[ad_1]

Apple,Inc., an American multinational know-how firm specializing within the design, manufacture, and sale of smartphones (iPhone), private computer systems (Mac), tablets (iPad), wearables and equipment (Apple Watch, AirPods, Apple Beats), TVs (Apple TV) and different sorts of associated providers (iCloud, digital content material shops, streaming, licensing providers), shall launch its Q2 2023 earnings outcomes on 4th Could (Thursday), after market shut. What lies forward for this conglomerate with the most important market capitalization at over $2.6T?

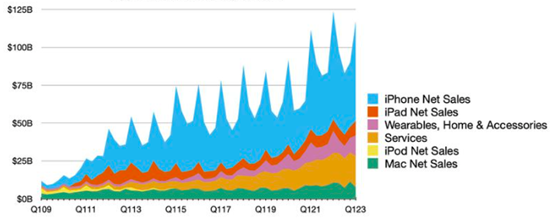

Fig.1: Apple Inc. Income by Product Class. Supply: MacRumors

Fig.1: Apple Inc. Income by Product Class. Supply: MacRumors

Within the earlier quarter, Apple gross sales income recorded its largest decline since 2016, by over -5% in comparison with the identical interval final yr. This was additionally the year-over-year gross sales decline since 2019. By product class, Mac income down probably the most, -28.66% (y/y) to $7.74B; iPhone income down -8.17% (y/y) to $65.78B, primarily impacted by the manufacturing points in China (much less prone to occur once more as Apple is slowly decreasing its manufacturing exercise in China); Different Merchandise income down -8.3% (y/y) to $13.48B; iPad was the one product class that recorded constructive good points, up +29.66% (y/y) to $9.4B; Providers income was up +6.4% (y/y) to $20.77B. The less-favoured gross sales end result was associated to difficult macroeconomic setting and the still-strong Greenback. Web revenue was down -13.3% (y/y) to $30B.

On a constructive notice, Apple Inc marked 2 billion lively customers on all of its merchandise, up from 1.8 billion as reported in January final yr. Constant enchancment in world attain could recommend higher monetization from previous and new prospects by way of its services and products sooner or later.

As well as, the corporate could proceed to see extra constructive breakthrough from its providers class, after attaining an all-time income document regardless of the tough setting. Just lately, the corporate has launched a fee characteristic specifically Apple Pay Later , which permits its customers within the US to cut up purchases into 4 funds, with zero curiosity and no further charges incurred. Different highlights embody a number of funds to totally different retailers in a single transaction, straightforward order monitoring and safe service provider tokens.

On 17th April, the corporate introduced that it shall work in collaboration with Goldman Sachs in providing Apple Card customers a saving account with a 4.15% APY. The speed is claimed to be increased than the nationwide common by 10 instances! Customers will be capable of simply arrange the account, construct financial savings immediately and seamlessly, observe account stability and curiosity earned anytime, and even get limitless every day money again as much as 3%.

Fig.2: Reported Gross sales of Apple.Inc versus Analyst Forecast. Supply: CNN Enterprise

Consensus estimate for gross sales stood at $92.9B, considerably down -20.73% from the earlier quarter, and down -4.52% from the identical interval final yr.

Fig.3: Reported EPS of Apple.Inc versus Analyst Forecast. Supply: CNN Enterprise

However, EPS is predicted to succeed in $1.43, down -23.94% from the earlier quarter, and down -5.92% from the identical interval final yr.

The administration expressed a pessimistic outlook for the approaching quarter, together with Mac and iPad gross sales declining by double digits in comparison with the identical interval final yr; iPhone gross sales might also fall however at a much less deteriorating price.

Technical Evaluation:

#Apple (AAPL.s) share worth pared most of its losses incurred within the latter half of 2022 since gaining floor in early January this yr, printing year-low at $124.17 (a degree not seen since June 2021). The asset rebound strongly in Q1 2023 and now traded inside an ascending wedge sample. $170 ( FR 78.6%, prolonged from the excessive of Jan’22 to the low of Jan’23) and the higher line of the ascending wedge function the closest resistance. A profitable break above these ranges could lead the bulls to proceed testing the excessive of Q3 final yr ($176.14) – $177, adopted by the excessive of Jan ‘22, at $182.87. However, the underside line of ascending wedge serves as the closest assist. A break beneath this line could point out a halt to the upside momentum, and the share worth could take a look at $160.50 (FR 61.8%), adopted by $153.50 (FR 50.0%) and the dynamic assist 100-day SMA.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link