KanawatTH

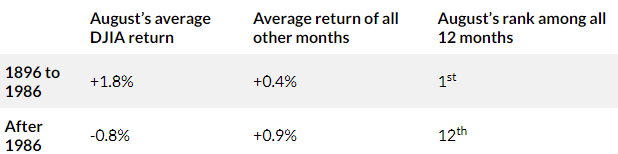

August hit the market like a ton of bricks. The month was once the most effective for markets, because the desk under exhibits, however during the last 40 years or so it has flipped to the worst month. On this article, we take a fast take a look at the scenario within the earnings area in gentle of the worth strikes thus far.

Marketwatch

A Progress Drawdown

In a late July article, we mentioned the historic patterns of earnings market drawdowns, the 2 forms of drawdowns and the way the subsequent one was extra more likely to be a growth-type drawdown. Although we didn’t count on a market drawdown solely days after the article, thus far, it’s enjoying out just about alongside the traces we anticipated.

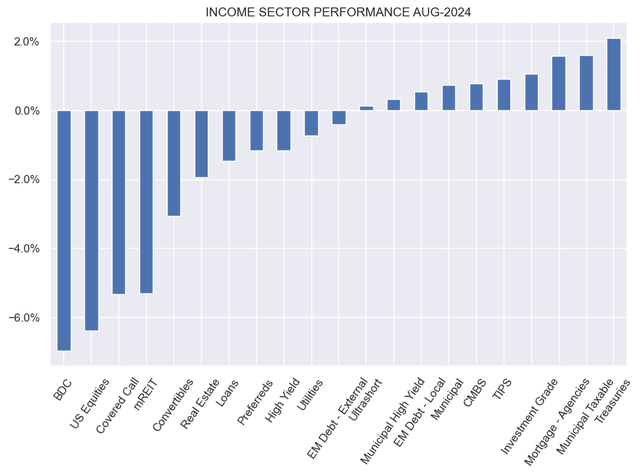

A typical development drawdown is brought on by issues about financial exercise. In any such drawdown, fairness costs are likely to fall and credit score spreads are likely to widen, whereas longer-term rates of interest are likely to fall. That is exactly what we have now seen thus far in August.

Larger-quality, longer-duration sectors like Munis have outperformed (and rallied) whereas fairness and credit-linked sectors have underperformed (and fallen). An essential level that we have now pressured a lot of occasions is that whereas Municipal bonds are additionally “credit score” belongings, they have an inclination to carry up nicely throughout development shocks. It is because credit score spreads widen proportionally so higher-quality belongings like Municipal bonds see comparatively little unfold widening versus company credit score belongings like high-yield company bonds and financial institution loans. This, together with the everyday drop in longer-term charges, is what permits them to outperform.

Systematic Revenue

Key Patterns And Benchmarks

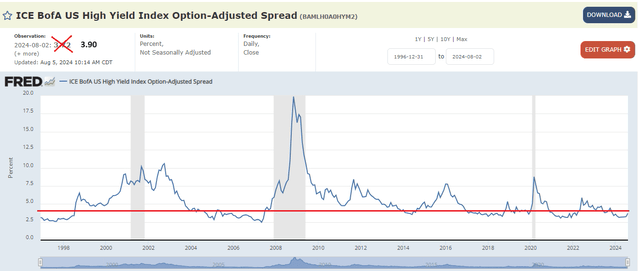

Along with checking on the habits of particular person sectors, it is essential to have a look at the larger image of the place valuations are at present relative to their longer-term historical past. If we use high-yield company bonds as our credit score market proxy, we get the next chart.

FRED

Typical recessions are likely to see spreads high out someplace round 7.5-10% – this contains 2001, the 2015 power crash which technically was not a recession and the COVID recession. The information is all the time a day delayed, so we add Monday’s transfer to the chart, which takes us to round 3.90% in credit score spreads. That is nonetheless low by historic requirements, although not as screamingly low because it was simply final week.

We’d think about including to higher-yielding belongings as soon as spreads transfer wider of 4-4.5% or so, including threat in common increments as spreads widen out to keep away from blowing the whole dry-powder allocation firstly of what may very well be a protracted drawdown.

Curiously, the fairness market, as gauged by the VIX is extra panicked than the credit score market. The VIX is on the highest stage since COVID, whereas credit score spreads are nonetheless nicely under their 2022 ranges.

Google

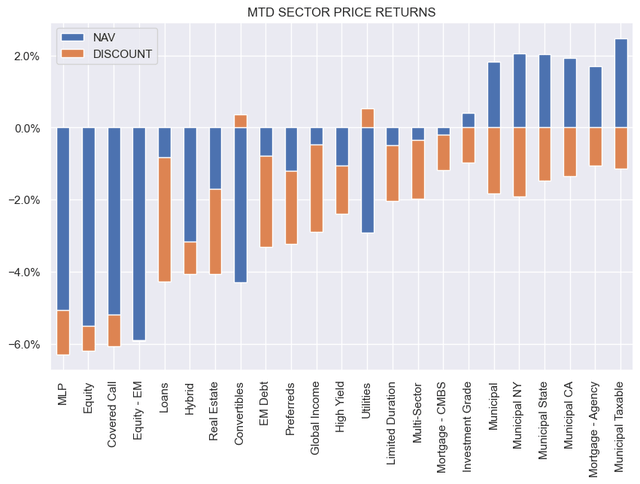

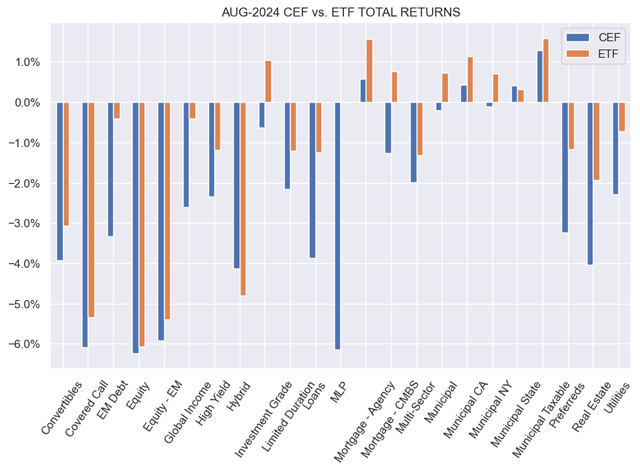

Let’s check out what CEFs have carried out. What we see is an identical sector response mentioned above with fairness and credit-linked sectors underperforming with higher-quality / longer-duration sectors like Munis, Companies and Funding Grade company bonds outperforming.

Systematic Revenue

The second theme that has additionally delivered as anticipated is that CEFs underperformed ETFs. Some subscribers expressed confusion about why Muni CEFs didn’t rally in step with the drop in longer-term charges and their leveraged publicity. The truth is that reductions typically matter extra for CEF value habits than NAVs. In reality, Muni reductions widened greater than Fairness, MLP and Lined Name sectors, all of which delivered large NAV drops vs. NAV rises for Muni CEFs.

Systematic Revenue

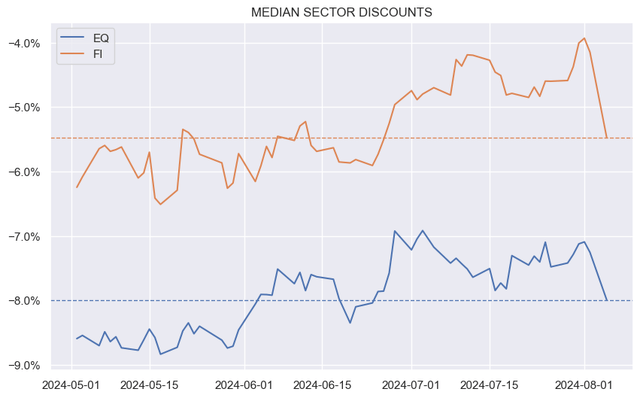

One other attention-grabbing theme that we have now mentioned a lot of occasions is that Fairness-linked CEF sector reductions typically widen greater than fixed-income reductions, regardless of their (Fairness-linked CEFs) worse NAV habits. This stays a puzzling however persistent theme within the CEF market. We noticed a lot the identical factor in 2020 as nicely.

Systematic Revenue

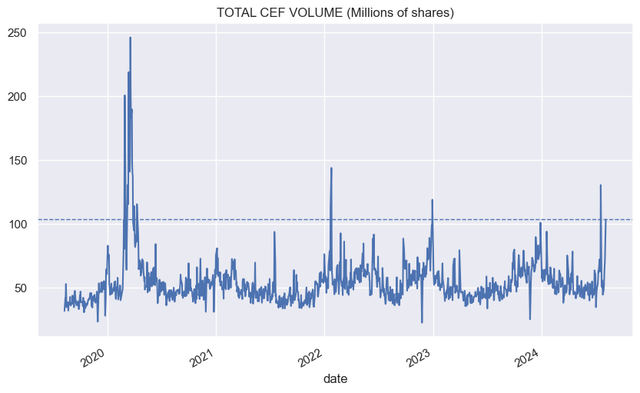

So far as CEF quantity, it was elevated however on par with what we see each 6-12 months.

Systematic Revenue

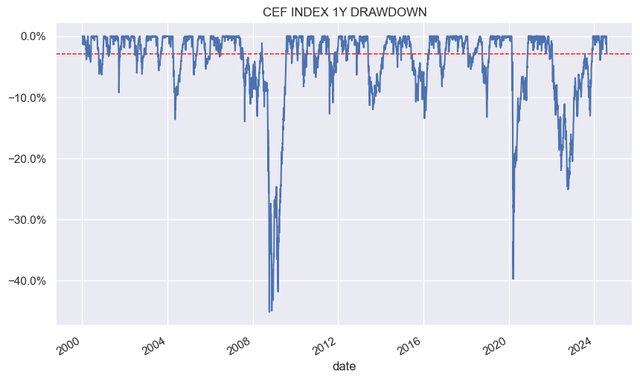

The extent of the drawdown thus far in August may be very delicate by historic requirements, as the next chart exhibits.

Systematic Revenue

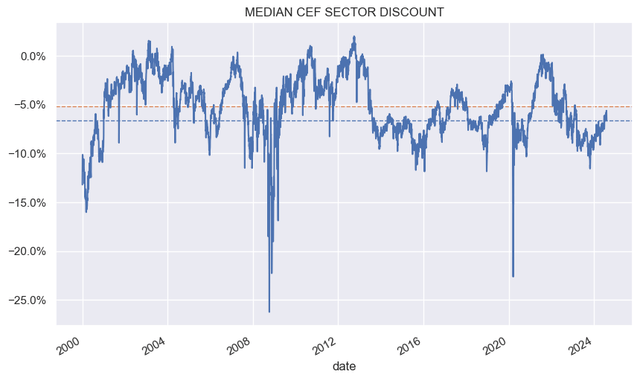

CEF reductions, in combination, are usually not notably broad – they have been considerably wider simply earlier within the 12 months.

Systematic Revenue

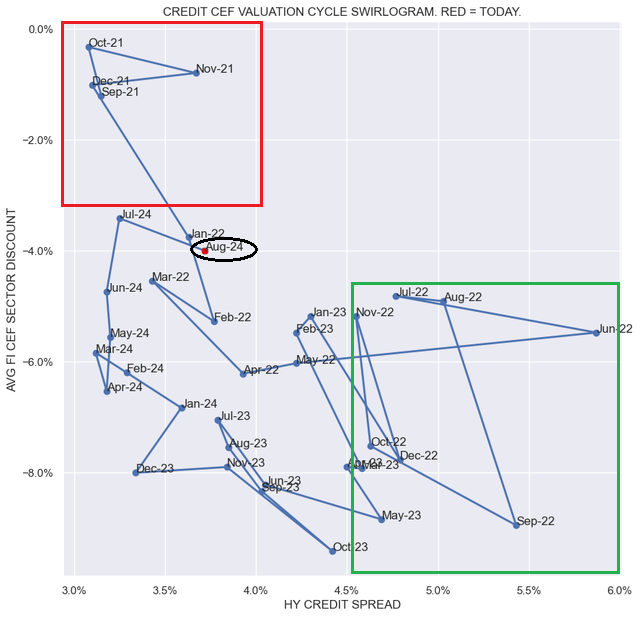

Now we have been making the purpose in our CEF Weeklies that the CEF market has been pretty costly, with regard to each reductions, in addition to, underlying asset valuations equivalent to credit score spreads. The transfer thus far in August has not made it low cost, nevertheless it moved it in the suitable route, as the next chart exhibits. The August mixture of spreads and reductions moved in the direction of the enticing inexperienced quadrant and away from the much less enticing pink quadrant.

Systematic Revenue

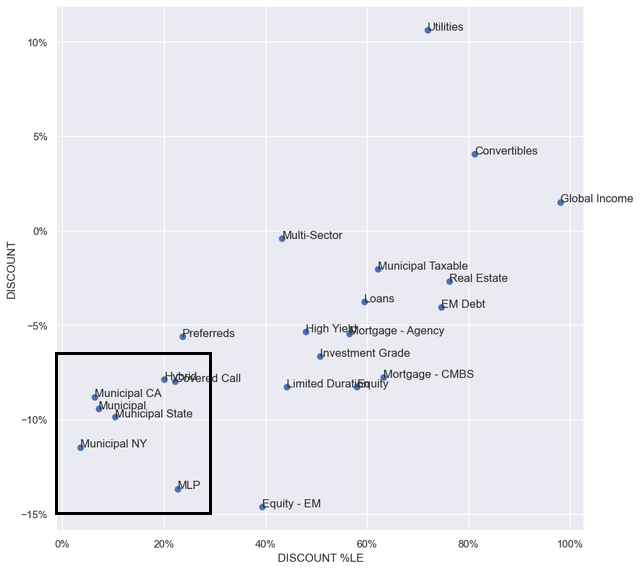

Throughout the CEF area, we proceed to favor Municipal CEFs as a result of mixture of their relative resilience throughout development drawdowns, nonetheless excessive actual charges and broad reductions.

Systematic Revenue

On this sector, we proceed to love the conditional tender supply funds like EIM and MVF (see our earlier commentary) that provide numerous further alpha above and past the sector publicity. They’ve reductions of round 10% and present yields of 5.8% and 4.9% respectively.

We additionally proceed to love child bonds, notably from the BDC sector. Over the previous week, they’ve been flat general. Right here, we like PFXNZ, CGBDL and TRINZ, buying and selling with yields of 8.7%, 8.4% and eight.2% respectively.

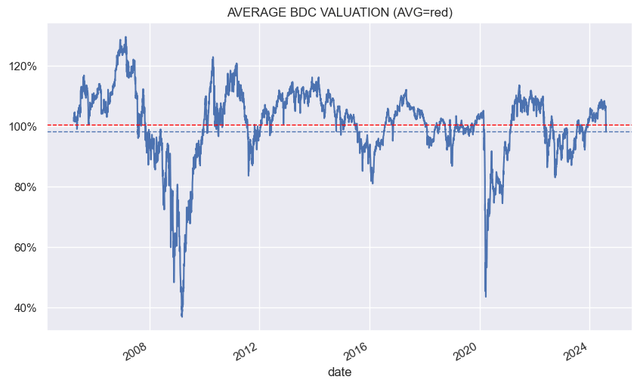

We’re additionally eyeing BDC widespread shares, the place the typical valuation has now fallen under the longer-term common. Right here, OBDE and BBDC shares look enticing, buying and selling at reductions of 12% and 19% and dividend yields of 11.2% and 11.9%.

Systematic Revenue