[ad_1]

Apple,Inc., an American multinational expertise firm specializes within the design, manufacture, and sale of smartphones (iPhone), private computer systems (Mac), tablets (iPad), wearables and equipment (Apple Watch, Airpods, Apple Beats), TVs (Apple TV) and different styles of associated providers (iCloud, digital content material shops, streaming, licensing providers), shall launch its This fall 2023 earnings consequence on 2nd November (Thursday), after market shut. Might this conglomerate with the most important market capitalization at over $2.6 Trillion ship passable consequence amidst uncertainties?

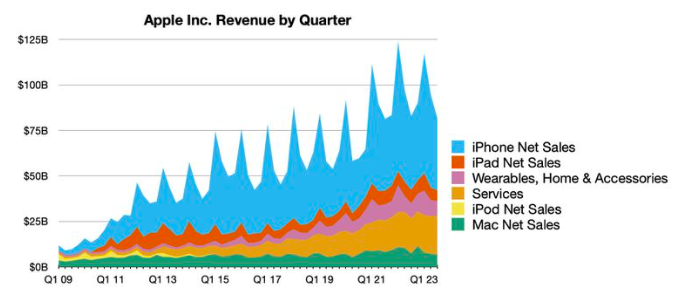

Apple Inc: Income by Quarter. Supply: MacRumors

Within the earlier quarter, Apple.Inc reported $81.8B in gross sales income, barely down over -1% from the identical interval in prior 12 months. By class, iPhone, Mac and iPad reported a decline in gross sales income from Q3 2022, to $39.7B (-2.5%; primarily damage by a slowing economic system), $6.8B (-7.3%) and $5.8B (-19.8%, which was stated to be as a consequence of powerful examine following introduction of latest iPad Air through the quarter). These losses have been partially offset by its Service class (up over 8% to $21.2B), pushed by over 1 billion paid subscriptions. Subscriptions have been additionally greater than doubled over the previous three years. The corporate additionally noticed a rise of 2% income progress in wearables class, to $8.3B. Working revenue barely all the way down to under 23.0B (was $23.08B (y/y)), however basically the corporate’s internet revenue nonetheless handle to edge up 2% to $19.9B, because of its cautious and managed spending within the midst of uncertainties. As well as, working money circulate stays strong with over $24B being returned to shareholders.

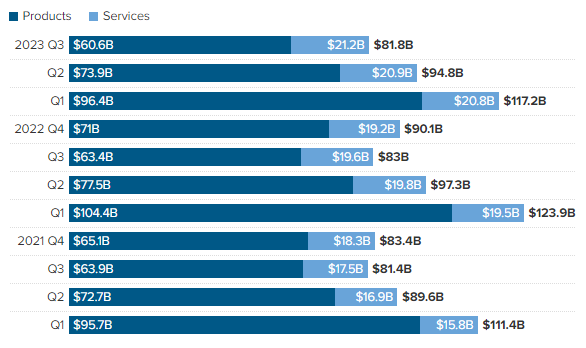

Apple: Internet Gross sales by Phase. Supply: CNBC

“We anticipate iPhone and providers year-over-year efficiency to speed up from the June quarter… Additionally, we anticipate the income for each Mac and iPad to say no by double digits as a consequence of tough compares.” – Luca Maestri, Apple CFO

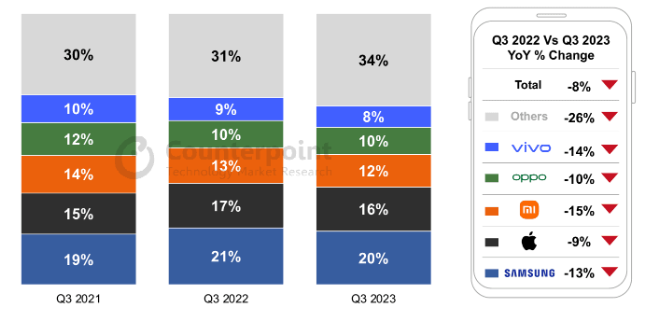

World Smartphone Market Promote-Via by Key OEMs (%). Supply: Gizmochina

Apple.Inc ranked second within the international smartphone gross sales race for Q3 2023, regardless of restricted availability of iPhone 15. In accordance with Counterpoint, the complete affect of the iPhone 15 sequence is anticipated to understand within the coming quarter. Additionally, the 11.11 gross sales occasion in China, festive season in India and end-of-year promotions shall additionally put a halt in year-over-year declines.

Paid subscribers for digital providers (App retailer, Apple Pay, Apple Card, Apple TV+, Apple Music and iCloud) reached over 1 billion, up 150 million over the previous 12 months, and almost a doubling from 3 years in the past. Within the earlier quarter, there have been 975 million paid subscriptions. The administration anticipated to see steady, wholesome progress within the class for the approaching quarters.

Apart from Imaginative and prescient Professional developer’s kits and associated purposes, Apple has additionally been engaged on incorporating the AI expertise to enhance fundamental capabilities in its units akin to iPhones and watches, hoping to enhance the general product high quality, growing consumer satisfaction and sustaining competitiveness.The work on AI and software program engineering is anticipated to convey a rise in R&D price, to roughly $1 billion each year, in keeping with the administration workforce.

Apple: Reported Gross sales versus Analyst Forecast. Supply: CNN Enterprise

Consensus estimate for gross sales stood at $90.3B, up over 10% from the earlier quarter. In This fall 2022, it was 90.1B. If the reported determine in keeping with the forecast, the whole gross sales income for FY 2023 shall hit $384.5B, barely down almost -10B from these in FY 2022.

Apple: Reported EPS versus Analyst Forecast. Supply: CNN Enterprise

Then again, EPS is anticipated to hit $1.36, up 10 cents from the earlier quarter, and up 7 cents from the identical interval final 12 months. Forecast for FY 2023 stood at $5.99, barely under final 12 months’s $6.11.

Technical Evaluation:

#Apple share worth hit ATH in July, at $198.21, earlier than going right into a correction to its bullish development which begins from early January this 12 months. It’s final closed under FR 38.2% ($170). The 100-SMA which intersects with FR 50.0% ($161) serves as the closest help to observe. A profitable break under this degree might point out extra promoting strain in the direction of the inventory, with the following goal at $152 (FR 61.8%). Each MACD and RSI indicators counsel a declining bullish momentum.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link