Australian Greenback Elementary Forecast: Bullish

- Aussie Greenback underpinned by commodity costs and rebounding sentiment

- March PMI knowledge exhibits Australia’s financial restoration is strengthening

- RBA fee hike bets key to AUD/USD’s course as potential dangers linger

The Australian Greenback has been on a tear versus most of its main friends in current weeks, boosted by rising commodity costs and a rebound in market sentiment. Upbeat home financial knowledge has additionally helped to carry the Aussie Greenback. Final week, Australia’s March buying managers’ index (PMI) for the manufacturing and providers sectors confirmed that the post-lockdown economic system continues to enhance.

That momentum will seemingly keep it up because the economic system continues to advance after Australia eliminated the brunt of Covid restrictions over the previous couple of months, leading to acute labor market progress. The upcoming week will see February’s preliminary retail gross sales figures cross the wires. Constructing permits for February and a Markit manufacturing PMI print for March will comply with later within the week. Analysts count on to see that PMI determine rise to 57.3 from 57.0, in keeping with a Bloomberg survey.

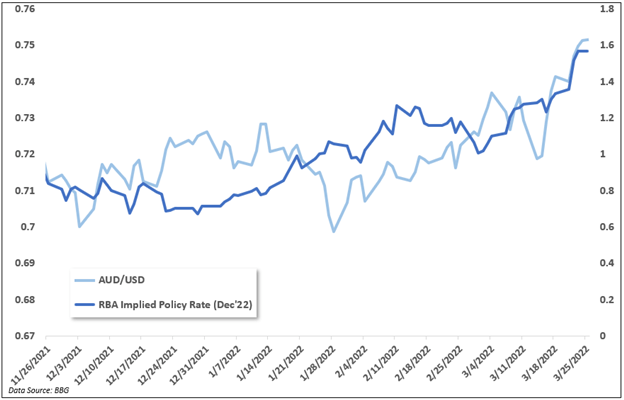

A greater-than-expected set of information would seemingly gasoline already rising fee hike bets for the Reserve Financial institution of Australia (RBA), benefiting AUD additional. Alternatively, disappointing knowledge may halt AUD’s current rally. A reversal in market sentiment would additionally weigh on the risk-sensitive foreign money, which may very well be induced by an escalation in Ukraine or an uptick in Covid instances in China. The 2022-2023 funds can also be set to be introduced on March 29 and will have an effect on the RBA’s outlook. The chart beneath shows the RBA’s implied coverage fee for the December 2022 assembly measured by money fee futures, at present pricing in round 150 foundation factors of tightening.

{{Publication}}

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwater on Twitter