[ad_1]

After a horrible CPI inflation determine within the UK the bar is about fairly excessive for the Financial institution of England to speed up the tempo of charge hikes to 50 foundation factors this week. The market provides it a 50% probability. On the similar time it believes that by August 23 charges will rise to 5.25% (from the present 4.5%) and by the tip of the 12 months to 6%. Are sterling merchants operating forward of themselves? ‘Extremely’- nicely, perhaps not for many who have been available in the market for a few years – the pound is falling with conviction as we speak, each in opposition to the EUR and the USD (about -0.50%).

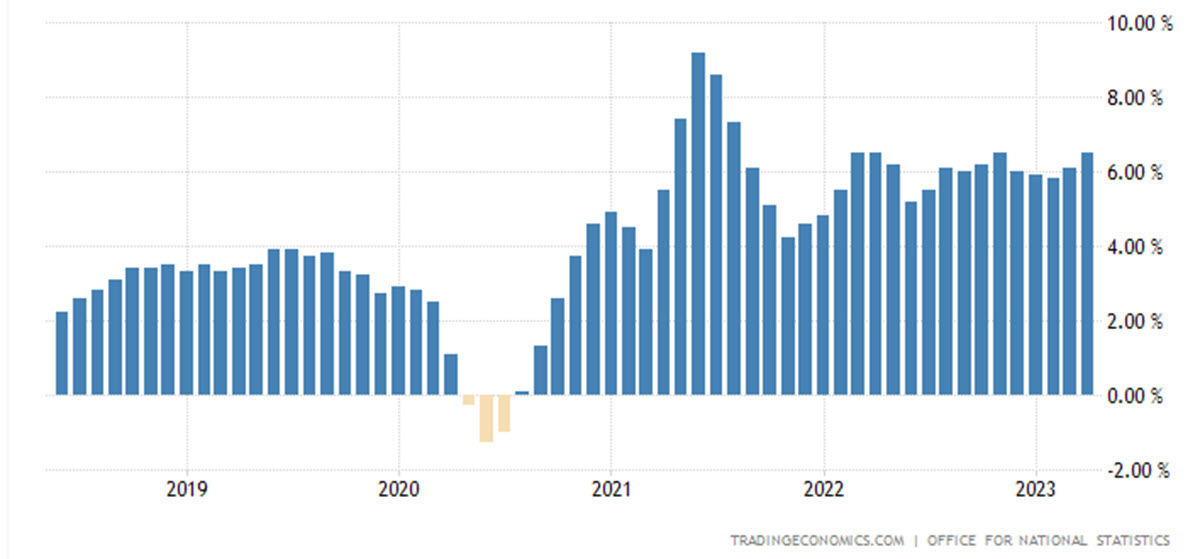

Headline inflation remained steady at 8.7% in Might, whereas core inflation (excluding the extra unstable parts of meals and vitality) rose to 7.1% from 6.8% in April: the times when the CPI fell under 10% (in March) are lengthy gone, and the phrases of each Bailey of the BOE and UK PM Sunak (inflation will halve by the tip of the 12 months) appear however a blurred shade from the previous. What’s stunning is the persistence of worth development in providers, which can be what the BOE is specializing in essentially the most.

In actual fact, year-on-year inflation is about to fall in the summertime, particularly given the very unfavourable comparability with final June’s figures and the clear fall in vitality and gas costs that’s going down now.

The issue, additionally expressed by the central financial institution, is that it’s not solely costs that have to be watched, but additionally the labour market and wage development. The BOE, utilizing a mannequin developed by former Fed Chairman Yellen, is sort of satisfied that the rise in wages is because of shoppers’ expectation of upper costs. However they may very well be improper: it may very well be, as in keeping with different fashions, the scarcity of staff influencing wage development. And this may be extra structural.

Earnings Development in UK

The Bailey-led establishment has already stated that the consequences of financial coverage haven’t but totally spilled over to the true financial system. It’s unlikely, nevertheless, that they are going to disregard market expectations of a terminal 6% charge at tomorrow’s assembly, solely to need to admit they had been improper sooner or later.

In all this, the pound is falling as we speak.

Technical Evaluation

At present’s transfer by Cable may simply be revenue taking after a protracted rally, a purely technical transfer and in distinction to the sharp rise in charges that’s going down. The pair appears to have damaged bearish a couple of days in the past and retesting it to ranges round 1.2670 can be a wholesome transfer. Even a take a look at in the direction of the MA 200 (and the bullish trendline from October 2022) would nonetheless not compromise a robust construction for the GBPUSD. RSI, MACD are constructive, worth is above the long run MAs.

GBPUSD, Every day

An identical argument applies to the EURGBP, which had just lately damaged the lows that had held since autumn 2022. Right here truthfully the RSI and MACD indicators are constructive, the MAs not a lot. A take a look at of 0.8635 and even larger close to 0.87 can be nothing uncommon. The pattern remains to be bearish.

EURUSD, Every day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link