[ad_1]

Over the previous few years, digital currencies and have grow to be first rate barometers of speculative investor urge for food. Such isn’t shocking given the evolution of the market right into a “on line casino” following the pandemic, the place .

“Such is unsurprising, on condition that retail traders usually fall sufferer to the psychological habits of the “worry of lacking out.”

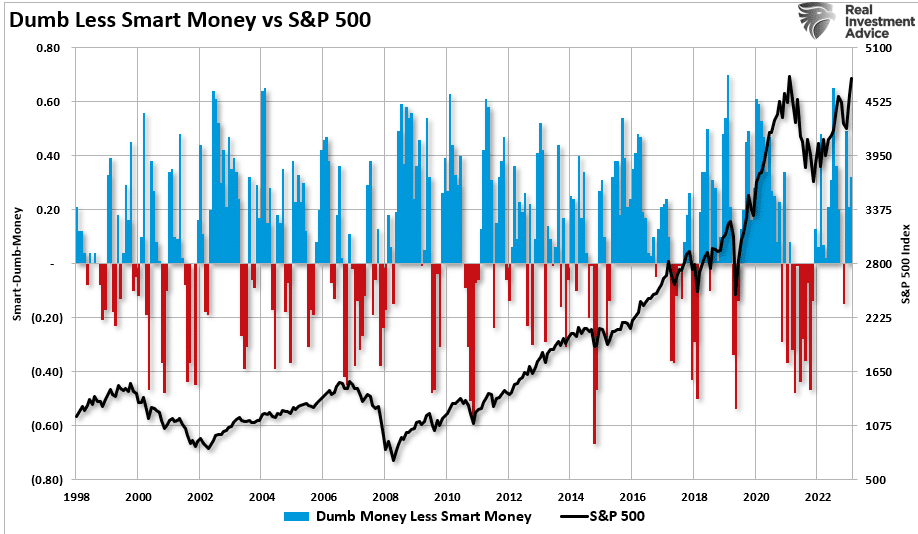

The chart under reveals the “dumb cash index” versus the S&P 500. As soon as once more, retail traders are very lengthy equities relative to the institutional gamers ascribed to being the “good cash.””

“The distinction between “good” and “dumb cash” traders reveals that, most of the time, the “dumb cash” invests close to market tops and sells close to market bottoms.”

Dumb Much less Good Cash vs S&P 500

Dumb Much less Good Cash vs S&P 500

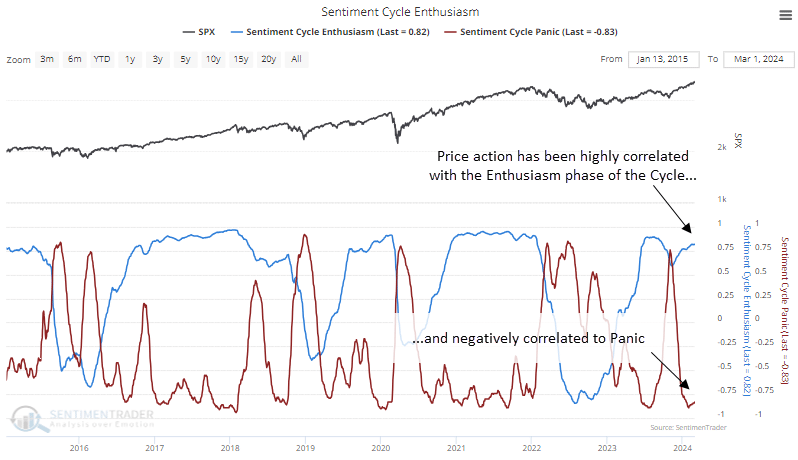

That enthusiasm has elevated sharply since final November as shares surged in hopes that the Federal Reserve would reduce rates of interest. As famous by Sentiment Dealer:

“Over the previous 18 weeks, the straight-up rally has moved us to an attention-grabbing juncture within the Sentiment Cycle. For the previous few weeks, the S&P 500 has demonstrated a excessive constructive correlation to the ‘Enthusiasm’ a part of the cycle and a extremely destructive correlation to the ‘Panic’ part.”

That frenzy to chase the markets, pushed by the psychological bias of the “worry of lacking out,” has permeated the whole lot of the market. As famous in this text:

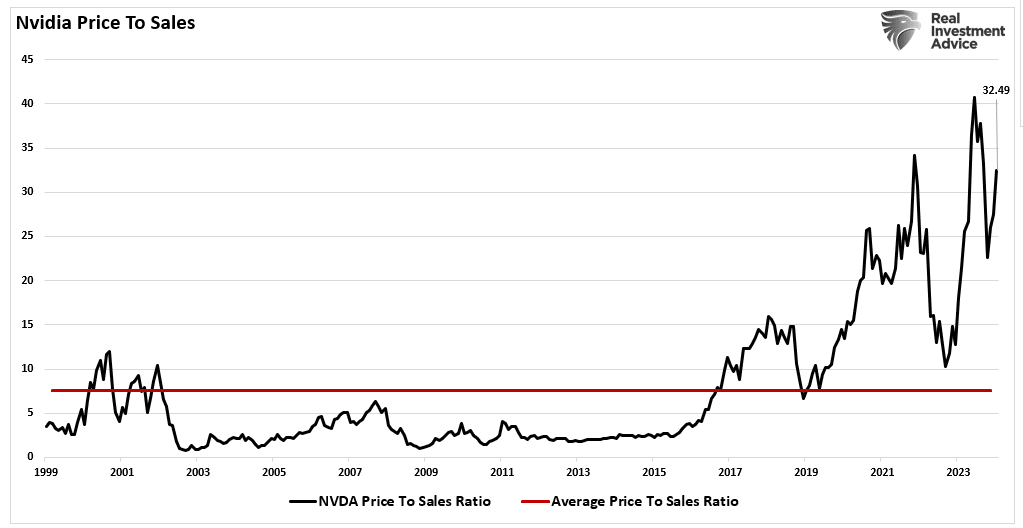

“Since then, the complete market has surged larger following final week’s earnings report from Nvidia. The rationale I say “that is nuts” is the belief that every one firms had been going to develop earnings and income at Nvidia’s charge.

There’s little doubt about Nvidia’s earnings and income development charges. Nevertheless, to keep up that development tempo indefinitely, significantly at 32x price-to-sales, means others like AMD and Intel should lose market share.”

NVDA Worth To Gross sales Ratio

NVDA Worth To Gross sales Ratio

After all, it’s not only a speculative frenzy within the markets for shares, particularly something associated to “synthetic intelligence,” however that exuberance has spilled over into gold and cryptocurrencies.

Birds Of A Feather

There are a few methods to measure exuberance within the belongings. Whereas sentiment measures look at the broad market, technical indicators can mirror exuberance on particular person asset ranges. Nevertheless, earlier than we get to our charts, we want a short clarification of statistics, particularly, customary deviation.

As I mentioned in “Revisiting Bob Farrell’s 10 Investing Guidelines”:

“Like a rubber band that has been stretched too far – it should be relaxed with the intention to be stretched once more. That is precisely the identical for inventory costs which are anchored to their shifting averages.

Tendencies that get overextended in a single path, or one other, at all times return to their long-term common. Even throughout a robust uptrend or sturdy downtrend, costs usually transfer again (revert) to a long-term shifting common.”

The concept of “stretching the rubber band” may be measured in a number of methods, however I’ll restrict our dialogue this week to Normal Deviation and measuring deviation with “Bollinger Bands.”

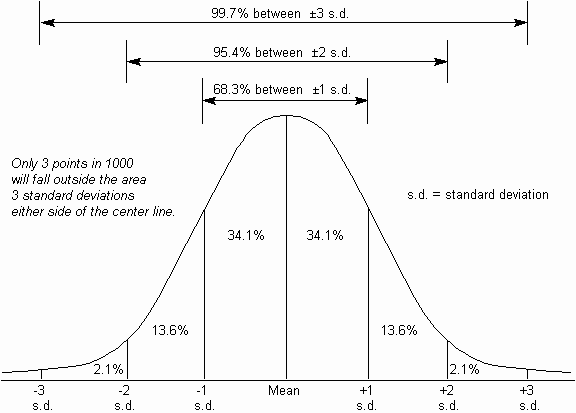

“Normal Deviation” is outlined as:

“A measure of the dispersion of a set of information from its imply. The extra unfold aside the info, the upper the deviation. Normal deviation is calculated because the sq. root of the variance.”

In plain English, this implies that the additional away from the common that an occasion happens, the extra unlikely it turns into.

As proven under, out of 1000 occurrences, solely three will fall exterior the world of 3 customary deviations. 95.4% of the time, occasions will happen inside two customary deviations.

Normal Deviation

A second measure of “exuberance” is “relative power.”

“In technical evaluation, the relative power index (RSI) is a momentum indicator that measures the magnitude of latest value adjustments to guage overbought or oversold situations within the value of a inventory or different asset. The RSI is displayed as an oscillator (a line graph that strikes between two extremes) and may learn from 0 to 100.

Conventional interpretation and utilization of the RSI are that values of 70 or above point out {that a} safety is changing into overbought or overvalued and could also be primed for a development reversal or corrective pullback in value. An RSI studying of 30 or under signifies an oversold or undervalued situation.” – Investopedia

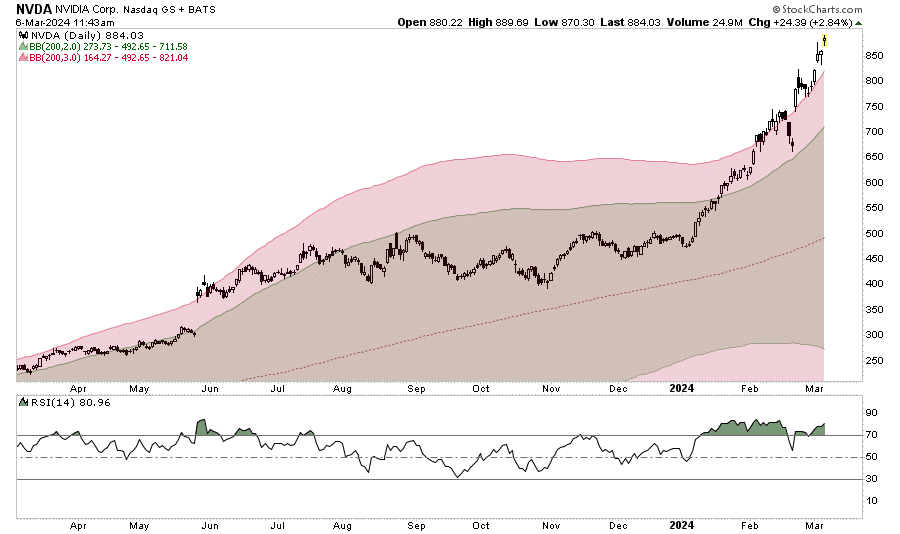

With these two measures, let’s have a look at Nvidia (NASDAQ:), the poster baby of speculative momentum buying and selling within the markets. Nvidia trades greater than 3 customary deviations above its shifting common, and its RSI is 81.

The final time this occurred was in July of 2023 when Nvidia consolidated and corrected costs by means of November.

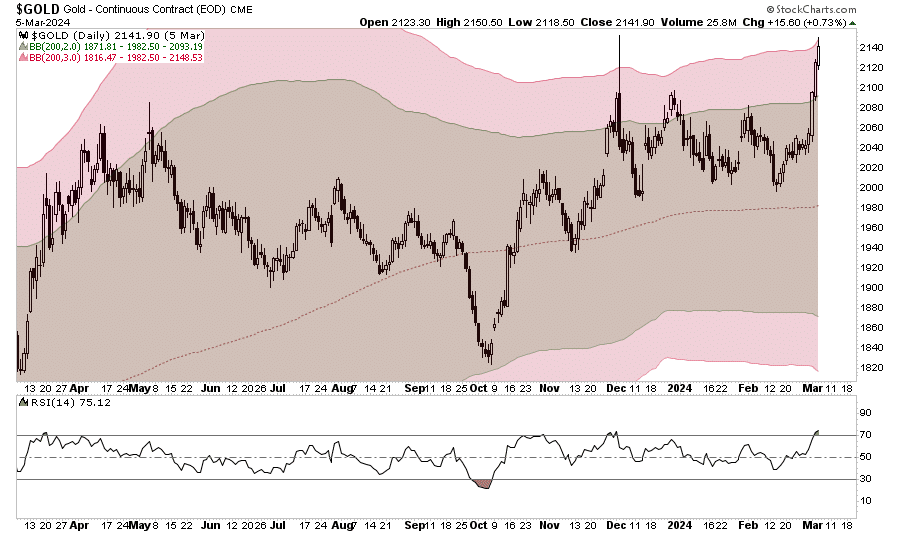

Curiously, gold additionally trades properly into 3 customary deviation territory with an RSI studying of 75. Provided that gold is meant to be a “secure haven” or “threat off” asset, it’s as an alternative getting swept up within the present market exuberance.

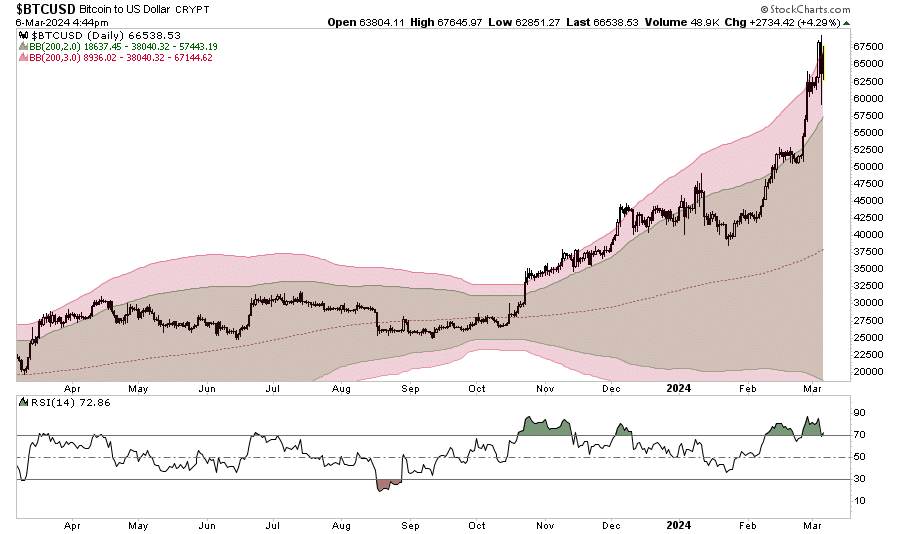

The identical is seen with digital currencies. Given the latest approval of spot, exchange-traded funds (ETFs), the panic bid to purchase Bitcoin has pushed the worth properly into 3 customary deviation territory with an RSI of 73.

In different phrases, the inventory market frenzy to “purchase something that’s going up” has unfold from only a handful of shares associated to synthetic intelligence to gold and digital currencies.

It’s All Relative

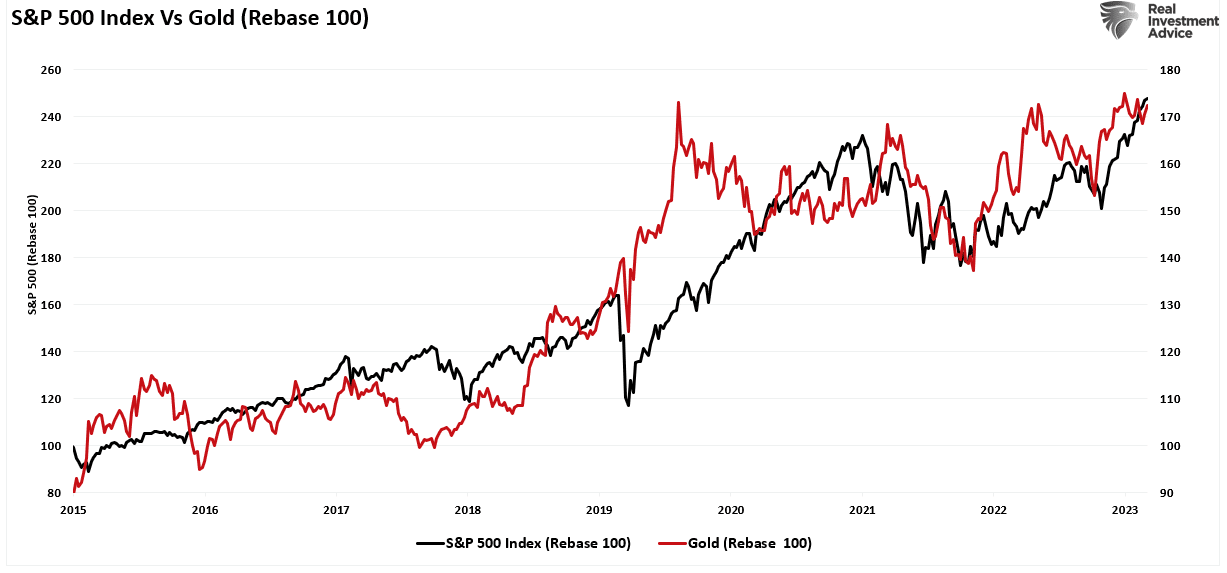

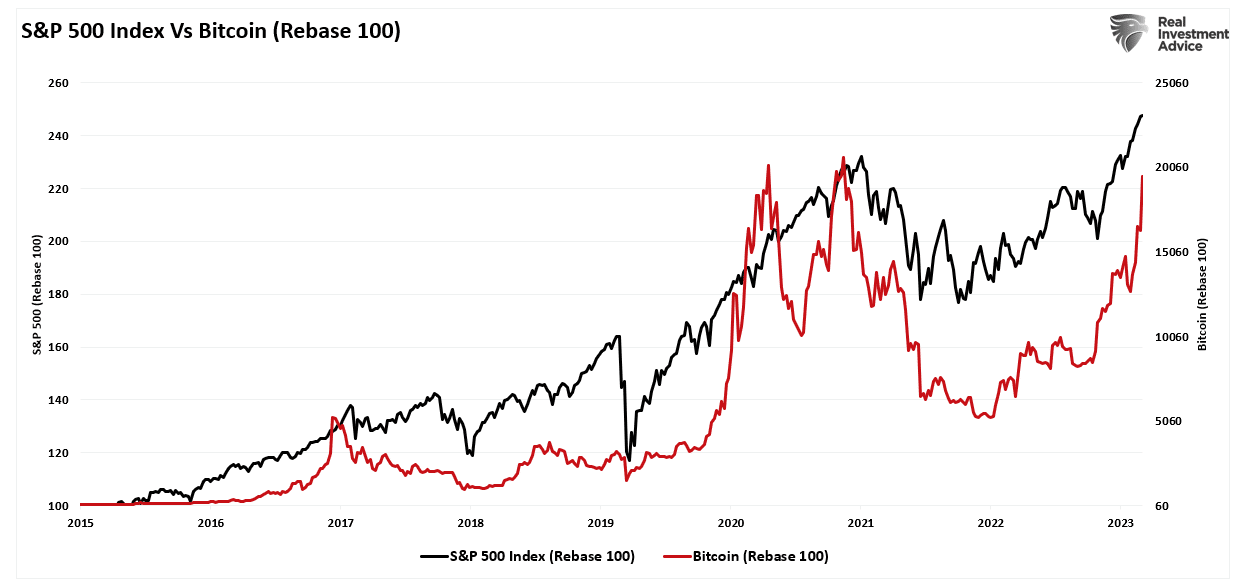

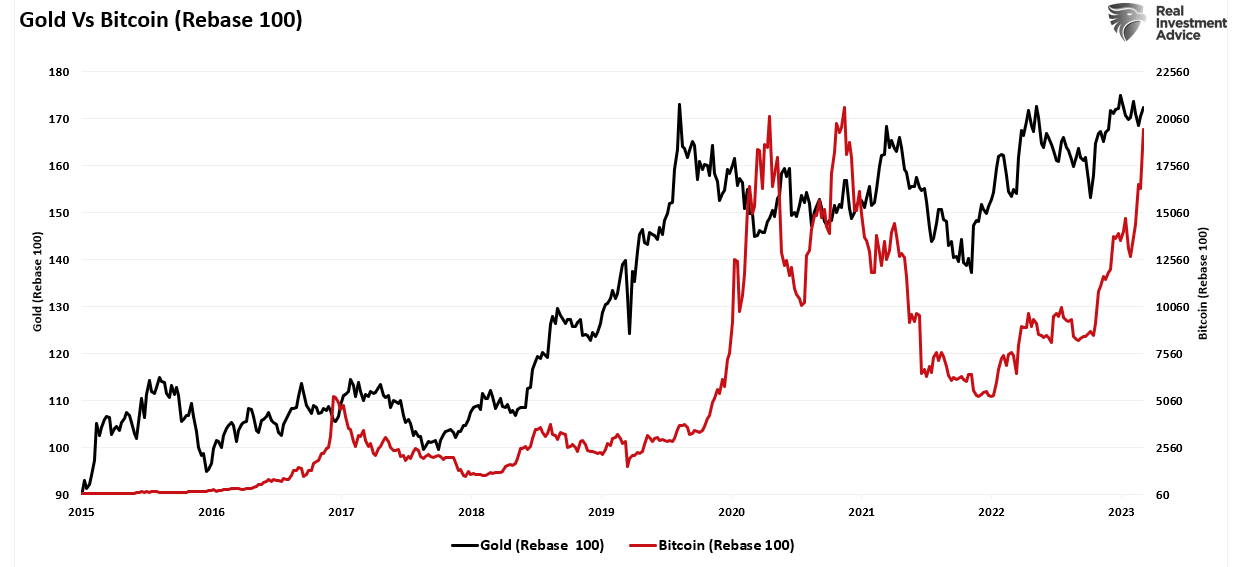

We will see the correlation between inventory market exuberance and gold and digital forex, which has risen since 2015 however accelerated following the post-pandemic, stimulus-fueled market frenzy. For the reason that market, gold and cryptocurrencies, or Bitcoin for our functions, have disparate costs, now we have rebased the efficiency to 100 in 2015.

Gold was speculated to be an inflation hedge. But, in 2022, gold costs fell because the market declined and inflation surged to 9%. Nevertheless, as inflation has fallen and the inventory market surged, so has gold.

Notably, since 2015, gold and the market have moved in a extra correlated sample, which has decreased the hedging impact of gold in portfolios. In different phrases, throughout the subsequent market decline, gold will doubtless monitor shares decrease, failing to offer its “wealth preservation” standing for traders.

The identical goes for cryptocurrencies. Bitcoin is considerably extra unstable than gold and tends to ebb and circulate with the general market. As sentiment surges within the , Bitcoin and different cryptocurrencies comply with go well with as speculative appetites improve.

Sadly, for people as soon as once more piling into Bitcoin to chase rising costs, if, or when, the market corrects, the decline in cryptocurrencies will doubtless considerably outpace the decline in market-based equities. That is significantly the case as Wall Avenue can now quick the spot-Bitcoin ETFs, creating further promoting strain on Bitcoin.

Only for added measure, right here is Bitcoin versus gold.

Not A Advice

There are numerous narratives surrounding the markets, digital forex, and gold. Nevertheless, in right this moment’s market, greater than in earlier years, all belongings are getting swept up into the investor-feeding frenzy.

Certain, this time could possibly be completely different. I’m solely making an statement and never an funding suggestion.

Nevertheless, from a portfolio administration perspective, it’ll doubtless pay to stay attentive to the correlated threat between asset lessons. If some occasion causes a reversal in bullish exuberance, money and bonds could be the solely place to cover.

[ad_2]

Source link