[ad_1]

Apple, Inc., an American multinational know-how firm specializing within the design, manufacture, and sale of smartphones (iPhone), private computer systems (Mac), tablets (iPad), wearables and equipment (Apple Watch, Airpods, Apple Beats), TVs (Apple TV) and different forms of associated companies (iCloud, digital content material shops, streaming, licensing companies), shall launch its Q1 2024 earnings outcome on 1st February (Thursday), after market shut.

Apple has taken the reins in market capitalization, with the most important market capitalization at over $3 trillion, forward of Microsoft which reached the milestone shortly after. What lies forward for this conglomerate?

Apple – Income Change by Product Class. Supply: MacroMicro

Within the earlier quarter, total gross sales of Apple. Inc fell for the fourth quarter in a row, to $89.5B. The determine was down -1% from the identical interval final 12 months. By product class, iPhone was the one {hardware} which mirrored progress within the quarter, with gross sales enhancing greater than 2% (y/y) to $43.8B (This was inclusive of per week of iPhone 15 gross sales). Whereas the outlook for the gross sales of the iPhone 15 sequence appear brighter than its earlier model, there have been nonetheless obstacles confronted by the tech conglomerate in its third largest market – China, following elevated competitors, geopolitical uncertainties, regulatory challenges and commerce restrictions. It was reported that the Chinese language iPhone gross sales dropped 30% within the first week of 2024, which led the corporate to slash its gadget value by 5% as an try to spice up gross sales within the area.

Alternatively, Mac, iPad, wearables/equipment had been down -33.8%, -10.2% and -3.4%, to $7.6B, $6.4B and $9.3B, respectively. Regardless of the disappointing gross sales hunch, CEO Tim Prepare dinner expects ‘vital’ enchancment within the Mac class, following the discharge of the most recent model iPad Air outfitted with speedier M3 processor. Gross sales of iPad might stay stagnant, because the revamped model remains to be within the course of. Earlier, Apple had been banned from promoting its Watch fashions Collection 9 and Extremely 2 which embody the blood oxygen characteristic following a patent infringement case. However, the damaging influence could possibly be minimal, as the corporate remains to be allowed to promote these fashions with the characteristic eliminated. Final however not least, Apple’s first spatial computing machine – the Imaginative and prescient Professional headset had pre-orders as much as 180,000, however steady demand for this “very area of interest product” remains to be questionable, because it “isn’t meant for the typical shopper” along with the costly value.

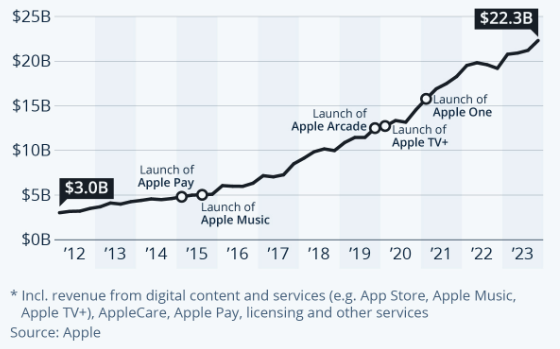

Apple Providers: A Decade of Progress. Supply: Statista

As well as, the companies division (Apply Pay, Apple TV+, iCloud, Apple Music, App Retailer, commercial, funds from Google for search) reached an all-time income excessive within the newest announcement, at $22.3B. This was pushed by an put in base of over two billion energetic units and fixed funding in new service choices. As of at the moment, it was reported that Apple’s paid subscriptions hit a couple of billion, almost doubled from the determine reported three years in the past. The administration stays optimistic in the direction of its companies companies, anticipating to see common income per week develop at a equally robust double-digit fee.

Apple.Inc: Reported Gross sales and EPS versus Analyst Forecast. Supply: CNN Enterprise

Consensus estimates for Apple’s gross sales income within the coming quarter stood at $126.1B, up over 40% from earlier quarter, and up 7.6% from the identical interval final 12 months. EPS is anticipated to hit $2.15, up over 47% from earlier quarter, and up over 14% from the identical interval final 12 months.

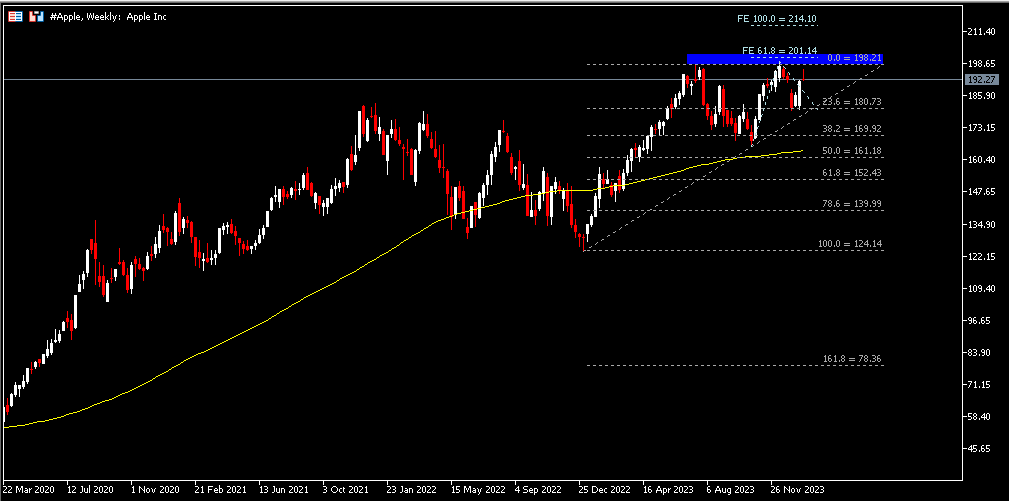

Technical Evaluation:

#Apple, Weekly: The corporate share value final closed barely above the excessive of the earlier week. $198.21, the excessive of July 2023 and $201.15, a 61.8% FE stage, each function the closest resistance zone. Breaking above this stage might lead the asset to check the following resistance stage, at $214. Alternatively, $180.70 and the 12 months low, $180.17 function the closest help zone. Breaking under the latter might lead the correction in the direction of the following help, at $170.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link