[ad_1]

It’s been a stable seven or eight months of manic buying and selling of synthetic intelligence shares, and about ten months now for the reason that first public model of ChatGPT was launched by OpenAI and actually sparked all of it, so I believed we’d attempt to do a fast rundown of which AI shares have been teased and pitched by the assorted newsletters to attempt to reply among the ongoing questions from of us… none of those are model new, however there have been so many who I think about lots of even essentially the most intrepid Inventory Gumshoe readers missed just a few of them. I’ll undergo them in alphabetical order, and can attempt to checklist all of the newsletters who teased the inventory, and when, with hyperlinks to these unique articles… and the rest I occur to learn about them. I snuck in a single or two picks that had been teased late in 2022, after ChatGPT was launched, however virtually all of those had been teased by the Spring and Summer season of this 12 months.

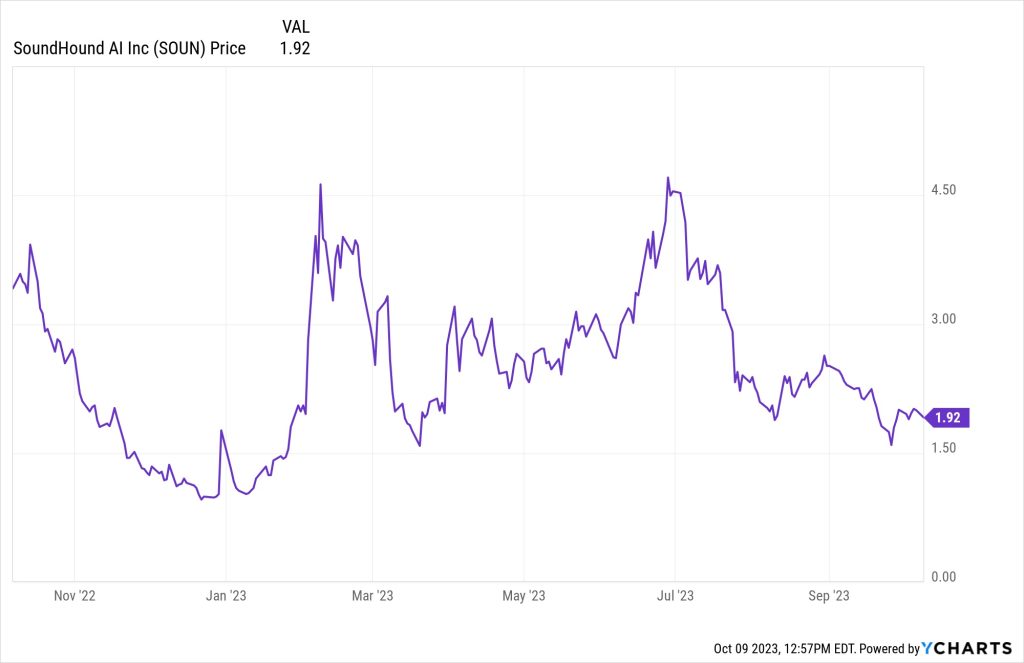

I’ll embrace a one-year chart for every, simply to place the inventory in some context (that’s NOT the chart “because it was picked” for any of those, simply the full-year chart — many of those names had been picked by completely different of us at completely different instances).

If you happen to’ve obtained different AI “story shares” that you understand are really helpful by numerous newsletters or pundits, be at liberty so as to add these within the feedback beneath so we will preserve monitor of ’em multi function place — and we all know, after all, that some shares that we didn’t see particularly teased by a giant publication this 12 months, even when we all know that many newsletters advocate them, like Meta Platforms (META), are additionally important AI gamers.

And sure, I additionally personal a bunch of those shares personally, full disclosures on the backside in case I neglect to say that in a selected abstract.

Alphabet (GOOG) has been one of many main A.I. shares for a decade, working largely behind the scenes (together with with their acquisition of DeepMind a few decade in the past), and it was typically talked about early on as a sufferer, since of us had been initially smitten by Microsoft’s ChatGPT-fueled Bing search as a competitor, although after that preliminary overreaction it bounced again strongly and is now seen as a fairly core a part of the AI story, together with fellow mega-cap tech firms Microsoft, Meta, Amazon and, extra instantly, NVIDIA. Whitney Tilson pitched this as considered one of his AI picks in April at about $106, although, like many of the huge tech shares, it’s an funding he has fairly constantly touted for a number of years. Can’t argue with this one, it’s been a giant a part of my Actual Cash Portfolio since 2005.

Amazon (AMZN) is, no shock, one of many core AI shares that just about everybody talks about — they use AI on Amazon.com for numerous issues, together with pricing and promoting and their suggestion engine, and AI companies are additionally a key providing for different firms by Amazon Internet Companies (AWS). Whitney Tilson additionally teased this as considered one of his AI picks in April, and, like Alphabet and Meta, he has really helpful it many instances over time — he touted it in January, too, at round $99, although probably not as an “AI-specific” play, but it surely obtained the total AI therapy in mid-April at round $107. I’ve additionally been progressively shopping for Amazon for about six years, although I can’t declare that “AI” was a giant a part of my reasoning.

Ambarella (AMBA) was pitched as a “subsequent wave” A.I. inventory due to their video chips that assist with processing of photos — the pitchman was Shah Gilani this 12 months, touting it as the subsequent nice chip story within the US in advertisements for his L.A.U.N.C.H. Investor, although the inventory has been teased earlier than as a play on drones, or on self-driving vehicles, and the corporate now calls itself an “edge AI semiconductor firm.”

My ideas on the time?

“The final time they reported an actual revenue was again in 2018, and rising bills and slack demand for digital units this 12 months have made issues even worse just lately. They definitely may bounce again, as extra “web of issues” units are put in to gather extra knowledge and as extra autonomous units depend on image-capture chips to grasp the world round them, however the windfalls that Ambarella buyers appear to have anticipated for a decade now haven’t come but. Whether or not that’s due to competitors from extra commoditized imaging chips which are “adequate,” or as a result of there are extra superior suppliers on the market that I don’t learn about, they’ve by no means been capable of put collectively actual income progress and margin enchancment that might inform buyers that the story in regards to the high quality of and demand for his or her chips and designs is actual sufficient to show into precise cash. I actually don’t know why, however, since we’re speaking in regards to the semiconductor enterprise, I think it’s competitors and pricing strain from their prospects that’s protecting them down.”

Appian (APPN) was, I guessed on the time, a decide by Luke Lango in his AI “SUPRMAN” promo. The attention-grabbing a part of Appian, which is without doubt one of the unprofitable crop of SaaS shares from the COVID growth that everybody briefly cherished, and drove as much as wild valuations of nicely over 20X gross sales, is the stickiness of their subscribers. They’re integrating AI into their enterprise on the “low code software program” facet, however they’ve additionally been speaking about their alternatives in non-public AI, AI programs that is likely to be skilled on public knowledge however are additionally accessing an organization’s non-public knowledge and getting used solely internally. I mentioned on the time that “they’ve been slightly bit left-for-dead after being a giant winner of the SaaS mania of 2020, they supply a low-code platform for customizing enterprise software program, and so they’ve continued to develop fairly properly… and they’re integrating AI into the enterprise, although it’s not a key a part of their quarterly earnings press releases but.”

Earnings haven’t notably impressed in current quarters for APPN, and there’s been a great chunk of insider promoting, which buyers by no means like to see, although they did launch an “AI Copilot” for builders. They’re nonetheless in all probability at the least 3 years from changing into worthwhile.

BigBear.ai (BBAI) was touted by Nomi Prins at Rogue Strategic Dealer — really, she actually really helpful the warrants on BigBear.ai (BBAI.WT), which largely strikes me as dumb, given how low the value of the inventory already was (the warrants didn’t present all that a lot leverage, given the extraordinarily excessive chance that they’ll expire nugatory). That was one of many first AI picks that the primary wave of next-big-thing speculators jumped on again in January — largely, I think, simply because it had the “.ai” in its title. BigBear was round $1.75 after we coated that Prins tease on August 30, and the warrants had been round 25 cents… although her consideration instantly spiked these warrants to 60 cents (they’re again down round 35-40 cents now, nonetheless awfully excessive for $11.50 warrants on what’s now a $1.40 inventory.

Right here’s a part of what I mentioned after I coated this one:

“I’m not so impressed by the corporate — they’re rising their income slowly, and so they’re operating brief on money, but it surely’s potential it’ll work out if they’ll win some meaningfully bigger contracts (although they’d in all probability need to spend closely to meet these contracts, too)… I definitely wouldn’t take the a lot bigger danger of speculating on BigBear utilizing warrants even at 26 cents, and that goes doubly true at 50 cents, that might imply you’re rising the chances of a 100% loss dramatically, on a inventory that’s already a dangerous wager (if BBAI goes up lower than 500% within the subsequent three years, the warrants would expire nugatory… and given the present fundamentals, a return of lower than 500% for the inventory appears awfully more likely to me).”

Shah Gilani pitched BigBear.ai (BBAI) shares in August, too, as a part of his “Three AI Breakthrough” shares advert for L.A.U.N.C.H. Investor, selecting smaller firms that he thought would crush NVIDIA, Microsoft and Alphabet. That was at a considerably cheaper price, round $1.30, after the AI mania had began to burn off a bit.

Braze (BRZE) was pitched by Cabot as their #1 AI inventory again in August at round $42. No huge information since, that is what I mentioned about it on the time:

“It is a pitch for an AI supplier that’s relied upon by a lot of giant companies, and the Thinkolator’s finest match (not 100% sure this time) is Braze, which is gives a software program platform for cross-channel buyer engagement/advertising, together with some advertising methods that use machine studying to focus on prospects and enhance outcomes. It could be a stretch to name it a giant AI story, however I suppose that’s a potential evolution of what they’re providing. They’re equally valued to quite a lot of smallish SaaS firms (unprofitable, 20%+ income progress, buying and selling at ~10X gross sales) — they’ve good metrics, with most of their income being from subscriptions and with 30%+ income progress just lately, and 122% dollar-based web retention (which implies their prospects are sticking round and spending extra every year), however they’re not fairly but at profitability — they is likely to be worthwhile on an adjusted foundation subsequent 12 months. They did have the benefit of going public close to the market peak in late 2021, so that they have a stable money stability that may help their continued progress. Looks as if an affordable small-cap SaaS story, I don’t know if there’s going to be a giant AI increase or in the event that they’re going to have the ability to push by to profitability and start producing earnings progress within the subsequent few years, however that’s the trajectory that analysts see proper now.”

Are you getting our free Each day Replace

“reveal” emails? If not,

simply click on right here…

C3.ai (AI) was one of many preliminary shares to react strongly to ChatGPT and the quick fascination with generative AI late within the Winter — partly as a result of it’s obtained the most effective ticker image of all, I think about (the entire shares that add “.ai” to their title caught at the least slightly consideration, together with BigBear.ai). The massive push for C3.ai in teaser world got here forst from Enrique Abeyta at Empire Monetary, he teased it closely beginning in mid-March round $21, in a pitch that was repeated at the least by April. Abeyta was keyed in to the truth that C3.ai launched a chat bot-style product this Spring, related in some methods to ChatGPT, and he thought that might drive curiosity… maybe it has.

And Dylan Jovine, although he was primarily pitching Palantir, additionally teased and really helpful C3.ai in his “residing software program” pitch beginning in late March, round $26, and persevering with at the least by August, when it was round $40, near the height of the mania for that specific title (at the least thus far — I’ve seen this advert extra just lately, as nicely). His pitch was defense-focused, so he talked up the AI-driven predictive plane upkeep product they promote to the navy.

Right here’s how I summed up my opinion of that one:

“… it’s a lot smaller than Palantir, extra “pure play” AI, however has struggled to develop its buyer base so it’s not almost as near changing into constantly worthwhile and never rising very quick this 12 months. I don’t belief C3.ai to construct or preserve these buyer relationships, given the dramatic discount in income progress, so I’d must see them construct on that income progress earlier than I’d contemplate the inventory. “

Deere & Co. (DE) was pitched by Porter Stansberry a few month in the past as a “fail-safe technique to play AI” due to their use of synthetic intelligence for (largely) autonomous and automatic tractors and farm gear. It was at about $400 on the time, and fairly cheap for a know-how chief, although additionally far more costly than all of its near-peer farm gear opponents world wide. Right here’s slightly little bit of what I mentioned on the time:

“They’ve constructed up a powerful stream of recurring income as they promote software program and repair on prime of the gear, and loved nice pricing (not not like the auto makers) lately, although there appears to be a widely-held perception that the gravy prepare is slowing, at the least for slightly bit, in all probability largely due to the influence of upper rates of interest on the farm financial system and on capital gear gross sales.”

Digital Realty (DLR) obtained the “revenue” model of the A.I. spiel from Jim Pearce at Private Finance again in early July, at round $114… that is what I mentioned about that on the time:

“It is a pitch that the surge in demand for AI will result in extra want for knowledge, which ought to profit the businesses who personal and handle knowledge facilities and lease out that house. The “AI Enabler” he teases is Digital Realty, which is the oldest knowledge middle REIT, and is presently in slightly little bit of strategic reset to take care of rising rates of interest — they’ve elevated their dividend yearly since going public in 2004, however they thus far have stored the dividend flat over the previous six quarters, and offered a bunch of inventory and a few property, as they struggle to ensure they’ll take care of their capex wants and the debt maturities that can come up over the subsequent few years. They face the identical challenges as quite a lot of the opposite very giant REITs, as their price of borrowing will get costlier and so they need to subject extra shares at larger dividend yields (and due to this fact decrease costs), which dilutes current shareholders a bit… perhaps they’ll be capable to change into extra environment friendly or increase their costs greater than they’ve just lately, to enhance per-share money movement and allow them to get again to elevating the dividend, however for the previous few years it has been a sluggish grower, and the present rate of interest atmosphere makes me fairly cautious about DLR and its near-peers within the “know-how infrastructure” REITs — they’ve nice property, but it surely’s exhausting for them to lift costs quick sufficient to maintain up with their working prices and their curiosity payments. Investor sentiment about DLR over the subsequent 12 months or so in all probability relies upon totally on whether or not they can increase their dividend within the subsequent quarter or two (subsequent announcement ought to be mid-August), and on what occurs to prevailing rates of interest — excellent news is definitely potential on both entrance, however I don’t understand how probably it’s — proper now, they appear like a really common REIT, with a yield of 4.25% and a dividend that has gone up about 4-5% per 12 months over the previous 5 years.”

Docebo (DCBO) was the inventory that the Canadian outpost of the Motley Idiot mentioned “might be the subsequent NVIDIA” in a barrage of late-August advertisements, when the inventory was round $42 — the AI connection is thus far fairly restricted, although that might change. Right here’s what I mentioned on the time:

“Docebo is concerned with AI however in a reasonably restricted approach to date, creating AI programs to assist them create higher studying and coaching packages for his or her company prospects (Docebo sells a cloud-based studying administration system for training and improvement of staff). I don’t know in the event that they’ll be an A.I. barnburner, however they do have stable longer-term contracts for his or her SaaS platform, with rising income and good buyer retention, so it’s fairly potential that they’ll be capable to develop into their pretty wealthy valuation, particularly as a small firm.”

Evolv Applied sciences (EVLV) was pitched by Shah Gilani in August at round $6.25, as a part of his “Three AI Breakthrough” shares advert — this one was referred to as a “Public Security AI” story, and we’ve been teased with so many of those safety screening shares over time, all of which turned out to be junk, that I’m all the time slightly cautious with such concepts. Right here’s how I described them on the time:

“Evolv makes safety screening {hardware}, largely for stadiums and colleges at this level, and so they have had preliminary success in constructing a fairly good buyer base, and it ought to have a great money movement profile due to the longer-term contracts of those programs and the continuing subscription charge and improve potential, although it’s not but sufficiently big to indicate any actual scalability within the enterprise.”

Excscientia (EXAI) was pitched as a “main AI drug discovery” inventory by Keith Kohl — he referred to as them the “Algo Meds” chief in an advert we coated just some weeks in the past. The second-best match for that tease was Recursion Prescription drugs (RXRX), which we’ve additionally briefly touched on earlier than (scroll down for that one).

Right here’s how I summed up that one…

“AI drug discovery shares will virtually definitely require persistence — even with slightly assist from synthetic intelligence, the drug improvement and approval course of requires discovering and treating sick sufferers and monitoring the outcomes over time, so it strikes fairly slowly and prices a ton of cash. As is all the time the case with biotech, I do just like the long-term royalty potential (most drug discovery corporations negotiate a royalty on any drug they uncover which a companion develops), and I agree that Exscientia sounds fairly compelling as a long-term hypothesis, however I attempt to reasonable my curiosity in that far-future income with the truth that I’m approach out of my league on the science facet, so if I purchase these shares that in all probability means I’ll be shopping for them from somebody who is aware of much more than I do… which doesn’t really feel like an ideal thought. “

FuboTV (FUBO) was teased as “the Nice $2 AI Moonshot” by LikeFolio Investor in advertisements that we coated again in July, when it was round $2.80. In addition they referred to as this one an “AI TV” inventory, and so they pitched it largely as a result of they noticed it getting a groundswell of social media consideration.

FUBO has fallen HARD lately, after an preliminary surge of enthusiasm once they went public… right here’s what I mentioned about this pitch again in July:

“FUBU has slightly little bit of an AI connection, at the least tangentially, of their potential to personalize streaming TV and do issues like acknowledge gamers on the sector in a sport. At coronary heart, FUBO is a ‘cable TV substitute’ whose sports activities focus is a technique to stand out in advertising (although all reside streaming choices concentrate on sports activities, as a result of advertisers love reside collective occasions), and I’ve a tough time believing that they’ll compete with Alphabet and Disney in reside streaming, given the price of content material rights, but it surely’s not inconceivable — they simply reported their first two quarters with a optimistic gross margin, to allow them to at the least cost their prospects as a lot because it prices them to ship the content material now, for the primary time, which is a hopeful signal. Not satisfied, personally, even with fairly good progress I’m unsure they’ll enhance their margins quick sufficient to change into sustainably worthwhile sooner or later, and their restricted AI work shouldn’t be sufficient to make an apparent distinction, however FUBO at the least seems so much higher right now than it did after I first regarded into the inventory two years in the past.”

Hon Hai Precision Business/Foxconn (HNHPF within the US) has been teased by Alexander Inexperienced on the Oxford Membership as his “single inventory retirement play” since mid-2018… however this 12 months, he began altering his advertisements slightly to name it a “hidden AI inventory” as nicely, largely as a result of, as a contract producer, additionally they assemble among the servers that firms are shopping for as much as gasoline their AI ambitions (true, however that is by definition a high-volume producer that’s been pushed by hit client merchandise, notably the iPhone, for many years, and that server demand is nowhere close to sufficient to make up for falling or decelerating gross sales of laptops and smartphones lately). The inventory is essentially unchanged since I final wrote about it — right here’s how I summed up my most up-to-date ideas on that inventory, which has been underwhelming for a really very long time:

“They’ve remained worthwhile, income per share has grown by virtually 50% in 5 years, and the subsequent upcoming catalyst, with iPhone gross sales volumes down a little bit of late, is the hope that they’ll have a brand new surge by constructing the Apple Automobile ultimately (or different electrical automobiles), or that progress in demand for servers will give them slightly income increase (they construct servers, too, although it’s a small a part of their enterprise)… however web revenue margins have fallen by 16%, so earnings per share have solely grown about 15-20% since 2018. 10-11X earnings might be nearly proper as the utmost valuation for this inventory except it positive aspects extra leverage over the manufacturers who rent them for manufacturing. Since Inexperienced began pitching it because the “One Inventory Retirement Plan” in mid-2018, the inventory has supplied a complete return of about 32%, with all however 3% of that from dividends, lower than half of what you’d have earned from holding a S&P 500 index fund (79%)”

IonQ (IONQ) has been pitched by Luke Lango and his ilk within the “subsequent huge factor” enterprise for some time now, everybody needs to get in early on no matter industrial quantum computing finally ends up wanting like a number of years from now, and IONQ has been essentially the most mature “pure play” on that theme. He additionally prolonged the argument to say that by some means the elevated computing energy of quantum computing will result in these new machines dominating AI processing, although that strikes me as much more of a “approach off sooner or later” argument. The most recent pitch of his on that entrance was again in March, at round $5, so it has performed nicely. The tease of his that we coated wasn’t technically an “AI” tease (this was the “Space 51” pitch he was making early within the 12 months, if that rings a bell), however he has thrown AI in as a cause to purchase IONQ in more moderen advertisements that we didn’t cowl, so we’ll embrace it on this checklist of AI hopefuls.

Microsoft (MSFT) has been, after all, the poster little one for AI over the previous 12 months, largely as a result of they’re the largest financier behind OpenAI, which launched ChatGPT. The inventory was one of many first to surge in January, because the goals of AI-fueled Bing taking over Google search obtained everybody excited, and it stays nicely above the place it was in January — it’s additionally an apparent story, so not many newsletters tried to “tease” it, however Luke Lango’s teaser pitch recommending Microsoft (MSFT) in mid-July referred to as it the “ChatGPT loophole” and implied that by some means shopping for Microsoft for that OpenAI publicity can be a “100X story”, and that looks as if fairly a stretch, but it surely’s at the least a stable firm with out the small (by MSFT requirements) funding they made in OpenAI. Right here’s what I mentioned on the time Lango pitched Microsoft:

“Sure, you may purchase MSFT for that OpenAI publicity — however the influence will virtually definitely be minimal within the subsequent few years. If OpenAI will increase in worth by 500%, that might imply a one-time $50-100 billion increase for Microsoft, and that’s actual cash… but it surely’s additionally about what they make in revenue in a standard 12 months. Possibly it does higher than that, however even a 100% acquire for MSFT shares at this level can be a wild growth, we’re not speaking about life-altering 10,000% returns (100X) for MSFT shareholders being in any respect possible. Microsoft is clearly an ideal firm, with a vastly profitable and high-margin enterprise as they dominate company computing in so some ways, however I’m not notably excited by investing at this valuation (PEG ratio of about 3.0), and it’s exhausting to see any urgency to purchase as a result of the influence of OpenAI is unlikely to be dramatic on their shareholder returns from this level.”

Mobileye (MBLY), which was purchased out by Intel years in the past after which resurfaced once they spun it out as an IPO late final 12 months, was, in response to a number of Gumshoe readers, one of many Luke Lango “SUPRMAN” AI picks, although I didn’t cowl it on the time (he didn’t actually drop clues in regards to the “MAN” a part of that acronym, I had guessed that his “M” in that acronym is likely to be Micron (MU), since AI initiatives and chipsets want quite a lot of fast-retrieval knowledge storage along with the “pondering” chips). They’re primarily a play on {hardware} and software program to help autonomous driving, which was one of many first sorts of AI to get quite a lot of consideration lately, and that’s a really aggressive house (although they’re the biggest present participant). They commerce at about 50X adjusted earnings in the mean time, which is a fairly stiff valuation for a corporation that’s anticipated by analysts to develop earnings at 15-20% per 12 months, and the largest driver for the foreseeable future is more likely to be automobile gross sales.

NVIDIA (NVDA) is, after all, the actual poster little one for AI — and the inventory that put the entire market into hyperdrive once they introduced simply how absurd the demand was for his or her AI chips of their first quarter report, again in Could. The inventory has been really helpful by quite a lot of newsletters over time, with lots of them keying on the AI market as a giant future demand driver, with the Motley Idiot the primary huge teaser of NVDA shares again in 2014 and has constantly teased this as an AI inventory for a few years, a part of their “AI Disruption Toolbox” extra just lately, but when we solely return to the post-ChatGPT days these are the parents who pitched the present market chief:

Whitney Tilson teased NVDA in January, although that was technically for his “EoD” teaser advert, which was largely about e-commerce and the on-demand world. The inventory was only a hair beneath $200 on the time. He additionally pitched NVDA as considered one of his 4 A.I. shares after issues heated up a bit extra, in April at about $270. Each have clearly performed nicely, with NVDA hovering so excessive this 12 months.

And Louis Navellier pitched NVIDIA once more in July of this 12 months because the “A.I. Grasp Key”, which was in all probability the last word assertion of the plain, although, like many pundits, he has additionally touted the inventory many instances prior to now (his first teaser pitch for NVIDIA that I noticed was in late 2017, although that was centered on NVIDIA GPUs being the “grasp key” for cryptocurrency miners, not AI initiatives).

If we return slightly previous the flip of the 12 months, to late December of 2022, Andy Snyder at Manward Letter was additionally pitching NVIDIA as considered one of his “metaverse” shares when it was round $150 — that advert should have been written earlier than ChatGPT was launched and fired everybody up, however he did point out AI within the advert, so he will get a spot on the checklist (his different metaverse picks on the time had been Shopify (SHOP) and Unity (U), that are additionally on our checklist right now however weren’t actually talked about as AI-specific concepts in his advert). For what it’s price, I’ve owned NVIDIA for years, and it has been a favourite decide of an ideal many newsletters since at the least 2016-2017, however I additionally offered some within the run-up earlier within the 12 months because the valuation obtained (and stays) fairly nutty (my timing with NVIDIA has by no means been good, however the inventory has been an enormous winner within the Actual Cash Portfolio anyway).

Palantir (PLTR) has lengthy been fashionable as a “huge knowledge” firm and a key contractor for presidency intelligence companies (and more and more for personal enterprise), however that’s probably not so completely different from an “AI” firm as of late, the phrases all mix collectively while you’re making an attempt to push computer systems to make sense of big knowledge units. It was touted because the “residing software program” secret weapon serving to Ukraine by Dylan Jovine beginning again in March, at round $8, and he was nonetheless pushing it with basically the identical language and the identical advert with the inventory round $19 in early August.

Shah Gilani is pitching Palantir (PLTR) in new advertisements this week, too, although I haven’t written about that specific spiel but… and Luke Lango included Palantir as considered one of his “SUPRMAN” AI shares that he teased in June. Right here’s a part of what I mentioned after I final wrote about Palantir, for that Dylan Jovine tease in August:

“Earlier this 12 months, for the primary time since going public, Palantir dropped to at the least the highest finish of “moderately valued”… after which the AI hype overwhelmed the inventory, and it has virtually tripled since Jovine began utilizing an identical teaser pitch in March (his advert hasn’t modified in substance, and is undated, however we first coated his Palantir tease on March 28 — it was round $8 on the time, and is at $20 now). C3.ai is pitched for its plane upkeep AI system, which helps cut back downtime and is being adopted by the navy as nicely, I coated C3 earlier this 12 months… it’s a lot smaller than Palantir, extra “pure play” AI, however has struggled to develop its buyer base so it’s not almost as near changing into constantly worthwhile and never rising very quick this 12 months. I don’t belief C3.ai to construct or preserve these buyer relationships, given the dramatic discount in income progress, so I’d must see them construct on that income progress earlier than I’d contemplate the inventory. Palantir has a way more established enterprise and will have fairly constant progress, so I’m not shopping for, it’s too costly for me now… but it surely’s at the least rather less loopy than NVIDIA at present costs (issues may change relying on what their subsequent earnings report seems like, however as of now, if I had been betting that this subsequent quarter might be superb, I may justify shopping for PLTR as much as about $13-15.)”

That quarter was good however not nice, in early August. I’d nonetheless persist with that value vary as the highest of what I may justify for Palantir, assuming a fairly excessive stage of optimism about new enterprise rolling in over the subsequent six months, however the story may definitely change — it’s fairly near that now, at $16 or so.

Recursion Prescription drugs (RXRX) was, I guessed, included in Luke Lango’s SUPRMAN tease in June, it’s considered one of a handful of publicly traded firms centered on utilizing synthetic intelligence for “drug discovery” to hurry up the seek for new therapies. The inventory briefly went bonkers a month or so later, largely as a result of NVIDIA partnered with them and purchased a small stake within the firm, however that has settled down dramatically since. It is a $1.4 billion firm that trades at 25X revenues, so it’s not for the faint of coronary heart — and their income isn’t more likely to develop into something significant inside the subsequent few years, so that is actually all in regards to the potential that their programs may develop medicine that flip into giant royalty windfalls within the extra distant future (AI drug discovery is likely to be dashing up so much, however the precise FDA approval course of and the very long time lag of testing for security and efficacy in human beings, utilizing medical trials, shouldn’t be going to speed up as dramatically, so any medicine found by their system nonetheless need to slog by approvals).

Shopify (SHOP) is clearly probably not a “pure play” AI decide, however Whitney Tilson included it in his “4 A.I. shares” pitch in mid-April at about $48, and it’s a inventory he had pitched prior to now as nicely — they’re utilizing some generative AI to assist their e-retailer prospects create higher retailer experiences.

SoundHound AI (SOUN), previously generally known as SoundHound, has been teased by a pair of us this 12 months as a low-priced inventory with AI publicity — Ross Givens pitched it because the “$3 AI Marvel Inventory that Might Make You 75X Richer” in early Could, and Jason Williams pitched that that purchasing the “tiny $2 inventory” SOUN in late June can be “like shopping for Google in 2004”. Right here’s what I mentioned about HOUN on June 26:

“We’ve checked out SOUN earlier than and my opinion hasn’t actually modified — they assume they’ll be near break-even by the top of this 12 months as new contracts are available in, and so they’re slicing prices and restructuring, however the income is simply so low that it’s exhausting to show the nook into changing into a viable enterprise except their partnership offers speed up a bit. Not inconceivable, however not so attention-grabbing to me at 20X gross sales.”

Symbotic (SYM) has been pitched a number of instances by Luke Lango over the previous 12 months, largely as considered one of a package deal of AI picks (he referred to as it his “#1 AI Inventory to Purchase Proper Now” in early June, but it surely was additionally the “S” in his SUPRMAN checklist of AI inventory picks that was teased slightly in a while, and, although I haven’t written about Lango just lately, it seems prefer it may additionally be in his more moderen “acronym” pitches, like, in response to considered one of our readers, his “Hyperscale AI to Purchase Now” concepts.

Right here’s how I summed it up in June:

“They’re partnered with some giant grocery and mass market retail firms for administration of distribution facilities, with a system of proprietary robots and software program that successfully manages and breaks up pallets into items and strikes them to the proper place. The keystone buyer is Walmart, which is committing to automating all 42 of their distribution facilities, in order that mission, which is able to in all probability take 6-8 years, present some visibility into future income and earnings. Comparatively interesting as an actual enterprise, not simply AI hype, although in all probability a bit too inflated by the AI hype and a few enormous income progress numbers in current quarters.”

Unity Software program (U) was one other of Luke Lango’s “SUPRMAN” picks in June, when it was within the excessive $30s. The final thought was that as Adobe (ADBE) is including generative AI instruments to its inventive software program suite (Photoshop, and so on.), Unity is doing one thing related with its inventive suite of real-time 3D video instruments (used for immersive 3D video, largely, however not totally, for video gaming and leisure prospects). Right here’s how I summed up my ideas on that inventory on the time (I do personal a small place):

“Unity shouldn’t be actually instantly an ‘AI inventory’ within the public consciousness, although I suppose it may change into one — Adobe is definitely pioneering generative AI inside photoshop, and Unity has AI instruments which are rising in use, but it surely hasn’t actually caught hearth as an AI ‘story’ for buyers but. The true driver for Unity this week was the introduction of the Apple Imaginative and prescient Professional augmented actuality headset, which received’t be out there till subsequent 12 months, and received’t be a mass-market product immediately, however does give Unity a brand new platform for its know-how, and can in all probability result in extra builders utilizing Unity’s merchandise to develop AR video games and functions for Apple (Apple talked about that Unity’s system might be suitable with the Imaginative and prescient Professional, which obtained buyers excited and drove the top off 20% or so on Monday afternoon, throughout the Apple occasion… it has since calmed down slightly).

“Unity screwed up their monetization platform final 12 months, what they now name Develop Options, by successfully dropping the info and having to rebuild it and in addition rebuild investor confidence. That put a pause on their march to profitability, and means they’re reporting odd professional forma progress numbers this 12 months, however they do look like again on monitor now.”

Verses AI (VERS.NEO, VRSSF) was one of many extra self-promotional AI “story shares” earlier this 12 months, and is an actual penny inventory — I checked out it in June as a result of it was additionally teased by Tobin Smith at about $2, and Smith is a blast from our hype-filled previous. Right here’s how I summed up my ideas on that one:

“Verses AI is a cool story about an organization making an attempt to construct an working system for AI, creating an app store-like infrastructure, although they’ve thus far accomplished only a couple pilot initiatives, largely in warehouse administration, so quite a lot of the story is driving on merchandise that haven’t but been publicly launched. They’re nonetheless basically pre-revenue, chewing by quite a lot of money and certain needing to lift much more, and I don’t typically belief extremely promotional firms that spend extra on investor relations than they soak up as income, notably earlier than they’ve obtained some stable prospects and a transparent product “hit,” so I received’t become involved with this one. I’ll give them one other look in the event that they construct the income up within the subsequent few quarters and have some actual merchandise to debate. Good story, not sufficient substance but for my style.”

These are those we’ve seen teased over the previous 12 months or so, or have coated on this house as we’ve reviewed picks by numerous newsletters — have others that you just’ve seen of us advocate and which we must always embrace on this checklist, or favorites you need to speak about? Our completely happy little remark field beneath awaits your enter… don’t fear, we don’t chew.

Disclosure: Of the businesses talked about above, I personal shares of and/or name choices on Alphabet, Amazon, NVIDIA, Shopify, Symbotic and Unity Software program. I can’t commerce in any coated inventory for at the least three days after publication, per Inventory Gumshoe’s buying and selling guidelines.

Irregulars Fast Take

Paid members get a fast abstract of the shares teased and our ideas right here.

Be a part of as a Inventory Gumshoe Irregular right now (already a member? Log in)

[ad_2]

Source link