Published on July 29th, 2022 by Josh Arnold

The financial services sector is inherently volatile during tough economic periods. This is because the group – especially traditional banks that make their income by lending deposits – rely upon economic strength for earnings. This fact means that banks with long dividend increase streaks are relatively difficult to come by, as periods of economic hardship see dividend cuts and suspensions.

However, not all banks are created equal. One superior bank is Bank OZK (OZK), which boasts a very impressive 27-year streak of dividend increases. That puts it firmly into the category of Blue Chips, which are stocks that have raised their dividends for at least 10 consecutive years.

Given this longevity, we feel the Blue Chip stocks that satisfy the 10-year payout growth streak criterion are among the safest dividend stocks that investors can buy. And when it comes to dividend increase streaks, the longer, the better.

There are more than 350 Blue Chip stocks today, and you can see the full list by clicking below:

In addition to the Excel spreadsheet above, we are individually reviewing the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This edition of the 2022 Blue Chip Stocks In Focus series will analyze Bank OZK’s prospects.

Business Overview

Bank OZK is a diversified financial institution that offers various retail and commercial banking services. The company has a variety of deposit-taking products for consumers and institutions, and makes loans against real estate, businesses, agriculture, homebuilding, and more.

Source: Investor presentation, page 3

Bank OZK also offers trust and wealth services, including retirement accounts, investment management, corporate trusts, and more. The company operates 240 offices in eight states. Bank OZK was founded in 1903, and we expect it to generate about $1.2 billion in revenue this year.

Bank OZK reported second quarter earnings on July 21st, 2022, and handily beat estimates on both the top and bottom lines. Earnings-per-share came to $1.10, which was eight cents ahead of expectations. Revenue was up almost 9% year-over-year to $292 million, and was $4.9 million better than estimates.

Provisions for credit losses came to $7 million, which was up sharply from a benefit of $31 million in the year-ago period. In last year’s second quarter, many banks – including Bank OZK – were unwinding better-than-feared provisions taken in the early phases of COVID.

Net interest income was $266 million, up from $249 million in Q1 and $241 million a year ago. Net interest margin was 4.52%, up sharply from 4.25% in Q1 and 3.95% in the year-ago period.

Noninterest expense was $109 million, up fractionally.

Total loans were $18.7 billion at the end of the quarter, down ~$200 million from Q1. Deposits were down as well, declining from $20.3 billion to $20.0 billion from Q1 to Q2.

Bank OZK noted it bought back 3.7 million shares of stock for $147 million during Q2. We now see $4.45 in earnings-per-share for this year following good Q2 results.

Growth Prospects

Bank OZK has averaged almost 15% earnings-per-share growth in the past decade, which it has achieved through a combination of acquisitions and organic growth. That’s certainly among the most impressive growth rates for a bank in our coverage universe, but we also note that earnings were still low a decade ago, following the Great Recession. Even still, Bank OZK stands above the crowd with its historical growth.

We see a more modest 3% growth rate going forward, as the company’s earnings base is extremely high. Thus, growth from current levels will likely prove more challenging than in previous years.

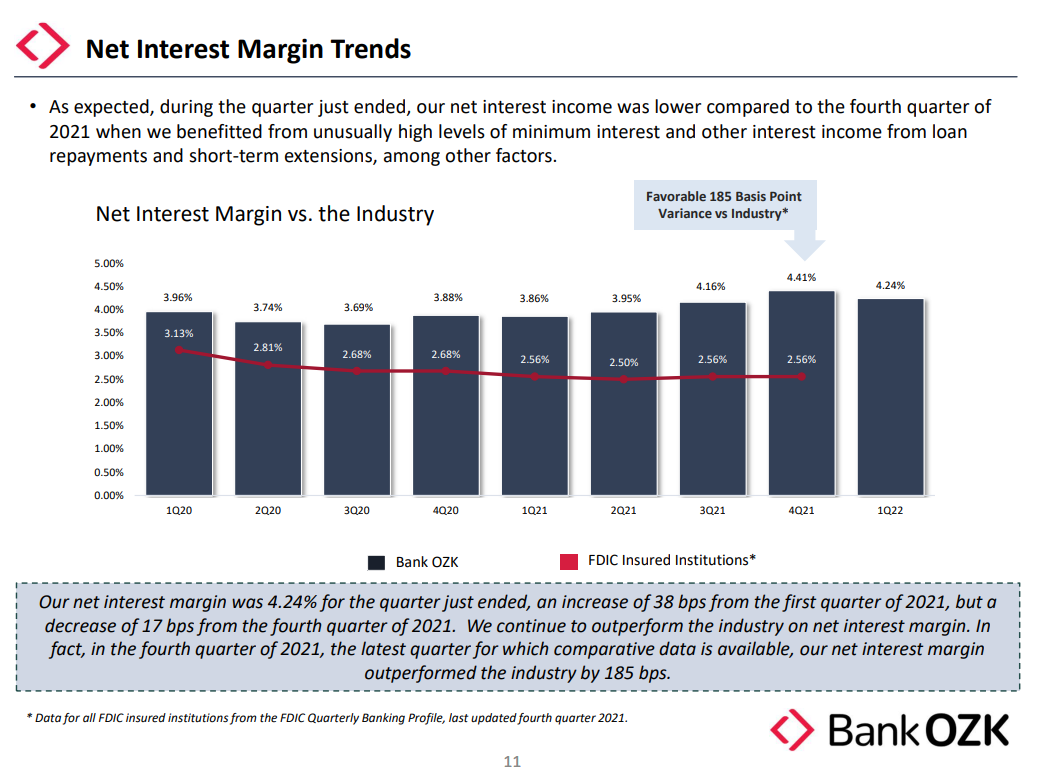

Source: Investor presentation, page 11

One catalyst for earnings growth is the company’s outstanding net interest margin. The bank is managing to grow NIM in what has been a very tough period for banks. However, as we can see, this is nothing new for Bank OZK. The company has found a way to balance loan risk and yields, with great effect.

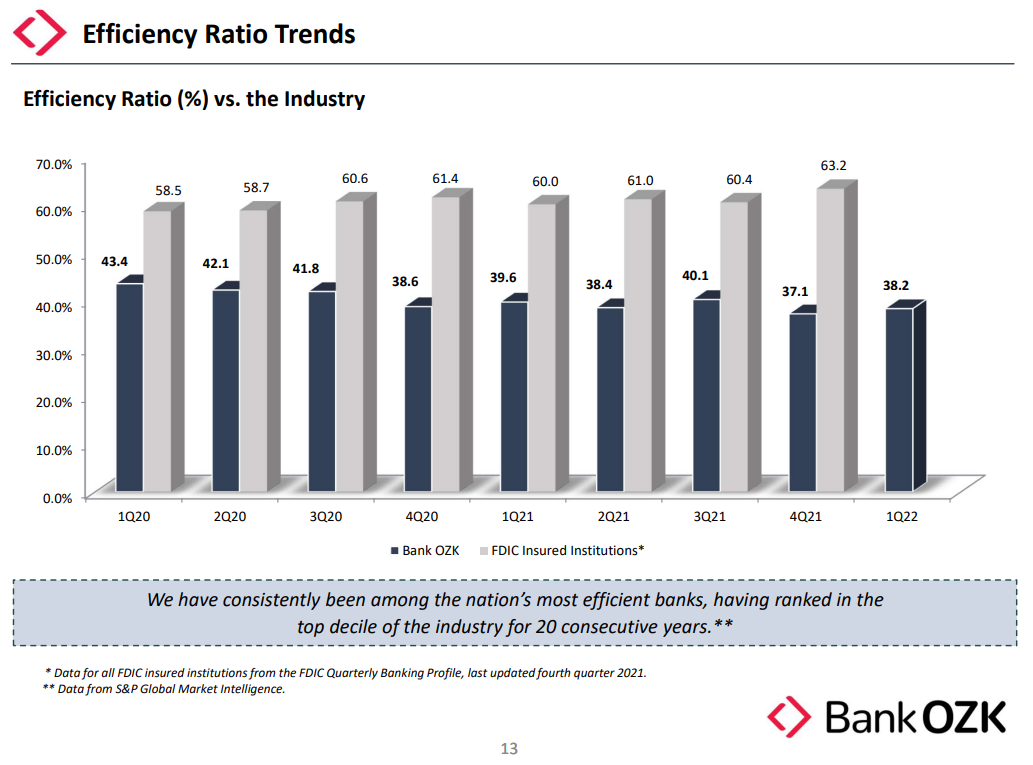

In addition, Bank OZK operates with a very lean cost structure.

Source: Investor presentation, page 13

This means that profit margins are very strong, and in concert with extremely high NIM, Bank OZK is a leader among banks in terms of outright profitability.

Bank OZK’s dividend has compounded at an average of almost 18% annually in the past decade, as the management team has taken full advantage of strong earnings to return capital to shareholders. That, along with the 27-year streak of increases, means Bank OZK is virtually peerless in the banking sector in terms of its attractiveness as a dividend stock. We see 5% growth going forward, accounting for slower rates of earnings growth.

Competitive Advantages & Recession Performance

Competitive advantages are difficult to come by in banking, simply because all entrants sell essentially the same thing. However, Bank OZK has crafted an advantage through its underwriting practices, which afford it strong yields while also achieving reasonable credit risk.

All banks are at least somewhat susceptible to recessions, as credit risk rises sharply during downturns. Bank OZK has lent out nearly 100% of its deposits, so we see it as somewhat more susceptible to earnings risk during a prolonged downturn. Its credit quality remains very strong today, but it’s a risk.

The payout ratio on this year’s earnings is just 29%, a value which we see rising modestly in the years to come. That should afford Bank OZK the ability to not only continue raising the payout, but absorb any weakness from a recession. As such, we believe the safety of the dividend is quite good.

Valuation & Expected Returns

Shares of Bank OZK go for just 9 times this year’s earnings, which is not only very low by historical standards, but is well below our estimate of fair value. We peg that at 11 times earnings, so if the stock were to revert to that over the next five years, it could generate a ~4% annual tailwind to total returns.

In concert with our 3% estimated growth, and the 3.2% dividend yield, we expect 9.9% total annual returns in the coming years.

Final Thoughts

We see Bank OZK as an extremely competent operator in what is a crowded and commoditized industry. The company has industry-leading margins on lending, as well as a very lean operating structure. While we expect growth to slow from the past decade to more normalized levels, the stock is attractively priced. In addition, buyers get a 3.2% dividend yield, and nearly three decades of consecutive dividend increases. Even among other Blue Chip stocks, Bank OZK stands out.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends, however.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].