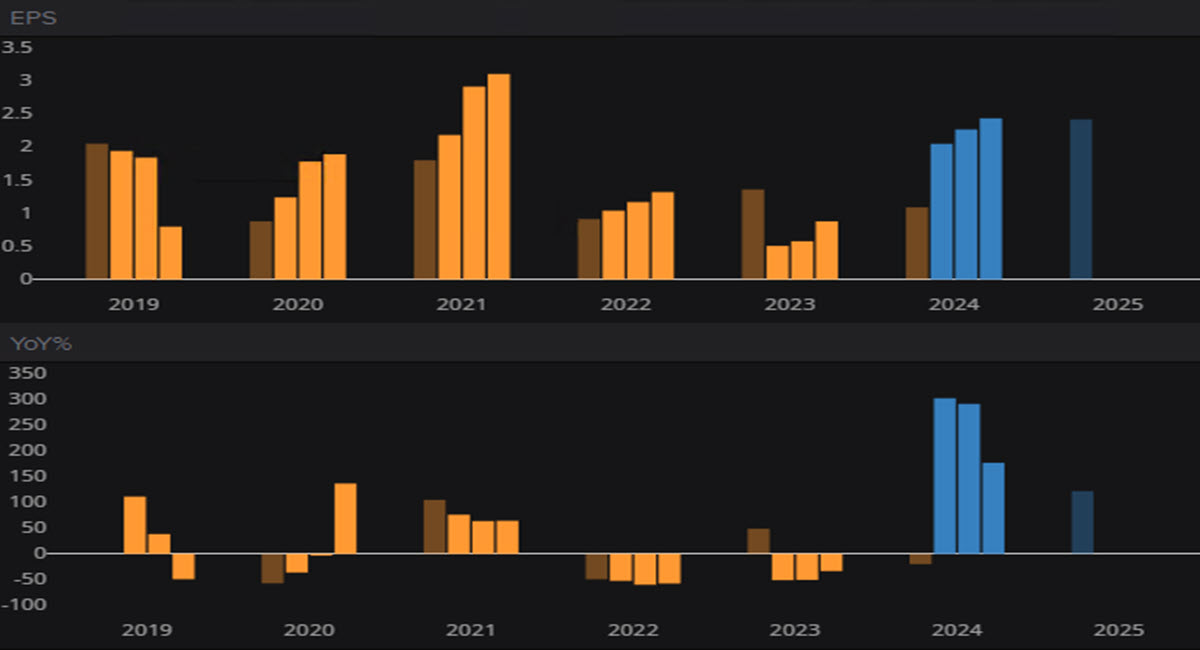

NVDA, EPS progress

The multiples, nonetheless, are eye-watering: PE 240.35 in opposition to a sector common of 43.33, Fwd PE 54.41 (14.69 common), P/ Gross sales 38.35 (sector at 7.30). The market cap of 1.03T is equal to all gross sales within the subsequent 38.35 years, assuming they continue to be secure as in 2022. What’s fascinating, nonetheless, is that EPS and Dividend Yield are effectively beneath the business common (1.74 vs 5.61 and 0.04% vs 1.44% respectively).

Basic analysts probably contemplate NVDA very, very costly: it’s a momentum commerce (regardless of the superb outlook).

TECHNICAL ANALYSYS

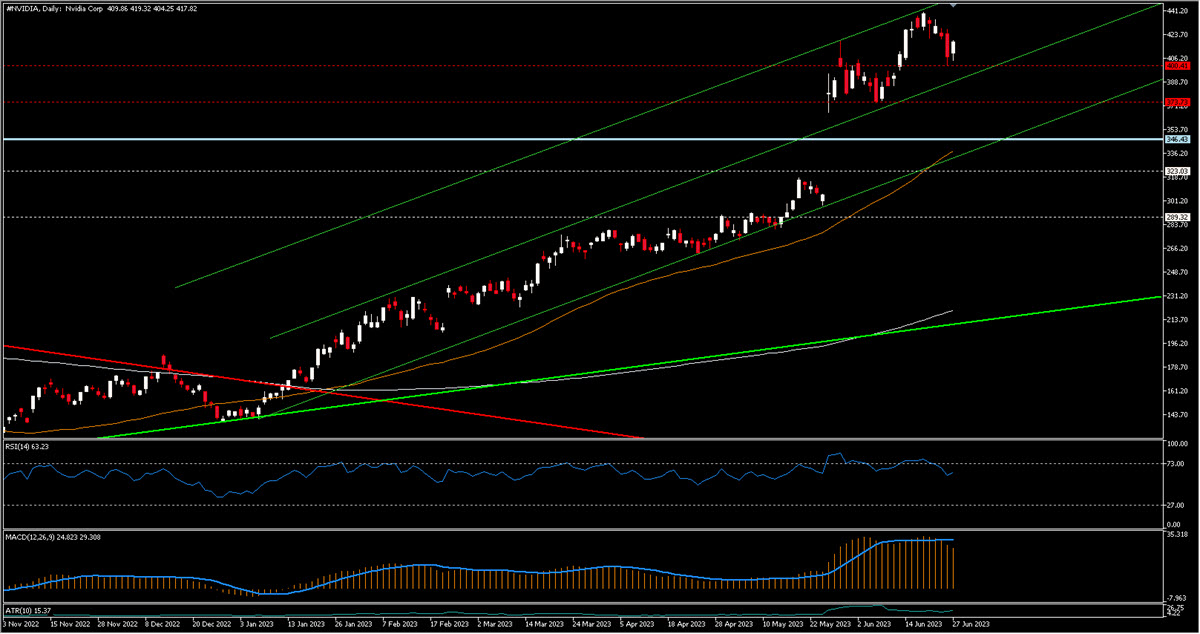

$345.95 was the earlier ATH marked in November 2021 and was pulverised after the final firm earnings releases. The motion is clearly exaggerated however might be framed inside an rising channel, of which NVDA has examined the higher half twice not too long ago (first at $419 after which at $439, a brand new ATH).

NVDA, Day by day

The RSI is diverging downwards and the MACD histogram has additionally crossed downwards. What we count on is a return in the direction of the MA 50 and the decrease certain of the channel. First, there would be the necessary static helps at $400 and $373.73 ($366 fascinating). If they’re damaged to the draw back, the targets could be the earlier ATH at $346 after which the GAP shut ($305). As talked about, MA50 and rising channel would work like obstacles (helps) in the sort of motion.

Ought to momentum be stronger than any prudent consideration, the $440 space will come into play for each lengthy and brief merchants.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link