The BRICS summit serves as a gathering of strategic minds hailing from Brazil, Russia, India, China, and South Africa — a formidable union constituting practically 1 / 4 of world GDP and embracing 40% of the world’s populace. This annual convergence navigates a spectrum of significant considerations: commerce, funding, innovation, improvement, and the orchestration of world governance. The fifteenth BRICS summit is ready to unfold from August 22 to 24, 2023, with Sandton, South Africa’s iconic skyline, portray the backdrop.

On the epicentre of this summit rests a notion that would doubtlessly recalibrate the worldwide monetary paradigm: the inception of a unified BRICS forex. It’s a proposition with profound implications, whereby some BRICS members are aiming to supply a substitute for the dominant US Greenback, which holds the reins of worldwide commerce and finance with an iron grip—commanding 88% of world transactions and 58% of overseas change reserves. But, BRICS nations have weathered the greenback’s storm—navigating sanctions, commerce tensions, debt quandaries, and inflationary waves.

On the epicentre of this summit rests a notion that would doubtlessly recalibrate the worldwide monetary paradigm: the inception of a unified BRICS forex. It’s a proposition with profound implications, whereby some BRICS members are aiming to supply a substitute for the dominant US Greenback, which holds the reins of worldwide commerce and finance with an iron grip—commanding 88% of world transactions and 58% of overseas change reserves. But, BRICS nations have weathered the greenback’s storm—navigating sanctions, commerce tensions, debt quandaries, and inflationary waves.

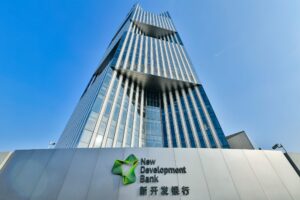

Endeavours to free their economies from the greenback’s grasp are properly underway. Take into account Russia and China begging to commerce in their very own currencies, or the flourishing partnerships fostering alternate options such because the Euro and Gold. The potent Yuan has knitted stronger ties between Brazil, India, and China, whereas the New Growth Financial institution (NDB) stands tall as a testomony of their collective would possibly—enabling BRICS to channel investments into sturdy infrastructure and sustainable desires, all whereas dealing in their very own currencies.

Nonetheless, fashioning a brand new forex is like sculpting a masterpiece. The trail ahead is laden with challenges, comparable to a fragile choreography of design, governance, issuance, distribution, change charges, and world acceptance. As they embark on this journey, we additionally should acknowledge the variations in financial magnitude, construction, coverage orientation, and strategic visions between these international locations. These divergent components, whereas inspiring, current challenges to the harmonious orchestration of a brand new forex.

Nonetheless, fashioning a brand new forex is like sculpting a masterpiece. The trail ahead is laden with challenges, comparable to a fragile choreography of design, governance, issuance, distribution, change charges, and world acceptance. As they embark on this journey, we additionally should acknowledge the variations in financial magnitude, construction, coverage orientation, and strategic visions between these international locations. These divergent components, whereas inspiring, current challenges to the harmonious orchestration of a brand new forex.

The greenback’s supremacy is not going to crumble in a single day. Its roots run deep, fortified by the intricate net of world finance and unwavering belief. Governments, banks, companies, buyers, and people alike view the Greenback as a paragon of worth, a cornerstone of commerce, a sanctuary for property, and a bedrock for reserves. The attract of the US monetary markets provides to its enduring energy.

The pursuit, although dangerous, guarantees metamorphosis. Think about a brand new BRICS forex, vibrant and resilient, standing shoulder to shoulder with the Greenback. Ought to it emerge as a contender, it may present a much-needed various, branching out worldwide commerce and finance. The repercussions would resonate, and doubtlessly see the greenback’s dominance challenged, its grip weakened, and the stage set for a extra various monetary narrative. Past the tangible, if profitable the brand new forex may defend the international locations inside BRICS from the tempestuous winds of exterior shocks and dollar-driven fluctuations. It may amplify their voice in world financial governance, including to the world’s financial discourse.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.