[ad_1]

AUD/USD, Australian greenback – Value Motion:

- Australia inflation eased from the earlier quarter however slowed lower than anticipated.

- Persistent worth pressures depart the door open for additional RBA tightening.

- What’s subsequent for AUD/USD?

Beneficial by Manish Jaradi

The best way to Commerce AUD/USD

The Australian greenback recouped preliminary losses in opposition to the US greenback after information launched confirmed Australian worth pressures stay stubbornly excessive, maintaining alive the potential for additional tightening by the Reserve Financial institution of Australia.

Australia’s CPI rose to 7% on-year within the January-March quarter, Vs 6.9% anticipated from 7.8% within the earlier quarter, and nicely above the central financial institution’s goal band of two%-3%. CPI rose 1.4% on-quarter Vs 1.3% anticipated, down from 1.9% within the earlier quarter. Trimmed imply slowed to 1.2% on-quarter from 1.4% anticipated Vs 1.7% beforehand. The sluggish cooldown in inflation towards RBA’s goal implies it might be too early to name an finish to the tightening cycle. The market is now pricing within the RBA Money Price at 3.81% by August (Vs 3.6% now), up from 3.72% simply earlier than the CPI information.

Australia inflation and the Financial Shock Index

Supply information: Bloomberg; Chart ready in Excel

RBA left rates of interest unchanged at its assembly earlier this month saying it needed extra time to evaluate the spillover of earlier price hikes on the broader financial system however left the door open for added tightening. “It was necessary to be clear that financial coverage could must be tightened at subsequent conferences”, stated the minutes of the RBA April 4 assembly.

The minutes confirmed board members thought-about the case for an additional 25-basis level enhance as inflation “remained too excessive and the labour market was very tight”. The board additionally thought-about the faster-than-expected pickup in inhabitants progress and wage progress earlier than opting to pause the speed hikes.

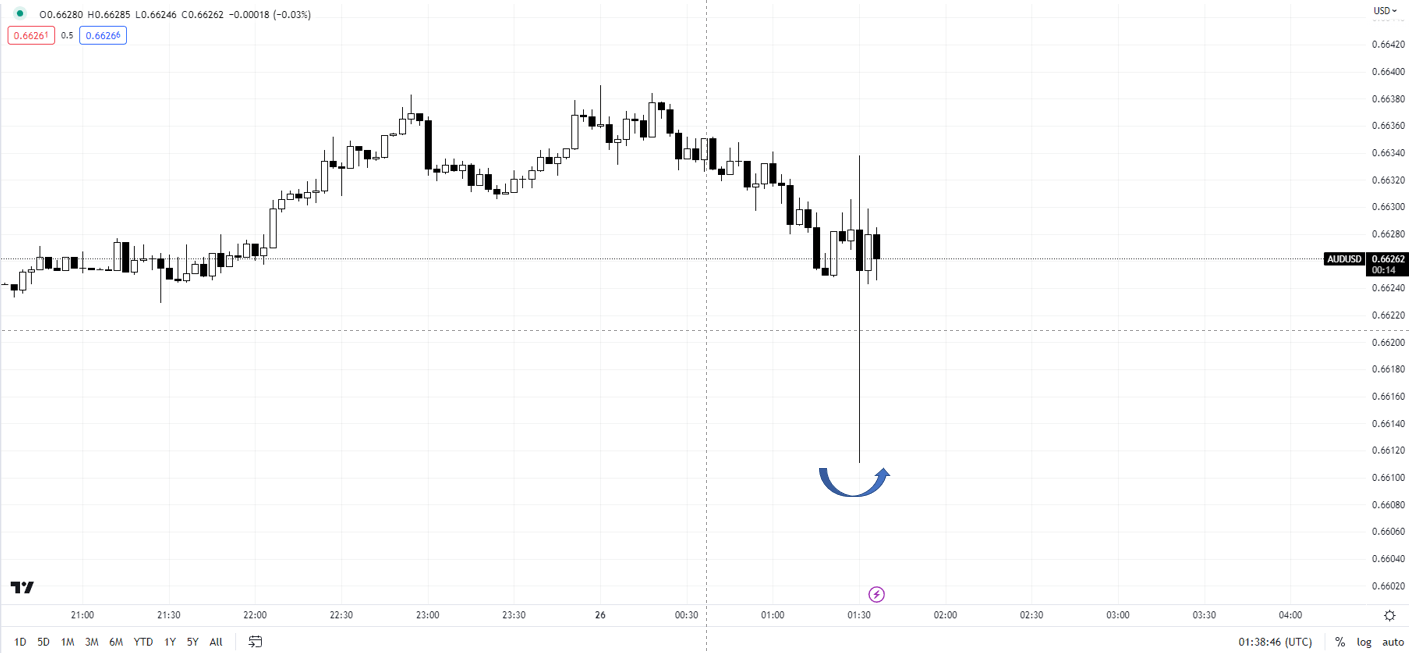

AUD/USD 5-minute Chart

Chart Created Utilizing TradingView

Australian macro information has underwhelmed in current weeks, because the Financial Shock Index exhibits. The job market has been tight with the unemployment price hovering round five-decade lows, however indicators of moderation within the labour market are rising. Developments overseas (together with recession dangers within the US and credit score market tightening on account of the stress within the banking sector) increase the draw back threat to the outlook.

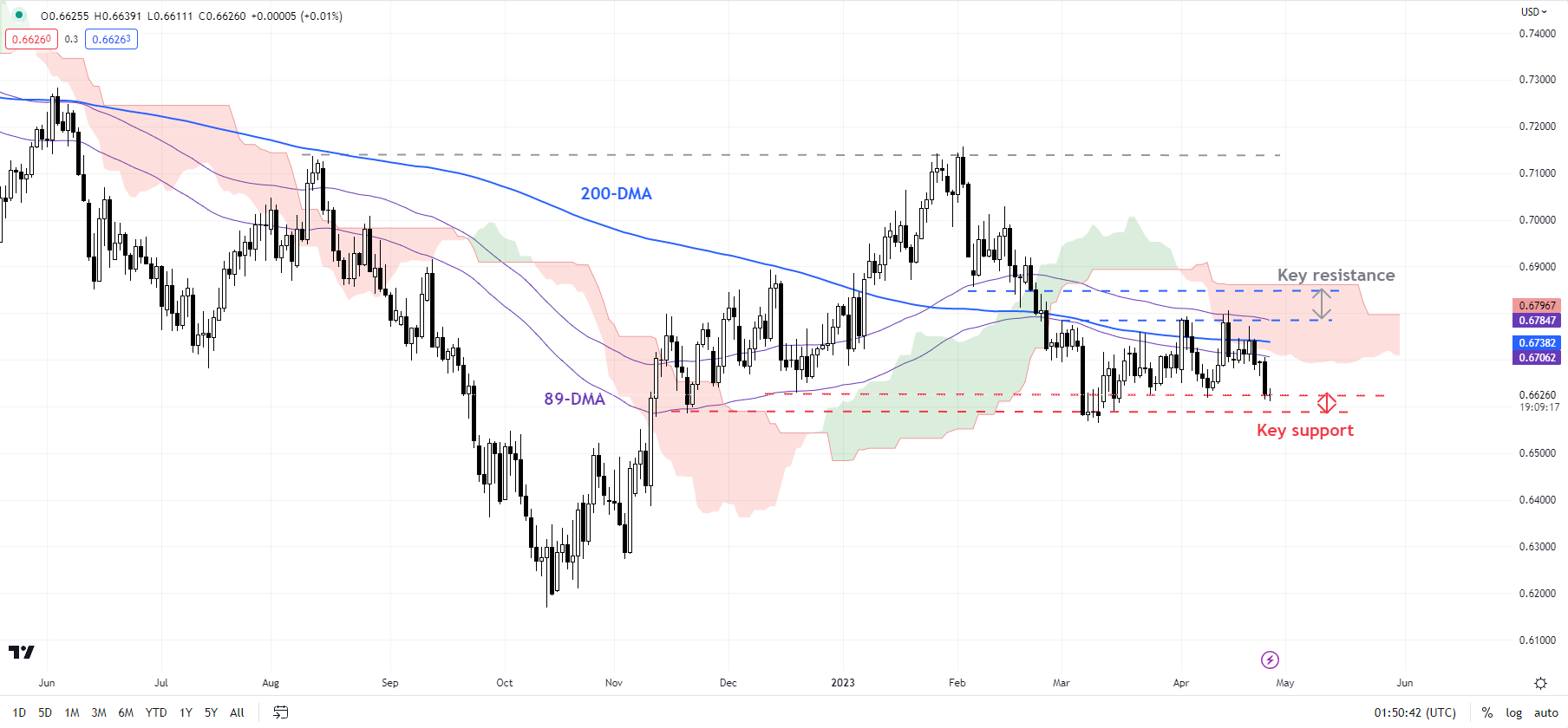

AUD/USD Every day Chart

Chart Created Utilizing TradingView

On the constructive aspect, China’s macro information have crushed expectations in current weeks, prompting analysts to improve the outlook on the world’s second-largest financial system for 2023. Provided that China is Australia’s greatest export market, any enchancment in China’s progress outlook may increase Australia’s progress prospects. In sum, except threat urge for food shrinks, from a macro perspective, issues look like evenly balanced for AUD/USD for now.

On technical charts, AUD/USD has settled in a slim vary not too long ago, with the draw back marked on the March low of 0.6550, whereas the topside is capped beneath a troublesome ceiling across the 89-day transferring common, roughly coinciding with the early-April excessive of 0.6795. On the draw back, instant assist is at 0.6625. AUD/USD must cross the higher fringe of the vary for the outlook to show constructive.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish

[ad_2]

Source link