milehightraveler

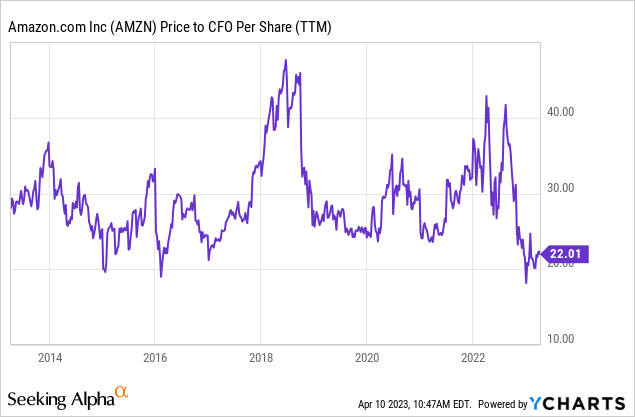

2022 has been a disastrous yr for Amazon (NASDAQ:AMZN), each basically and for the inventory worth. Shares fell 52% from peak to trough and are nonetheless down 44% after a slight restoration. That is probably the most substantial drop Amazon has had since the lows of the Nice Monetary Disaster in 08. Let’s overview what led to this efficiency, why it went mistaken and the way the long run would possibly play out.

Amazon 2022 drawdown (Google)

US E-Commerce gross sales

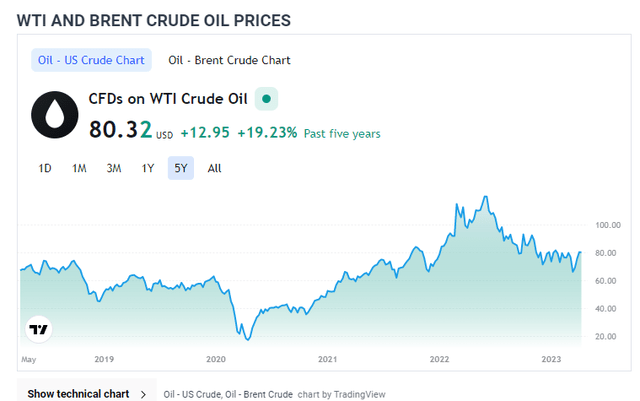

US E-Commerce gross sales have been steadily trending upwards as a proportion of whole retail gross sales. This secular progress trended slowly from 1% in 2000 to 11% in 2019. Then in 2020, with Covid lockdowns, it shot as much as 16.4% in Q2 2020 after which consolidated right down to 14.3% in Q1 2022. This has been the primary time we noticed brick-and-mortar gaining share again. We now see the info returning to the long-term pattern, with E-Commerce rising to 14.7% final quarter.

US E-Commerce retail gross sales as a proportion of whole retail (FRED)

It was robust to determine if this demand was sustainable or not. In hindsight, it was straightforward, however no one knew how lengthy the Covid restrictions had been right here to remain. Over the previous couple of years, we noticed numerous change in individuals’s habits and evolution in retail, with Omnichannel retailer ideas gaining massively in reputation. Amazon has made it a precedence to make sure that they will at all times serve their prospects, no matter how the state of affairs unfolds. Under you’ll be able to see a quote of the dimensions of funding Amazon made during the last years:

it is vital to keep in mind that over the previous couple of years, we have — we took a achievement middle footprint that we have constructed over 25 years and doubled it in simply a few years. After which we, on the similar time, constructed out a transportation community for final mile roughly the dimensions of UPS in a few years.

Andy Jessy, Amazon CEO This fall 2022 earnings name

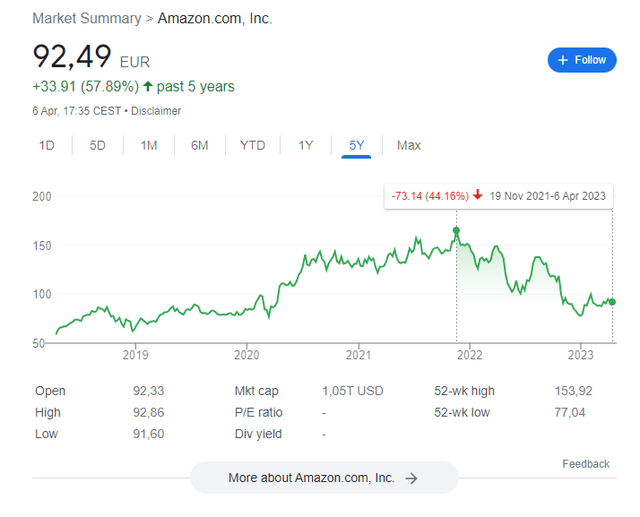

Under you’ll be able to see how large the funding in capital expenditures has been because the pandemic began: It greater than doubled from $17 billion in 2019 to $40 billion in 2020 after which elevated additional to over $60 billion every of the final two monetary years. This CapEx enabled the infrastructure talked about above that ought to construct the muse of the following decade of progress in E-Commerce. A lot of the spending went into constructing Warehouse & Distribution Facilities, Electrical Automobile fleet and Information Heart infrastructure for AWS, and investments in renewable energies. These are investments that Amazon would have been capable of make ultimately anyhow, so regardless that they’re overbuilt now, they may have the ability to make the most of the infrastructure over the approaching years as they develop into the brand new value construction.

Amazon Capital Expenditures (Koyfin)

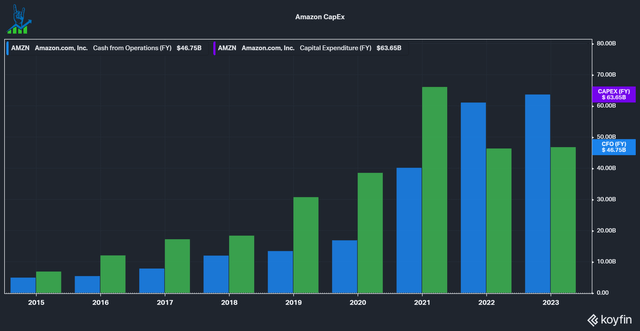

Vitality prices as a headwind

The Russian invasion of Ukraine has wreaked havoc on the oil market and spiked costs as much as $120 per barrel for some time. Amazon wants numerous gas for its infrastructure and though they’re investing billions into making the fleet extra sustainable, they’re presently depending on oil. Transport prices have elevated from $61.1 billion in 2020 to $76.6 billion in 2021 and $83.4 billion in 2022. I cannot fake that I perceive the vitality market properly, however I would count on volatility to say no because the warfare (hopefully) ends. This could transfer vitality prices from a headwind to a tailwind for Amazon.

Historic oil worth (DailyFx)

Amazon serving to AWS prospects

Amazon has at all times performed the lengthy recreation and seeks to construct long-term relationships with its prospects and lock them into the system by providing superior companies. Under is a quote from the newest earnings name, the place the CFO mentions that they’ve been serving to prospects cut back prices in these difficult occasions, impacting short-term progress charges for AWS. This has led to a damaging market response: AWS is anticipated to decelerate to teenagers progress in 2023. Whereas I would desire >20% progress as properly, the long-term tailwinds for the cloud transition are nonetheless very actual and the expansion runway for AWS is giant, with an anticipated CAGR of 20%. Particularly as a result of Amazon has numerous SMB prospects, I imagine this can assist bind them for the long run. I like the choice administration took to not milk prospects in these occasions.

All through Amazon’s historical past, we’ve discovered that our deal with the client helps to set us aside in occasions like these. […] Enterprise prospects continued their multi-decade shift to the cloud whereas working carefully with our AWS groups to thoughtfully establish alternatives to scale back prices and optimize their work.

Brian Olsavsky, Amazon CFO This fall 22 earnings name

Amazon is a compelling alternative

Valuing Amazon is at all times tough as a result of they fight every part within the ebook to scale back internet revenue margin by aggressively reinvesting. Fellow creator Brett Ashcroft Inexperienced wrote this nice article speaking about this subject. I imagine the Working money move is an effective metric to guage Amazon as a result of it reveals the profitability earlier than its large reinvestment into capital expenditures. We will see that Amazon is buying and selling at a trough a number of in comparison with the final decade of twenty-two occasions working money move. I imagine that Amazon is a compelling risk-reward at this level. It’s the largest place in my portfolio after I aggressively added to my place the final months below $100.

Amazon’s government compensation is one other half to think about: Not like most corporations, they do not present short-term incentives. All government compensation (moreover the $175k wage) is in fairness primarily based on the full shareholder return with a 5-year vesting interval. Which means Andy Jassy is probably going very eager on turning this ship round. Amazon has performed a exceptional infrastructure growth during the last years and can obtain wonderful working leverage as soon as they develop into it. Over the quick time period, we may see extra draw back, however for the long run, I am optimistic. It is a likelihood to purchase an organization with an unimaginable moat at a compelling worth, working in a number of industries with lengthy, secular tailwinds.