lorozco3D/iStock via Getty Images

Ascend Wellness Holdings (Ascend) (OTCQX:AAWH) is a diversified multi-state operator in the US cannabis markets. The firm employs approximately 1,500 people and was founded by Abner Kurtin, a lifelong investor and former Managing Director of Baupost Group, a legendary hedge fund. In this article, I’ll explain why their expanding footprint, compelling valuation, and bearish sentiment make Ascend a top pick for cannabis investors.

1. Expanding Footprint

Ascend’s current footprint consists of 20 dispensaries in five states. Illinois is their core market, with eight retail stores and one cultivation/processing facility. Michigan is another strong state, with 6 current retail, 2 more planned, and one cultivation/processing facility. Massachusetts and Ohio are their other two current markets. These core states give Ascend exposure to 4 of the top 9 recreational markets and a top-three medical market with Ohio.

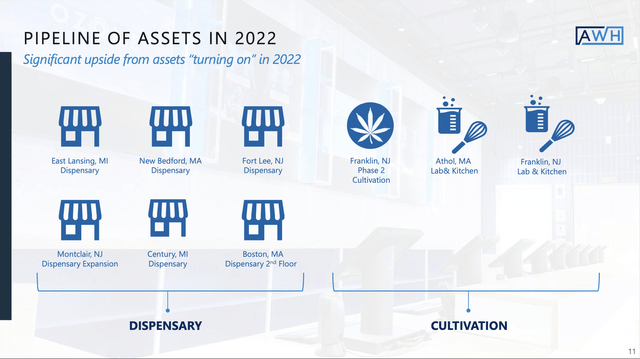

Even more exciting are the assets coming online in 2022. New Jersey is transitioning from medical only to adult use and Ascend is well positioned to capitalize. It is the seventh-most populated state and most of the state’s estimated $2.2 billion in legal and illicit sales comes from the traditional market.

New Jersey approved adult-use sales in February 2021, but has been slow in rolling out the program. Many expected multiple MSOs to get approval at the New Jersey CRC meeting on March 24th, however the state was not ready. Shortly after that meeting, regulators announced an unscheduled meeting for April 11th. Current speculation is that a handful of operators may be authorized. Once approved, the soonest adult-use sales can start is 30 days later.

When New Jersey opens, Ascend is ready with prime locations in Fort Lee and Montclair, plus cultivation, labs and a kitchen in Franklin. Their prime dispensary locations will not only attract New Jersey residents, but also neighboring New Yorkers that do not yet have access to legal cannabis.

Ascend Investor Roadshow Presentation March 2022

2. Valuation

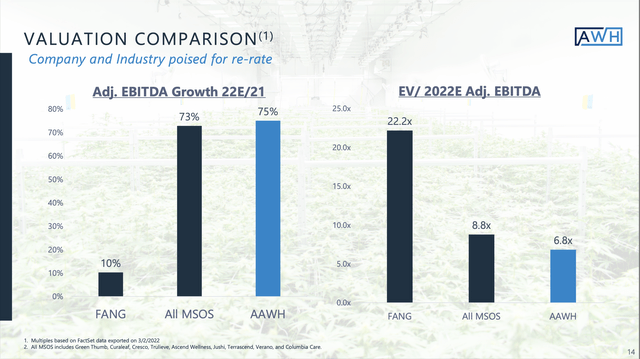

US cannabis multi-state operators are priced like value stocks, while having upside similar to many growth companies. The first comparison is to the famed “FANG” stocks: Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOG) (GOOGL). This basket is perceived as among the fastest growing and highest-quality companies in America.

However, when comparing adjusted EBITDA with a basket of eight MSOs, the cannabis stocks are growing 7.3x faster. From a valuation perspective, the MSO basket is 60% cheaper, and Ascend’s valuation is even more compelling.

Ascend Investor Roadshow Presentation March 2022

Ascend is also cheap when compared to peers. Below is a basket of tier 2 cannabis stocks with their respective enterprise values divided by adjusted EBITDA. On average, Ascend trades at a 45% discount to the basket.

Enterprise Value/Adj. EBITDA

|

MSO |

2021 |

2022 |

2023 |

|

TerrAscend |

37.0 |

21.2 |

12.1 |

|

Columbia Care |

25.1 |

9.8 |

6.4 |

|

Ayr Wellness |

13.4 |

6.9 |

4.0 |

|

Jushi |

45.6 |

12.7 |

5.9 |

|

Ascend |

10.0 |

7.4 |

4.1 |

|

Average |

26.2 |

11.6 |

6.5 |

|

Ascend Discount |

61.8% |

36.2% |

36.9% |

FactSet data as of 04/05/22

3. Sentiment

Sentiment is defined as an attitude, thought, or judgment prompted by feeling. As investors, we always need to weigh sentiment versus fundamentals to assess how much of our expectations are priced into current valuations. It’s an art, not a science.

I’m active on Twitter and r/weedstocks on Reddit. Both are excellent resources for learning and seeing how investors are feeling. Lately, sentiment is as bearish as I’ve seen it. While hard to quantify, I’ve witnessed a pickup in bearish views, anger over losses, and some respected voices finally tossing in the towel.

To quantify sentiment, I looked at two imperfect metrics for context. First is how widely stocks are followed on Seeking Alpha. The average for the tier-two basket is 3,782 followers, while Ascend has a paltry 458 followers, 88% less than the average. For perspective, Tilray (TLRY) has 137,000.

Seeking Alpha Followers

|

MSO |

SA Followers |

|

TerrAscend |

4,940 |

|

Columbia Care |

3,890 |

|

Ayr Wellness |

4,470 |

|

Jushi |

5,150 |

|

Ascend |

458 |

|

Average |

3,782 |

|

Ascend Followers vs Average |

12.1% |

Source: Seeking Alpha data as of 04/05/22

Next, I measured average-daily dollar-volume traded. Ascend trades 89% less dollar volume than the average of the tier-two basket. Volume does not directly measure sentiment, but when you put together the pieces it paints a picture that most cannabis investors are not following, much less trading Ascend.

Average Daily Dollar Volume Traded

|

MSO |

Avg $ Volume |

|

TerrAscend |

1,650,000 |

|

Columbia Care |

985,490 |

|

Ayr Wellness |

1,229,900 |

|

Jushi |

726,110 |

|

Ascend |

103,950 |

|

Average |

939,080 |

|

Ascend Volume vs Average |

11.1% |

Source: Yahoo Finance data as of 04/05/22

A piece of the dollar-volume puzzle is that Ascend is the only top 10 MSO not included in the industry’s largest ETF, AdvisorShares MSOS. This fund manages about $1 billion, making it the largest in the cannabis space. When the ETF receives inflows, we see a wave of buying across the underlying names. Jungle Java on Twitter tracks this daily. Not being in this stream of flows is a negative currently, but the potential for inclusion in the future may offer meaningful upside.

Potential Risk

One issue likely clouding sentiment—and maybe making MSOS reluctant – is Ascend’s pending lawsuit with MedMen. From Ascend’s perspective, MedMen has a case of seller’s remorse and backed out of a $73 million deal to buy their New York license. Ascend gave them $8.5 million up front, the transfer received regulatory approval, and MedMen refuses to relinquish the license. Given this is one of just 10 licenses in the state, it is a prized asset as New York transitions from medical-only to wider adult use.

I don’t have an edge in predicting legal outcomes, but after reading the available documents and talking with the Ascend team, it is difficult to understand MedMen’s case. Upon resolution, this could become a very valuable asset purchased at cheap price. Winning the lawsuit may also swing sentiment and bring in investors waiting for resolution.

Conclusion

Ascend is one of the premier US cannabis multi-state operators. They are well managed, have an expanding footprint, and compelling valuation. This backdrop when combined with few followers, low volume, and a fatigued investor base presents an opportunity. We should seek stocks where fundamentals are improving and no one cares.

I recommend Ascend for investors with a high-risk tolerance and long-time horizon. The top-down cannabis trade will play out in a series of stair-step events. Now is the time to be buying at attractive valuations and Ascend is an under-appreciated story.