Higher instances for Bitcoin might lie forward because the co-founder of BitMEX feels that the present geopolitical tensions within the Center East might solely push the cryptocurrency to rise greater. In line with Arthur Hayes, the results of conflict would resonate intensely within the US economic system within the type of elevated authorities spending and inflationary ranges of financial coverage.

Hayes believes extra borrowing will ensue with growing navy spending and that this borrowing can be serviced by extra stability sheet enlargement by the Federal Reserve and industrial banks, all in the end to the detriment of the US greenback.

Hayes is fast to notice that in instances when conventional fiat currencies are weakening, Bitcoin stands to achieve as a result of it acts as a hedge towards inflation. The current enhance of the US Producer Value Index to 1.8% over market expectations resonates towards inflation issues and goes in favor of the traders in search of security from declining fiat cash.

Arthur Hayes. Picture: Jackie Robinson Basis

The Battle’s Influence On Bitcoin & Financial Coverage

Hayes attracts on historical past to help his speculation, saying US intervention in wars tends to result in cash printing, which may profit Bitcoin’s value. He then continues to state that there’s an analogy to be drawn between the ’73 power disaster and the way gold behaved as a tough asset at rising inflationary ranges. Hayes says Bitcoin, typically dubbed “digital gold,” can soar considerably due to inflationary forces and cash printing stemming from war-time expenditures.

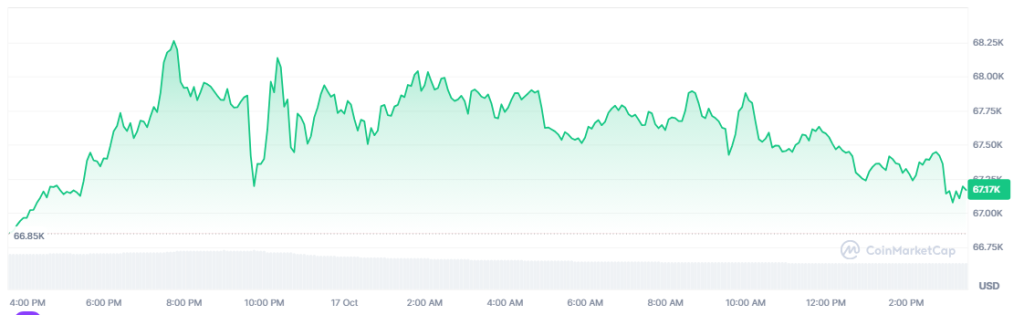

BTCUSD buying and selling at $67,199 on the every day chart: TradingView.com

He additionally highlights the chance of upper power costs if Center East conflicts flip extra lethal, particularly if there are strikes and even average harm to essential infrastructure resembling oil fields or different key services. On this situation, inflation would worsen and have a tendency to drive up demand for Bitcoin as a “saved power” kind within the monetary markets. Hayes, naturally sufficient, cautions that if extra macro-level instability takes maintain, it would additionally trigger market volatility.

Strategic Concerns For Traders

Whereas he’s optimistic about Bitcoin, he cautions and manages his threat prudently as he has been pulling his publicity on the smaller cryptocurrencies, hoping it will decrease losses when geopolitical tensions rage uncontrolled.

He signifies that debt-financed, spending-friendly insurance policies is not going to solely proceed funding long-term development in Bitcoin however will even proceed the historic development exhibited all through historical past. He notes that if Bitcoin can outpace the Federal Reserve stability sheet development alongside historic time frames, it does the job of a hedge towards weakening fiat currencies.

Hayes is cautious about impulsive buying and selling attributable to political information: “You should protect your self and your capital.” Folks ought to make investments capital in a retailer of worth like Bitcoin, saving from the debasement of foreign money and buying energy throughout unsure instances. As geopolitical instability continues, Bitcoin continues to be in an excellent place for additional development.

Featured picture from DALL-E, chart from TradingView