[ad_1]

Key Takeaways

- Bitcoin has dropped by nearly 13% since Mar. 28.

- Likewise, Ethereum has incurred more than 12% in losses.

- Both tokens are now approaching key support areas that may contain the bleeding.

Share this article

Bitcoin and Ethereum are struggling to find support, while traders in the futures markets are showing signs of optimism. Such market behavior could result in a brief upswing before another retrace.

Bitcoin Prepares to Bounce

Bitcoin appears to be gaining momentum for a rebound after the steep correction it has endured over the past two weeks.

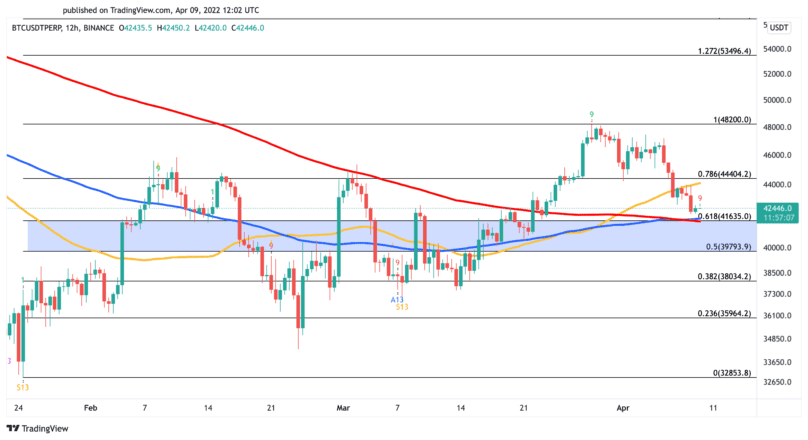

The top crypto suffered a significant downturn after reaching a high of $48,000 on Mar. 28. Its price dropped by nearly 13%, losing more than 6,000 points in market value. Despite the significant losses incurred, it appears that market participants are still optimistic.

On Binance Futures, the BTCUSDT Long/Short Ratio has continued to surge, hitting a 2.62 ratio on Apr. 9. Roughly 72.4% of all accounts on the world’s largest crypto derivatives exchange by trading volume are net-long on Bitcoin.

Although Bitcoin does not tend to follow the herd, the bulls could be proven right this time around.

The Tom DeMark (TD) Sequential currently presents a buy signal on Bitcoin’s 12-hour chart. The bullish formation developed in the form of a red nine candlestick, which is indicative of a one to four candlesticks upswing.

A spike in buying pressure could help validate the optimistic outlook and push Bitcoin toward the $44,400 resistance level. A decisive 12-hour candlestick close above this hurdle could result in a more significant upswing to retest the recent high of $48,200.

However, while the odds appear to favor the bulls, Bitcoin could still extend its losses before it rebounds. The most significant foothold underneath Bitcoin lies between $41,600 and $40,000. If this support area is breached, it may trigger a liquidations cascade, sending prices to $38,000 or even $36,000.

Ethereum at a Crossroads

Ethereum is consolidating within a $140 price range without providing a clear signal of its next move.

The second-largest cryptocurrency by market cap has been stuck between $3,300 and $3,160 over the last three days after suffering a 12.27% correction. This price pocket does not appear to be attracting sidelined investors despite the significance of Ethereum’s upcoming plans. Though the launch date is still unknown, Ethereum is currently preparing to complete “the Merge” from a Proof-of-Work to a Proof-of-Stake consensus mechanism, something the blockchain’s fans have been anticipating for several years. It’s expected to ship sometime in 2022.

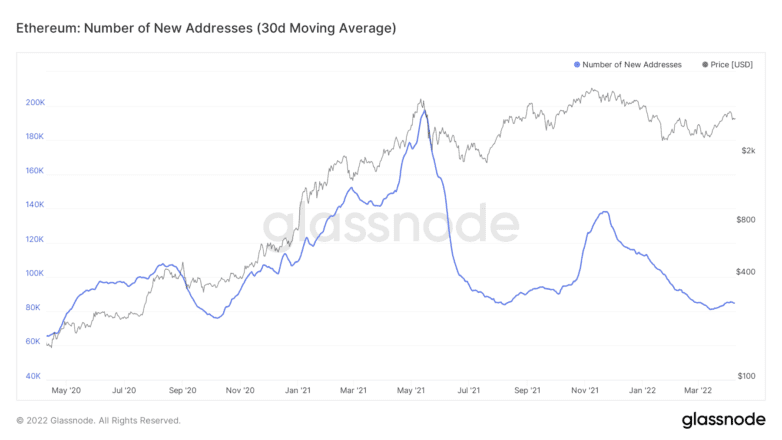

The network’s current expansion rate reflects the lack of interest. The number of new daily addresses created on the Ethereum blockchain has remained stagnant at an average of 85,000 addresses over the past month. A sustained uptrend on this on-chain metric could lead to further upward price action as it would signal the entrance of retail investors.

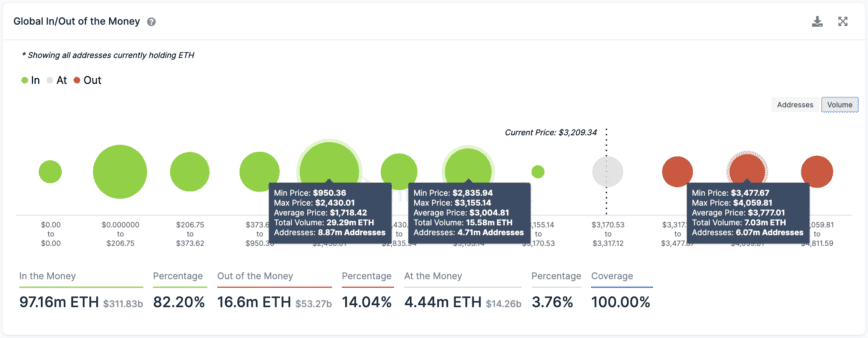

Until that happens, transaction history shows critical supply and demand areas to watch out for.

IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals that the most significant support level for Ethereum sits at an average price of $3,000, where 4.71 million addresses are holding 15.58 million ETH. Meanwhile, the most significant resistance zone is $3,780, where 6.07 million addresses have previously purchased over 7 million ETH.

Ethereum needs to break through support or resistance to resolve its ambiguity. Slicing through the $3,000 demand zone could see ETH drop toward $2,400. However, if the bulls break past the $3,780 supply wall, prices could advance toward $4,600.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

Get up to $600 in AVAX or LUNA

With our goal of bringing the next 100 million people to crypto, Celsius is always looking to provide the best experiences and opportunities for our community. This includes looking for…

New Bitcoin Political Advocacy Groups Announced at Bitcoin 2022

The Bitcoin Advocacy Project announced two new pro-Bitcoin political advocacy organizations today: the Bitcoin Policy Institute, and Financial Freedom PAC. Together, these groups will seek to influence legislation, regulation, and…

“Don’t Sell Your Bitcoin”: Wood and Saylor Evangeliz…

ARK Invest CEO Cathie Wood and MicroStrategy CEO Michael Saylor appeared together for a fireside chat at Bitcoin 2022 today. The duo talked about the shifting regulatory landscape, projections for…

What Is ETH? Defining Ethereum’s Scarce Asset

From a “triple-point asset” to “ultra sound money,” Crypto Briefing explores how Ethereum’s native asset has been conceptualized and whether viewing it as a perpetual bond might be the next…

[ad_2]

Source link