Crypto exchanges can earn income by way of numerous means, together with lending to margin merchants, liquidation charges, and on/off ramping prices. Nevertheless, the core income generator stays taking a price on transactions.

There are a number of varieties of transactions and, subsequently, many varieties of transaction charges. When evaluating completely different transaction charges on the Bitcoin and Ethereum chains, the info steered exchanges want to make use of the previous to switch worth internally.

Transaction charges

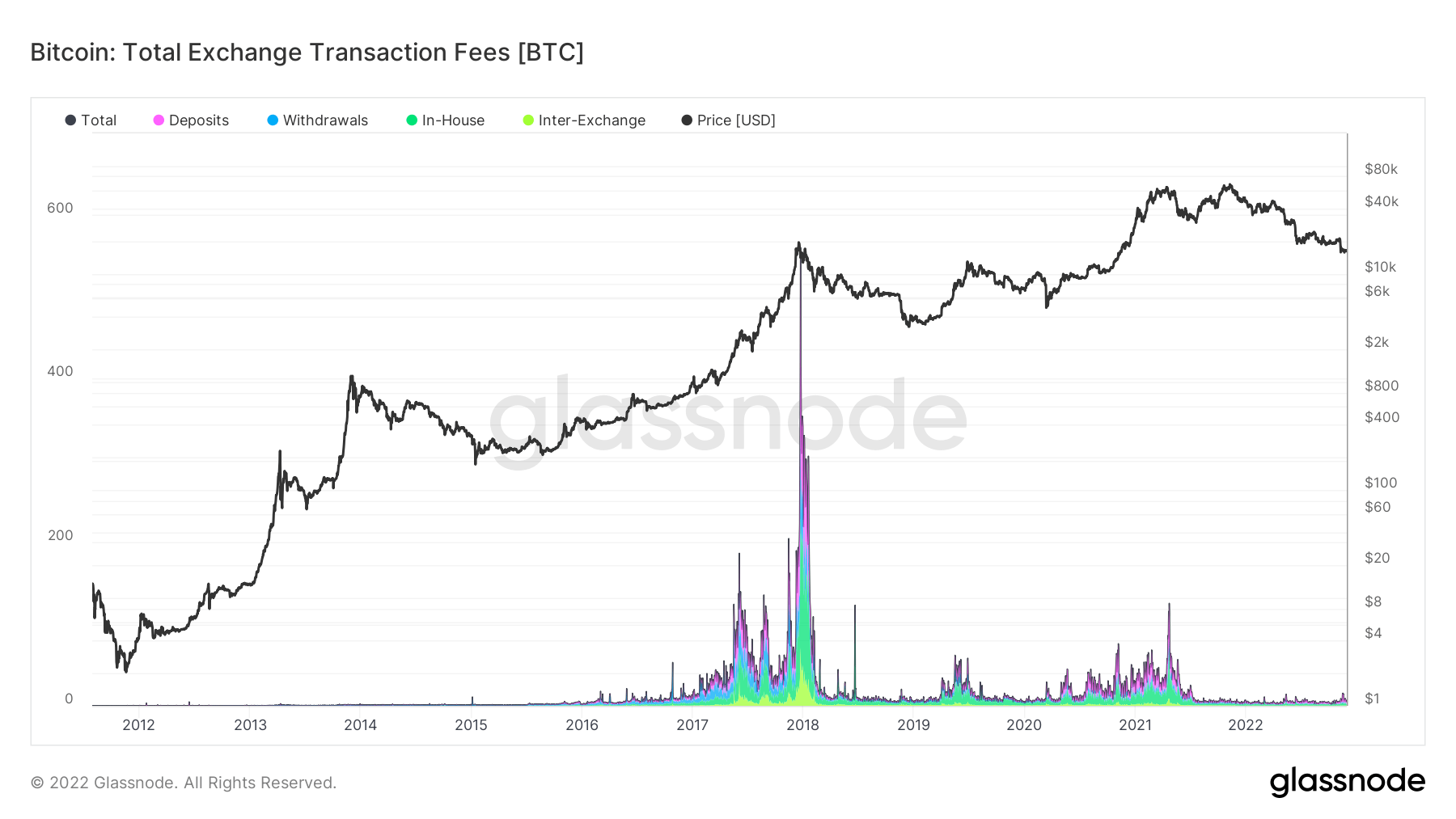

On-chain knowledge supplied by Glassnode and analyzed by CryptoSlate confirmed an erratic historical past for charges earned by exchanges on Bitcoin transactions.

The chart beneath includes a appreciable spike in charges in the direction of the top of 2017, as BTC hit its $20,000 earlier cycle peak.

The 2021 bull market noticed one other price spike in April 2021, albeit considerably lower than the 2017 bull, as BTC approached $65,000.

Unusually, the latest bull market high, of $69,000 in Nov. 2021, was not accompanied by one other price spike, suggesting comparatively much less alternate exercise versus April 2021.

Since April 2021, charges by way of Bitcoin transactions have sunk considerably and stay truncated.

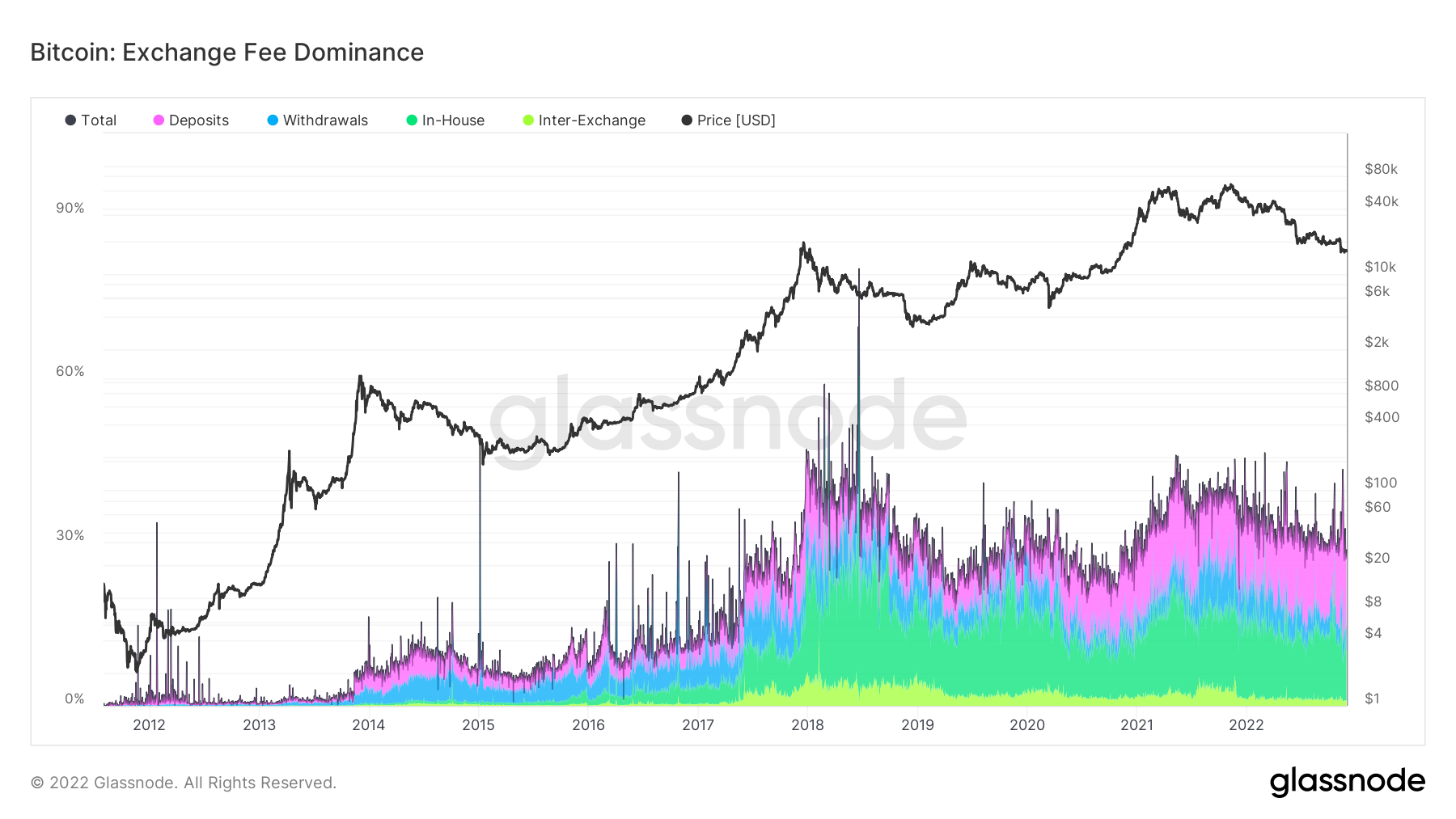

Bitcoin: Change Charge Dominance

The Change Charge Dominance metric is outlined as the share of whole transaction charges paid in relation to on-chain alternate exercise. That is additional break up into the kind of transaction that earned the price as follows:

- Deposits: Transactions that embrace an alternate deal with because the receiver of funds.

- Withdrawals: Transactions that embrace an alternate deal with because the sender of funds.

- In-Home: Transactions that embrace addresses of a single alternate as each the sender and receiver of funds.

- Inter-Change: Transactions that embrace addresses of (distinct) exchanges as each the sender and receiver of funds.

The chart beneath reveals Bitcoin transaction charges made up 36% of all alternate income sources associated to BTC. That is additional break up:

- Deposits – 21%

- Withdrawals – 4%

- In-Home – 10%

- Inter-Change – 1%

Over the previous 5 years, the classes of Deposits and In-Home have grown exponentially.

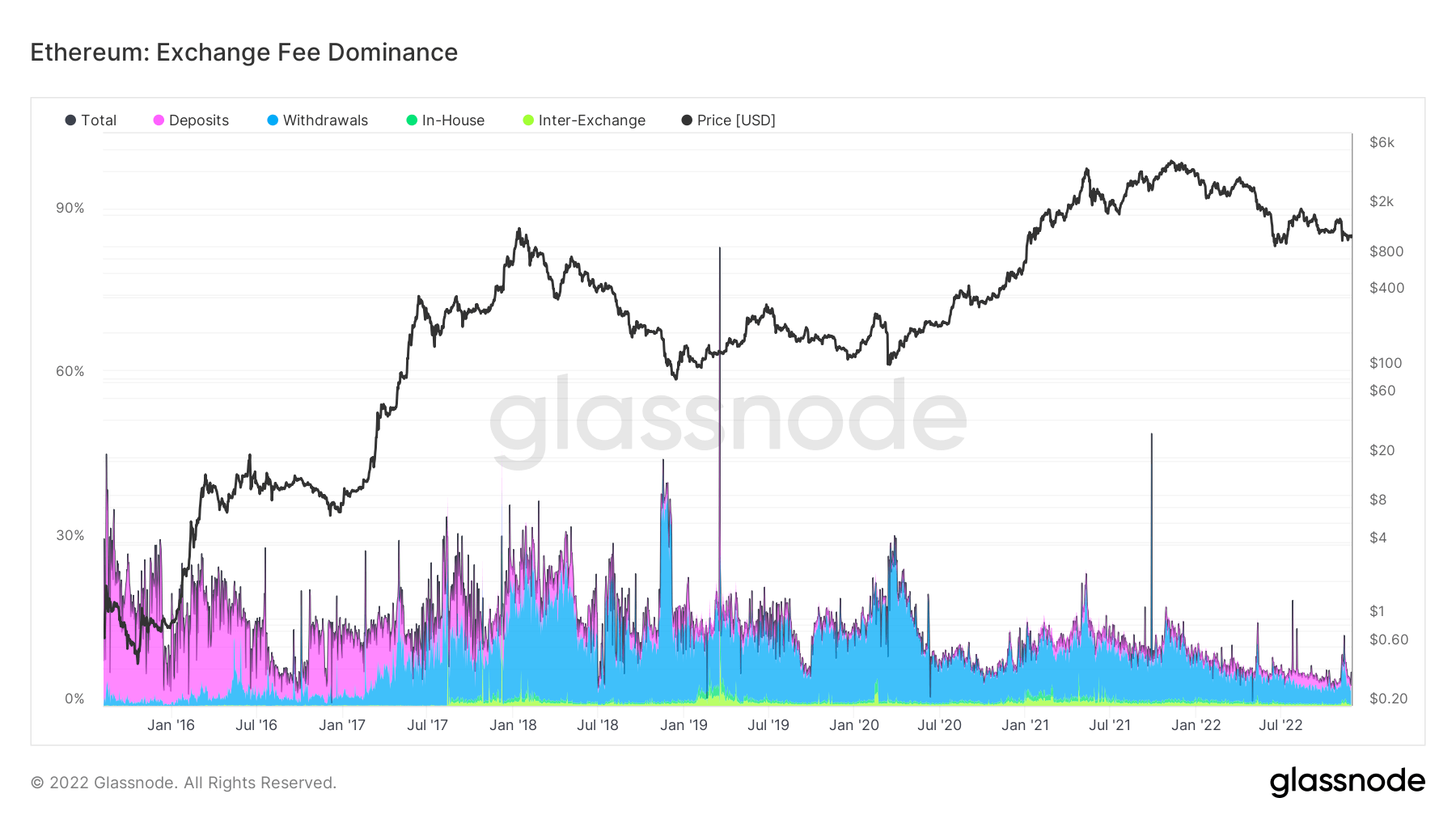

Ethereum: Change Charge Dominance

Evaluation of Ethereum’s Change Charge Dominance paints a really completely different image. Presently, Ethereum transaction charges account for five% of alternate income sources associated to ETH.

Withdrawals make up probably the most vital class of transaction price kind, which has been the case since July 2017.

The relative lack of In-Home charges in comparison with Bitcoin suggests exchanges want to not use ETH when transferring funds between inside wallets.