Word: Do to a modified CUSIP quantity, Baker Brothers holding Evofem Biosiences (EVFM) isn’t within the spreadsheet.

Preserve studying this text to be taught extra about Baker Brothers Advisors.

Desk Of Contents

Baker Brothers’ Philosophy and Technique

Brothers Julian and Felix Baker have earned their guru standing on Wall Avenue, having delivered an distinctive observe document of annualized returns through the years. Julian has a enterprise background from Harvard, whereas Felix has a Ph.D. in Immunology from Stanford.

Collectively, they’ve mixed their particular person experience to generate superior returns by focusing solely on the biotech trade. Property underneath administration grew from $250 million in 2003, to $15.2 billion as of November fifteenth, 2022.

The fund’s technique contains using a fundamentally-driven means of investing to provide you with its funding selections, also referred to as “bottom-up investing”. In contrast to top-down investing, which suggests learning the larger image of financial elements to make funding selections, bottom-up investing entails wanting on the company-specific fundamentals.

These elementary metrics embrace enterprise financials, money flows, and the benefit of its items and companies. That is essential when investing within the biotech trade, as every firm may be very distinctive, requiring area of interest information to know its enterprise mannequin.

The fund’s philosophy stands in holding its investments ordinarily for 3 years, although its higher-conviction investments may be seen held for longer. Moreover, Baker Bros. don’t intend to dilute their standing as extremely profitable biotech traders, as they don’t intend to ever allocate belongings in different industries. Nonetheless, some minor stakes within the industrial sector had been reported up to now.

Lastly, the 2 brothers don’t imagine in diversifying the fund’s portfolio. As a substitute, they emphasize that specializing in particular firms, which they will analyze and perceive deeply and place concentrated positions of their securities, can generate superior returns over the long run.

Baker Brothers Investments’ Portfolio & 5 Largest Public-Fairness Investments

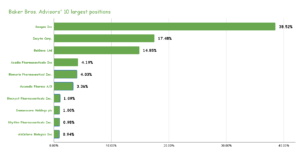

Upon Baker Bros’ portfolio, one can see that it holds 109 particular person shares, questioning the fund’s disbelief in diversification. Nevertheless, the fund’s investing philosophy does maintain up, as the highest 10 holdings account for 86.4% of the full capital invested, confirming their inclination in direction of high-conviction investments. Moreover, 100% of the fund’s holdings comprise firms working within the healthcare sector.

Supply: 13F submitting, Creator

Seagen Inc. (SGEN)

Seagen is a biotechnology firm that focuses on the event and commercialization of therapies for the remedy of most cancers. The corporate provides medication for the remedy of sufferers with Hodgkin lymphoma, superior or metastatic urothelial most cancers, and unresectable or metastatic HER2-positive breast most cancers, amongst others.

Seagen’s revenues have been experiencing an uptrend, however the firm’s losses have additionally been widening.

Baker Bros owns round 25.5% of the corporate, the inventory occupies round 38.5% of its complete public fairness holdings, and it’s the fund’s largest holding by far. The place was held secure through the quarter.

Incyte Company (INCY):

Incyte Company focuses on the invention, growth, and commercialization of assorted therapeutics. Its flagship merchandise embrace JAKAFI, which is a drug for the remedy of myelofibrosis and polycythemia, and Iclusig, a kinase inhibitor to deal with continual myeloid leukemia.

In contrast to many biotech firms, that are pre-revenue, Incyte has been rising its prime and backside line for years. Revenues have expanded from round $169 million in 2010 to $3.33 billion over the previous 4 quarters. The inventory is buying and selling at a ahead P/E ratio of ~28, which is a near-record low valuation a number of for the corporate.

EPS over the medium-term is anticipated to develop by round 30% since Incyte is an trade chief, having primarily monopolized its areas of remedy. In that regard, the valuation appears compressed. Nevertheless, the trade is filled with dangers, and when the corporate’s patents expire, competitors is prone to rise.

The fund owns round 16.3% of the corporate, with a market cap of $23 billion. The place was boosted by lower than 1% within the earlier quarter.

BeiGene, Ltd. (BGNE):

BeiGene is an early commercial-stage biopharmaceutical agency engaged on creating and commercializing modern molecularly-targeted and immune-oncology medication for the remedy of most cancers. It’s the fund’s second-largest holding, occupying 14.9% of its complete portfolio.

That is fairly odd because the firm relies in Beijing, China, which signifies that the fund’s due diligence course of has to go to the following stage as a result of weaker Chinese language reporting requirements.

Regardless of the uncertainty surrounding BeiGene, the corporate has developed into a completely built-in international biotechnology firm with operations in China, the USA, Europe, and Australia. The corporate has a strong pipeline of prescribed drugs, strengthening its repute.

Nonetheless, BeiGene produces miniature revenues in opposition to its $18.7 billion market cap, indicating that traders are betting closely on the corporate’s long-term prospects. The corporate holds important money, which ought to hopefully be sufficient till the following drug commercialization earlier than additional diluting shareholders.

Baker Bros held its place regular final quarter, although the fund nonetheless owns almost 11.4% of the corporate.

ACADIA Prescribed drugs Inc. (ACAD):

ACADIA Prescribed drugs focuses on the event and commercialization of small molecule medication geared toward unmet medical wants in central nervous system issues. The corporate options extraordinary income progress, with its 5-year CAGR standing at 40.6%. The underside line has by no means been constructive, nevertheless, with losses persisting whilst gross sales are rising.

In March of 2021, Acadia had introduced deficiencies recognized by the FDA concerning its advertising and marketing software for Pimavanserin in hallucinations and delusions related to dementia-related psychosis. Shares plunged by an enormous 45%, they usually have but to get better since then. Whereas the corporate has continued to develop, the enterprise appears incapable of assembly traders’ previous expectations.

This is without doubt one of the fund’s highest conviction picks, as Baker Bros nonetheless owns almost 26% of the corporate’s shares, which have been held since 2010. Whereas the fund has made nice features since, the latest plunge has undoubtedly compressed its unrealized features, because the place was held secure as soon as once more.

BioMarin Pharmaceutical Inc. (BMRN):

BioMarin Pharmaceutical formulates and markets therapies for individuals with extreme and life-threatening uncommon ailments and medical illnesses. Whereas the corporate’s income progress has seemingly stagnated over the previous couple of years, it seems that the corporate’s growth pipeline stays fairly robust. Most lately, BioMarine obtained a constructive CHMP opinion in Europe for ValRox for the remedy of Hemophilia sort A.

BioMarine has had a spot in Baker Bros’ portfolio since Q2 2012. The place was left unchanged through the earlier quarter. BioMarine is now Baker Bros’ fifth largest holding, with the fund proudly owning 4.14% of the corporate’s excellent shares.

Remaining Ideas

The Baker brothers have constructed a very particular hedge fund. Specializing in a sector that’s difficult to know by most traders, the agency has traditionally outperformed the general market over a number of years, with its concentrated biotech portfolio.

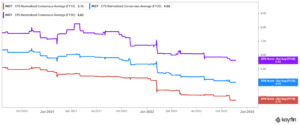

Efficiency over the previous three years has lagged, but it surely could possibly be a brief part for the fund, which, in spite of everything, focuses on long-term returns. Traders which are acquainted with biotech firms are prone to discover some hidden gems amongst their holdings.

Nevertheless, most of them comprise dangerous pre-revenue corporations that ought to solely be thought of upon having an awesome understanding of their enterprise mannequin. Retail traders needs to be cautious of simply “copying” the fund’s portfolio.

Extra Assets

See the articles beneath for evaluation on different main funding corporations/asset managers:

In case you are interested by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month: