On-chain information exhibits the Bitcoin Hashrate has slumped again down not too long ago because the cryptocurrency’s worth has continued in a bearish trajectory.

Bitcoin Mining Hashrate Has Retraced Its August Restoration

The “Mining Hashrate” refers to a Bitcoin metric that retains observe of the full quantity of computing energy that the miners have presently linked to the BTC community.

When the worth of this metric goes up, it means new miners are becoming a member of the blockchain and/or outdated ones are including to their services. Such a pattern implies that the community seems to be like a horny enterprise to those chain validators.

Then again, the indicator registering a decline implies a few of the miners have determined to disconnect from the chain, doubtlessly as a result of BTC mining is not worthwhile for them.

Now, here’s a chart from Blockchain.com that exhibits how the 7-day common Bitcoin Mining Hashrate has modified over the previous 12 months:

Seems to be like the worth of the metric has gone down in current days | Supply: Blockchain.com

As is seen within the above graph, the 7-day common Bitcoin Mining Hashrate had proven an increase in the course of final month and had made restoration to ranges not removed from its all-time excessive (ATH) set again in July.

In the direction of the tip of the month, nevertheless, the indicator had began happening as an alternative and now, it has retreaded to nearly the identical lows as within the first-third of August.

The reason behind these developments could lie in the truth that the miners rely on the BTC spot worth for his or her revenue margin. It is because the block subsidy, which they obtain as compensation for fixing blocks on the community, makes up for the first a part of their revenue.

These rewards are given out at a set BTC worth and at a set time interval, so the one variable associated to them is the USD worth of the cryptocurrency. With the worth combating bearish winds once more not too long ago, it is sensible that miners have been downsizing their operations.

As has traditionally been the case, although, this current drop within the 7-day common Bitcoin Mining Hashrate could not stick for too lengthy, with any recent surges within the worth more likely to renew uptrend within the metric.

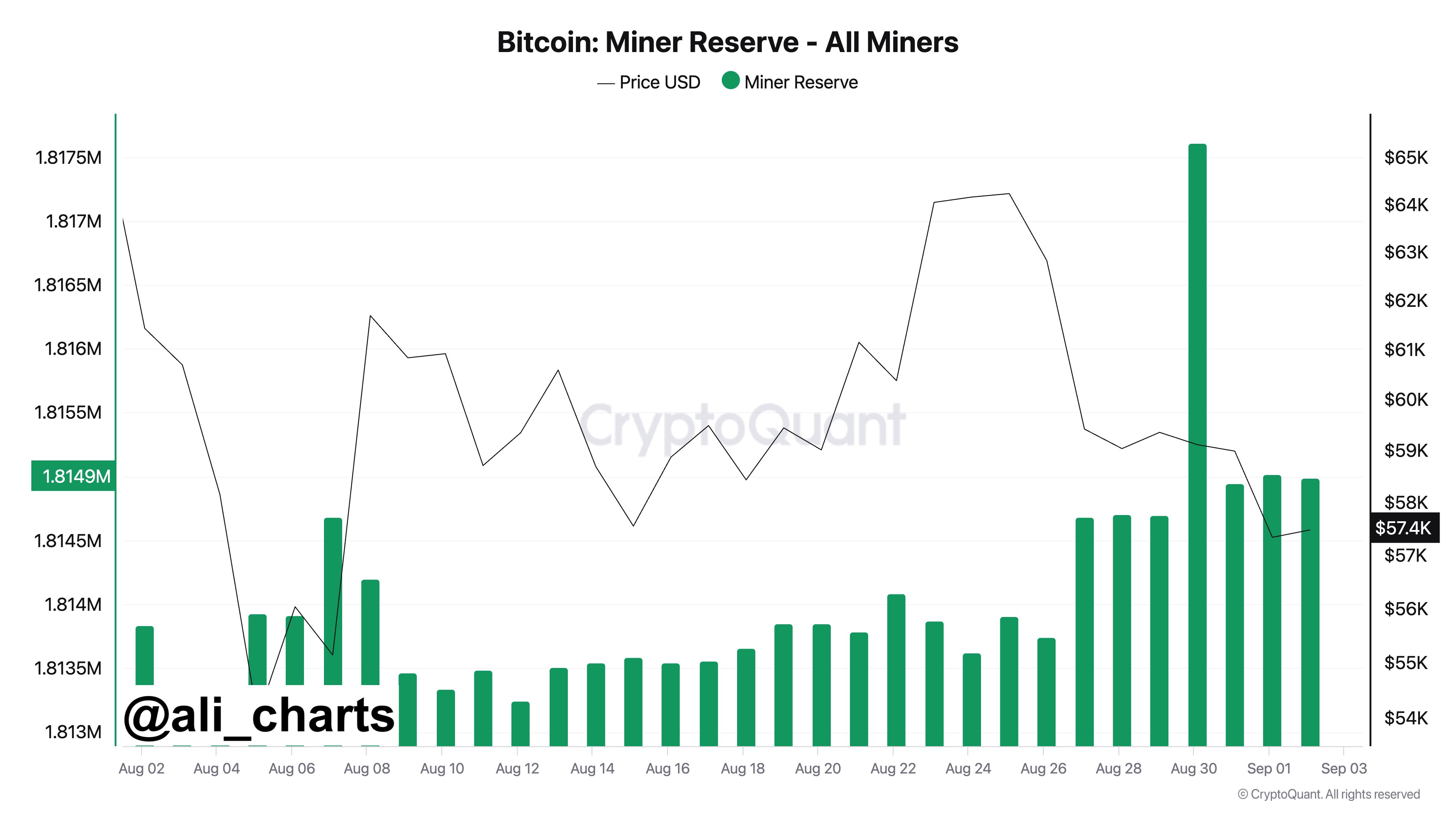

Moreover the Hashrate, one other indicator that might maybe showcase miner misery is the Miner Reserve, which measures the full quantity of Bitcoin that’s presently sitting within the wallets associated to those chain validators.

As analyst Ali Martinez has identified in an X submit, miners participated in a notable quantity of promoting over the weekend.

The pattern within the BTC Miner Reserve over the previous month | Supply: @ali_charts on X

In complete, the Bitcoin miners eliminated 2,655 BTC from their wallets throughout this window, which is price greater than $156 million on the present change fee of the cryptocurrency.

BTC Worth

On the time of writing, Bitcoin is floating round $59,000, down over 5% within the final seven days.

The worth of the coin seems to have been shifting sideways over the previous few weeks | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, Blockchain.com, chart from TradingView.com