[ad_1]

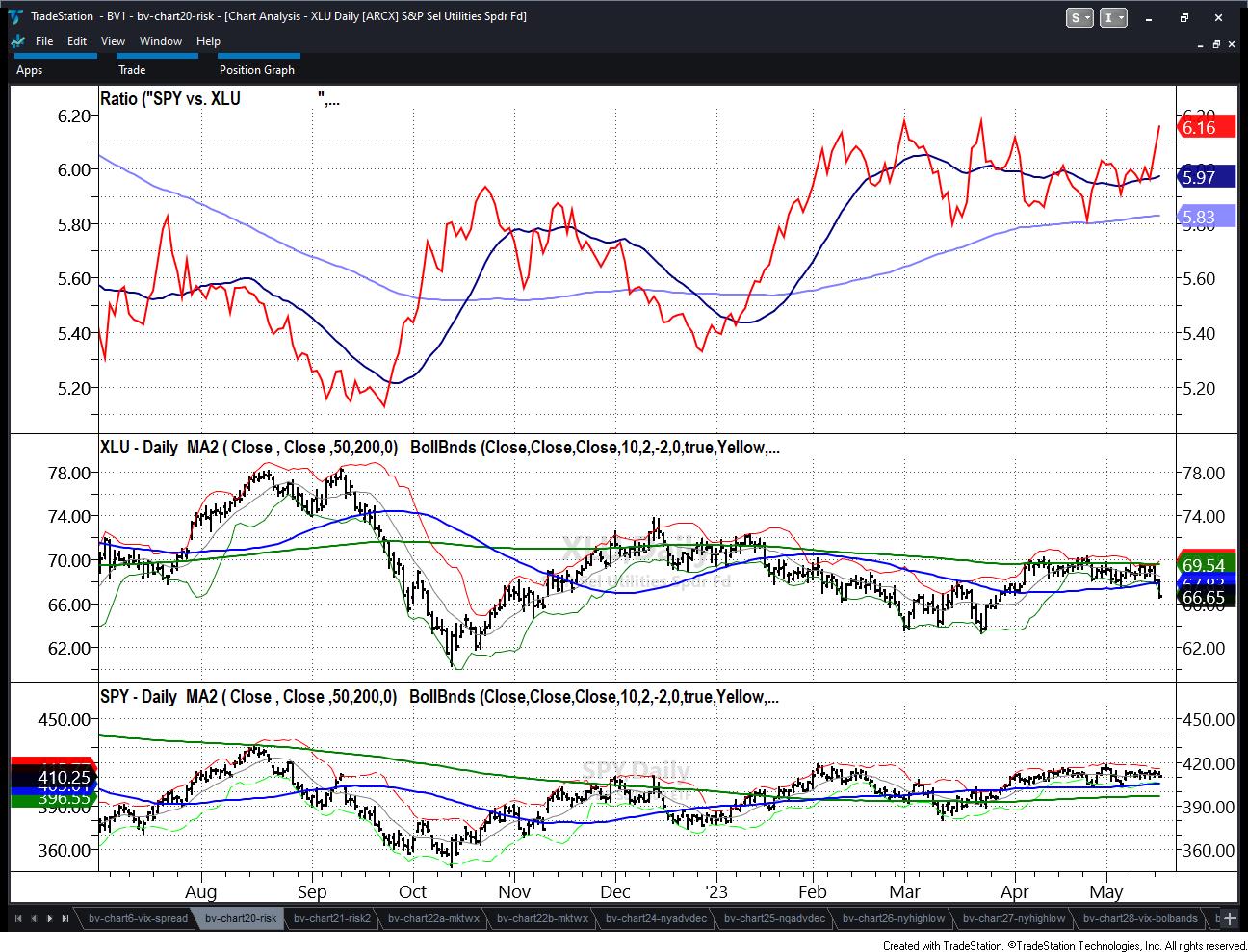

The 4 ratio indicators monitor key intermarket relationships which determine danger on/off market circumstances.

These 4 indicators can be utilized collectively to substantiate or determine the power of the core danger on/off indicator, which is the v. Utilities.

As clearly illustrated, all of the ratios are flashing 100% risk-on. Is it time to place your money to work?

The underside of the current buying and selling vary seems to be holding at this level.

And, what led to extra confidence in our current picks (), World X Lithium & Battery Tech ETF (NYSE:), GME, 3 most up-to-date examples) was the ratio between SPDR® S&P 500 (NYSE:) and Lengthy Bonds (iShares 20+ Yr Treasury Bond ETF (NASDAQ:)).

I’ve been vocal within the media about junk bonds () versus lengthy bonds (TLT). When a excessive yield outperforms lengthy bonds, making a case for recession is difficult.

Moreover, we now have talked about that seemed to be in for a relaxation.

As you possibly can see, SPY and outperform gold, a superb factor for the inventory market.

These ratios gave us a consolation stage as bulls need SPY within the lead. Nonetheless, allow us to not lose sight of the ratios, for first, they may flip.

Secondly, the buying and selling vary continues to be very a lot so a buying and selling vary.

Lastly, the small caps () could have gotten a cross for now however nonetheless have to show much more.

We proceed to consider that the economic system could not contract additional, which continues to be fairly completely different than predicting the economic system can develop.

Stagflation continues to be a factor.

ETF Abstract

- S&P 500 (SPY) 23-month MA 420 Help 410

- Russell 2000 (IWM) 170 assist – 180 resistance

- Dow (DIA) 336, the 23-month MA

- Nasdaq (QQQ) 328 cleared or the 23-mont MA-now its all about staying above

- Regional banks (KRE) 42 now pivotal resistance-37 assist

- Semiconductors (SMH) 23-month MA at 124 now extra within the rearview mirror

- Transportation (IYT) 202-240 largest vary to look at

- Biotechnology (IBB) 121-135 vary to look at from month-to-month charts

- Retail (XRT) 59.74 held, so now we watch the 50-DMA at 62.00

[ad_2]

Source link