[ad_1]

USD/JPY PRICES, CHARTS AND ANALYSIS:

Most Learn: S&P 500 and Gold (XAU/USD) Take Diverging Paths Forward of a Raft of Information Releases

The Yen has put in two consecutive days of positive factors towards the buck for the primary time since August. An indication of the strain the Japanese foreign money has been beneath for a big a part of Q3 and This autumn to this point. Markets have been ready with bated breath for the specter of FX intervention to materialize which has stored USDJPY bereft of a transparent route.

Elevate your buying and selling abilities and acquire a aggressive edge. Get your fingers on the Japanese Yen This autumn outlook at present for unique insights into key market catalysts that ought to be on each dealer’s radar.

Beneficial by Zain Vawda

Get Your Free JPY Forecast

NIKKEI NEWS AND BANK OF JAPAN (BoJ) INTEREST RATE MEETING

The Japanese Authorities has tried to make use of warnings of intervention to underpin the Yen within the second half of 2023. This method does seem like sporting skinny nevertheless, as market contributors have grown accustomed to the warnings being adopted up by little or no motion from the Central Financial institution.

This morning nevertheless we noticed a report from Nikkei Asia that the BoJ perhaps getting ready to regulate the Yield Curve Management coverage as soon as extra and permit 10Y Japanese Authorities bond Yields to rise above 1%. The query on market contributors minds will probably be whether or not the BoJ will observe by means of. The larger image is apparent, in that Governor Ueda was introduced in to normalize financial coverage. But until now we have now solely heard the BoJ use feedback to taper Yen weak point, however one fears extra might must be achieved if the US Greenback Index continues to carry the excessive floor.

RISK EVENTS AHEAD

Rather a lot on the calendar this week with tomorrows BoJ assembly kicking issues off. The BoJ assembly might be probably the most thrilling one in latest reminiscence if the BoJ do announce a shake as much as their YCC coverage which might stoke some severe volatility in Japanese Yen pairs.

Following the BoJ assembly the outlook for the USDJPY could also be drastically completely different forward of the FOMC assembly. The Federal Reserve are anticipated to carry charges regular however focus will probably be on the Fed outlook transferring ahead and a possible hike in December. The robust knowledge from the US retains the door open for now with market contributors on the lookout for additional readability.

For all market-moving financial releases and occasions, see the DailyFX Calendar

For Suggestions and Tips on Buying and selling USDJPY, Obtain the Information Beneath

Beneficial by Zain Vawda

Find out how to Commerce USD/JPY

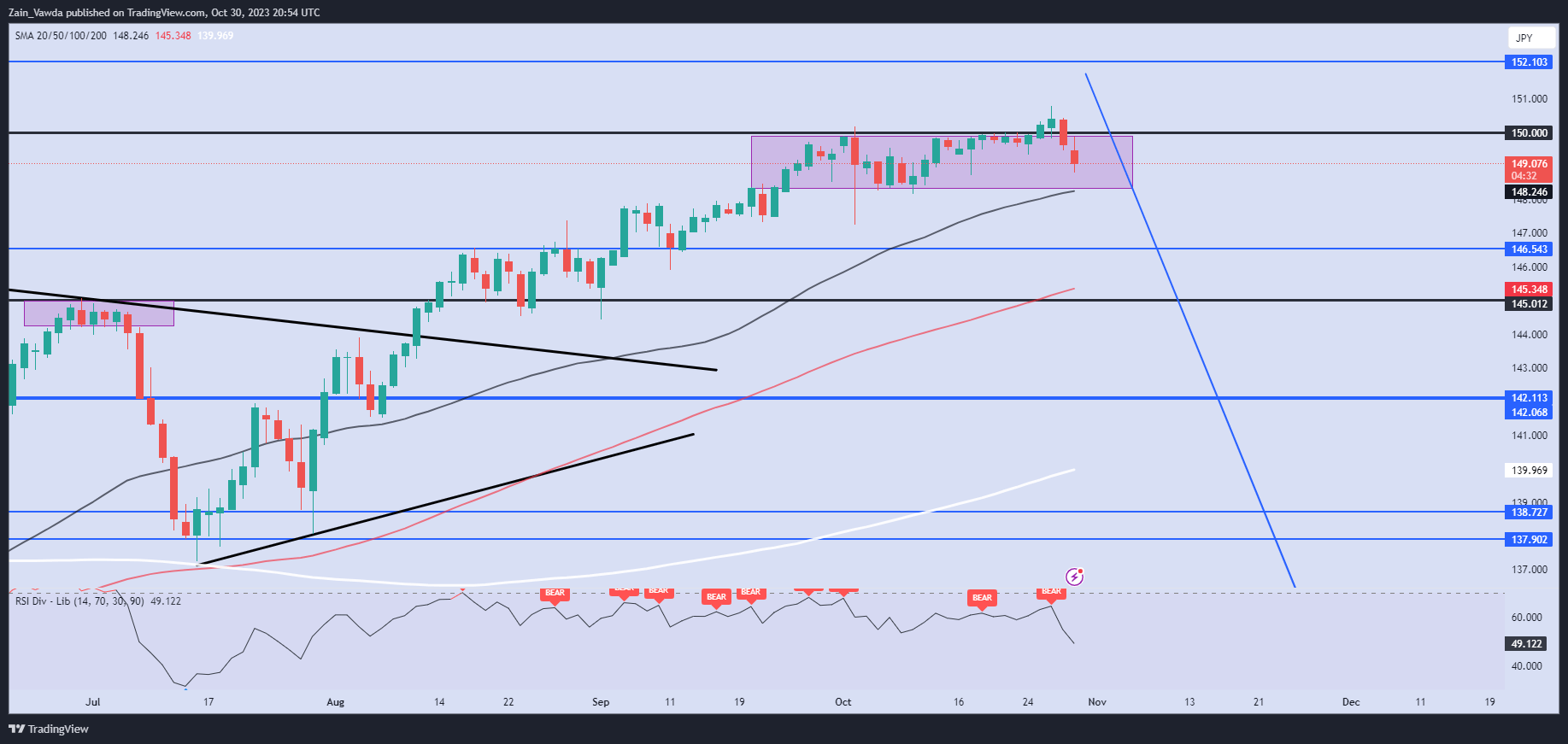

FINAL THOUGHTS AND TECHNICAL OUTLOOK

USD/JPY technical outlook stays difficult given the steep rise and lengthy interval of consolidation of late. We’ve got nevertheless printed two successive days of losses for the primary time since August, which might be an indication that additional draw back could also be imminent. As we have now mentioned for months, with out a change in financial coverage from the BoJ the probability of a sustained transfer to the draw back might stay elusive.

A day by day candle shut under the latest vary and 50-day MA resting across the 148.300 mark. This might be one other signal that we’re constructing bearish momentum. Nevertheless, the query of how massive a transfer we might get will rely solely on the BoJ assembly tomorrow and what adjustments/tweaks the Central Financial institution makes to financial coverage.

Key Intraday Ranges to Hold an Eye On:

Help ranges:

Resistance ranges:

USD/JPY Each day Chart – October 30, 2023

Supply: TradingView, Chart Created by Zain Vawda

IGCS reveals retail merchants are at the moment Web-Brief on USDJPY, with 83% of merchants at the moment holding SHORT positions. Given the contrarian view adopted right here at DailyFX will we see a return to the 150.00 degree and past?

To Get the Full IG Consumer Sentiment Breakdown in addition to Tips about easy methods to use it, Please Obtain the Information Beneath

| Change in | Longs | Shorts | OI |

| Each day | -3% | 2% | 1% |

| Weekly | 7% | -10% | -8% |

Written by: Zain Vawda, Markets Author for DailyFX.com

Contact and observe Zain on Twitter: @zvawda

[ad_2]

Source link