AUD/USD ANALYSIS & TALKING POINTS

- Tender Chinese language CPI and protected haven demand for USD weighs on AUD.

- US information below the highlight later at this time.

- New yearly lows looming for AUD/USD?

Elevate your buying and selling abilities and achieve a aggressive edge. Get your arms on the Australian greenback This autumn outlook at this time for unique insights into key market catalysts that must be on each dealer’s radar.

Beneficial by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian greenback stays subdued near yearly lows after the Fed’s larger for longer narrative features traction. US CPI confirmed some stickiness in core metrics though price hike expectations didn’t change a lot from a Federal Reserve standpoint. Ongoing geopolitical tensions between Israel-Palestine within the Center East may see riskier currencies just like the AUD come below stress in favor of protected haven currencies just like the US greenback.

Weak Chinese language information this morning (see financial calendar beneath) has restricted Aussie upside through the CPI report highlighting the nation’s financial system I nonetheless struggling regardless of stimulus measures by the Chinese language authorities.

Later at this time, US particular elements might be in focus as soon as once more from Fed communicate and the Michigan client sentiment launch.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

Wish to keep up to date with essentially the most related buying and selling info? Join our bi-weekly e-newsletter and maintain abreast of the most recent market shifting occasions!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

TECHNICAL ANALYSIS

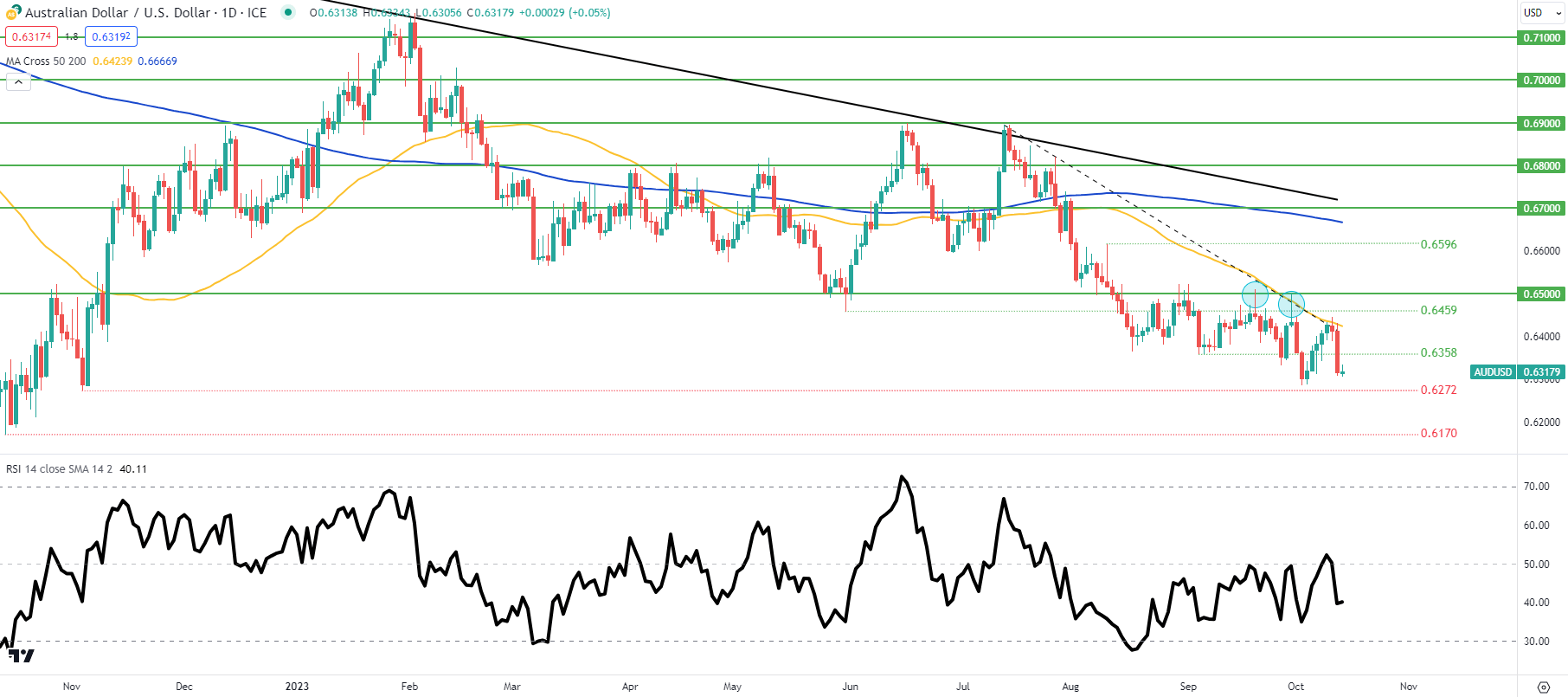

AUD/USD DAILY CHART

Chart ready by Warren Venketas, TradingView

Day by day AUD/USD value motion above reveals the pair unable to maneuver out of the present downtrend and will expose the November 2022 swing low at 0.6272 and past. I don’t’ count on too many adjustments this week as markets put together for subsequent week’s key information together with the Australian job report and China GDP.

Key resistance ranges:

- 0.6500

- 0.6459

- 50-day shifting common (yellow)/Trendline resistance

- 0.6358

Key help ranges:

IG CLIENT SENTIMENT DATA: BEARISH (AUD/USD)

IGCS reveals retail merchants are presently web LONG on AUD/USD, with 83% of merchants presently holding lengthy positions.

Obtain the most recent sentiment information (beneath) to see how every day and weekly positional adjustments have an effect on AUD/USD sentiment and outlook.

Introduction to Technical Evaluation

Market Sentiment

Beneficial by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas