[ad_1]

Gold Worth (XAU/USD), Silver Worth (XAG/USD): Charts, Worth, and Evaluation

- A slight hawkish re-pricing of the Fed’s intentions is weighing on gold and silver.

- US debt ceiling fears develop.

Really helpful by Nick Cawley

Get Your Free Gold Forecast

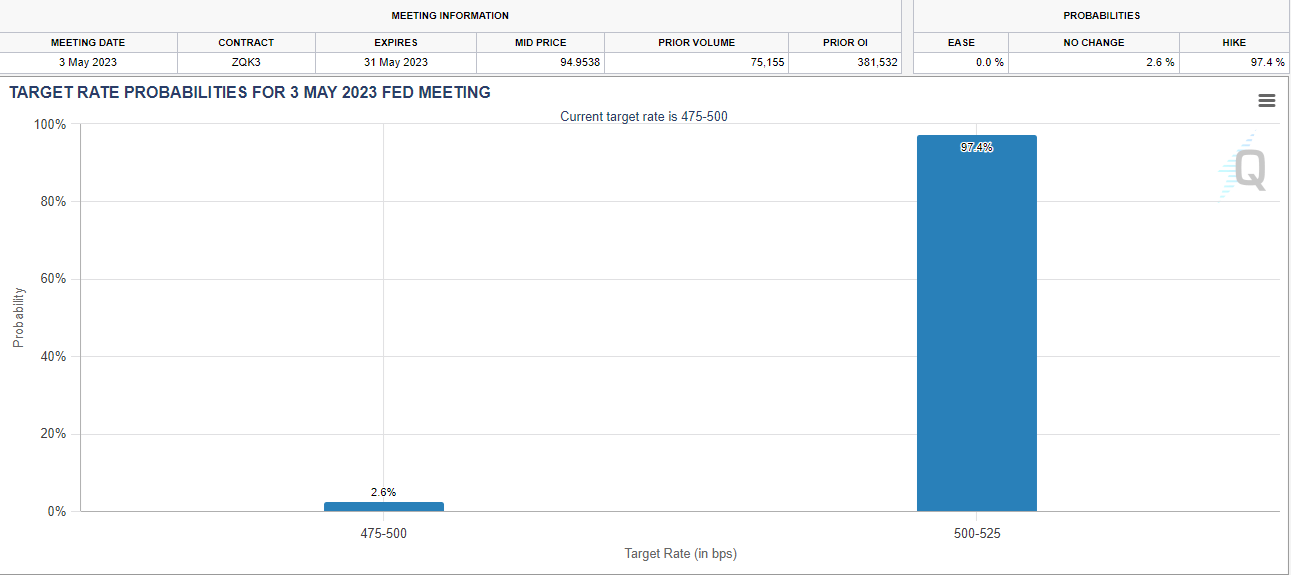

A spread of asset lessons are on maintain right now because the market waits for the newest Federal Reserve financial coverage determination, anticipated at 19:00 UK on Wednesday. The market absolutely expects and has priced in, a 25 foundation level price hike to 500-525. The press convention, half-hour after the choice, will likely be carefully watched by the marketplace for any signal that the US central financial institution is considering the pausing the rate-hiking cycle. The market has just lately priced in a barely hawkish end result at tomorrow’s FOMC assembly and that has weighed on the short-term outlook of gold and silver. Quick-term US bond yields moved increased final week, lending assist to the US greenback. The dollar has been underneath promoting stress for months nevertheless it seems to be to have discovered assist across the 100.50-101.00 space forward of tomorrow’s assembly. The dollar is pushing additional increased right now and sits at ranges final seen two weeks in the past.

US Greenback Index – Day by day Chart

For all market-moving knowledge releases and occasions, see the DailyFX Financial Calendar

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to E-newsletter

The CME Fed Funds possibilities now present a 97.4% probability of a 25bp price hike on Wednesday night.

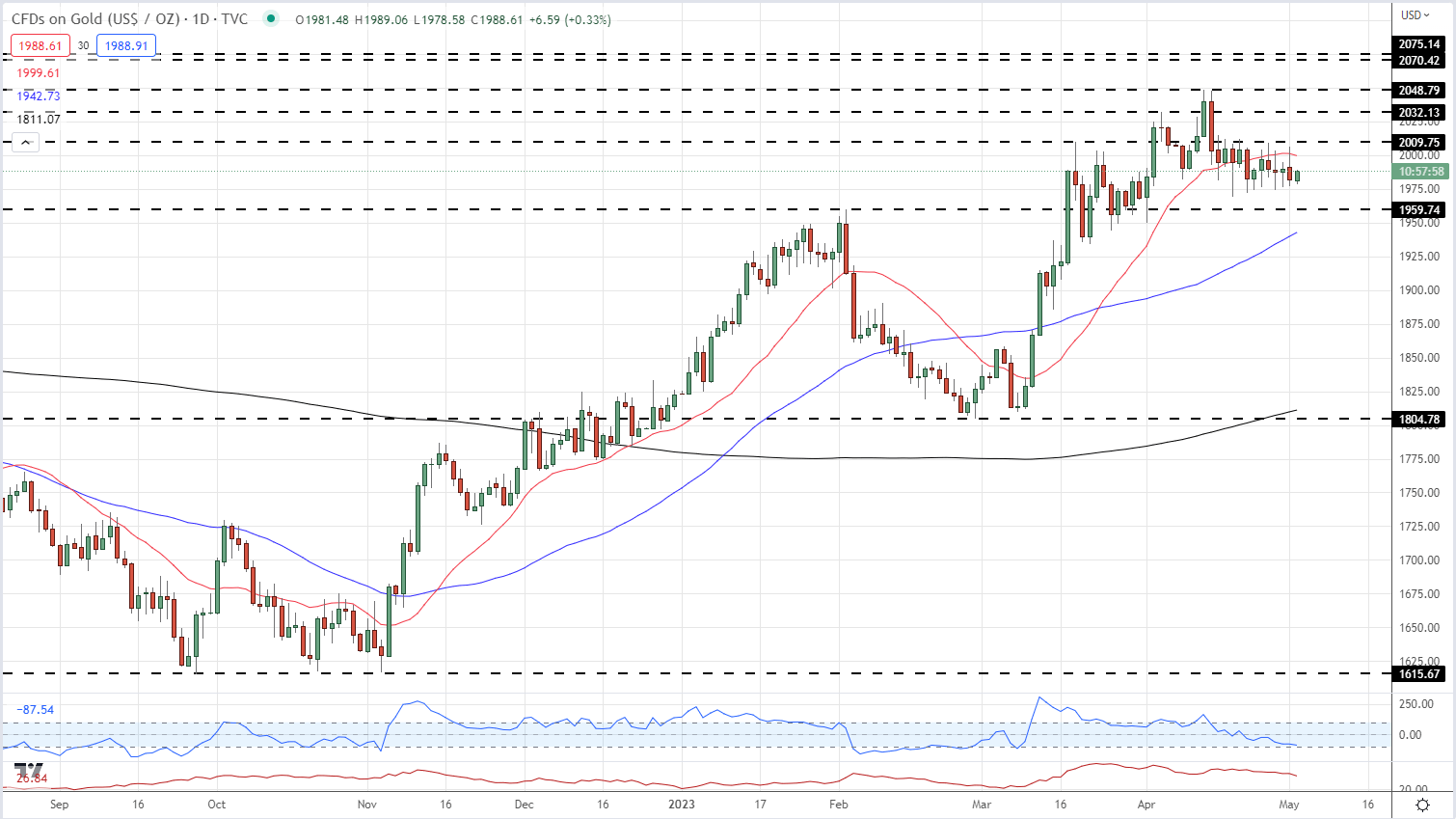

In opposition to this backdrop of a barely firmer US greenback and ideas that the Federal Reserve could not roll again on rates of interest as quickly as beforehand thought, gold has come underneath stress and is struggling to regain the $2,000/oz. marker. Quick-term assist begins round $1,970/oz. with $2,009/oz. the primary line of resistance. Gold’s short-term future will likely be set out by Fed chair Powell tomorrow.

Gold Worth Day by day Chart – Might 2, 2023

Chart through TradingView

Really helpful by Nick Cawley

The way to Commerce Gold

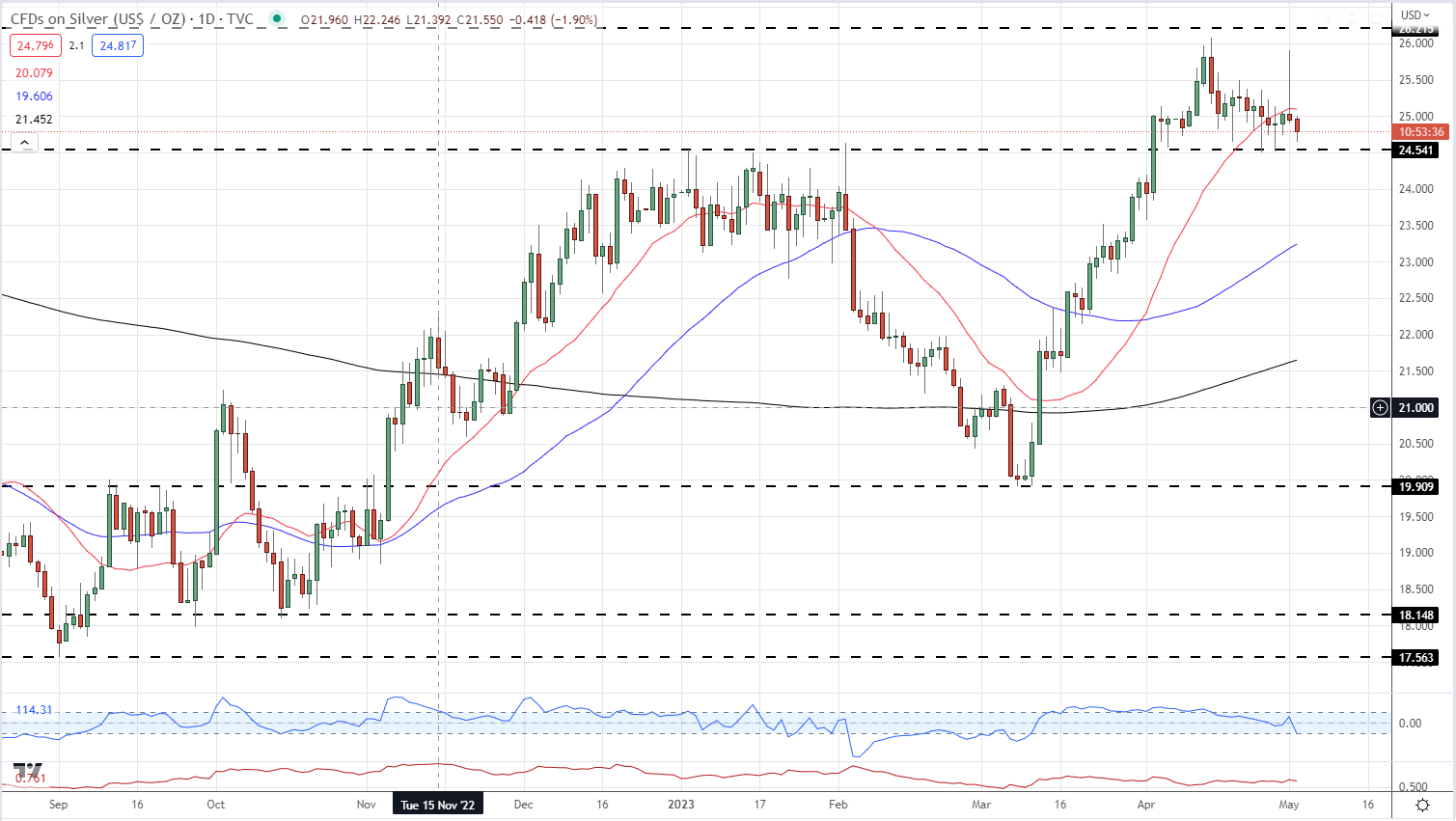

The every day silver chart seems to be similar to gold’s with the valuable metallic now caught between $24.50 and $26.25. Monday’s ‘spike’ was retraced rapidly, with skinny market circumstances doubtless behind the transfer. Help round $25.50 could come underneath stress quickly with silver posting a collection of decrease highs and decrease lows recently. As with gold, chair Powell will management silver’s subsequent transfer.

Silver Day by day Worth Chart – Might 2, 2023

What’s your view on Gold and Silver – bullish or bearish?? You’ll be able to tell us through the shape on the finish of this piece or you possibly can contact the creator through Twitter @nickcawley1.

[ad_2]

Source link