On Tuesday [05/09], the Reserve Financial institution of Australia will decide on rates of interest, that are anticipated to stay unchanged for the third consecutive month. Weaker financial development makes the RBA more likely to be extra cautious this time round. GDP figures as a result of be launched on Wednesday [06/09] will present whether or not development slowed or accelerated in Q2. A much less hawkish RBA and rising issues over a slowdown in China may go away the Australian foreign money susceptible to additional declines.

Chinese language information has been intently watched currently; total each non-public and nationwide PMIs had been higher than anticipated, suggesting that the economic system has not totally recovered. The authorities got here up with a collection of insurance policies to stimulate the economic system this week with a discount within the down cost required for house consumers being significantly essential, given the elevated dangers emanating from the actual property market. Within the occasion that developer Nation Backyard fails to repay its money owed, it may trigger renewed stress on the Chinese language market. Commerce steadiness figures as a result of weak exports have additionally been a priority currently. Any downturn in China, as Australia’s buying and selling accomplice, could have a big impression on regional exporters.

In the meantime, Australia’s inflation charge is declining quickly. Since February 2022, the patron worth index has been falling. In July, it fell to 4.9% y/y. The weighted CPI, one of many underlying indices of inflation, can be declining, from 5.4% to 4.9% y/y, . One other good improvement is that wage development appears to have peaked.

The central financial institution is more likely to maintain charges regular in September, because the cumulative impression of 400 bps of tightening has but to be felt. Australia’s financial development slowed considerably this yr as a result of many challenges. Since final yr, the largest drag on development has been the housing market, which was the primary market to really feel the impression of rising borrowing prices. This yr, rising rates of interest have had a damaging impression on consumption, as customers are pressured to chop again on spending.

The central financial institution is more likely to maintain charges regular in September, because the cumulative impression of 400 bps of tightening has but to be felt. Australia’s financial development slowed considerably this yr as a result of many challenges. Since final yr, the largest drag on development has been the housing market, which was the primary market to really feel the impression of rising borrowing prices. This yr, rising rates of interest have had a damaging impression on consumption, as customers are pressured to chop again on spending.

GDP development slowed to only 0.2% q/q within the first three months of the yr and is more likely to speed up barely to 0.3% in Q2. Nonetheless if the S&P International PMI survey is any indication, worse figures are probably and the economic system might even see a small contraction in Q3.

AUDUSD’s underperformance this yr has been influenced by extra aggressive Fed coverage and a stronger American economic system, however the underlying reason for this underperformance has been the thorny points surrounding China in latest months.

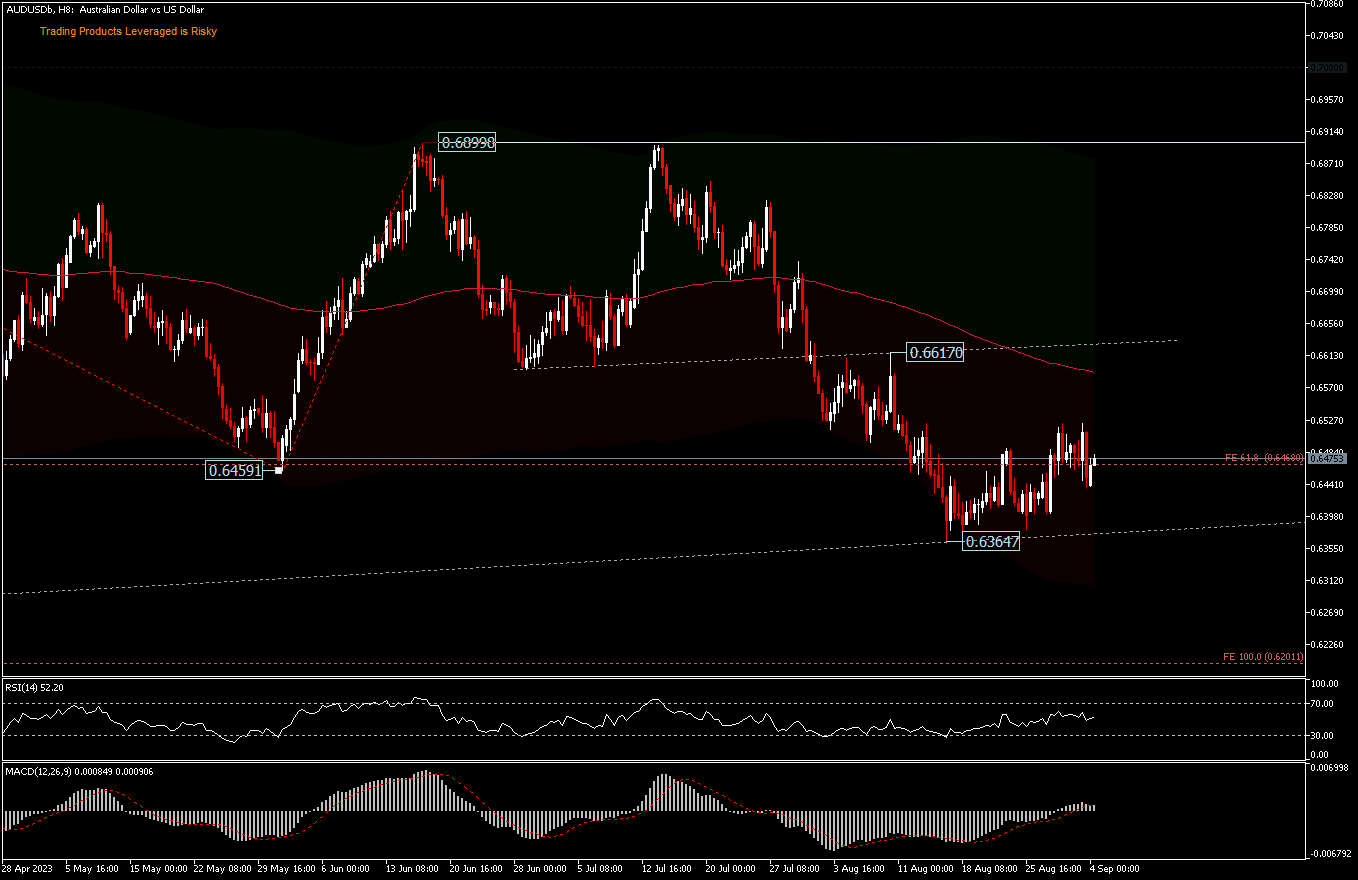

Technical Evaluation

AUDUSD, W1 – The pair’s downtrend from the 2021 peak [0.8007] continues to be ongoing. A decisive break of 0.6170 will goal the FE61.8% projection of 0.6021 [from 0.8007-0.6170 and 0.7157 pullback]. The extent will now stay a priority, so long as 0.6899 holds.

On the H8 interval, consolidation from 0.6364 continued final week and the outlook has not modified. The preliminary bias nonetheless appears to be like impartial at the start of this week. In case of one other restoration, the upside will likely be restricted by the 0.6617 resistance. A break of 0.6364 will resume a bigger decline from the FE100% projection at 6.2059 [from 0.7157-0.6458 and 0.6899 pullback]. Worth is presently nonetheless shifting under the 200 EMA, RSI is floating above the 50 stage and MACD is depicting an ongoing consolidation in the intervening time. Nonetheless, if the RBA offers a hawkish shock on Tuesday, then a break above the 0.6617 resistance may convey a short-term change in course, to check 0.6899.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.