[ad_1]

Binance‘s and OKX‘s annual income grew 10x and 4x over the previous two years, respectively, whereas Huobi’s quarterly income fell by -98% because the second quarter of 2021, as reported by CryptoQuant.com.

Binance

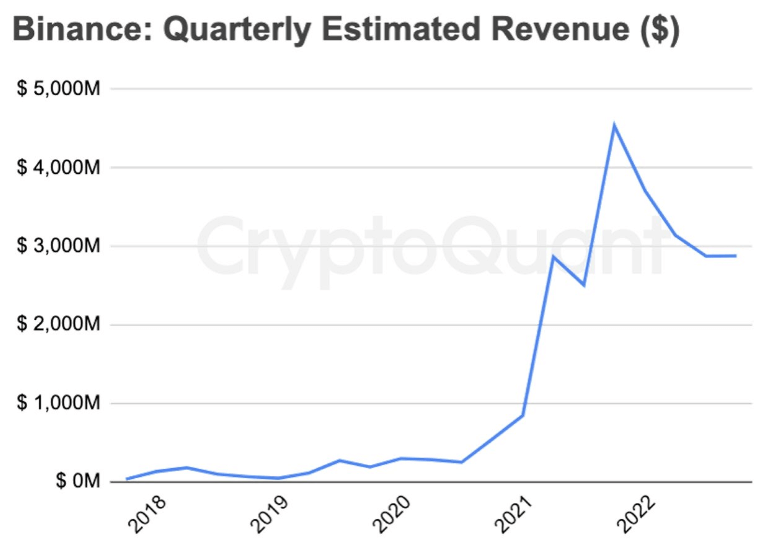

Binance’s quarterly income began to develop exponentially in 2021 and maintained its development all year long. The trade’s annual income reached round $12 billion in 2022.

Nevertheless, the trade’s buying and selling volumes began to fall on the finish of 2022, which additionally lowered the estimated quarterly income. In December 2022, Binance misplaced 90,000 Bitcoin (BTC) from its reserves in a single week. In keeping with knowledge from Jan. 9, the trade noticed $12 billion price of withdrawals within the earlier two months. The trade’s buying and selling quantity additionally hit its two-months low on Dec. 23, reaching $9.39 billion.

OKX

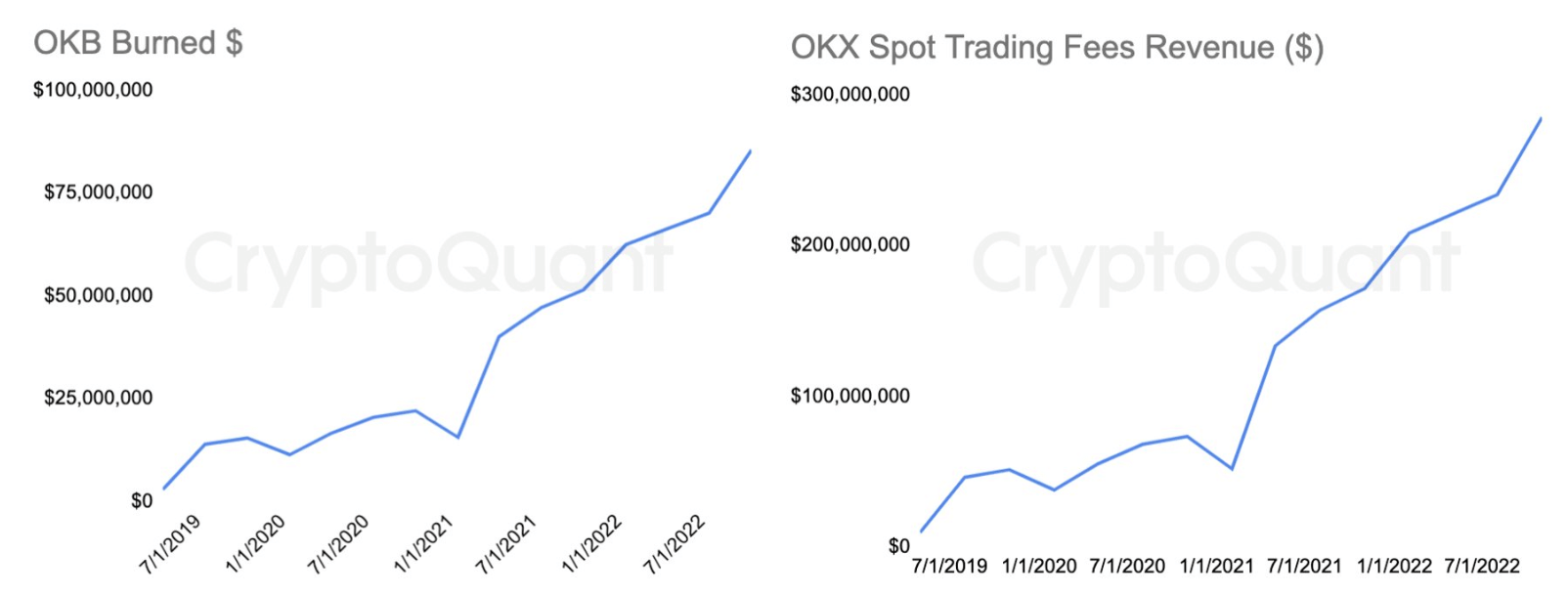

In keeping with CryptoQuant, OKX’s income recorded 4x natural development over the previous two years.

The trade burns its native token OKB or repurchases them primarily based on spot buying and selling price income. The burned OKB tokens recorded a rise of 600% in 2021, growing from $12.5 million to $87.5 million. The token’s spot buying and selling quantity additionally recorded a parallel development, reaching nearly $3 billion on January 2022.

Huobi

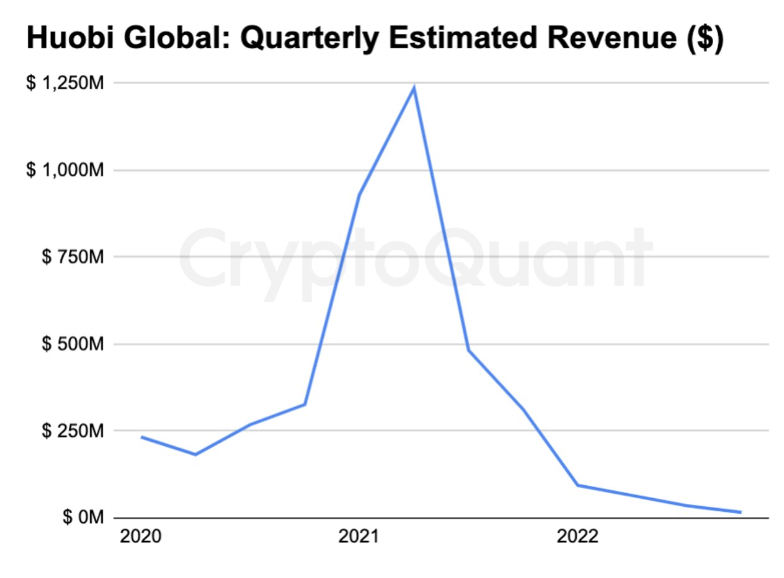

Within the meantime, Huobi World’s quarterly income has been recording a gentle lower since April 2021.

In April 2021, the trade recorded $1.25 billion in income, solely to drop under $250 million by 2022. Primarily based on the info, the trade is anticipated to return even nearer to zero in quarterly income by 2023.

The trade determined to retreat from China in November 2021, regardless that it was the dominant trade within the Chinese language market on the time. In October 2022, Huobi’s founder sold his shares, which corresponded to 60% of the corporate. On December 2022, the group was knowledgeable that Huobi was fighting the winter situations and will begin layoffs.

Though Huobi’s CEO denied these claims on Jan. 2, the trade mentioned it was planning to put off 20% of its workers on Jan.6. On Jan.5, over $60 million price of crypto left Huobi’s reserves inside 24 hours. On Jan.9, Huobi Korea introduced that it’s separating itself from Huobi World to turn into an unbiased entity.

[ad_2]

Source link