[ad_1]

Are the FANG shares lifeless? Or, to be clear, are the MANNGMAT shares lifeless? In fact, we’re speaking in regards to the massive know-how heavyweights of Meta Platforms (NASDAQ:), Apple (NASDAQ:), Netflix (NASDAQ:), NVIDIA (NASDAQ:), Google (NASDAQ:), Microsoft (NASDAQ:), Amazon (NASDAQ:) and Tesla (NASDAQ:). Based on a latest article by way of the WSJ, such appears to be the case. To wit:

“Massive know-how shares are within the midst of their greatest rout in additional than a decade. Some traders, haunted by the 2000 dot-com bust, are bracing for greater losses forward.

Some traders say the decadelong period of tech dominance in markets is coming to an finish.”

Within the short-term, it definitely appears that worth traders, after greater than a decade of underperformance, are lastly taking a victory lap because the long-awaited resurgence happens. The worth commerce was one thing we wrote about extensively in 2020, as many believed “worth investing was lifeless.”

“Such definitely appears to be the mantra as traders proceed to pile into progress shares whereas rationalizing valuations utilizing methodologies that traditionally haven’t labored effectively.”

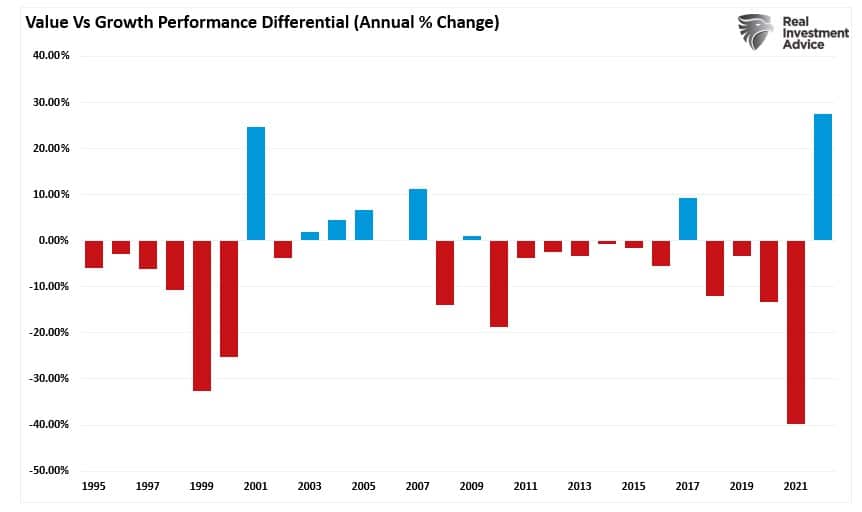

The chart under reveals the annual efficiency distinction between the Vanguard Worth and Development Index funds. The surge in worth in 2022 is unsurprising as traders search for a “protected place” to cover as markets stumbled.

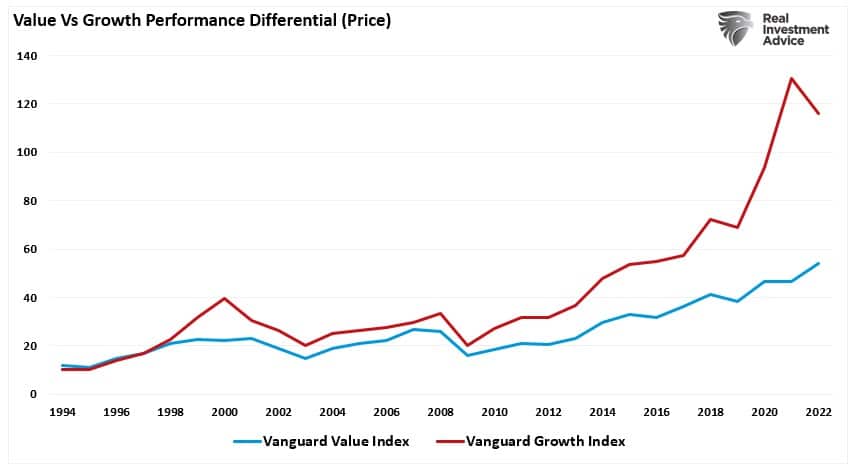

The temporary intervals of outperformance of worth versus progress occurred throughout tough patches within the monetary markets. Nevertheless, as the next chart reveals, there’s a large efficiency hole between worth and progress.

Since 2008, a lot of that “hole” stays attributable to a few major elements – FANG shares, buybacks, and passive investing.

Buybacks & Protected Havens

We have now beforehand mentioned the

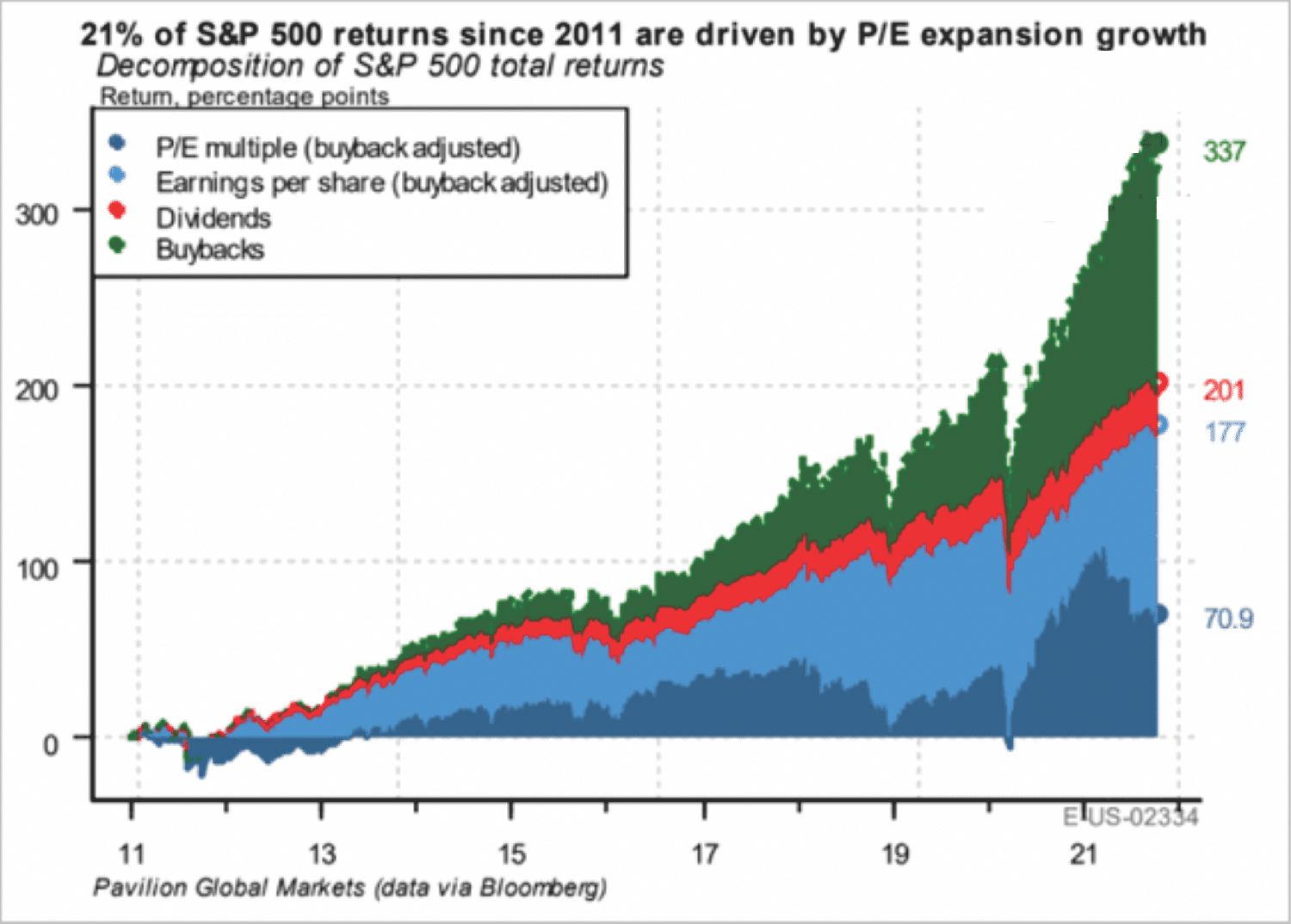

“The chart under by way of Pavilion World Markets reveals the affect inventory buybacks have had available on the market over the past decade. The decomposition of returns for the S&P 500 breaks down as follows:

- 21% from a number of expansions,

- 31.4% from earnings,

- 7.1% from dividends, and

- 40.5% from share buybacks.

In different phrases, within the absence of share repurchases, the inventory market wouldn’t be pushing document highs of 4600 however as a substitute ranges nearer to 2700.“

In fact, most of these “share buybacks” have been concentrated within the largest market-capitalization shares with the free money circulate, or borrowing capability, to have an effect on these transactions. For instance, Apple has repurchased greater than $500 billion of its shares. However these buybacks occurred throughout everything of the FANG advanced to assist increase share costs greater.

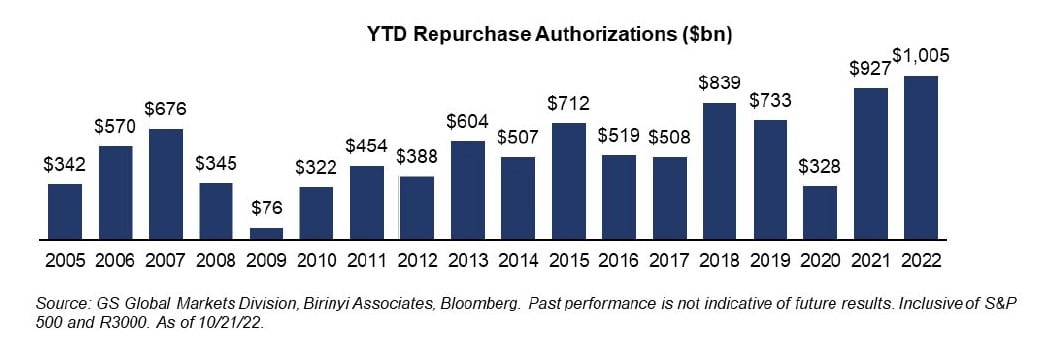

Not surprisingly, with earnings beneath strain attributable to greater rates of interest, firms have introduced a document of greater than $1 trillion in buybacks for this yr.

Importantly, what these “buybacks” present to FANG shares is an “synthetic purchaser.” Subsequently, when asset managers are searching for a “protected haven” to carry capital, the FANG shares have been the shares of alternative. Such was as a result of they maintained a excessive degree of liquidity, and the buybacks supplied a prepared purchaser when wanted. Such allowed asset managers to shortly transfer a whole lot of thousands and thousands of {dollars} out and in of positions with out considerably impacting the value.

Traders mustn’t readily dismiss the affect of share buybacks. As John Arthurs beforehand penned.

“For a lot of the final decade, firms shopping for their very own shares have accounted for all web purchases. The whole quantity of inventory purchased again by firms because the 2008 disaster even exceeds the Federal Reserve’s spending on shopping for bonds over the identical interval as a part of quantitative easing. Each pushed up asset costs.”

In different phrases, between the Federal Reserve injecting an enormous quantity of liquidity into the monetary markets, and firms shopping for again their shares, there have been successfully no different actual patrons available in the market.

Nevertheless, one other side of the FANG shares stays very important to their future efficiency.

It’s A Operate Of Passive

One of many issues with the monetary markets at present is the phantasm of efficiency. That phantasm will get created by the biggest market capitalization-weighted shares. (Market capitalization is calculated by taking the value of an organization multiplied by its variety of shares excellent.)

Notably, aside from the , the main market indexes are weighted by market capitalization. Subsequently, as an organization’s inventory value appreciates, it turns into a extra important index constituent. Such signifies that costs adjustments within the largest shares have an outsized affect on the index.

You’ll acknowledge the names of the top-10 shares within the index.”

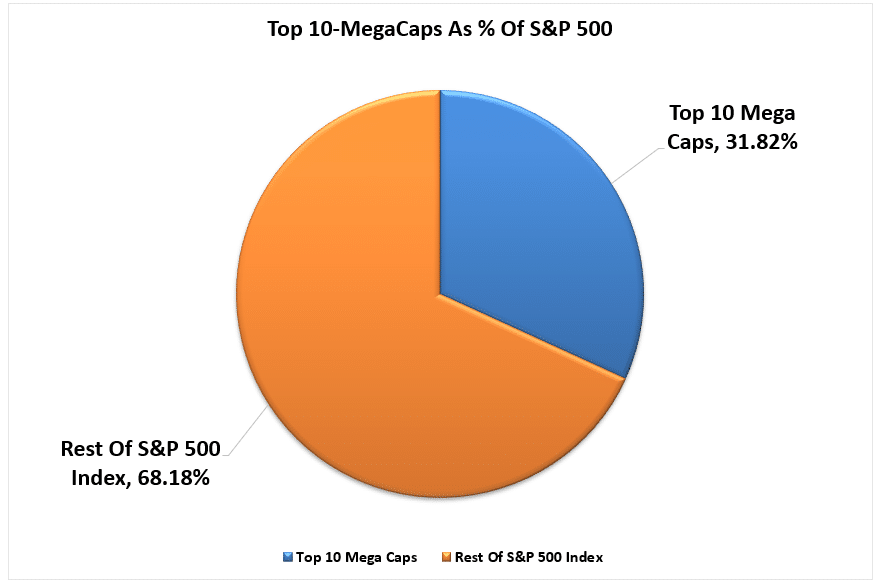

The highest-10 shares within the index comprise roughly 1/third of your entire index. In different phrases, for each $1 that flows right into a passive S&P 500 index, $0.31 flows into the highest 10 shares.

At the moment, roughly 2165 ETFs are buying and selling within the U.S., with every of these ETFs proudly owning most of the identical underlying firms. For instance, what number of passive ETFs personal the identical shares comprising the highest 10 firms within the S&P 500? Based on ETF.com:

- 403 personal Apple

- 437 personal Microsoft

- 625 personal Google

- 347 personal Amazon

- 251 personal Netflix

- 377 personal NVIDIA

- 310 personal Tesla

- 216 personal Berkshire Hathaway

- 269 personal JP Morgan

In different phrases, out of roughly 2165 fairness ETFs, the top-10 shares within the index comprise roughly 20% of all issued ETFs. Such is sensible, provided that for an ETF issuer to “promote” you a product, they want good efficiency. Furthermore, in a late-stage market cycle pushed by momentum, it isn’t unusual to seek out the identical “best-performing” shares proliferating many ETFs.

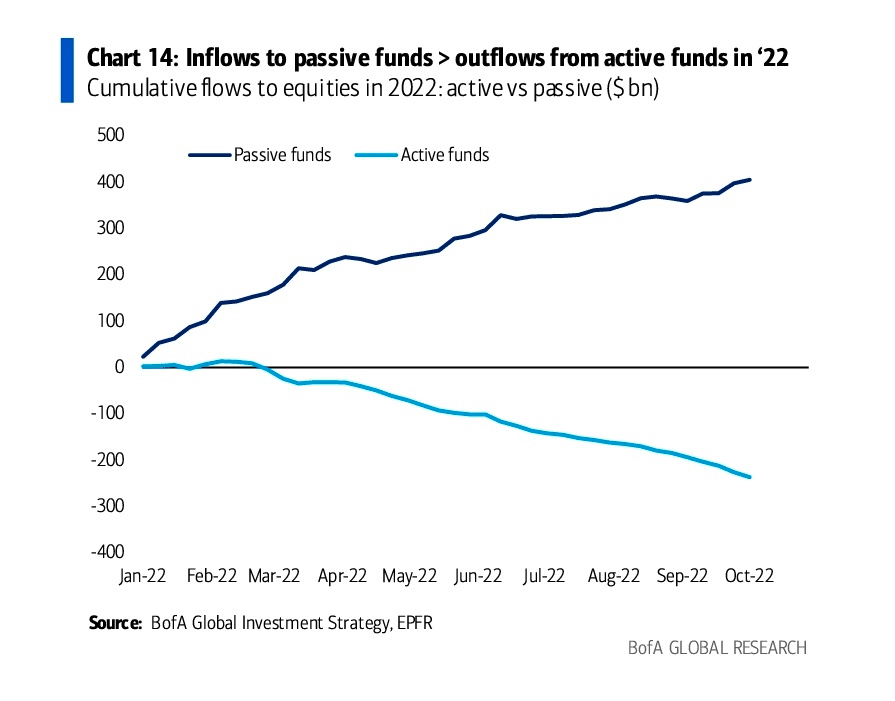

One of many causes that FANG shares might not be “lifeless” going ahead is identical motive they have been the leaders up to now. Regardless of the market decline this yr, investor capital flows are nonetheless headed into passive funds.

In fact, as traders purchase shares of an ETF, the shares of all of the underlying firms additionally get bought. When the bearish market cycle reverses, the rise in flows into passive ETFs will push these FANG shares greater together with the market.

Disinflation Could Be The Catalyst

As we head into 2023, there’s one ultimate motive why FANG shares will possible carry out a lot better than many at present anticipate – “disinflation.”

In a disinflationary/deflationary surroundings, notably in an financial recession, traders search out firms with sustainable earnings progress charges. Whereas most of the FANG shares have come beneath strain as of late attributable to “disappointing” earnings and forecasts, it’s price noting the earnings progress charges of those firms stay excessive over the subsequent 3-5 years, in keeping with Zacks Analysis:

- AAPL – 12.5% Yearly

- GOOG – 11.3% Yearly

- MSFT – 10.8% Yearly

- NVDA – 12.3% Yearly

- AMZN – 20.2% Yearly

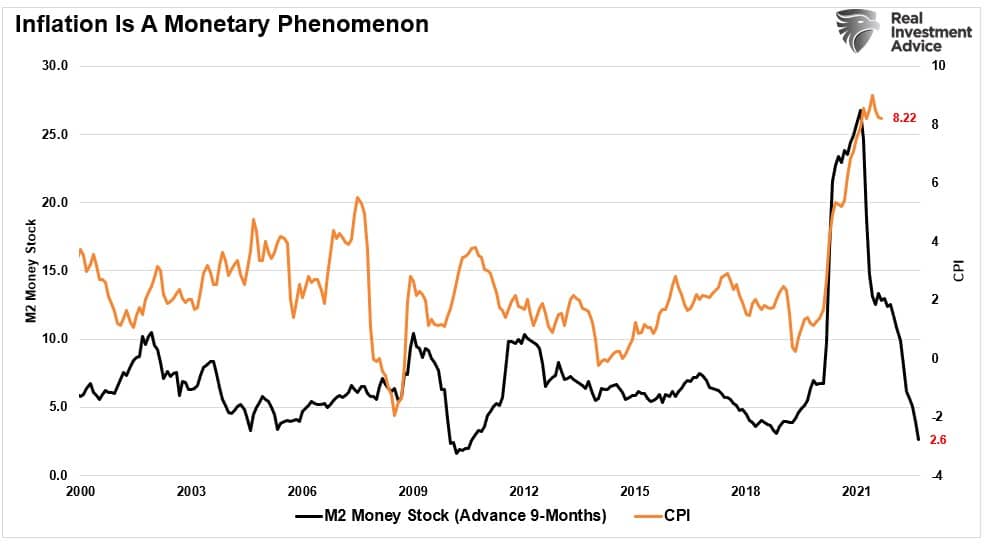

You get the thought. The purpose right here is that the affect of upper charges on financial progress will result in a disinflationary surroundings. Nevertheless, it isn’t simply rates of interest weighing on the financial system however the extraction of the huge financial injections over the past two years that fostered the inflationary surge. The reversal of the cash provide, which leads the inflation measure by about 9 months, suggests inflation will fall sharply subsequent yr.

As traders search out investments with sustainable earnings progress charges in a slowing financial surroundings, many FANG shares will garner their consideration. Mix that focus with the inflows from passive traders when the market cycle turns, ongoing share buybacks, and the liquidity wants of main traders; possible, FANG shares will nonetheless discover some favor.

Does this imply they’ll carry out in addition to they’ve up to now? No. They may underperform different property in a disinflationary surroundings, like bonds, the place yields fall sharply.

The purpose is that traders mustn’t dismiss FANG shares completely as a result of the media says they’re “lifeless.” It’s price remembering many stated the identical about Vitality shares in late 2020. In fact, that was simply earlier than that “lifeless asset” outperformed all the pieces else available in the market.

[ad_2]

Source link