POUND STERLING ANALYSIS & TALKING POINTS

- Extra certainty round BoE leaves USD components extra attention-grabbing by way of Fed steerage (Jerome Powell).

- U.S. financial information together with NFP and ISM to make clear the image shifting ahead.

- Will the rising wedge strike once more?

Advisable by Warren Venketas

Get Your Free GBP Forecast

GBP/USD FUNDAMENTAL FORECAST: BEARISH

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

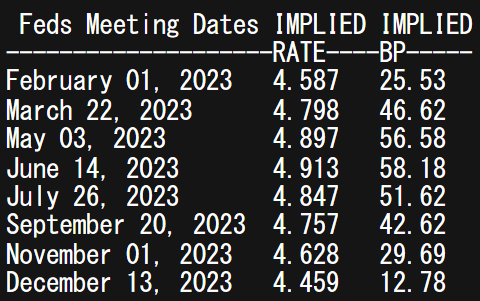

The British pound prepares itself for a stacked week forward that embrace each Financial institution of England (BoE) and Federal Reserve rate of interest selections respectively (see financial calendar under). The BoE has hinted at one more 50bps hike which is confirmed by cash market pricing as seen within the desk under. Whereas that is largely priced into GBP crosses, the vote break up proven within the February assembly could present some value volatility. Final assembly noticed a majority in favor of 50bps however contemplating new financial information there could also be extra votes break up between 50bps and 25bps with the BoE’s Tenreyro and Dhingra probably remaining with their unchanged stance – this may possible lead to a bearish response on the pound. Quite the opposite, softer vitality costs could also be limiting recessionary fears however with 2023 terminal charges anticipated round 4.5% (agreed to by Governor Bailey), the BoE could stay on this path keep it’s institutional credibility.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Supply: Refinitiv

From a USD viewpoint, markets are trying by way of the Fed’s steerage of a 5% terminal charge for 2023 on the idea of slowing inflationary pressures. The labor market then again has been extraordinarily resilient and shall be intently watched subsequent week through the Non-Farm Payroll (NFP) report. As well as, ISM providers information is essential allowing for that the U.S. is primarily a providers pushed economic system (a detailed eye shall be on wage statistics as nicely).

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Supply: Refinitiv

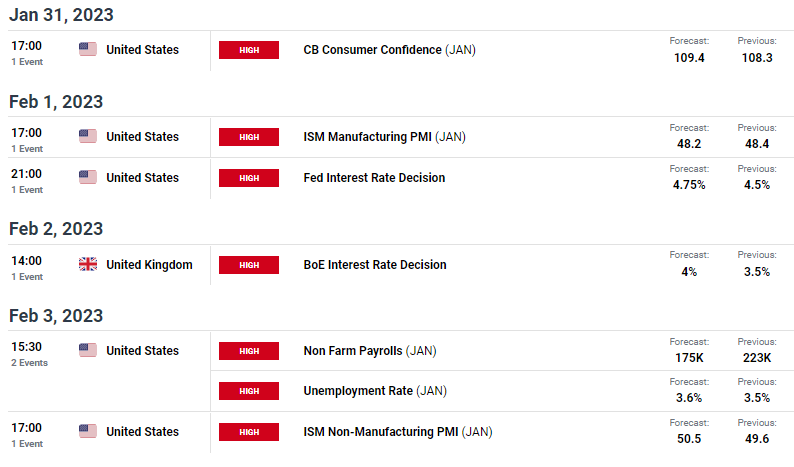

GBP/USD ECONOMIC CALENDAR

Supply: DailyFX Financial Calendar

TECHNICAL ANALYSIS

Introduction to Technical Evaluation

Candlestick Patterns

Advisable by Warren Venketas

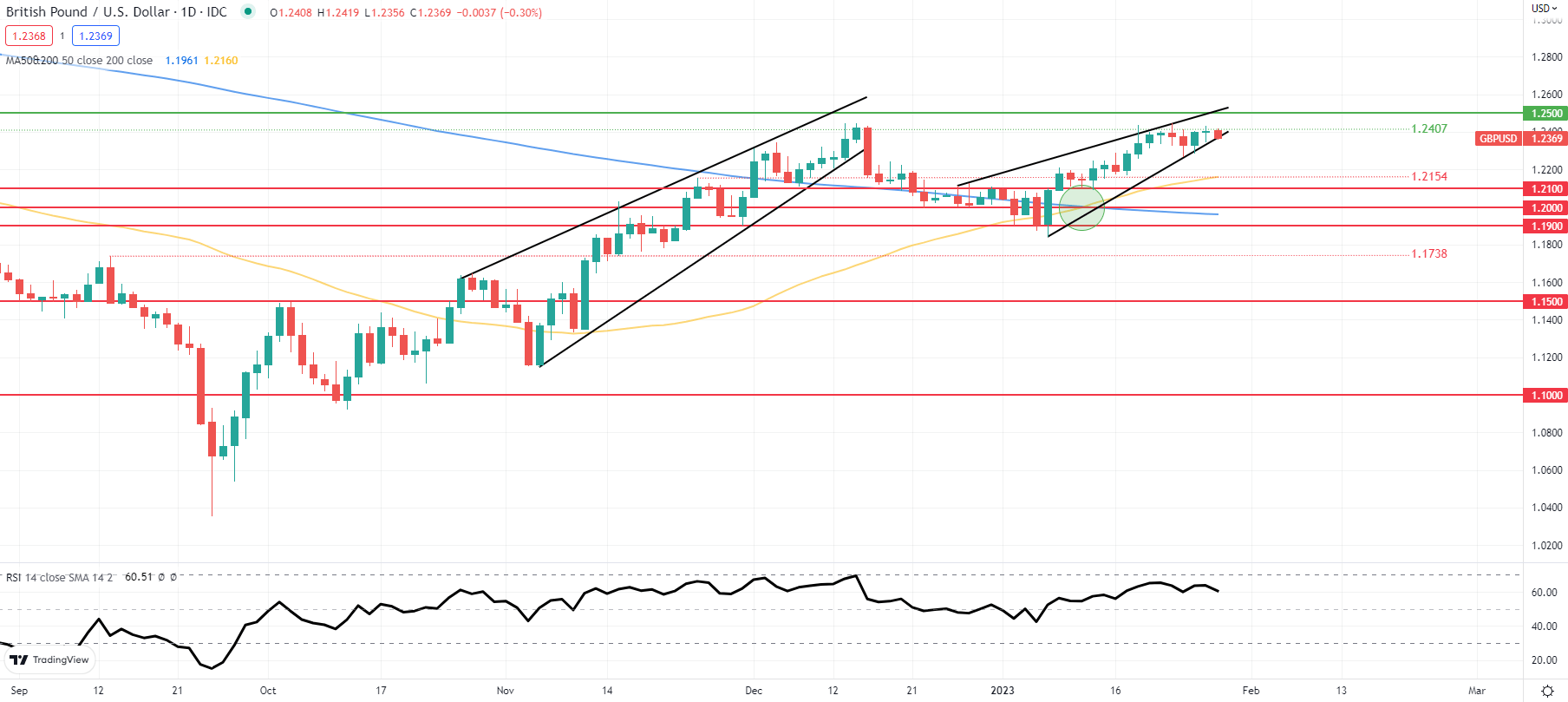

GBP/USD DAILY CHART

Chart ready by Warren Venketas, IG

Each day GBP/USD value motion has now been hovering across the December 2022 highs with no success from bulls to confidently push by way of this resistance zone simply but. Subsequent week’s basic drivers might actually present the catalyst relying on the assembly outcomes. Bears shall be trying intently on the growing rising wedge formation (black) for the second time because the December breakout performed out in a textbook trend. With the Relative Energy Index (RSI) degree near overbought territory, a leg decrease shouldn’t be inconceivable; whereas an invalidation of the wedge formation could happen ought to we see a day by day candle shut above the 1.2500 psychological deal with.

Key resistance ranges:

Key help ranges:

- Wedge help

- 1.2154/200-day SMA

- 1.2000

BEARISH IG CLIENT SENTIMENT

IG Consumer Sentiment Knowledge (IGCS) exhibits retail merchants are presently SHORT on GBP/USD, with 57% of merchants presently holding quick positions (as of this writing). At DailyFX we usually take a contrarian view to crowd sentiment however on account of current modifications in lengthy and quick positioning, we arrive at a short-term draw back bias.

Contact and followWarrenon Twitter:@WVenketas