- Shares in Aptiv have slid almost 28% since January

- Recovery in production levels is expected in the second half 2022

- Long-term investors could consider buying APTV at current levels

Shareholders in the vehicle architecture and auto technology player Aptiv (NYSE:) stock have seen the value of their investment drop more than 15% over the past 52 weeks, and 27.8% year-to-date (YTD).

Meanwhile, the MSCI ACWI Automobiles and Components Index returned 26.8% in 2021. However, the KraneShares Electric Vehicles and Future Mobility Index ETF (NYSE:) is down 8.3% in the past year and 15.4% so far in 2022.

On Nov. 4, 2021, shares in Ireland-based Aptiv surpassed $180, hitting a record high. The stock’s 52-week range has been $94.75-$180.81, while the market capitalization (cap) currently stands close to $32.3 billion.

How Recent Metrics Came

Aptiv is a leading designer and manufacturer of auto components. In late 2017, the US-based company Delphi split into two companies. As a result, Delphi Automotive became Aptiv and Delphi Powertrain became Delphi Technologies (NYSE:).

Recent metrics suggest:

“Global Automotive Aftermarket Market to Reach $542.1 Billion by 2026.”

Between 2020 and 2026, such an increase would mean a compound annual growth rate (CAGR) of 3.6%.

As one of the leading names in the vehicle aftermarket, Aptiv has been increasingly focusing on electronic products as well as safety technology. Analysts expect e-mobility and autonomous driving to provide tailwinds for revenue growth in future quarters.

Management released Q4 2021 figures on Feb. 3. of $4.1 billion was down 4% year-over-year (YoY). In part due to commodities and foreign exchange (currency) costs, EPS of 56 cents was also down compared to $1.13 a year ago.

On the results, CEO Kevin Clark said:

“Aptiv’s record above-market revenue growth and new business awards of $24 billion validate the strength of our industry-leading portfolio… The efforts taken to build a more sustainable and resilient business, focused on delivering electrified, software-defined vehicles, are truly making the future of mobility real.”

Now, the company expects to achieve a production growth of 15% in 2022. Revenue should be in the $17.75 billion to $18.15 billion range, while EPS is forecast between the $3.90-4.80 band.

Prior to the release of the quarterly results, Aptiv stock was around $134. But on Apr. 1, it closed at $119.07, a decline of over 10% in the last two months.

What To Expect From Aptiv Shares

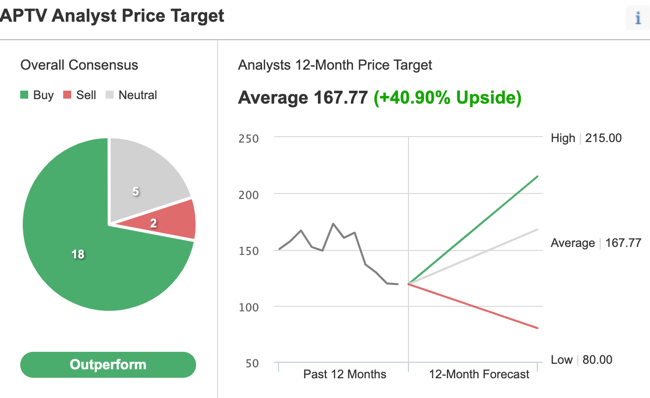

Among 25 analysts polled via Investing.com, APTV stock has an “outperform” rating.

Aptiv Consensus

Source: Investing.com

Wall Street also has a 12-month median price target of $167.77 for the stock, implying an increase of more than 40% from current levels. The 12-month price range currently stands between $80 and $215.

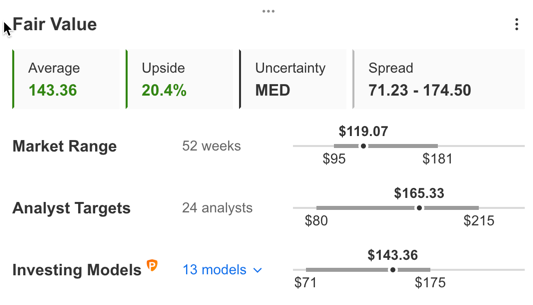

But according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for Aptiv stock at InvestingPro stands at $143.36.

Aptiv Fair Value

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase only about 20%.

We can also look at Aptiv’s financial health as determined by ranking more than 100 factors against peers in the consumer discretionary sector.

For instance, in terms of cash flow and profit, it scores 3 out of 5. Its overall score of 2 points indicates a performance ranking.

At present, APTV’s P/E, P/B, and P/S ratios are 61.5x, 3.9x, and 2.1x. Comparable metrics for peers stand at 11.6x, 1.8x, and 0.8x. These numbers show that despite the recent decline in price, the fundamental valuation for APTV stock is still on the rich side.

Our expectation is for Aptiv stock to build a base between $110 and $120 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding APTV Stock To Portfolios

Aptiv bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $143.36, as suggested by various valuation models.

Alternatively, investors might consider buying an exchange-traded fund (ETF) that has APTV stock as a holding. Examples include:

- First Trust NASDAQ Clean Edge Smart Grid Infra Index Fund (NASDAQ:)

- Fidelity Electric Vehicles and Future Transportation ETF (NYSE:FDRV)

- Gabelli Growth Innovators ETF (NYSE:GGRW)

- SmartETFS Sustainable Energy II ETF (NYSE:SOLR)

- Alger Mid Cap 40 ETF (NYSE:)

- KraneShares Electric Vehicles and Future Mobility Index ETF (NYSE:)

Finally, investors who expect APTV stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on APTV stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Aptiv Stock

Intraday Price At Time Of Writing: $119.07

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Aptiv) and the same expiration date.

The trader wants APTV stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the August 19 expiry 120 strike call for $11.50 and selling the 130 strike call for $7.35.

Buying this call spread costs the investor around $4.15, or $415 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the APTV stock price at expiration is below the strike price of the long call (or $120 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($10 – $4.15) x 100 = $585.

The trader will realize this maximum profit if the Aptiv stock price is at or above the strike price of the short call (higher strike) at expiration (or $130 in our example).

Bottom Line

In recent months, Aptiv stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors who could consider investing soon in the prominent automotive technology name. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of Aptiv stock.