Rafael_Wiedenmeier

Amcor plc (NYSE:AMCR) has been capable of obtain sturdy development over time in regard to gross sales however has lagged in its share worth efficiency. With a robust dividend, growth of margins by acquisitions, and overvaluation assuming my DCF figures, I fee Amcor a maintain.

Enterprise Overview

Amcor plc is a packaging merchandise firm that has over 44,000 workers and operates in a number of areas together with Europe, North America, Latin America, Africa, and the Asia Pacific. The corporate is split into two segments: Flexibles and Inflexible Packaging. The Flexibles section gives packaging merchandise which can be versatile and made from movie. These merchandise are utilized in varied industries akin to meals and beverage, medical and pharmaceutical, recent produce, snack meals, private care, and others. Then again, the Inflexible Packaging section gives containers which can be inflexible and used for several types of drinks and meals merchandise like carbonated delicate drinks, water, juices, sports activities drinks, milk-based drinks, spirits, and beer, as nicely as sauces, dressings, spreads, and private care objects. As well as, plastic caps for varied functions are additionally supplied by this section. The corporate sells its merchandise by its direct gross sales pressure.

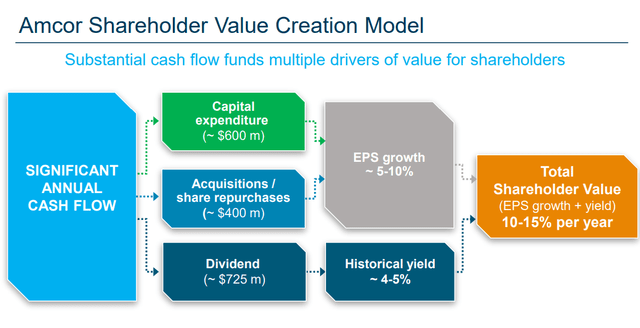

Investor Presentation

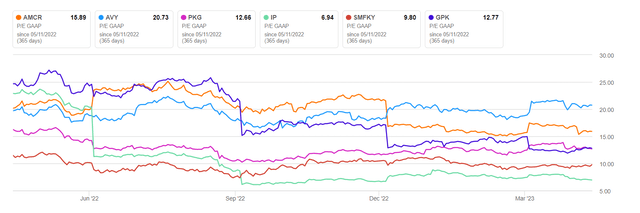

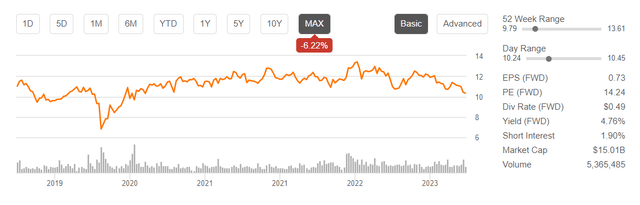

Amcor has a market capitalization of $15.156 billion and a ROIC that’s at 7%. The inventory’s 52-week excessive is $13.61 and its low is $9.79, whereas the present worth is $10.30 with a P/E ratio of 15.89. The inventory is at present buying and selling beneath its 200-day shifting common and in comparison with its rivals, Amcor’s inventory worth is barely larger when it comes to worth on a P/E foundation, as illustrated beneath.

Amcor P/E In comparison with Friends (Looking for Alpha)

Amcor additionally pays a excessive dividend of 4.76% representing a protected payout ratio of 73.8%, giving shareholders fixed returns by earnings whereas sustaining satisfactory FCF to broaden the corporate’s operations.

Looking for Alpha

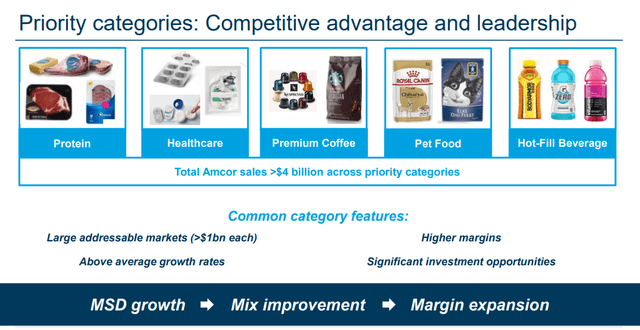

Amcor has fallen in need of expectations in its March 2023 outcomes, lacking each income and earnings per share estimates. Particularly, the earnings per share got here in at $0.119, which is $0.05 decrease than anticipated, whereas income was $3.67 billion, lacking the forecast by $20 million. These outcomes counsel that the corporate is going through challenges in a interval of reasonable financial difficulties. In consequence, Amcor is trying to shift its focus away from its core enterprise merchandise and broaden into extra worthwhile segments akin to protein, premium espresso, and healthcare. The corporate has revised its EPS estimates downwards from $0.77-$0.81 to $0.72-$0.74 per share, because of anticipated decrease demand for core merchandise on account of financial pullbacks. Amcor’s publicity to the broader market is because of its vital presence in varied industries, which leaves it susceptible throughout instances of financial recession. Nevertheless, this additionally gives a hedge in opposition to underperformance in particular person industries, which may be advantageous for buyers targeted on stability.

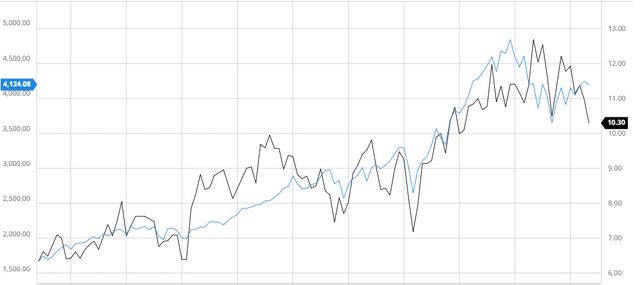

Amcor In comparison with the Broader Market

Within the final decade, Amcor’s efficiency has been beneath that of the S&P 500 after accounting for dividends, partly attributed to their latest earnings shortfall and the following downgrades by analysts. Nevertheless, based mostly on the corporate’s historic correlation with the broader market, I anticipate that its shift in the direction of premium packaged merchandise will enhance its inventory efficiency sooner or later.

Amcor In comparison with the S&P 500 10Y (Created by writer utilizing Bar Charts)

Premium Packaging Acquisitions to Increase Progress and Margins

Lately, Amcor has emphasised the importance of transitioning in the direction of higher-margin industries for his or her packaging merchandise, geared toward producing elevated money flows and future development. An indication of this technique in motion is their latest acquisition of Moda Methods on Might eighth, 2023. Moda Methods is a worldwide designer, producer, and supporter of cutting-edge modular vacuum packaging options for the meat, poultry, and dairy industries. This acquisition will allow Amcor to additional advance its focus in the direction of the high-profit protein section, whereas diversifying income streams, thereby providing better safety in opposition to industry-specific challenges.

Investor Presentation

Amcor receives a aggressive edge from its latest acquisition with new tools that permits the corporate to be simpler and direct with shoppers, along with improved profitability and fast development. With this acquisition, Amcor distinguishes itself as the one versatile packaging producer to offer this expertise for recent meat. This tools contains high-speed, rotational equipment for automated protein packing. Amcor now has a aggressive benefit over rivals who solely provide commonplace shrink baggage because of the brand new tools’s capacity to ship bespoke format options.

I imagine that such acquisitions are a giant a part of why Amcor is positioned for long-term success as a result of it’s utilizing capital extra successfully and has better free money circulate to develop the enterprise.

Investor Presentation

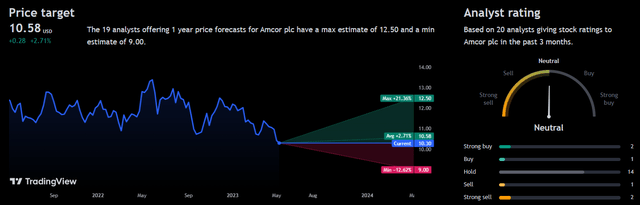

Analyst Consensus

Analyst consensus charges Amcor as a “maintain”. With scores all around the board, analysts are very conflicted over Amcor’s efficiency with a median 1Y worth estimate of $10.58 presenting a median 2.71% upside.

Buying and selling View

Valuation

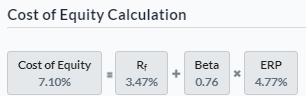

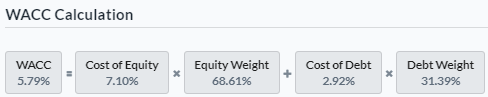

Earlier than creating my assumptions and calculating my DCF, I’ll calculate the Price of Fairness and WACC for Amcor utilizing the Capital Asset Pricing Mannequin. Factoring in a risk-free fee of three.47%, I used to be capable of conclude that the Price of Fairness was 7.10% as displayed beneath.

Created by writer utilizing Alpha Unfold

Assuming this Price of Fairness worth, I used to be capable of calculate the WACC to be 5.79% as proven beneath, which is beneath the {industry} common of seven.25%.

Created by writer utilizing Alpha Unfold

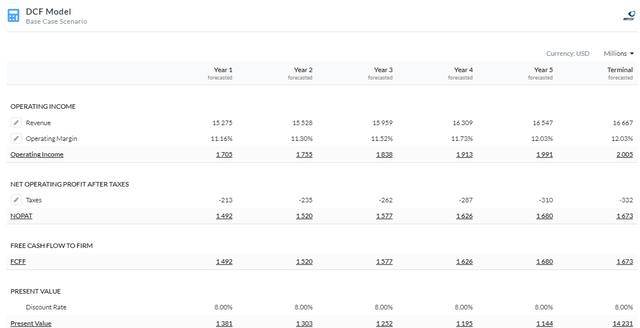

By using a Agency Mannequin DCF evaluation utilizing FCFF with out CapEX, I’ve ascertained that Amcor is presently overvalued by 4% when contemplating a good worth of round $9.93. To reach at this determine, I utilized a reduction fee of 8% for a 5-year period. I made a decision so as to add a 0.9% danger premium because of macroeconomic headwinds which can impression Amcor because of their diversification and publicity to a number of industries. Moreover, I predicted that the corporate will proceed to shift into extra worthwhile segments by acquisitions and achieve integrating these purchases leading to margin growth over time.

5Y DCF Mannequin Utilizing FCFF With out CapEX (Created by writer utilizing Alpha Unfold) Capital Construction (Created by writer utilizing Alpha Unfold)

Dangers

Uncooked materials prices: The value of uncooked supplies like plastic resins and aluminum has a big impression on Amcor’s profitability. Price will increase for uncooked supplies could have a unfavourable impact on Amcor’s revenue margins.

Regulatory and environmental dangers: Amcor works in extremely regulated sectors such because the packaging of meals and prescription drugs, that are held to exacting regulatory requirements. The fame and monetary efficiency of the corporate might be harmed by regulatory adjustments or non-compliance with already-existing restrictions. Moreover, environmental points like air pollution and waste disposal could have an effect on Amcor’s operations.

Conclusion

In abstract, I like to recommend a maintain on Amcor because of its enticing dividend yield and strategic acquisitions geared toward getting into high-margin industries however warning that it could be overvalued based mostly on my DCF evaluation. It could be value revisiting the corporate sooner or later, because it has the potential to generate constant returns if the inventory worth is at an appropriate degree.