Article by IG Market Analyst Hebe Chen

Amazon Earnings:

Amazon is scheduled to launch its This fall, 2023 earnings on February 1st, 2024, after the closure of US markets.

Amazon This fall expectations and key watches:

The anticipated earnings report for the upcoming quarter signifies a considerable enchancment in earnings per share (EPS), projected to be $0.79. This marks a big improve from the identical quarter in 2022, the place the EPS was solely $0.12 per share.

Relating to income, Amazon’s This fall steering from the earlier earnings report means that web gross sales are anticipated to vary between $160.0 billion and $167.0 billion. This represents a progress fee of seven% to 12% in comparison with the fourth quarter of 2022, additionally double-digit progress from the earlier quarter.

Moreover, the forecast for working earnings falls between $7.0 billion and $11.0 billion, a notable improve from the $2.7 billion reported within the fourth quarter of 2022.

Supply: Amazon

By way of key enterprise items, Amazon’s main cloud service, AWS, is anticipated to showcase strong progress as soon as once more. AWS’s sale is anticipated to develop 15% year-over-year This fall, a slight enchancment from the earlier interval’s 12%, whereas sustaining a formidable working margin above 30%. Regardless of encountering intense competitors from Microsoft’s Azure and a stabilizing progress fee and Google Cloud, Amazon’s main place within the cloud service has been additional fortified by the AI surge, with present clients now initiating generative AI workloads on AWS.

One other main space to observe within the upcoming earnings report shall be Amazon’s internet advertising enterprise. Within the third quarter, this section recorded $12.06 billion in income, indicating a 26% improve from the corresponding interval within the earlier 12 months. The fourth quarter, encompassing the normal vacation procuring interval, is anticipated to draw extra buyers to the e-commerce platform, offering Amazon with an extra increase to its retail and promoting earnings.

Amazon share value:

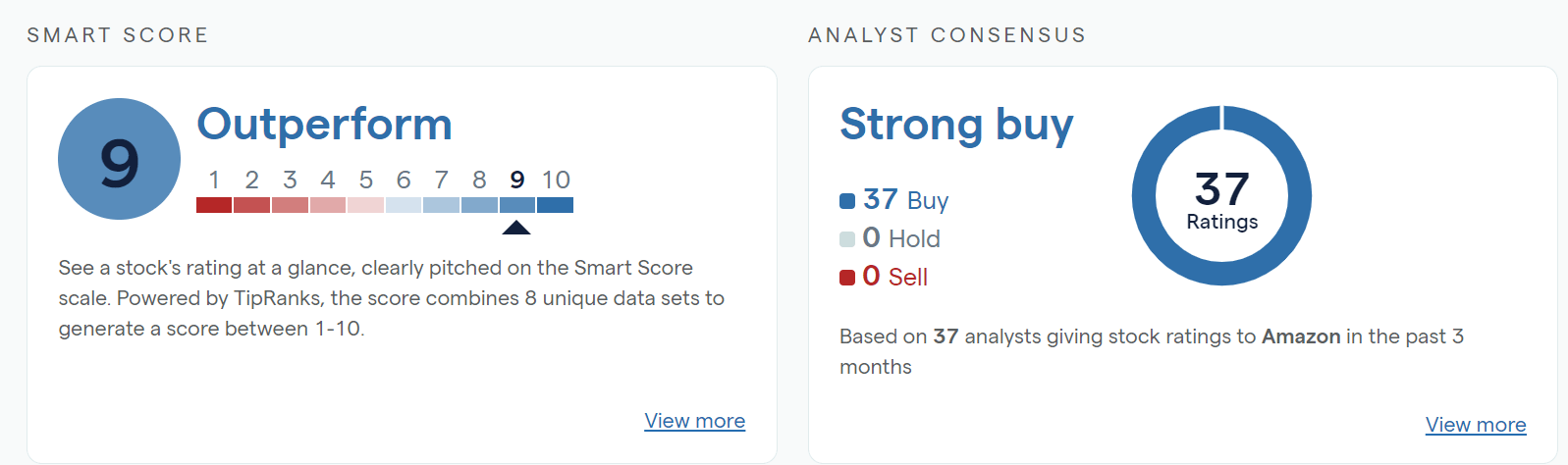

Amazon inventory outperformed the S&P500 benchmark in 2023, boasting a formidable 63% yearly achieve and securing its place as the most effective performers within the Magnificent Seven membership. The e-commerce large has unquestionably come out of the woods from the 2022 meltdown, impressing buyers with its strong progress and promising outlook. Subsequently, it’s not too shocking that primarily based on the IG platform’s TipRanks score, the good rating for Amazon is 9 out of 10.

During the last three months, all 37 surveyed analysts have rated Amazon as a ‘purchase.’

Supply: IG

From a technical standpoint, as noticed on the weekly chart, Amazon’s inventory costs proceed to push in direction of the early 2022 excessive, with the $160 stage showing to be a big hurdle and testing level forward of the earnings report.

From a longer-term perspective, the uptrend in value stays strong. Notably, the reversed head-and-shoulders sample may unlock extra upside potential as soon as the shoulder line for this sample, which additionally sits round $160, is conquered.

Within the close to time period, primarily based on the each day chart, imminent help will be discovered at $155, and an additional decline could convey the 20-day SMA into view.

Amazon Weekly Chart

Supply: IG

Amazon Every day Chart

Supply: Tradingview